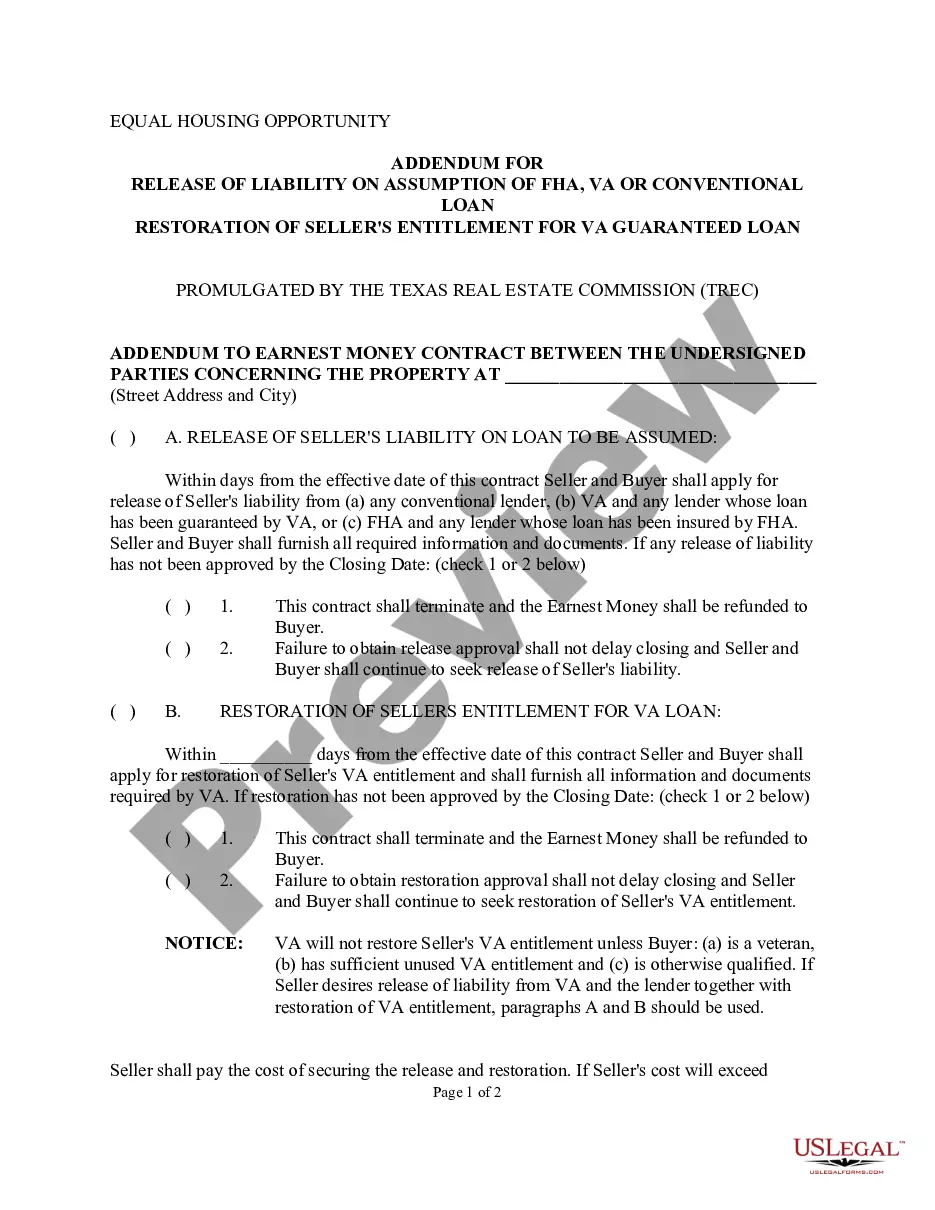

This detailed sample Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

The Brownsville Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan is a legal document that serves as an additional agreement to the existing loan and entitlement terms in the real estate transaction process. This addendum plays a crucial role in ensuring that all parties involved, including the buyer, seller, and lender, understand and agree to the terms and conditions related to assumption of loans, restoration of seller's entitlement, and the guarantee provided by the Department of Veterans Affairs (VA) for VA guaranteed loans. When it comes to assumption of loans, the Brownsville Texas Addendum provides the necessary framework for transferring the responsibility of the loan from the seller to the buyer. This process allows the buyer to assume the existing loan rather than applying for a new one. By including this addendum, the buyer acknowledges and accepts liability for the assumed loan, relieving the seller of any future obligations. This addendum specifies the loan type, be it FHA, VA, or conventional, and outlines the terms and conditions that the buyer agrees to abide by. In the case of VA guaranteed loans, the addendum also addresses the seller's entitlement restoration. When a home with a VA loan is sold, the seller's entitlement, which refers to the amount of loan guarantee provided by the VA, is typically partially used. The addendum outlines the process and conditions under which the seller's entitlement can be restored, allowing them to potentially utilize their VA loan benefits in the future. It's important to note that there may be different versions or variations of the Brownsville Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. These may include specific addendums tailored to each loan type, such as one for FHA loans, another for VA loans, and one for conventional loans. The addendums may have slight variations to address the unique requirements and regulations associated with each loan type. In conclusion, the Brownsville Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is a crucial legal document in the real estate transaction process. It outlines the terms and conditions related to assumption of loans, transfer of liability, and the restoration of seller's entitlement for VA guaranteed loans. Multiple variations of this addendum may exist to address the specific loan types involved in the transaction.The Brownsville Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan is a legal document that serves as an additional agreement to the existing loan and entitlement terms in the real estate transaction process. This addendum plays a crucial role in ensuring that all parties involved, including the buyer, seller, and lender, understand and agree to the terms and conditions related to assumption of loans, restoration of seller's entitlement, and the guarantee provided by the Department of Veterans Affairs (VA) for VA guaranteed loans. When it comes to assumption of loans, the Brownsville Texas Addendum provides the necessary framework for transferring the responsibility of the loan from the seller to the buyer. This process allows the buyer to assume the existing loan rather than applying for a new one. By including this addendum, the buyer acknowledges and accepts liability for the assumed loan, relieving the seller of any future obligations. This addendum specifies the loan type, be it FHA, VA, or conventional, and outlines the terms and conditions that the buyer agrees to abide by. In the case of VA guaranteed loans, the addendum also addresses the seller's entitlement restoration. When a home with a VA loan is sold, the seller's entitlement, which refers to the amount of loan guarantee provided by the VA, is typically partially used. The addendum outlines the process and conditions under which the seller's entitlement can be restored, allowing them to potentially utilize their VA loan benefits in the future. It's important to note that there may be different versions or variations of the Brownsville Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. These may include specific addendums tailored to each loan type, such as one for FHA loans, another for VA loans, and one for conventional loans. The addendums may have slight variations to address the unique requirements and regulations associated with each loan type. In conclusion, the Brownsville Texas Addendum for Release of Liability on Assumption of FHA, VA, or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is a crucial legal document in the real estate transaction process. It outlines the terms and conditions related to assumption of loans, transfer of liability, and the restoration of seller's entitlement for VA guaranteed loans. Multiple variations of this addendum may exist to address the specific loan types involved in the transaction.