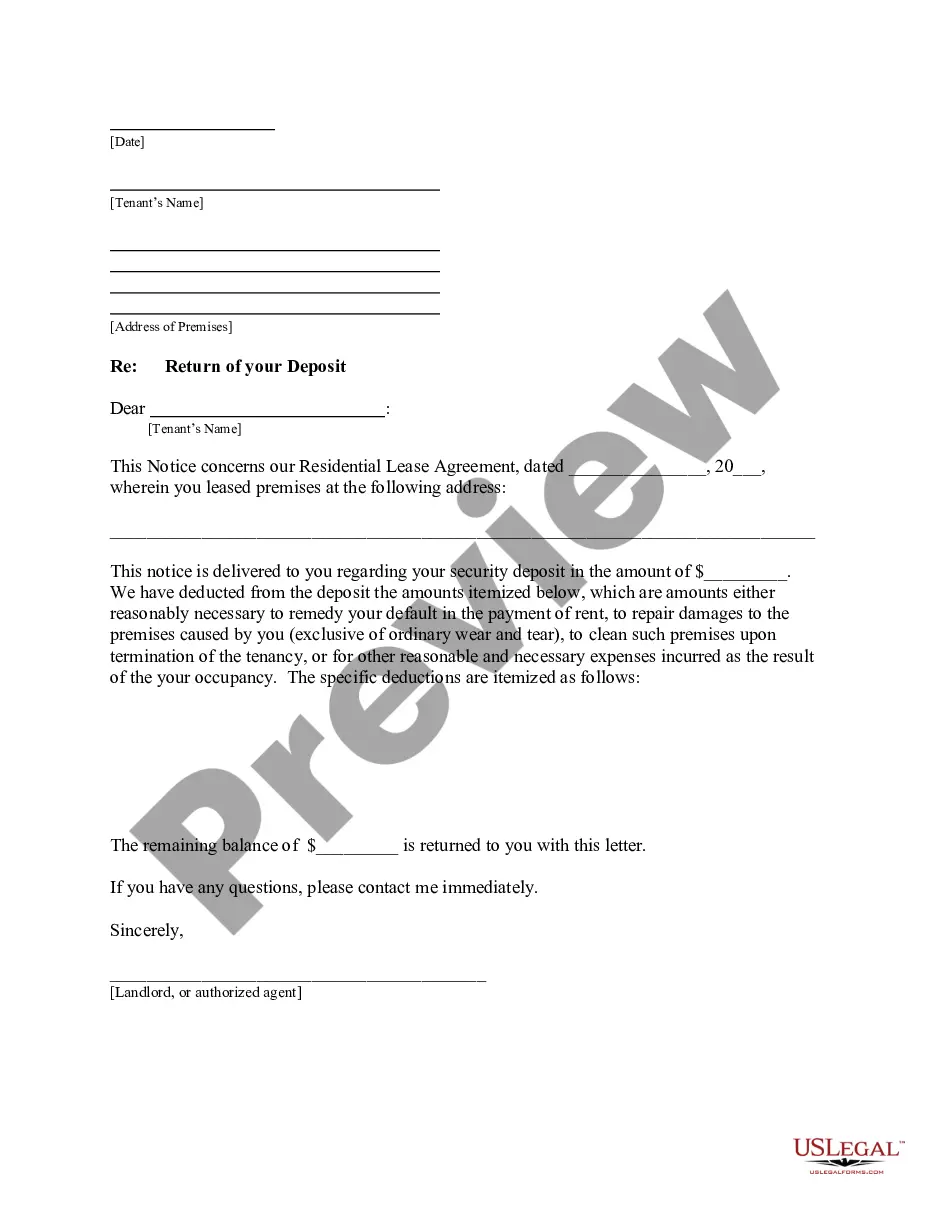

This is a letter informing Tenant that Landlord has deducted from the deposit the amounts itemized which are amounts either reasonably necessary to remedy default in the payment of rent, to repair damages to the premises caused by tenant, to clean such premises upon termination of the tenancy, or for other reasonable and necessary expenses incurred as the result of the tenant's occupancy.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

Title: San Angelo Texas Letter from Landlord to Tenant Returning Security Deposit less Deductions Introduction: A San Angelo Texas Letter from Landlord to Tenant Returning Security Deposit less Deductions is a formal document that outlines the return of a tenant's security deposit while deducting any necessary charges for damages or outstanding payments. This letter serves as a transparent communication medium between the landlord and tenant regarding the final amount being returned. Below, you will find a detailed description of the content typically included in this letter, along with different types based on specific circumstances. Content of the San Angelo Texas Letter from Landlord to Tenant Returning Security Deposit less Deductions: 1. Salutation: Begin the letter with a formal salutation, using the tenant's full name, and address them respectfully. 2. Introductory Paragraph: Clearly state the purpose of the letter, indicating that it is regarding the tenant's security deposit refund. 3. Lease Agreement Reference: Mention the lease agreement number, the beginning and ending dates of the tenancy, and the address of the rented property. This information helps both parties identify the specific rental unit and lease terms. 4. Security Deposit Amount: Specify the original security deposit amount paid by the tenant when entering the lease agreement. 5. Deductions: List and explain any deductions made from the security deposit, if applicable. Deductions may include damages beyond normal wear and tear, unpaid rent, cleaning and repair expenses, or outstanding utility bills. Provide detailed explanations for each deduction, including the dates and descriptions of the damages and the corresponding charges incurred. 6. Utility Reconciliation: If utility charges are being deducted, provide a comprehensive breakdown of the costs, including the billing period, the utility company's name, and the amount deducted. 7. Security Deposit Remaining: Subtract the total deductions from the original security deposit amount and state the final amount being returned to the tenant. 8. Refund Delivery: Describe how the refund will be delivered to the tenant, whether it will be via check, bank transfer, or any other preferred method. Include relevant details such as the address where the refund will be sent or the account number for direct transfers. 9. Contact Information: Provide your contact details as the landlord, including your name, address, phone number, and email address. Encourage the tenant to reach out if they have any further questions or concerns. 10. Final Paragraph: Express gratitude for the tenant's tenancy, briefly summarize the actions taken to complete the refund process, and convey your hopes for a successful future for both parties. Different Types of San Angelo Texas Letters from Landlord to Tenant Returning Security Deposit less Deductions: 1. Refund with No Deductions: This type of letter acknowledges that no deductions were made, and the tenant is receiving their full security deposit amount. 2. Refund with Deductions for Damages: This letter specifies the deductions made for property damages beyond normal wear and tear, providing a detailed breakdown of the expenses. 