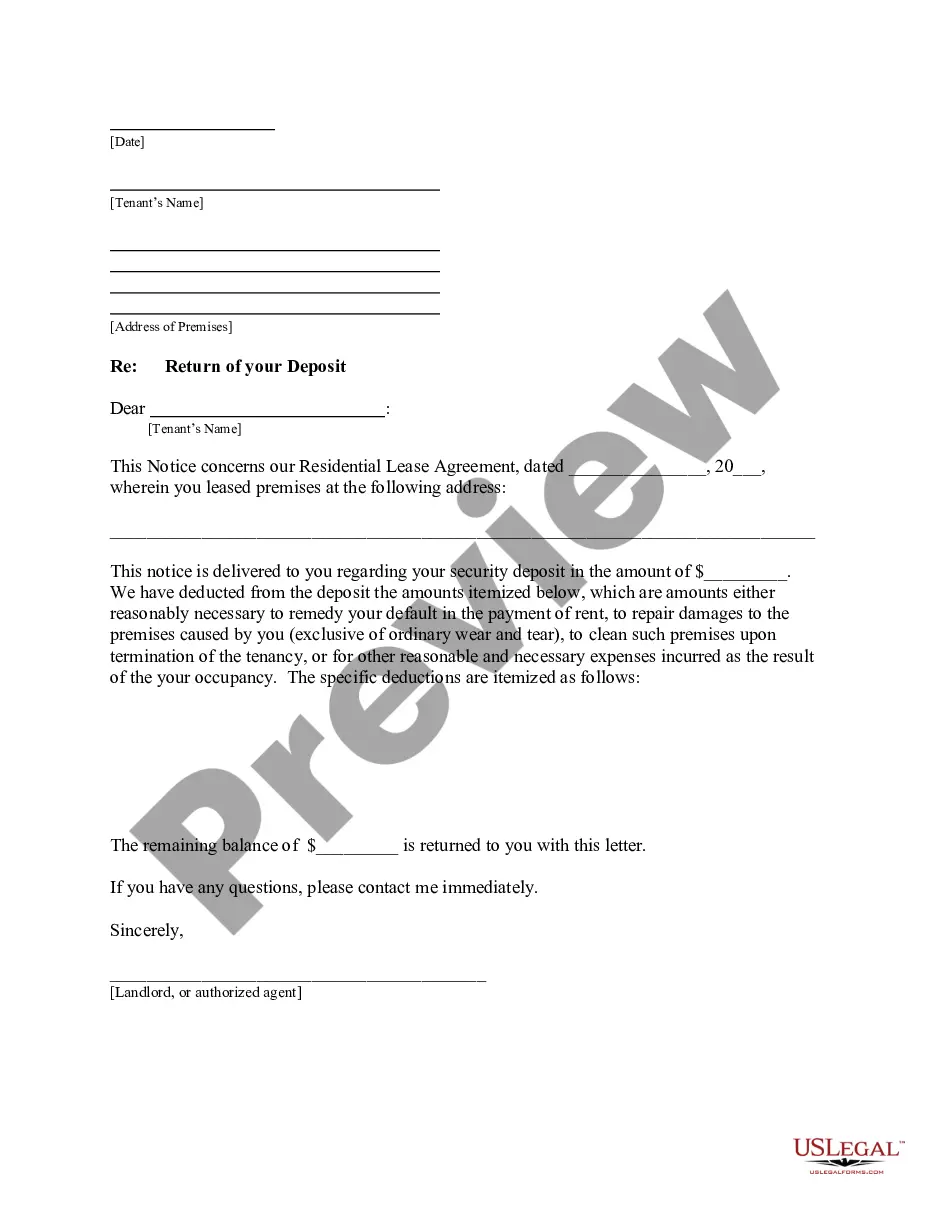

This is a letter informing Tenant that Landlord has deducted from the deposit the amounts itemized which are amounts either reasonably necessary to remedy default in the payment of rent, to repair damages to the premises caused by tenant, to clean such premises upon termination of the tenancy, or for other reasonable and necessary expenses incurred as the result of the tenant's occupancy.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

A Houston Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions is a formal document used by a landlord or property management company to notify a tenant of the amount of their security deposit being returned, along with any deductions made for damages, unpaid rent, or other outstanding charges. The purpose of this letter is to provide transparency and a clear breakdown of the deductions made, if any, from the original security deposit. The letter typically includes the date, the landlord's or property management company's name and contact information, the tenant's name and forwarding address, and a formal salutation. It also includes a reference to the lease agreement and the specific rental property address for clarity. The body of the letter begins by acknowledging the termination of the lease agreement and stating that the tenant has met all the required conditions for receiving their security deposit back. It then proceeds to outline the total amount of the security deposit received from the tenant at the beginning of the lease. The next section details any deductions or charges that are being withheld from the security deposit. Common reasons for deductions include damages to the property beyond normal wear and tear, unpaid rent, unpaid utility bills, cleaning expenses, and any outstanding fees or penalties outlined in the lease agreement. Each deduction is described individually, providing a clear explanation of the reason for the deduction and referencing any relevant documentation or evidence. The letter specifies the amount being deducted for each item and provides a subtotal of all deductions made. After listing the deductions, the letter calculates the net amount being returned to the tenant by subtracting the total deductions from the original security deposit. This net amount is clearly stated, along with any remaining rent or utility charges owed by the tenant. If the tenant has an outstanding balance, the landlord may provide instructions on how to settle the remaining charges. These instructions could include the acceptance of personal checks, money orders, or online payment methods, and the timeline within which the tenant should make the payment. Finally, the letter concludes with a friendly closing, inviting the tenant to reach out with any questions or concerns. The landlord's or property management company's contact information is reiterated for convenience. Different types of Houston Texas Letters from Landlord to Tenant Returning Security Deposit Less Deductions may include variations in the format and specific legal requirements as dictated by local and state regulations. Some variations might