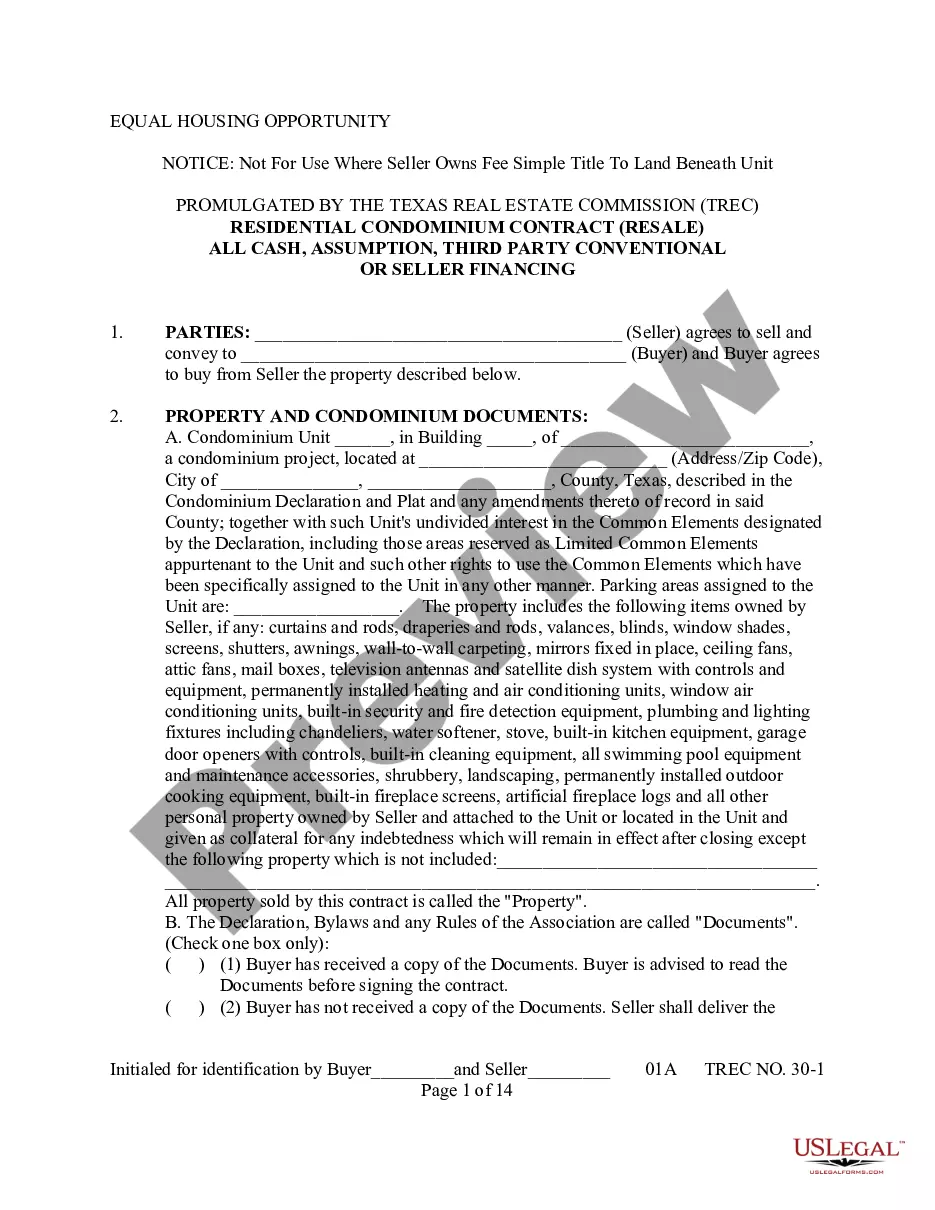

This detailed sample Conventional or Seller Financing Agreementcomplies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

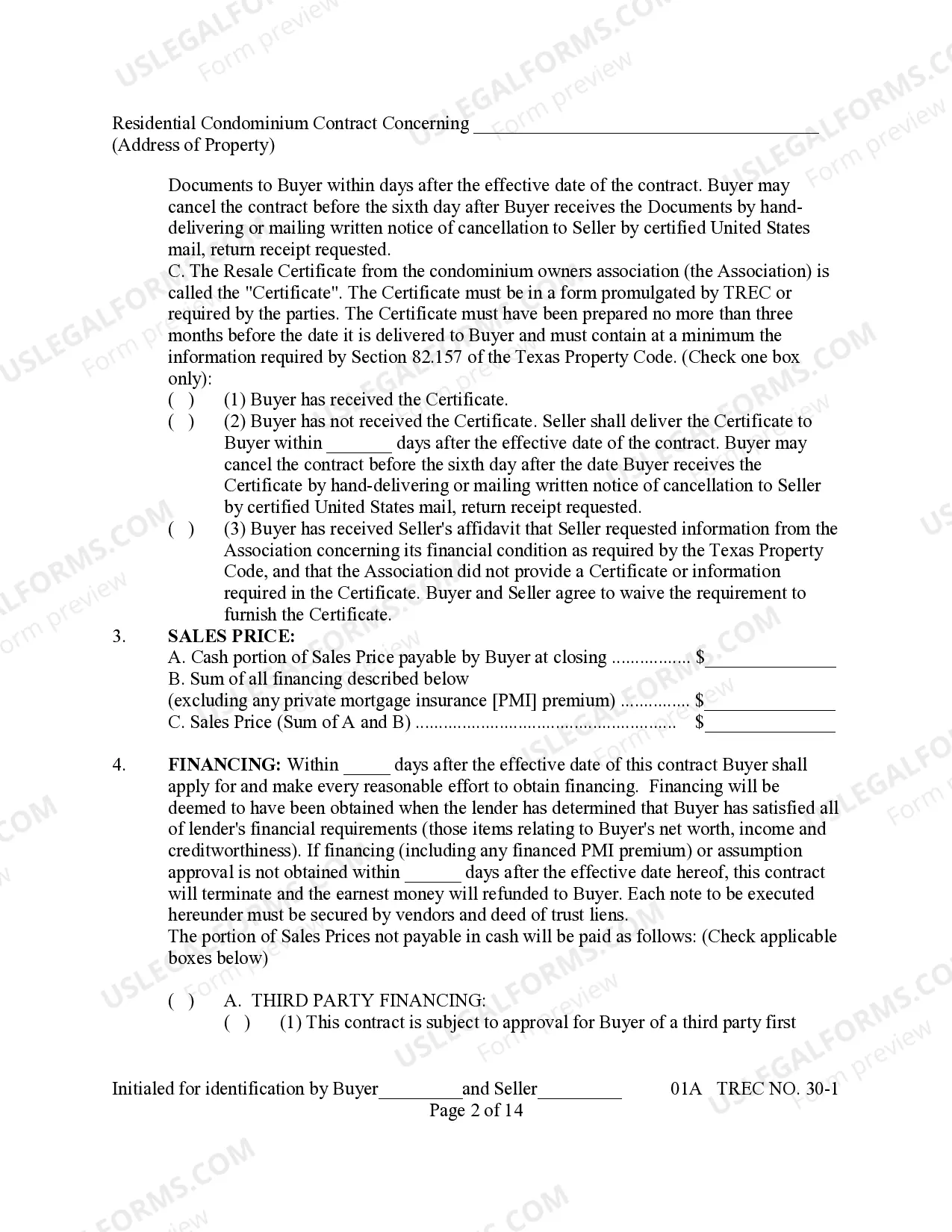

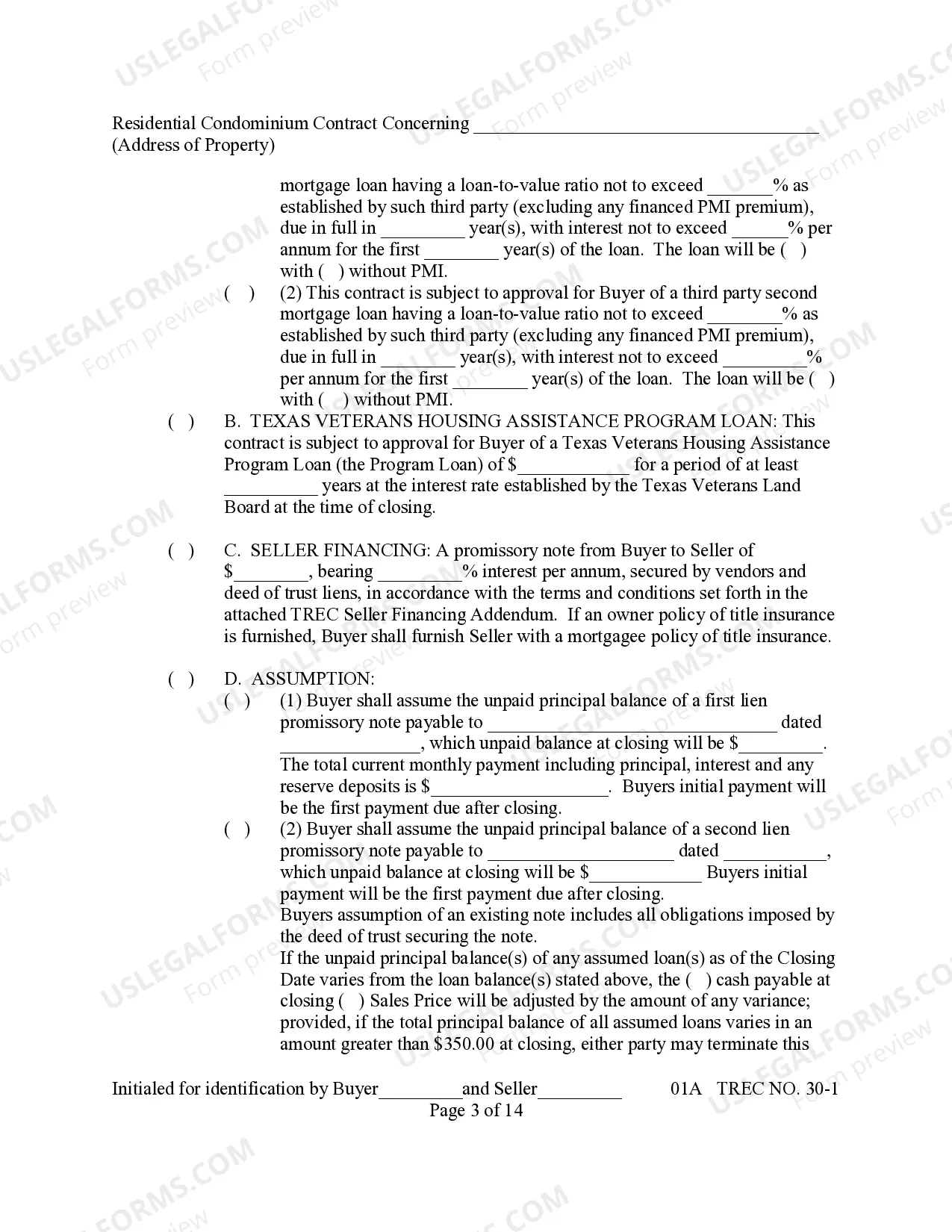

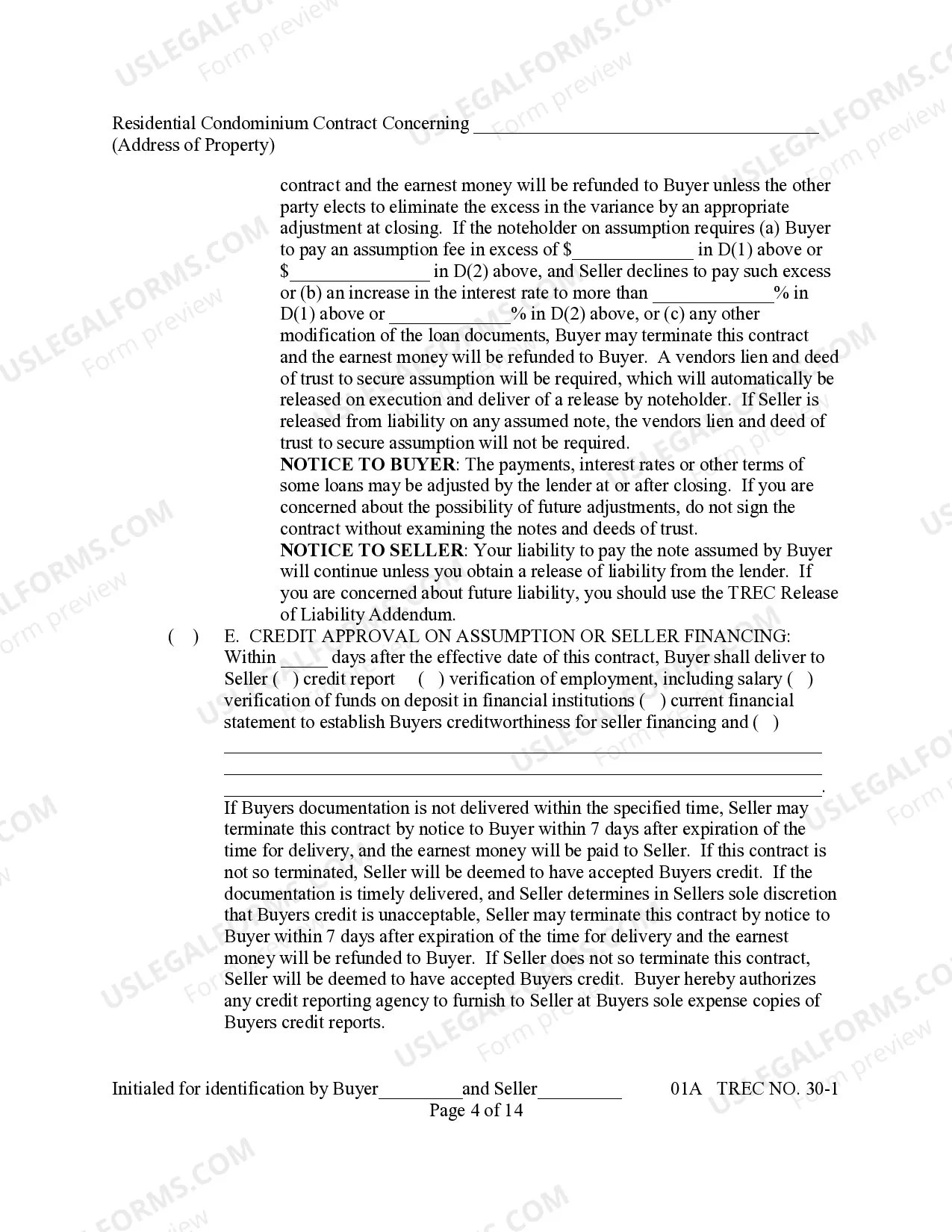

Dallas Texas conventional financing refers to a traditional method of obtaining a loan for purchasing a property, which is secured by the property itself. This type of financing typically involves a mortgage loan from a bank or a lender and requires a down payment, a good credit history, and an ability to meet specific income and debt criteria. Conventional financing is widely available and offers competitive interest rates. It allows homebuyers the flexibility to choose different loan terms, such as fixed-rate or adjustable-rate mortgages. The loan amount depends on the property's appraised value, ensuring fair market value assessment. In Dallas, homebuyers can access several types of conventional financing options. These include: 1. Fixed-rate mortgages: This type of conventional financing offers a fixed interest rate throughout the loan term, typically lasting 15 or 30 years. It provides stability and predictable monthly payments, making it a popular choice for many homebuyers in Dallas. 2. Adjustable-rate mortgages (ARM's): ARM's offer a lower initial interest rate, which is subject to periodic adjustments based on market conditions. The interest rate fluctuations may result in lower or higher monthly payments. Typically, ARM shaves an initial fixed-rate period (e.g., 5, 7, or 10 