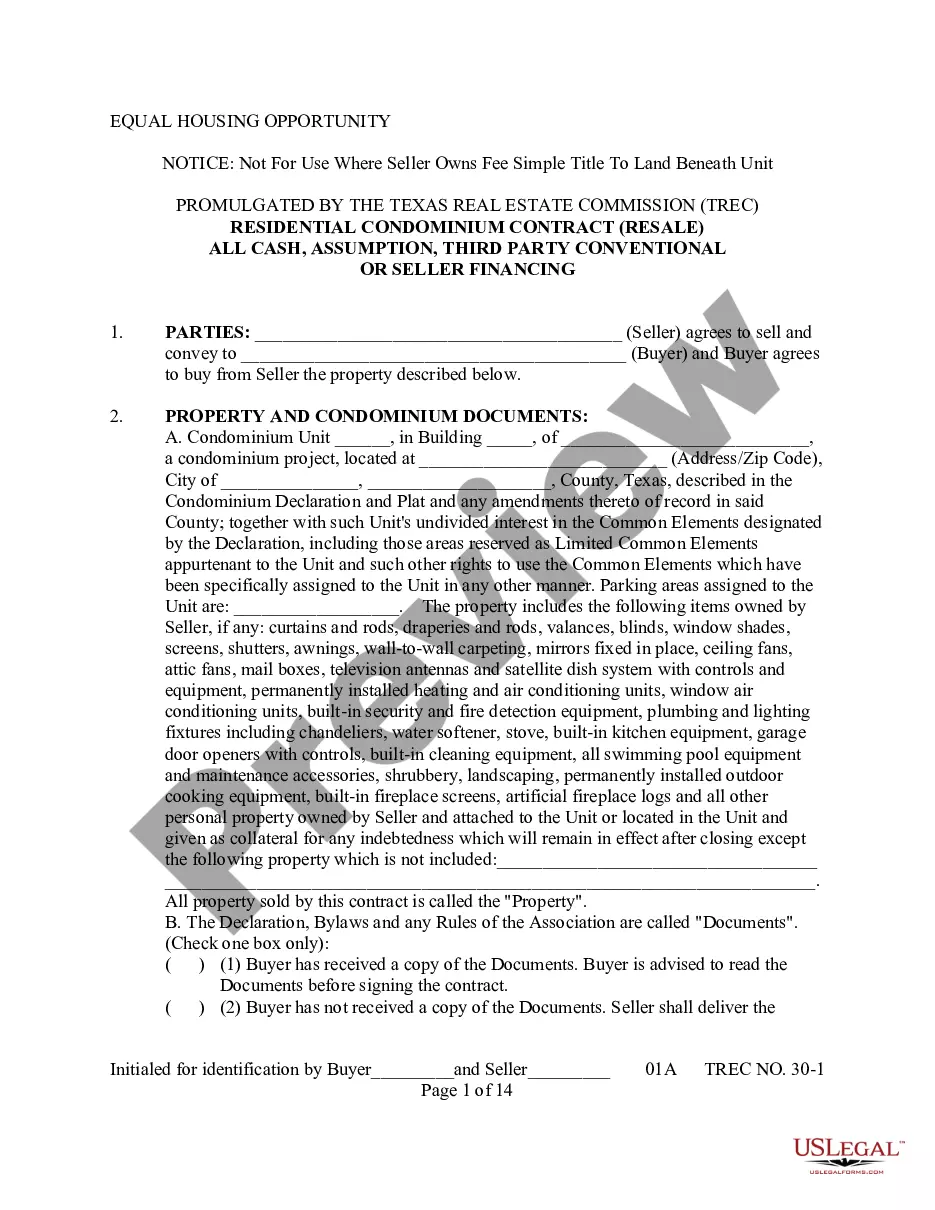

This detailed sample Conventional or Seller Financing Agreementcomplies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

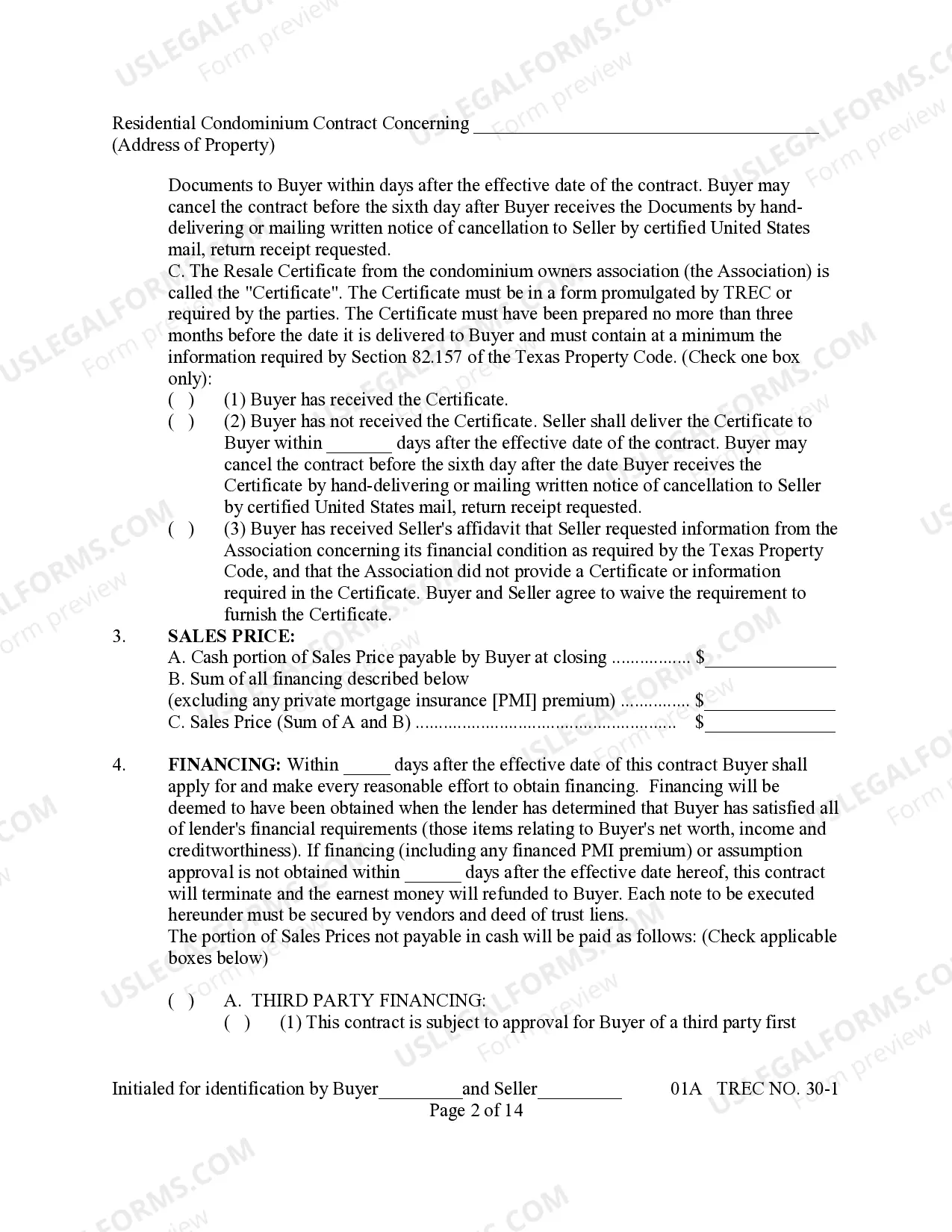

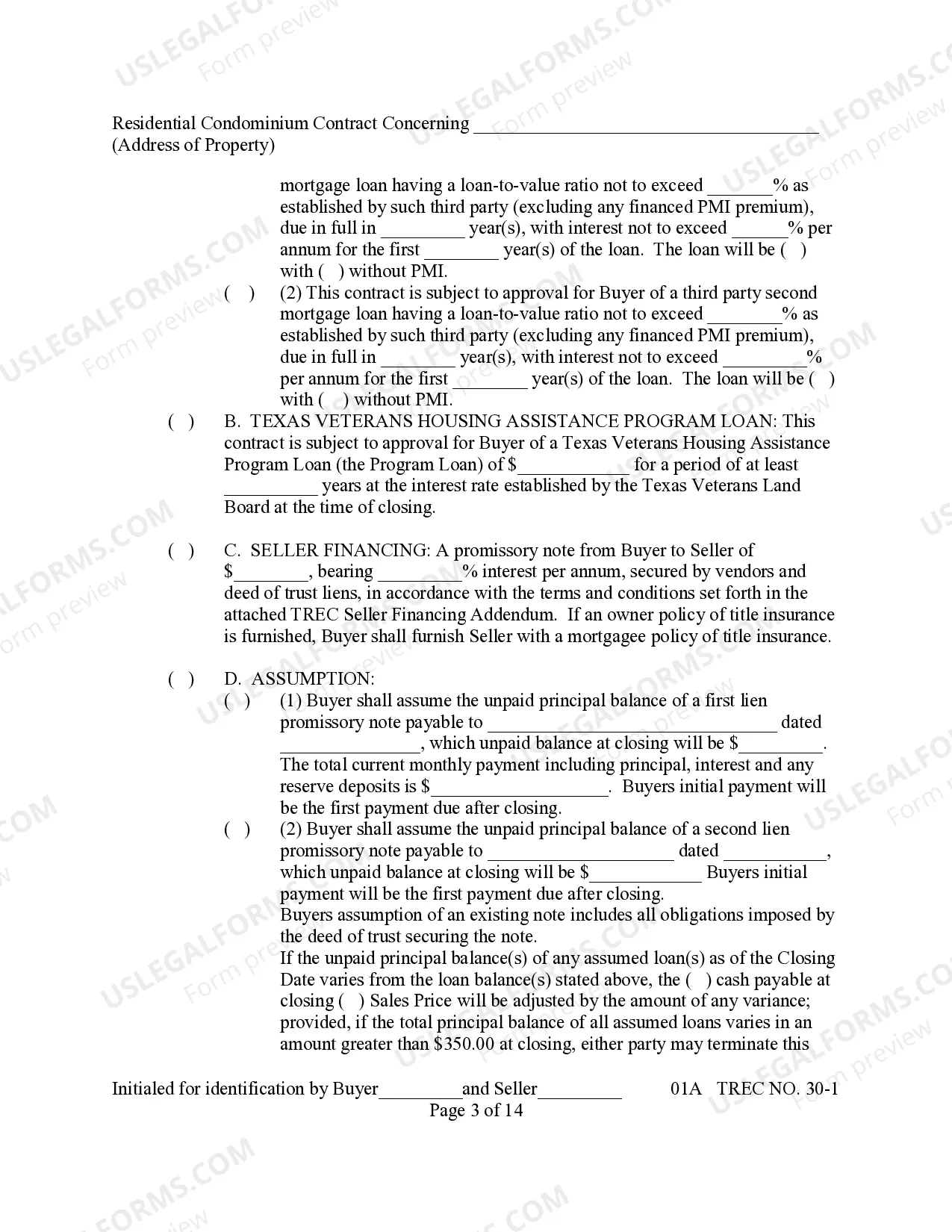

Lewisville Texas Conventional or Seller Financing: A Comprehensive Overview In Lewisville, Texas, there are several financing options available for homebuyers, including conventional and seller financing. This detailed description will explore these financing methods, explaining their key characteristics and benefits. Conventional Financing: Conventional financing refers to a traditional mortgage loan that is obtained through a financial institution such as a bank, credit union, or mortgage broker. It is a popular choice among homebuyers and offers various advantages. 1. Fixed or Adjustable Rate: Conventional financing offers both fixed-rate and adjustable-rate mortgage (ARM) options. A fixed-rate mortgage locks in a specific interest rate for the entire loan term, providing stability and predictable monthly payments. In contrast, an ARM offers an initial fixed rate for a specified period, after which the interest rate adjusts periodically based on market conditions. 