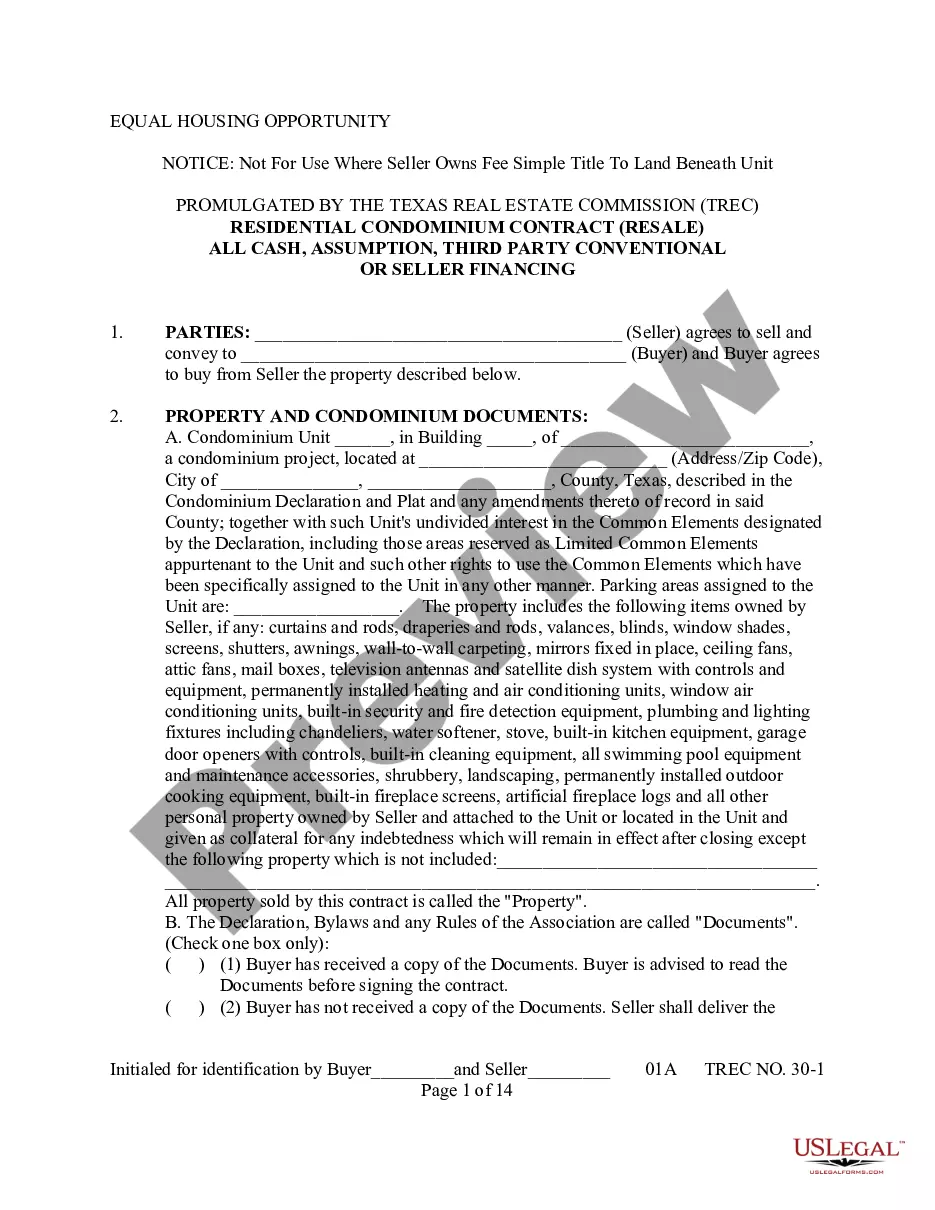

This detailed sample Conventional or Seller Financing Agreementcomplies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Austin Texas Conventional or Seller Financing

Description

How to fill out Texas Conventional Or Seller Financing?

Regardless of one's social or occupational standing, completing legal forms has become an unfortunate requirement in the current professional landscape.

Frequently, it is nearly impossible for individuals without a legal background to generate this type of documentation from scratch, primarily due to the complex language and legal intricacies involved.