years) before transitioning to an adjustable rate. 3. Jumbo loans: Dallas being a city with high property values, jumbo loans are available for homebuyers seeking to finance properties that exceed the conforming loan limits set by government-sponsored enterprises (Uses) such as Fannie Mae and Freddie Mac. This financing option offers flexibility for those needing larger loans but may require a higher credit score and down payment. On the other hand, Dallas Texas seller financing, also known as owner financing or seller carry back, is an alternative financing option where the seller takes on the role of the lender. In this scenario, the seller holds the mortgage note while the buyer makes payments directly to them, instead of obtaining a traditional loan from a financial institution. Seller financing can be advantageous for buyers who may not qualify for conventional financing due to credit issues or insufficient down payment. It also provides sellers with additional options for selling their property. By offering seller financing, sellers can attract a wider pool of buyers and potentially negotiate a higher sale price. In Dallas, there are various types of seller financing arrangements, including: 1. Contract for Deed: Also known as land contracts, this agreement allows the buyer to gain equitable title to the property while the seller retains legal ownership until the terms of the contract are met. This often involves regular payments over a specified period, after which the buyer obtains full ownership. 2. Lease-Option: This arrangement combines a rental lease agreement with an option to purchase at a predetermined price within a specific timeframe. It allows the buyer to lease the property initially and potentially transition into conventional financing later. 3. All-Inclusive Mortgage (AIM): In an AIM, the buyer takes over the existing mortgage payment from the seller and pays the remainder of the purchase price directly to the seller. This arrangement is commonly used when the outstanding mortgage balance is lower than the property's market value. Both conventional and seller financing options are available in Dallas, catering to the diverse needs of homebuyers. The choice between the two depends on factors such as the buyer's financial situation, credit history, down payment ability, and personal preferences. It is crucial for potential buyers to carefully evaluate their options and consult with professionals, such as mortgage lenders and real estate attorneys, to make a well-informed decision.Dallas Texas conventional financing refers to a traditional method of obtaining a loan for purchasing a property, which is secured by the property itself. This type of financing typically involves a mortgage loan from a bank or a lender and requires a down payment, a good credit history, and an ability to meet specific income and debt criteria. Conventional financing is widely available and offers competitive interest rates. It allows homebuyers the flexibility to choose different loan terms, such as fixed-rate or adjustable-rate mortgages. The loan amount depends on the property's appraised value, ensuring fair market value assessment. In