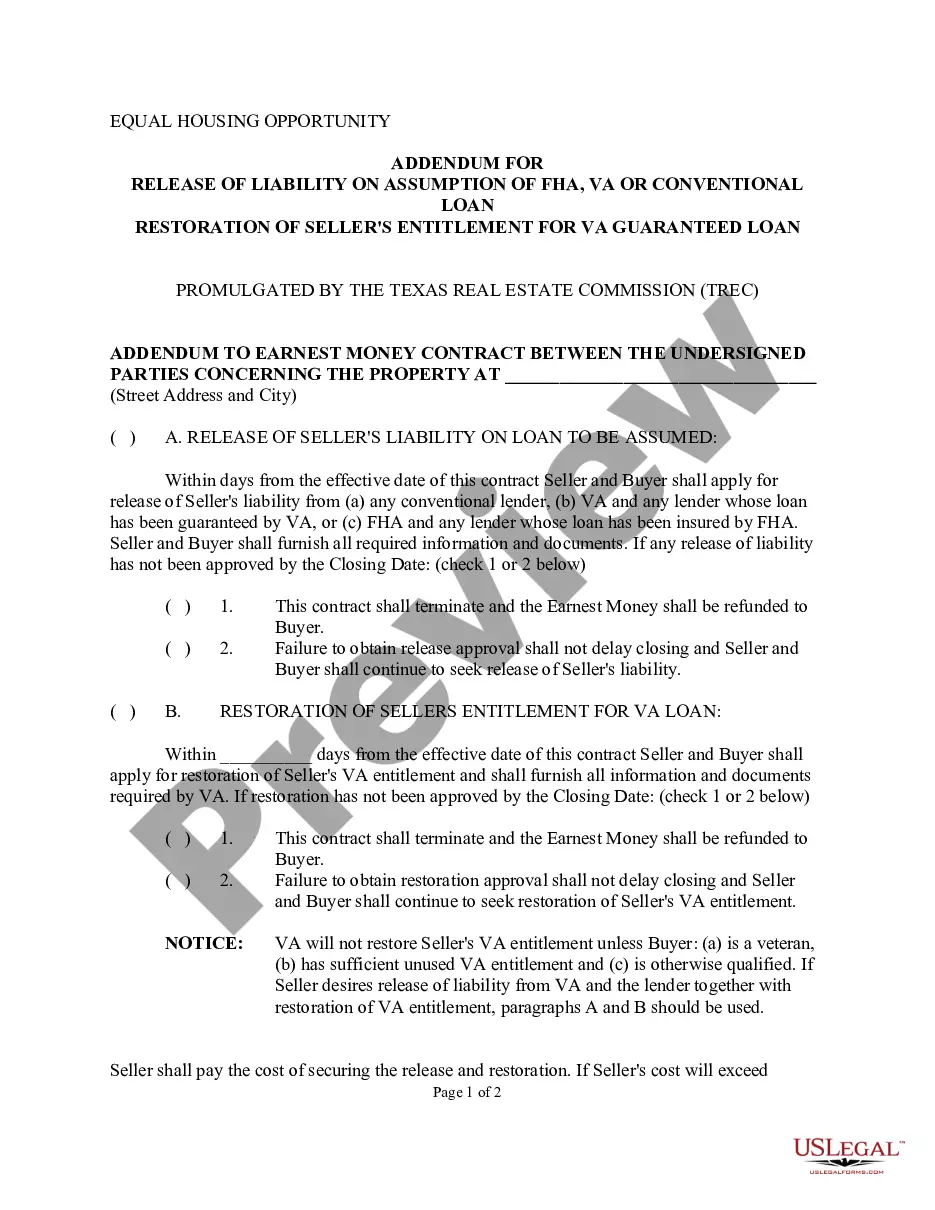

This detailed sample Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

College Station Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is a legal document specific to real estate transactions in College Station, Texas. This addendum addresses the release of liability and restoration of entitlement for different types of loans, including FHA, VA, and conventional loans. It is an important document that protects both the buyer and seller involved in the real estate transaction. When a buyer assumes a mortgage, the seller's liability on the loan is typically released, ensuring that the buyer takes responsibility for the loan payments. However, in the case of FHA, VA, or conventional loans, this liability release is subject to certain conditions outlined in the College Station Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. This addendum ensures that the buyer is financially capable of assuming the loan and meets the lender's qualifications. The addendum may also address the restoration of the seller's entitlement for VA guaranteed loans. VA entitlement is the amount of loan guarantee given by the Department of Veterans Affairs. When a veteran sells a property with a VA loan, their entitlement typically remains tied to the original loan until it is fully paid off or transferred to another veteran. However, if the buyer of the property is also eligible for a VA loan and chooses to assume the seller's VA loan, the seller's entitlement can potentially be restored. There may be variations of the College Station Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan depending on the specific requirements set by the Texas Real Estate Commission and the preferences of the parties involved in the transaction. These variations may include additional clauses or conditions to suit the specific circumstances of the transaction. In conclusion, the College Station Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is a crucial document that ensures the smooth transfer of loans and protects both buyer and seller in a real estate transaction. It addresses the release of liability for different types of loans, such as FHA, VA, and conventional loans, as well as the restoration of a seller's entitlement for VA guaranteed loans. This addendum may have variations depending on the specific requirements and preferences of the parties involved.College Station Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is a legal document specific to real estate transactions in College Station, Texas. This addendum addresses the release of liability and restoration of entitlement for different types of loans, including FHA, VA, and conventional loans. It is an important document that protects both the buyer and seller involved in the real estate transaction. When a buyer assumes a mortgage, the seller's liability on the loan is typically released, ensuring that the buyer takes responsibility for the loan payments. However, in the case of FHA, VA, or conventional loans, this liability release is subject to certain conditions outlined in the College Station Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. This addendum ensures that the buyer is financially capable of assuming the loan and meets the lender's qualifications. The addendum may also address the restoration of the seller's entitlement for VA guaranteed loans. VA entitlement is the amount of loan guarantee given by the Department of Veterans Affairs. When a veteran sells a property with a VA loan, their entitlement typically remains tied to the original loan until it is fully paid off or transferred to another veteran. However, if the buyer of the property is also eligible for a VA loan and chooses to assume the seller's VA loan, the seller's entitlement can potentially be restored. There may be variations of the College Station Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan depending on the specific requirements set by the Texas Real Estate Commission and the preferences of the parties involved in the transaction. These variations may include additional clauses or conditions to suit the specific circumstances of the transaction. In conclusion, the College Station Texas Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan is a crucial document that ensures the smooth transfer of loans and protects both buyer and seller in a real estate transaction. It addresses the release of liability for different types of loans, such as FHA, VA, and conventional loans, as well as the restoration of a seller's entitlement for VA guaranteed loans. This addendum may have variations depending on the specific requirements and preferences of the parties involved.