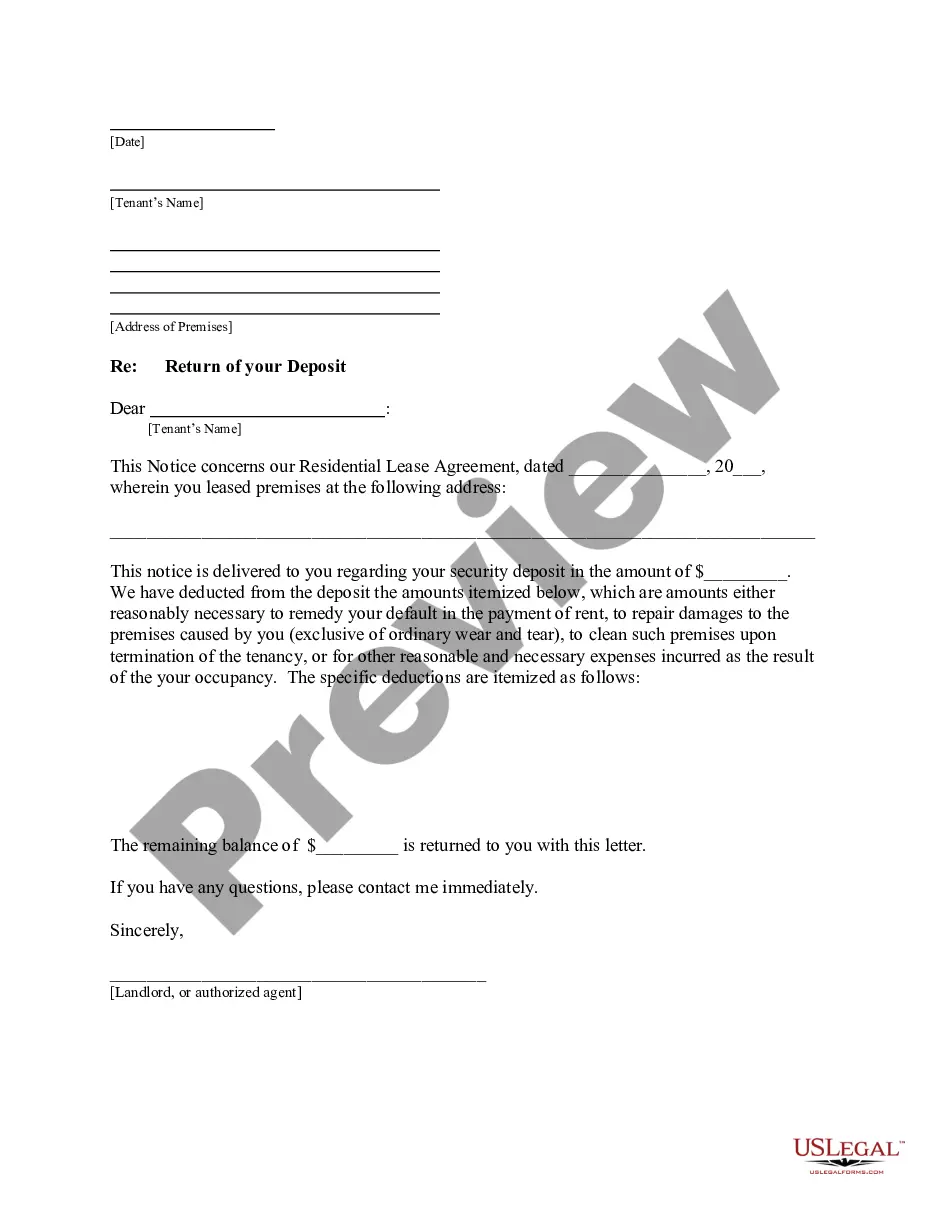

This is a letter informing Tenant that Landlord has deducted from the deposit the amounts itemized which are amounts either reasonably necessary to remedy default in the payment of rent, to repair damages to the premises caused by tenant, to clean such premises upon termination of the tenancy, or for other reasonable and necessary expenses incurred as the result of the tenant's occupancy.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

Title: Carrollton Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions: Detailed Description and Types Explained Description: When it comes to rental agreements, tenants often provide a security deposit to landlords as a form of protection against potential damages or unpaid rent. However, at the end of the lease term, landlords must return the security deposit to tenants, minus any necessary deductions. In Carrollton, Texas, there are specific guidelines and laws that landlords must follow when returning the security deposit. This detailed description aims to provide an understanding of the content typically found in a Carrollton Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions. Content: 1. Introduction: The letter should start with a professional and courteous tone, addressing the tenant by name and mentioning the property address. The intro should also mention the purpose of the letter: to return the security deposit and outline any necessary deductions. 2. Security Deposit Calculation: Here, the letter should outline the original security deposit amount provided by the tenant and state the total amount of deductions made. Landlords must itemize each deduction category and provide a clear breakdown of costs. Common deductions may include: a. Unpaid rent or utilities: If the tenant has any unpaid balance for rent or utilities, the amount will be deducted accordingly. Specify the period for which they owe rent or utilities, including any late fees incurred. b. Repair or cleaning expenses: If the tenant's actions caused damage beyond reasonable wear and tear, describe each repair needed and the corresponding cost. Include expenses for cleaning services if required to restore the property's original condition. c. Replacement or missing items: If any items listed in the initial inventory are damaged, missing, or broken, detail the associated costs for replacements or repairs. d. Other charges: This section addresses any other valid deductions, such as outstanding fines or penalties for lease violations, pet damages (if applicable), or fees for unauthorized alterations. 3. Security Deposit Amount to be Returned: After accounting for all deductions, mention the final amount to be returned to the tenant. Specify the payment method, such as a check or direct deposit, and the expected timeline for receiving the refund. 4. Instructions for Address Updating: If the tenant has moved to a new address, request that they provide their updated address to ensure the security deposit return reaches them correctly. 5. Contact Information: Include the landlord's contact information, such as phone number, email address, and mailing address. Encourage the tenant to reach out if they have any questions or concerns. Types of Carrollton Texas Letters from Landlord to Tenant Returning Security Deposit Less Deductions: 1. Standard Security Deposit Return Letter: This is the most common type of letter, where the landlord returns the security deposit to the tenant after assessing deductions based on damages, cleaning, unpaid rent, etc. 2. Partial Security Deposit Return Letter: In some cases, landlords may only deduct a portion of the security deposit, in which case the partial security deposit return letter is used. This type of letter provides transparency by explaining the deductions applied and outlines the remaining amount to be returned. Remember, it's crucial for landlords in Carrollton, Texas, to adhere to state laws pertaining to security deposit deductions and timely return. It is advisable to consult legal professionals or refer to specific local guidelines to ensure compliance.