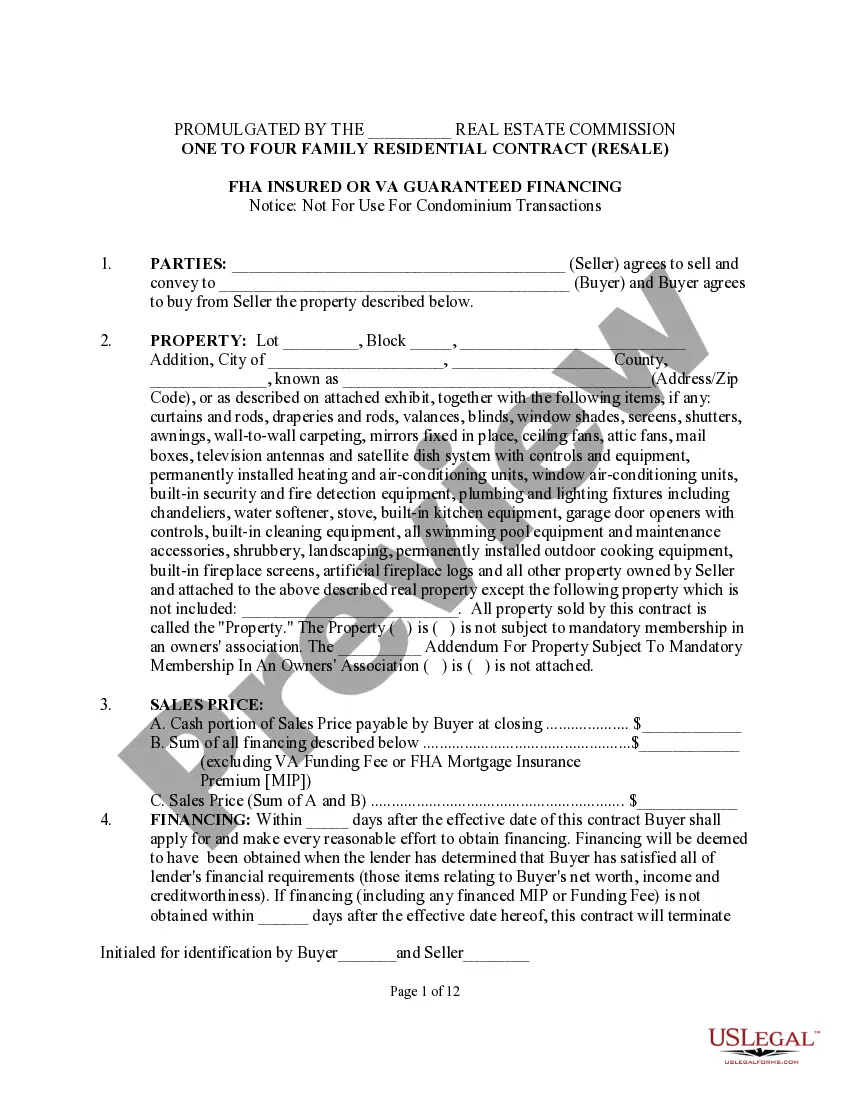

In this contract, seller agrees to sell and to convey to buyer and the buyer agrees to purchase from seller certain property described in the contract. The contract also states that the monthly payments, interest rates and other terms of some loans may be adjusted by the lender at or after closing. The contract also contains a section entitled Broker Information and Ratification of Fee? which states that the listing broker will pay the other broker a certain percentage of the total sales price when the listing brokers fee is received.

Dallas Texas One to Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional or Seller Financing

Description

How to fill out Texas One To Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional Or Seller Financing?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s a digital repository of over 85,000 legal documents for both personal and business purposes and various real-world scenarios.

All the forms are systematically organized by category and area of jurisdiction, so finding the Dallas Texas One to Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional or Seller Financing can be as straightforward as 1-2-3.

Complete your purchase. Enter your credit card information or use your PayPal account to finalize the subscription payment. Download the Dallas Texas One to Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional or Seller Financing. Store the template on your device to fill it out and gain access to it in the My documents section of your profile whenever you need it again.

- For those already familiar with our database and who have used it previously, acquiring the Dallas Texas One to Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional or Seller Financing is as easy as a few clicks.

- Simply Log In to your account, select the document, and click Download to store it on your device.

- New users will need to follow a few extra steps to complete the process.

- Review the Preview mode and document description. Ensure you’ve selected the correct one that fits your needs and is entirely compliant with local jurisdiction requirements.

- Search for another template, if necessary. If you notice any discrepancies, use the Search tab above to find the accurate one. If it meets your criteria, proceed to the next step.

