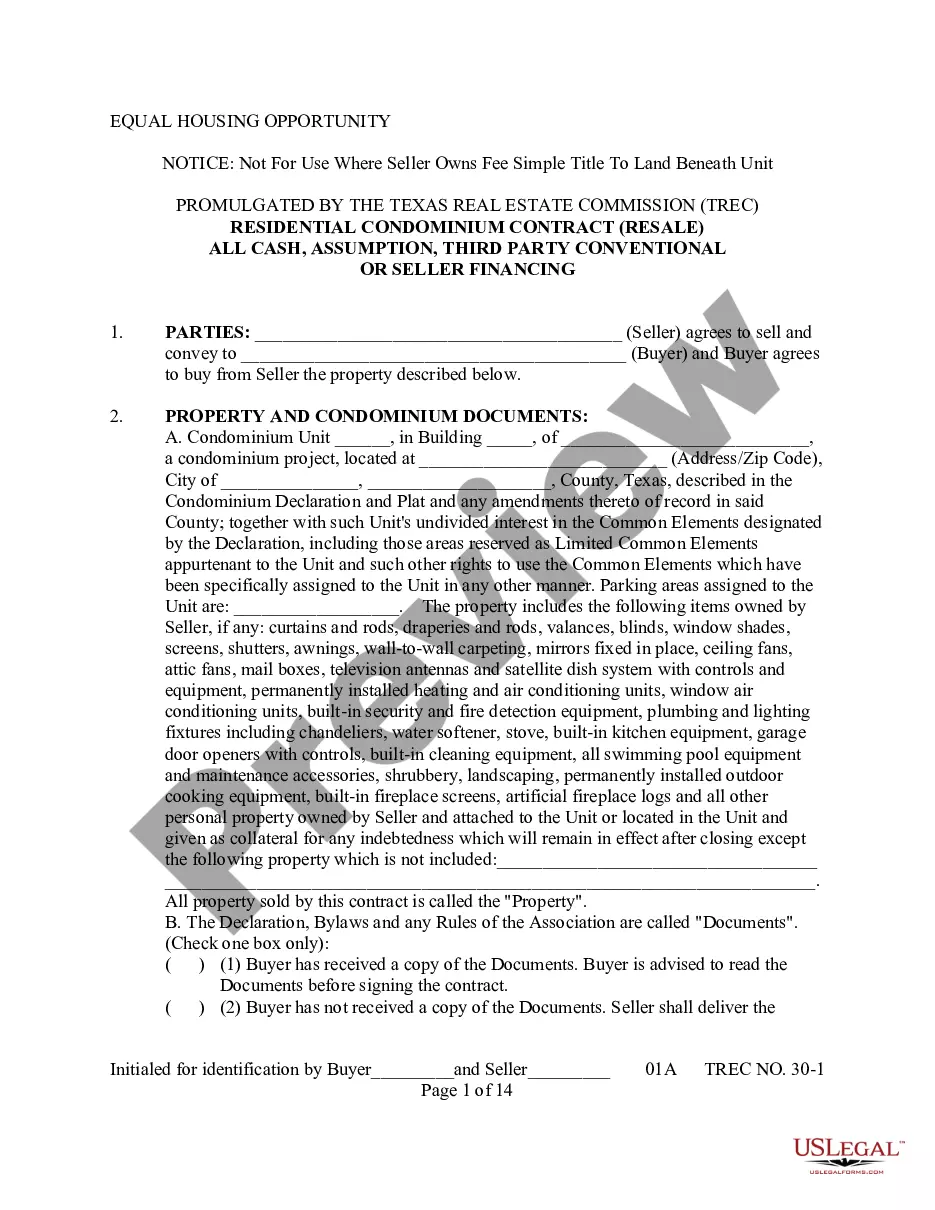

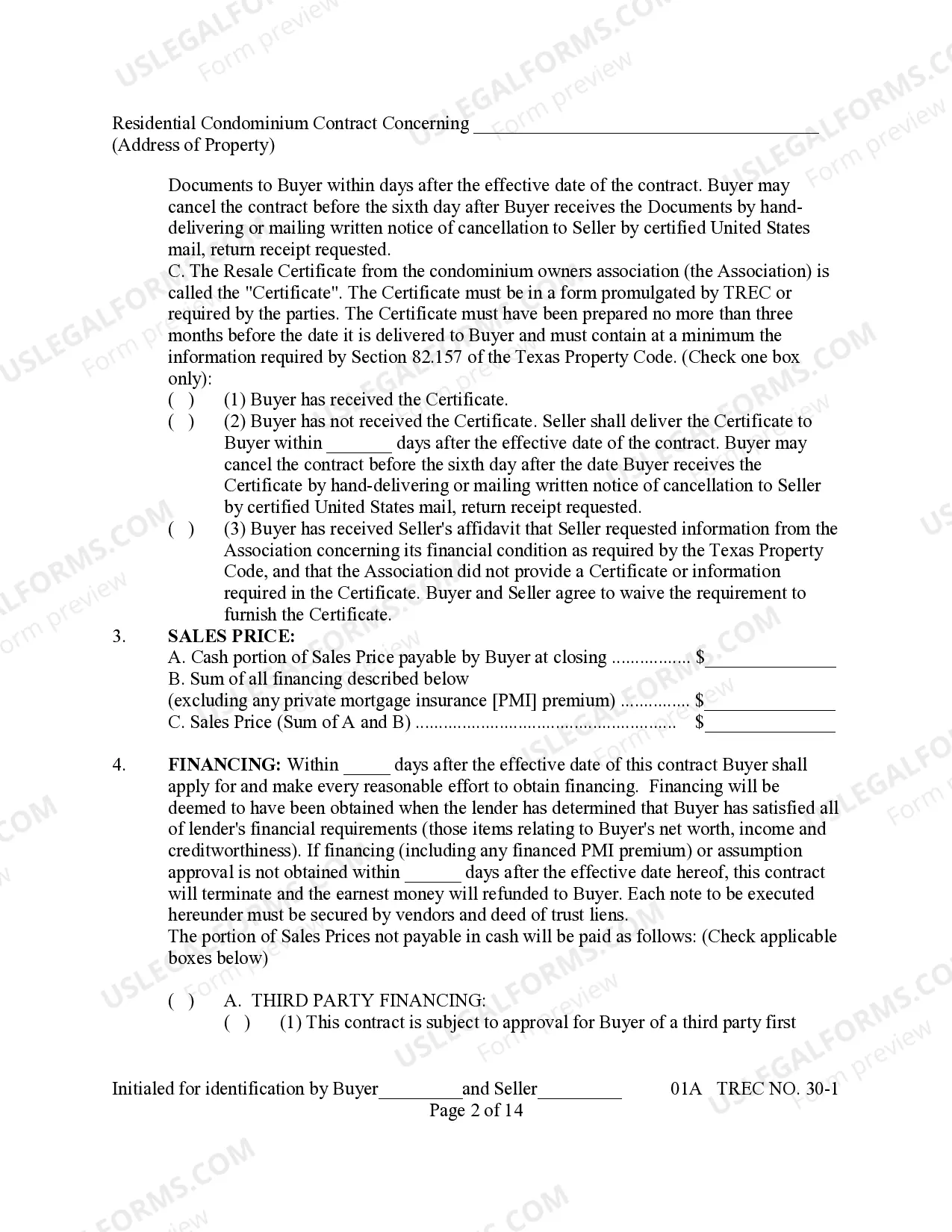

This detailed sample Conventional or Seller Financing Agreementcomplies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

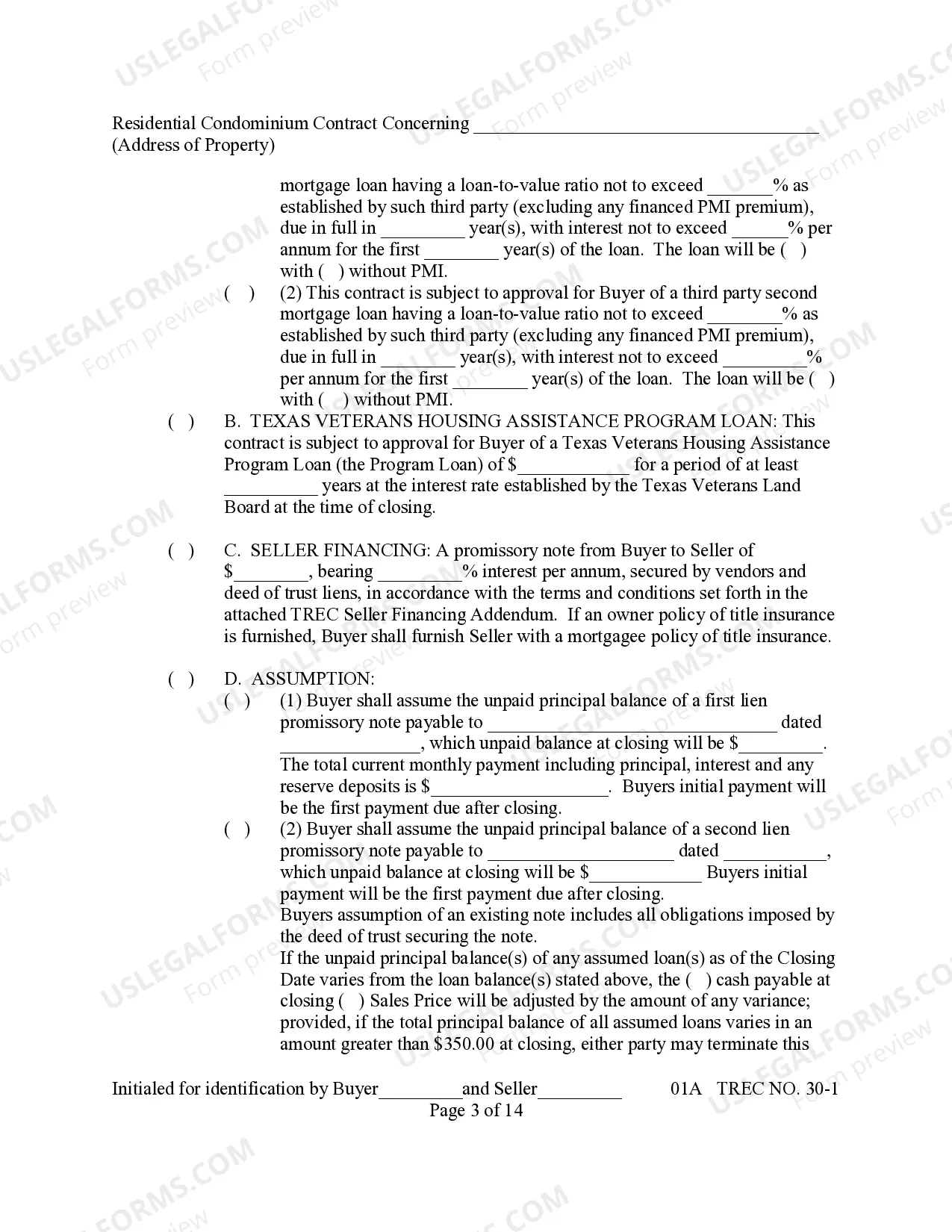

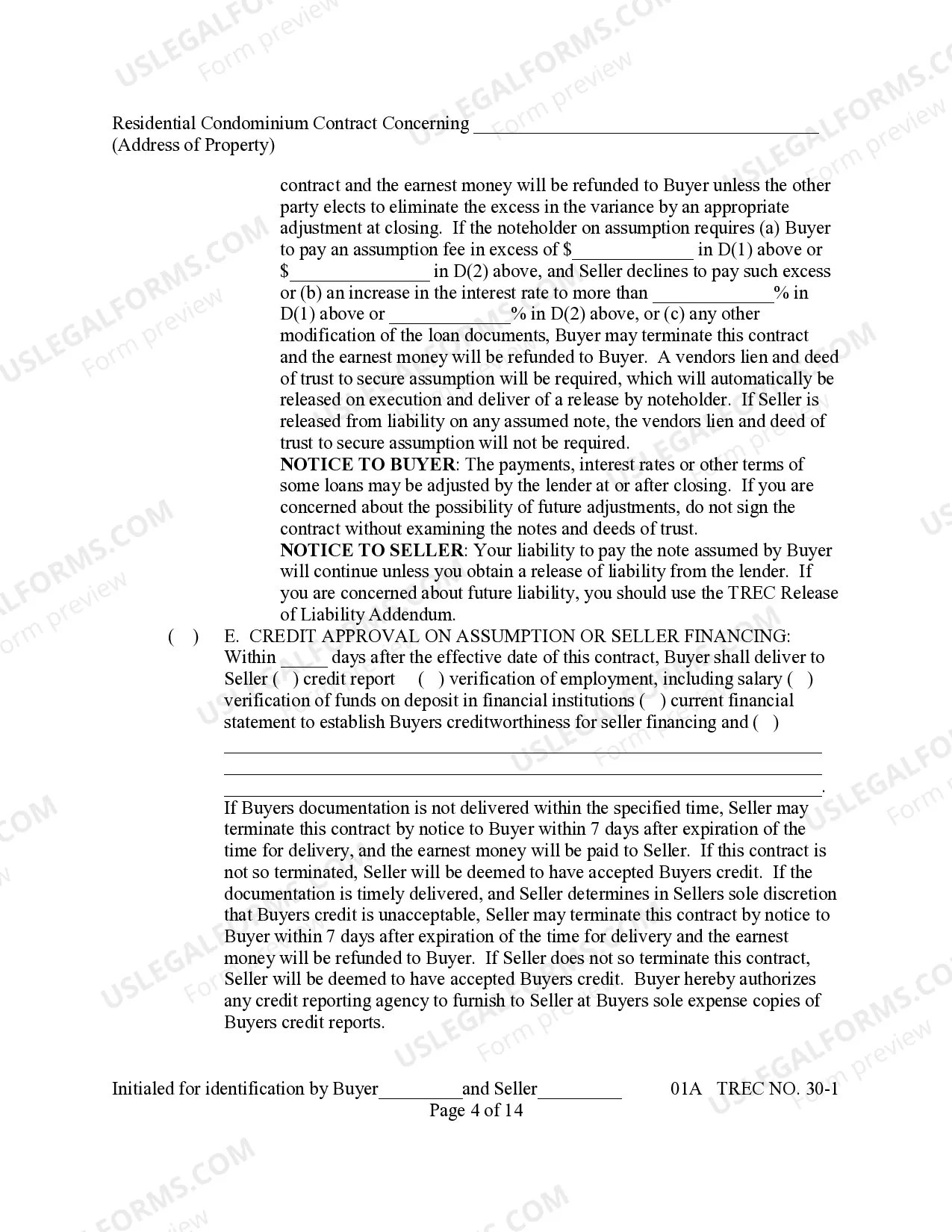

Amarillo, Texas offers various financing options for homebuyers, including conventional financing and seller financing. These two approaches provide unique opportunities for individuals seeking to purchase real estate in Amarillo. In this article, we will delve into the details of Amarillo Texas Conventional and Seller Financing, exploring their features, differences, and potential benefits. Conventional Financing in Amarillo, Texas: Conventional financing refers to the traditional method of obtaining a mortgage through a financial institution like banks, credit unions, or mortgage lenders. This form of financing requires potential buyers to have a good credit score, stable income, and a down payment, typically ranging from 5% to 20% of the property's purchase price. Amarillo Texas conventional financing offers several advantages to homebuyers. Firstly, it allows for more significant borrowing power, enabling buyers to purchase higher-priced properties. Secondly, conventional loans often come with lower interest rates compared to other financing options available in the market. Additionally, conventional financing generally offers more flexible repayment terms, enabling borrowers to choose fixed-rate or adjustable-rate mortgage (ARM) options. Seller