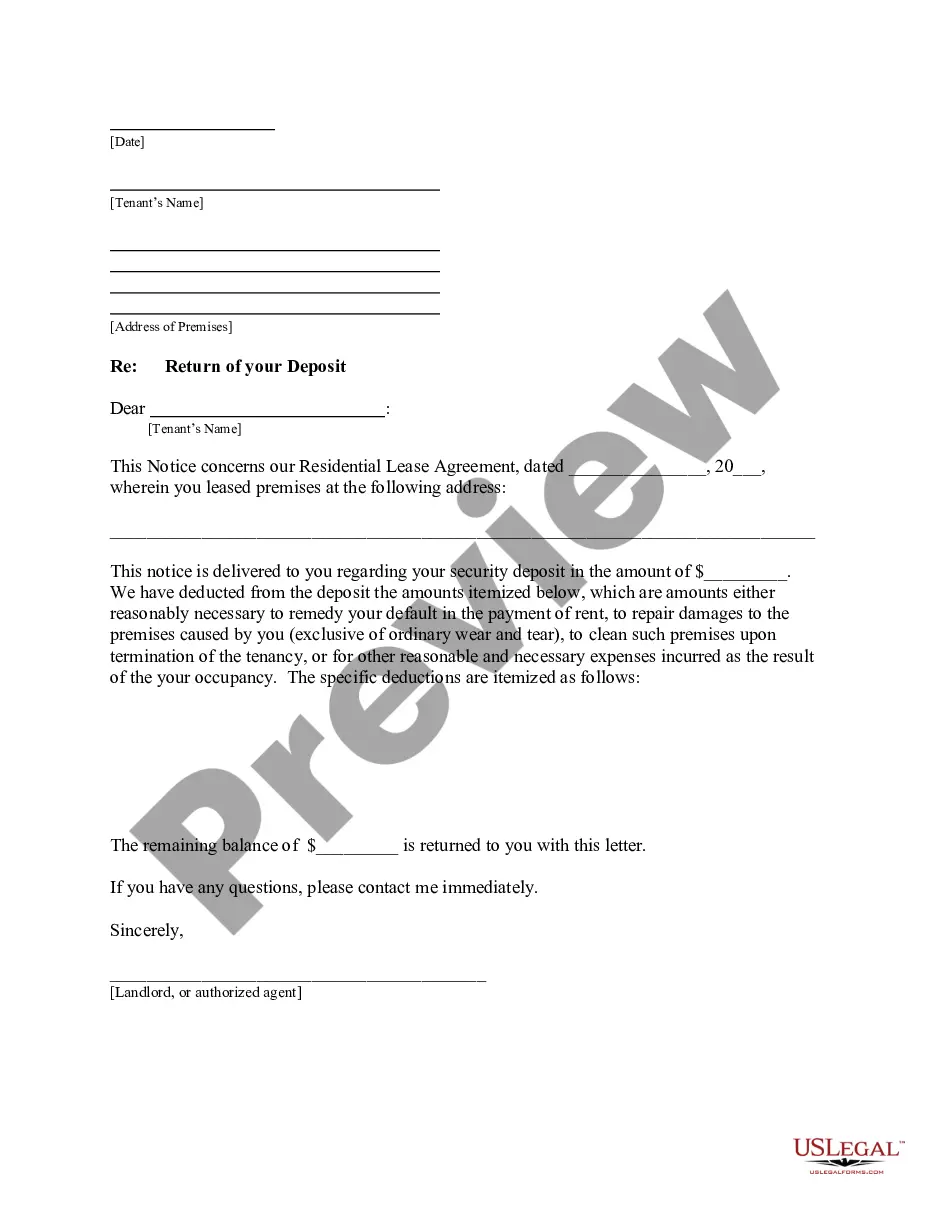

This is a letter informing Tenant that Landlord has deducted from the deposit the amounts itemized which are amounts either reasonably necessary to remedy default in the payment of rent, to repair damages to the premises caused by tenant, to clean such premises upon termination of the tenancy, or for other reasonable and necessary expenses incurred as the result of the tenant's occupancy.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

Title: Comprehensive Guide to Bexar Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: In Bexar County, Texas, the letter from a landlord to a tenant returning a security deposit less deductions holds great significance. This detailed guide aims to provide you with an in-depth understanding of this legal document, including its purpose, key components, and relevant keywords. Additionally, we will mention some variations of this letter that can occur in Bexar County. 1. Purpose of the Bexar Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: The primary objective of this letter is to formally inform the tenant about deductions made from their security deposit upon moving out of the rental property. It serves as a transparent means of communicating any deductions made and returning the remaining amount, if applicable. 2. Key Components of the Letter: a. Landlord's Contact Information: Include the landlord's full name, address, and contact details at the beginning of the letter. b. Tenant's Contact Information: Mention the tenant's full name, address, and any relevant details. c. Rental Property Details: Clearly identify the specific rental property, mentioning the address and any other identifiable information. d. Security Deposit Amount: State the original security deposit amount provided by the tenant at the beginning of the lease. e. Deductions: Provide a detailed explanation of each deduction made, along with its specific monetary value, such as unpaid rent, damages, outstanding utility bills, cleaning expenses, etc. f. Calculation of Deductions: Give a breakdown of the total amount deducted, along with any applicable receipts or invoices. g. Remaining Balance: If any amount remains after the deductions, state the final balance that will be returned to the tenant. h. Return of Remaining Balance: Provide a timeline and method for returning the remaining balance, such as via check, direct deposit, or any other agreed-upon means. i. Signatures: Request both the landlord and tenant to sign and date the document to indicate their acknowledgment and agreement. j. Attachments: Include copies of relevant invoices, receipts, or any supporting documentation. Variations: 1. Bexar Texas Letter from Landlord to Tenant Returning Partial Security Deposit Less Deductions: This version applies when the deductions exceed the original security deposit, leaving the tenant responsible for paying the remaining amount. It should outline the deductions and clearly explain the additional payment required. 