Form popularity

FAQ

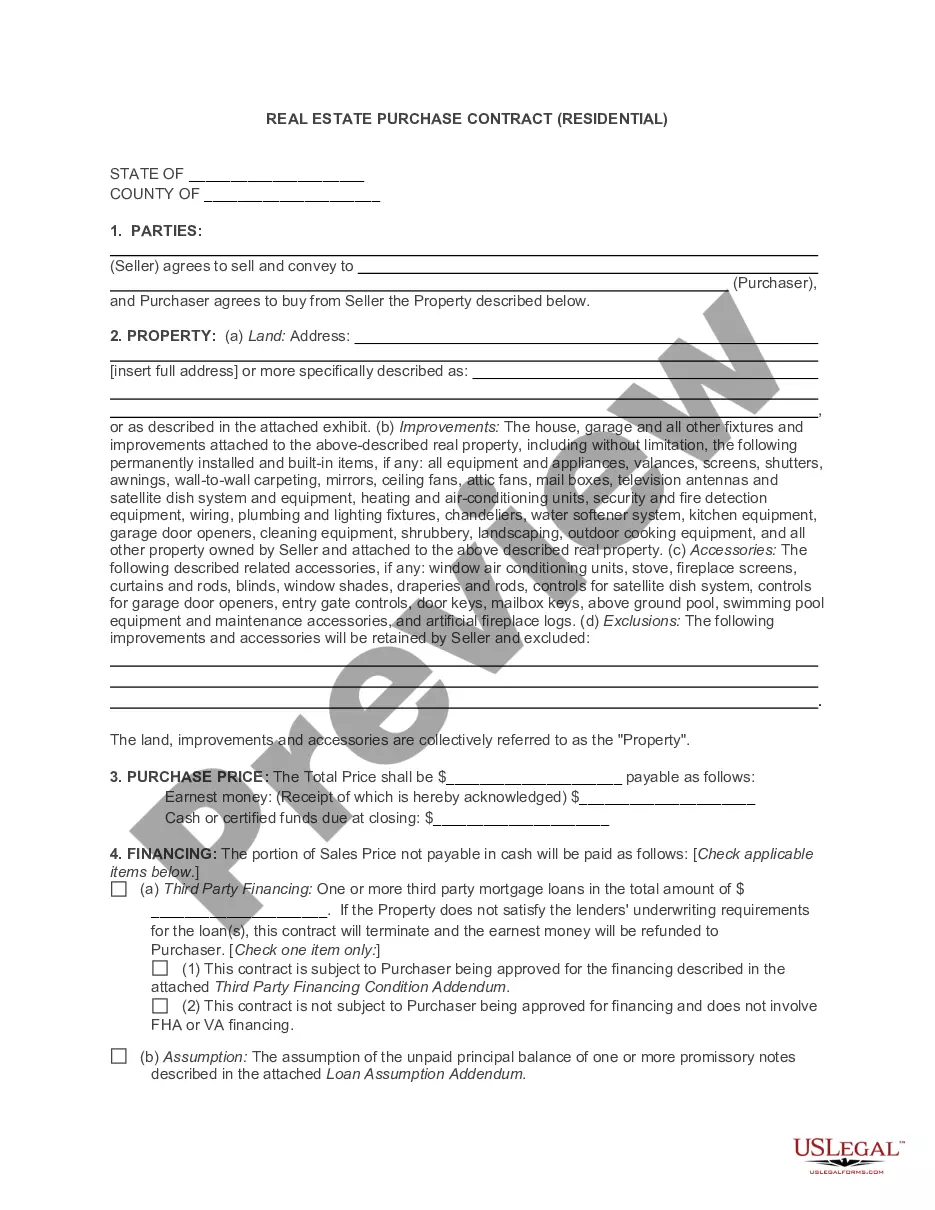

The paragraph addressing title issues in the TREC one to four family residential contract is crucial for clarifying title conditions. It usually outlines the responsibilities for obtaining and delivering the title policy and may specify any exceptions. Understanding this paragraph is essential for ensuring that buyers are aware of title conditions before closing. For easier access to this information, consider using uslegalforms.

The paragraph addressing title policy information in the TREC one to four family residential contract is typically found in the title section. This section outlines the responsibilities of both the buyer and seller regarding title insurance. It is crucial to understand this paragraph to ensure that the buyer receives a clear title upon closing. For more insights, refer to uslegalforms to get comprehensive details.

Yes, anyone can use a Texas Realtors lease agreement, provided they meet the necessary legal requirements for tenancy. This document serves as a standardized template that ensures both landlords and tenants protect their interests. However, it is crucial for users to tailor the agreement to their specific situation and needs. Platforms like UsLegalForms offer helpful resources to assist in customizing these lease agreements effectively.

When filling out the TREC one to four family residential contract for a property located outside of city limits, ensure you indicate the rural or county designation on the form. This distinction is essential for accurately detailing the property's zoning status and any pertinent local regulations. Further, be sure to address any unique disclosure requirements that may apply in rural areas. Using platforms like UsLegalForms can streamline this process and provide clarity on compliance.

The Special Provisions Paragraph provides instructions to only insert ?factual statements and business details.? But what is the difference between a factual statement or business detail and language that could be considered the unauthorized practice of law?

1) Paragraph 5 covers earnest money. If the Buyer fails to deliver the earnest money within 3 days, Seller may terminate.

One to Four Family Residential Contract (Resale) (Form ID: 20-16) 09/01/2021. Description: This is the most frequently used contract form. It is used for the resale of residential properties that are either a single family home, a duplex, a tri-plex or a four-plex.

In conclusion, Paragraph 1 is the first consideration in the contract (promise exchange for a promise) and the blueprint to the transaction. Performing these basic ?housekeeping? practices could avoid issues in the future.

There are essentially four types of real estate contracts: purchase agreement contracts, contracts for deed, lease agreements, and power of attorney contracts. They each have different uses and stipulations.

(9) PROPANE GAS SYSTEM SERVICE AREA: If the Property is located in a propane gas system service area owned by a distribution system retailer, Seller must give Buyer written notice as required by §141.010, Texas Utilities Code. An addendum containing the notice approved by TREC or required by the parties should be used.