Financing in Amarillo, Texas: Seller financing, also known as owner financing or seller carry back, is an alternative method where the property seller acts as the lender. In seller financing, the seller extends a loan directly to the buyer, eliminating the need for traditional mortgage institutions. This form of financing is particularly useful for individuals facing challenges obtaining a conventional mortgage due to factors such as poor credit history or insufficient down payment. In Amarillo, Texas, seller financing presents an excellent opportunity for individuals who may not qualify for conventional loans. The terms and conditions of seller financing are negotiable between the buyer and seller, providing more flexibility regarding interest rates, repayment schedule, and down payment requirements. Notable Types of Amarillo, Texas Conventional or Seller Financing: 1. FHA Loans: Amarillo homebuyers may explore FHA (Federal Housing Administration) loans, which are backed by the government. These loans typically offer more lenient credit score requirements and allow down payments as low as 3.5% of the purchase price. 2. USDA Loans: Another option within conventional financing is USDA loans, primarily designed for rural properties. As Amarillo is situated in the Texas Panhandle region, certain areas may qualify for USDA loans, providing low to no down payment options for eligible buyers. 3. Contract for Deed: Under the umbrella of seller financing, Amarillo homebuyers may come across the contract for deed option. This type of financing allows the buyer to pay the purchase price over time with interest, while the seller retains the title until the full payment is made. 4. Lease-to-Own: Lease-to-own is another variety of seller financing, where the buyer signs a lease with an option to purchase the property at a predetermined price within a specified period. A portion of the monthly rent is often credited towards the future purchase. Understanding the differences between Amarillo Texas conventional and seller financing is essential for aspiring homeowners to make informed decisions. While conventional financing relies on financial institutions, seller financing offers greater flexibility and may be more accessible to individuals facing certain obstacles. By exploring these options, prospective buyers can find the right financing method that aligns with their specific circumstances and achieve their dream of owning a home in Amarillo, Texas.Amarillo, Texas offers various financing options for homebuyers, including conventional financing and seller financing. These two approaches provide unique opportunities for individuals seeking to purchase real estate in Amarillo. In this article, we will delve into the details of Amarillo Texas Conventional and Seller Financing, exploring their features, differences, and potential benefits. Conventional Financing in Amarillo, Texas: Conventional financing refers to the traditional method of obtaining a mortgage through a financial institution like banks, credit unions, or mortgage lenders. This form of financing requires