This is where US Legal Forms comes in to assist.

Check that the form you’ve found is applicable to your area, as the regulations of one state or county may not apply to another.

Review the document and read a brief description (if available) of the situations the document can address.

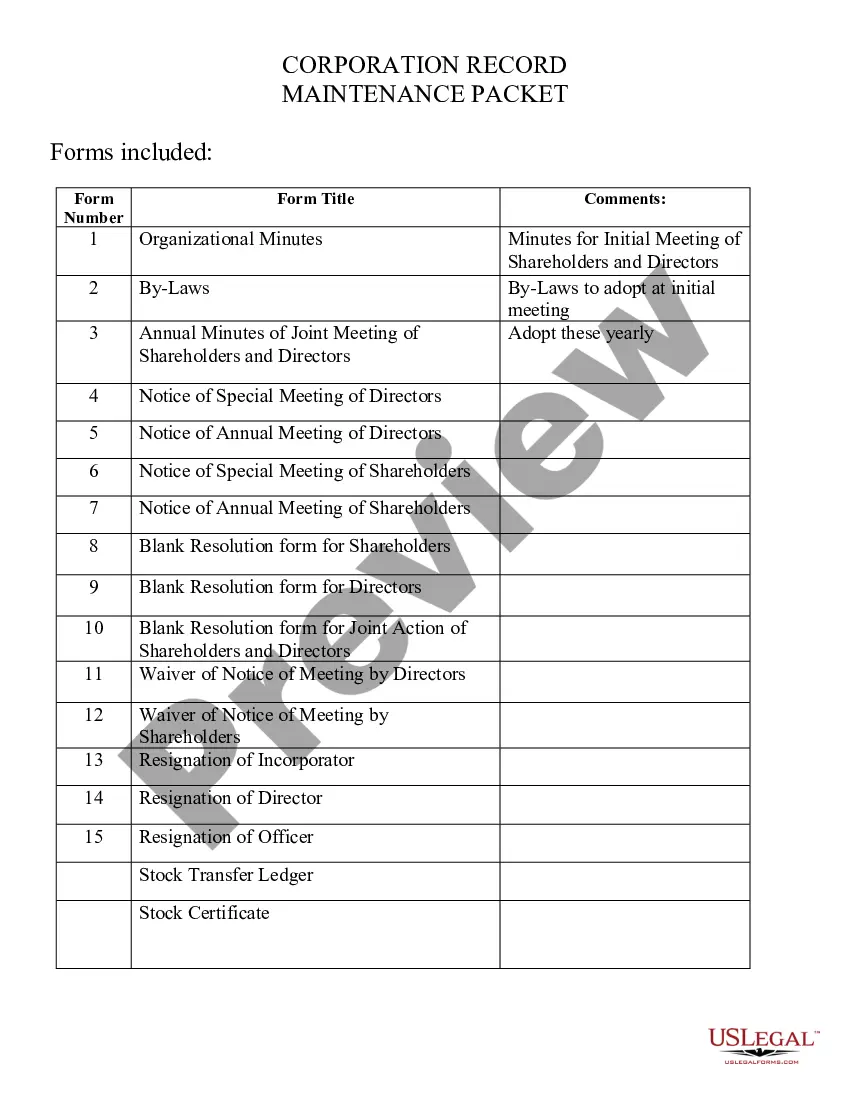

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific forms applicable for nearly any legal situation.

- US Legal Forms also provides significant benefits for associates or legal advisors looking to enhance their efficiency through our DIY forms.

- Whether you need the Austin Texas Conventional or Seller Financing forms, or any other documentation recognized in your state or county, everything is readily available with US Legal Forms.

- Here’s how you can obtain the Austin Texas Conventional or Seller Financing quickly through our dependable service.

- If you are already a subscriber, feel free to Log In to your account to download the desired form.

- However, if you are new to our library, make sure to follow these steps before acquiring the Austin Texas Conventional or Seller Financing.

Form popularity

FAQ

Owner financed land is also referred to as ?seller financing? and is an alternate option to traditional bank financing. Through owner financing, you make the payment on the land directly to the seller of the property until the land purchase is paid off.