3. Refund with Deductions for Unpaid Rent: In this case, the letter outlines the deductions made for unpaid rent or late payment fees, clarifying the rent period and the amounts due. 4. Refund with Deductions for Unpaid Utilities: This type of letter explains the deductions made for outstanding utility bills, including a comprehensive breakdown of the charges. Remember to tailor the content of the letter based on the specific circumstances and the terms stated in the lease agreement.Title: San Angelo Texas Letter from Landlord to Tenant Returning Security Deposit less Deductions Introduction: A San Angelo Texas Letter from Landlord to Tenant Returning Security Deposit less Deductions is a formal document that outlines the return of a tenant's security deposit while deducting any necessary charges for damages or outstanding payments. This letter serves as a transparent communication medium between the landlord and tenant regarding the final amount being returned. Below, you will find a detailed description of the content typically included in this letter, along with different types based on specific circumstances. Content of the San Angelo Texas Letter from Landlord to Tenant Returning Security Deposit less Deductions: 1. Salutation: Begin the letter with a formal salutation, using the tenant's full name, and address them respectfully. 2. Introductory Paragraph: Clearly state the purpose of the letter, indicating that it is regarding the tenant's security deposit refund. 3. Lease Agreement Reference: Mention the lease agreement number, the beginning and ending dates of the tenancy, and the address of the rented property. This information helps both parties identify the specific rental unit and lease terms. 4. Security Deposit Amount: Specify the original security deposit amount paid by the tenant when entering the lease agreement. 5. Deductions: List and explain any deductions made from the security deposit, if applicable. Deductions may include damages beyond normal wear and tear, unpaid rent, cleaning and repair expenses, or outstanding utility bills. Provide detailed explanations for each deduction, including the dates and descriptions of the damages and the corresponding charges incurred. 6. Utility Reconciliation: If utility charges are being deducted, provide a comprehensive breakdown of the costs, including the billing period, the utility company's name, and the amount deducted. 7. Security Deposit Remaining: Subtract the total deductions from the original security deposit amount and state the final amount being returned to the tenant. 8. Refund Delivery: Describe how the refund will be delivered to the tenant, whether it will be via check, bank transfer, or any other preferred method. Include relevant details such as the address where the refund will be sent or the account number for direct transfers. 9. Contact Information: Provide your contact details as the landlord, including your name, address, phone number, and email address. Encourage the tenant to reach out if they have any further questions or concerns. 10. Final Paragraph: Express gratitude for the tenant's tenancy, briefly summarize the actions taken to complete the refund process, and convey your hopes for a successful future for both parties. Different Types of San Angelo Texas Letters from Landlord to Tenant Returning Security Deposit less Deductions: 1. Refund with No Deductions: This type of letter acknowledges that no deductions were made, and the tenant is receiving their full security deposit amount. 2. Refund with Deductions for Damages: This letter specifies the deductions made for property damages beyond normal wear and tear, providing a detailed breakdown of the expenses. 3. Refund with Deductions for Unpaid Rent: In this case, the letter outlines the deductions made for unpaid rent or late payment fees, clarifying the rent period and the amounts due. 4. Refund with Deductions for Unpaid Utilities: This type of letter explains the deductions made for outstanding utility bills, including a comprehensive breakdown of the charges. Remember to tailor the content of the letter based on the specific circumstances and the terms stated in the lease agreement.