be specific templates designed for different property types or letter formats to accommodate different situations, such as returning the security deposit for a commercial property or for an apartment within a multifamily building.A Houston Texas Letter from Landlord to Tenant Returning Security Deposit Less Deductions is a formal document used by a landlord or property management company to notify a tenant of the amount of their security deposit being returned, along with any deductions made for damages, unpaid rent, or other outstanding charges. The purpose of this letter is to provide transparency and a clear breakdown of the deductions made, if any, from the original security deposit. The letter typically includes the date, the landlord's or property management company's name and contact information, the tenant's name and forwarding address, and a formal salutation. It also includes a reference to the lease agreement and the specific rental property address for clarity. The body of the letter begins by acknowledging the termination of the lease agreement and stating that the tenant has met all the required conditions for receiving their security deposit back. It then proceeds to outline the total amount of the security deposit received from the tenant at the beginning of the lease. The next section details any deductions or charges that are being withheld from the security deposit. Common reasons for deductions include damages to the property beyond normal wear and tear, unpaid rent, unpaid utility bills, cleaning expenses, and any outstanding fees or penalties outlined in the lease agreement. Each deduction is described individually, providing a clear explanation of the reason for the deduction and referencing any relevant documentation or evidence. The letter specifies the amount being deducted for each item and provides a subtotal of all deductions made. After listing the deductions, the letter calculates the net amount being returned to the tenant by subtracting the total deductions from the original security deposit. This net amount is clearly stated, along with any remaining rent or utility charges owed by the tenant. If the tenant has an outstanding balance, the landlord may provide instructions on how to settle the remaining charges. These instructions could include the acceptance of personal checks, money orders, or online payment methods, and the timeline within which the tenant should make the payment. Finally, the letter concludes with a friendly closing, inviting the tenant to reach out with any questions or concerns. The landlord's or property management company's contact information is reiterated for convenience. Different types of Houston Texas Letters from Landlord to Tenant Returning Security Deposit Less Deductions may include variations in the format and specific legal requirements as dictated by local and state regulations. Some variations might be specific templates designed for different property types or letter formats to accommodate different situations, such as returning the security deposit for a commercial property or for an apartment within a multifamily building.