2. Bexar Texas Letter from Landlord to Tenant Returning Security Deposit Without Deductions: This type of letter indicates that no deductions were made from the security deposit, and the full amount is being returned to the tenant. It should explicitly state the complete refund, any applicable interest, and the method of refund. Conclusion: Understanding the Bexar Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions is crucial for both landlords and tenants. By addressing the purpose, key components, and variations, this comprehensive guide aims to facilitate clear communication and mitigate any disputes related to security deposit deductions in Bexar County, Texas.Title: Comprehensive Guide to Bexar Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: In Bexar County, Texas, the letter from a landlord to a tenant returning a security deposit less deductions holds great significance. This detailed guide aims to provide you with an in-depth understanding of this legal document, including its purpose, key components, and relevant keywords. Additionally, we will mention some variations of this letter that can occur in Bexar County. 1. Purpose of the Bexar Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: The primary objective of this letter is to formally inform the tenant about deductions made from their security deposit upon moving out of the rental property. It serves as a transparent means of communicating any deductions made and returning the remaining amount, if applicable. 2. Key Components of the Letter: a. Landlord's Contact Information: Include the landlord's full name, address, and contact details at the beginning of the letter. b. Tenant's Contact Information: Mention the tenant's full name, address, and any relevant details. c. Rental Property Details: Clearly identify the specific rental property, mentioning the address and any other identifiable information. d. Security Deposit Amount: State the original security deposit amount provided by the tenant at the beginning of the lease. e. Deductions: Provide a detailed explanation of each deduction made, along with its specific monetary value, such as unpaid rent, damages, outstanding utility bills, cleaning expenses, etc. f. Calculation of Deductions: Give a breakdown of the total amount deducted, along with any applicable receipts or invoices. g. Remaining Balance: If any amount remains after the deductions, state the final balance that will be returned to the tenant. h. Return of Remaining Balance: Provide a timeline and method for returning the remaining balance, such as via check, direct deposit, or any other agreed-upon means. i. Signatures: Request both the landlord and tenant to sign and date the document to indicate their acknowledgment and agreement. j. Attachments: Include copies of relevant invoices, receipts, or any supporting documentation. Variations: 1. Bexar Texas Letter from Landlord to Tenant Returning Partial Security Deposit Less Deductions: This version applies when the deductions exceed the original security deposit, leaving the tenant responsible for paying the remaining amount. It should outline the deductions and clearly explain the additional payment required. 2. Bexar Texas Letter from Landlord to Tenant Returning Security Deposit Without Deductions: This type of letter indicates that no deductions were made from the security deposit, and the full amount is being returned to the tenant. It should explicitly state the complete refund, any applicable interest, and the method of refund. Conclusion: Understanding the Bexar Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions is crucial for both landlords and tenants. By addressing the purpose, key components, and variations, this comprehensive guide aims to facilitate clear communication and mitigate any disputes related to security deposit deductions in Bexar County, Texas.