potential buyers to have a good credit score, stable income, and a down payment, typically ranging from 5% to 20% of the property's purchase price. Amarillo Texas conventional financing offers several advantages to homebuyers. Firstly, it allows for more significant borrowing power, enabling buyers to purchase higher-priced properties. Secondly, conventional loans often come with lower interest rates compared to other financing options available in the market. Additionally, conventional financing generally offers more flexible repayment terms, enabling borrowers to choose fixed-rate or adjustable-rate mortgage (ARM) options. Seller Financing in Amarillo, Texas: Seller financing, also known as owner financing or seller carry back, is an alternative method where the property seller acts as the lender. In seller financing, the seller extends a loan directly to the buyer, eliminating the need for traditional mortgage institutions. This form of financing is particularly useful for individuals facing challenges obtaining a conventional mortgage due to factors such as poor credit history or insufficient down payment. In Amarillo, Texas, seller financing presents an excellent opportunity for individuals who may not qualify for conventional loans. The terms and conditions of seller financing are negotiable between the buyer and seller, providing more flexibility regarding interest rates, repayment schedule, and down payment requirements. Notable Types of Amarillo, Texas Conventional or Seller Financing: 1. FHA Loans: Amarillo homebuyers may explore FHA (Federal Housing Administration) loans, which are backed by the government. These loans typically offer more lenient credit score requirements and allow down payments as low as 3.5% of the purchase price. 2. USDA Loans: Another option within conventional financing is USDA loans, primarily designed for rural properties. As Amarillo is situated in the Texas Panhandle region, certain areas may qualify for USDA loans, providing low to no down payment options for eligible buyers. 3. Contract for Deed: Under the umbrella of seller financing, Amarillo homebuyers may come across the contract for deed option. This type of financing allows the buyer to pay the purchase price over time with interest, while the seller retains the title until the full payment is made. 4. Lease-to-Own: Lease-to-own is another variety of seller financing, where the buyer signs a lease with an option to purchase the property at a predetermined price within a specified period. A portion of the monthly rent is often credited towards the future purchase. Understanding the differences between Amarillo Texas conventional and seller financing is essential for aspiring homeowners to make informed decisions. While conventional financing relies on financial institutions, seller financing offers greater flexibility and may be more accessible to individuals facing certain obstacles. By exploring these options, prospective buyers can find the right financing method that aligns with their specific circumstances and achieve their dream of owning a home in Amarillo, Texas.