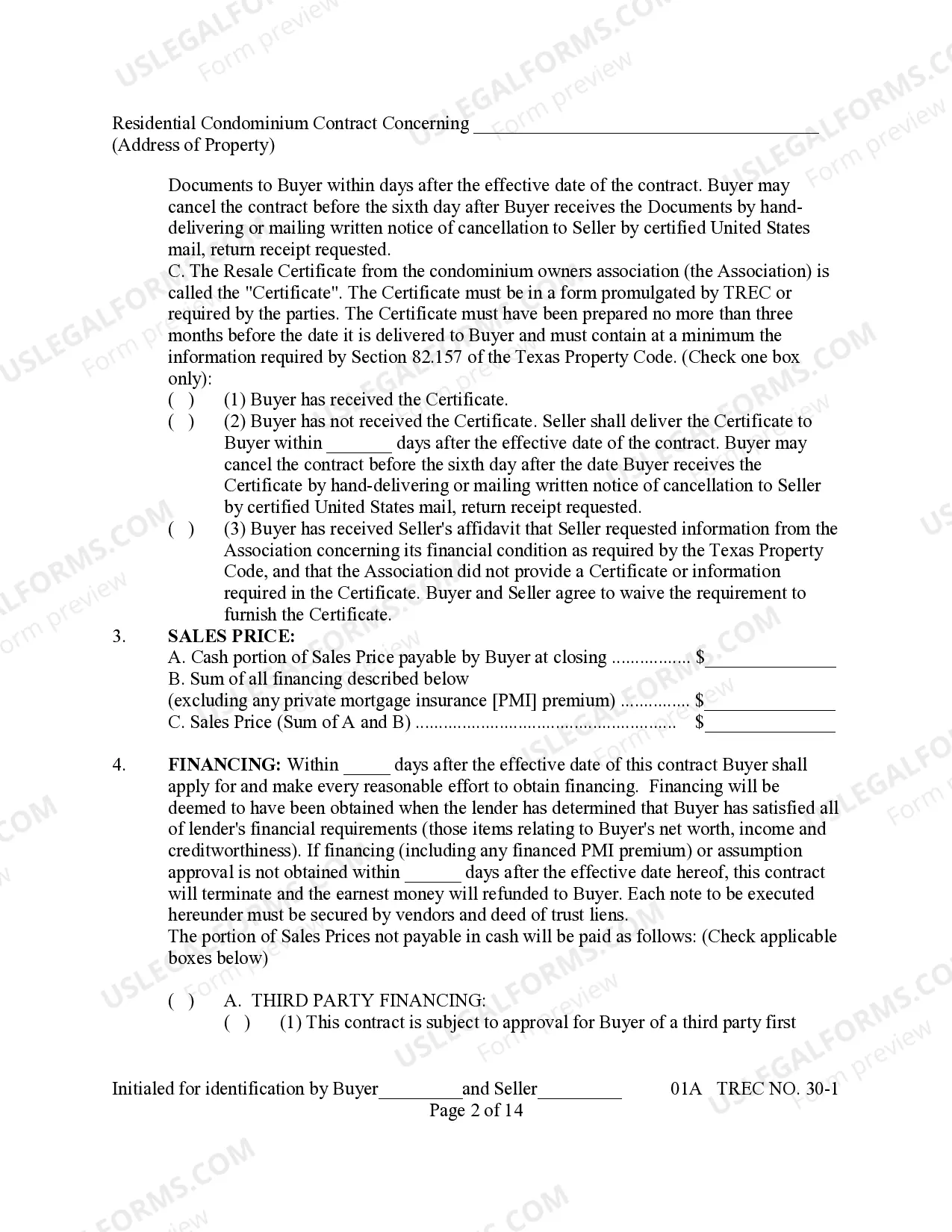

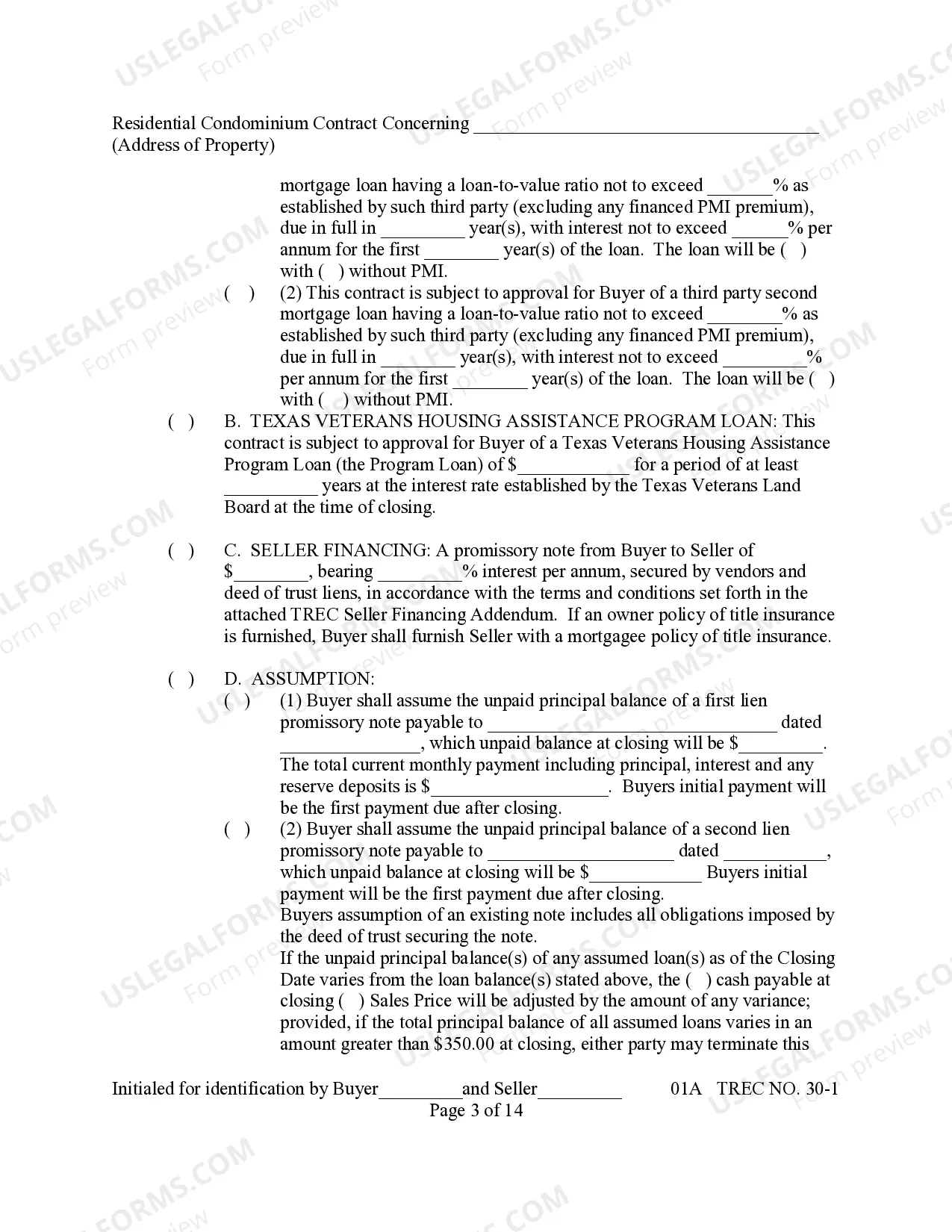

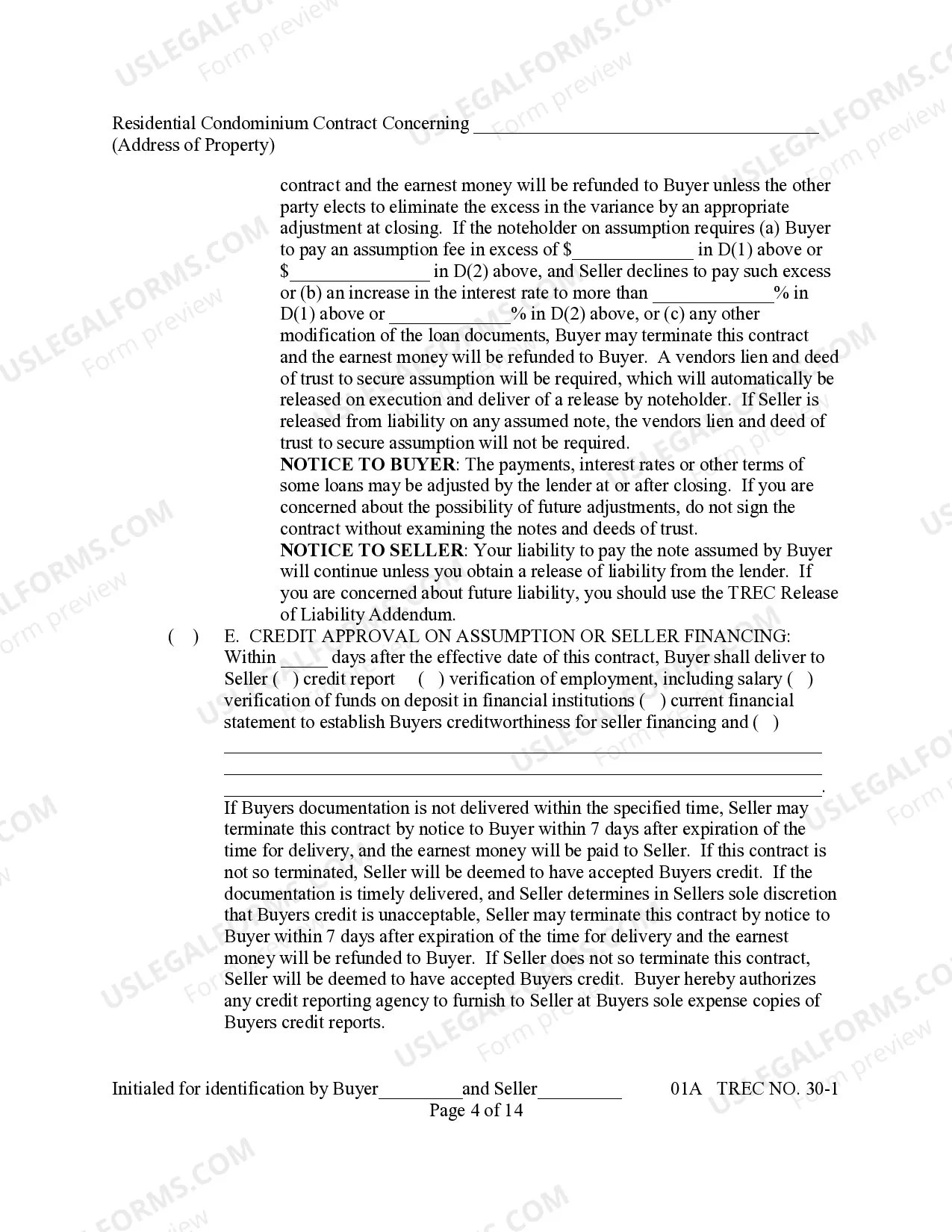

Yes. However, seller financing is subject to state and federal laws. The Texas Real Estate Commission promulgates the Seller Financing Addendum (TXR 1914) for seller financed transactions. If the seller finance box in a TREC contract is checked, you must fill out and attach this addendum to the contract.

Owner financing a home in Texas means that the seller takes on the role of the lender, which would typically be a bank in a traditional financing transaction. But instead of providing cash to the buyer, the seller extends credit in the amount of the agreed upon sale price minus the buyer's down payment.

When a home is sold through seller financing, the seller takes the role of the lender, which would typically be a bank or similar institution in a traditional financing transaction. The seller extends credit to the buyer sufficient to cover the purchase price of the home, minus any down payment made by the buyer.

For sellers, owner financing provides a faster way to close because buyers can skip the lengthy mortgage process. Another perk for sellers is that they may be able to sell the home as-is, which allows them to pocket more money from the sale.

Cons for Sellers Repair cost: If you do take back the property (for whatever reason), then you might end up having to pay for repairs and maintenance, depending on how well the buyer took care of the property.