Dallas, homebuyers can access several types of conventional financing options. These include: 1. Fixed-rate mortgages: This type of conventional financing offers a fixed interest rate throughout the loan term, typically lasting 15 or 30 years. It provides stability and predictable monthly payments, making it a popular choice for many homebuyers in Dallas. 2. Adjustable-rate mortgages (ARM's): ARM's offer a lower initial interest rate, which is subject to periodic adjustments based on market conditions. The interest rate fluctuations may result in lower or higher monthly payments. Typically, ARM shaves an initial fixed-rate period (e.g., 5, 7, or 10 years) before transitioning to an adjustable rate. 3. Jumbo loans: Dallas being a city with high property values, jumbo loans are available for homebuyers seeking to finance properties that exceed the conforming loan limits set by government-sponsored enterprises (Uses) such as Fannie Mae and Freddie Mac. This financing option offers flexibility for those needing larger loans but may require a higher credit score and down payment. On the other hand, Dallas Texas seller financing, also known as owner financing or seller carry back, is an alternative financing option where the seller takes on the role of the lender. In this scenario, the seller holds the mortgage note while the buyer makes payments directly to them, instead of obtaining a traditional loan from a financial institution. Seller financing can be advantageous for buyers who may not qualify for conventional financing due to credit issues or insufficient down payment. It also provides sellers with additional options for selling their property. By offering seller financing, sellers can attract a wider pool of buyers and potentially negotiate a higher sale price. In Dallas, there are various types of seller financing arrangements, including: 1. Contract for Deed: Also known as land contracts, this agreement allows the buyer to gain equitable title to the property while the seller retains legal ownership until the terms of the contract are met. This often involves regular payments over a specified period, after which the buyer obtains full ownership. 2. Lease-Option: This arrangement combines a rental lease agreement with an option to purchase at a predetermined price within a specific timeframe. It allows the buyer to lease the property initially and potentially transition into conventional financing later. 3. All-Inclusive Mortgage (AIM): In an AIM, the buyer takes over the existing mortgage payment from the seller and pays the remainder of the purchase price directly to the seller. This arrangement is commonly used when the outstanding mortgage balance is lower than the property's market value. Both conventional and seller financing options are available in Dallas, catering to the diverse needs of homebuyers. The choice between the two depends on factors such as the buyer's financial situation, credit history, down payment ability, and personal preferences. It is crucial for potential buyers to carefully evaluate their options and consult with professionals, such as mortgage lenders and real estate attorneys, to make a well-informed decision.