2. Down Payment: Conventional loans typically require a down payment ranging from 3% to 20% of the home's purchase price. A higher down payment often results in better interest rates and can help avoid costly private mortgage insurance (PMI) premiums for buyers with less than a 20% down payment. 3. Mortgage Insurance: If the down payment is less than 20%, private mortgage insurance (PMI) may be required. However, once the loan-to-value ratio reaches 80%, PMI can usually be canceled. 4. Credit Score: Conventional lenders typically require a minimum credit score of 620. A stronger credit score enhances the likelihood of loan approval and better interest rates. Seller Financing: Seller financing, also known as owner financing, is an alternative financing option wherein the seller acts as the lender and provides financing for the buyer. It offers unique advantages for both buyers and sellers. 1. Terms Negotiation: With seller financing, the terms of the loan are negotiated directly between the buyer and the seller, allowing for greater flexibility. This can include the interest rate, down payment, loan duration, and other terms, making it suitable for buyers who may not meet conventional lender requirements. 2. Minimal Bank Approval Hurdles: Since seller financing bypasses traditional lenders, buyers may face fewer loan approval hurdles. This can be beneficial for individuals with less-than-ideal credit scores, limited documentation, or non-traditional income sources. 3. Faster Process: Seller financing often results in a quicker closing process compared to traditional mortgages, as it eliminates the need for bank underwriting and related paperwork. Types of Seller Financing in Lewisville, Texas: 1. All-inclusive mortgage: This involves the buyer making a single monthly payment to the seller, who then allocates a portion to pay an underlying mortgage. 2. Contract for deed: The buyer pays the seller in installments under a contract, granting them equitable title. The buyer gains full ownership rights upon fulfilling the contract's obligations. 3. Lease option: The seller leases the property to the buyer with an option to purchase it within a specific timeframe. A portion of the monthly rent is often credited toward the purchase price. In conclusion, Lewisville, Texas offers homebuyers a range of financing options, including conventional and seller financing. Conventional financing provides stability, flexibility, and options for fixed or adjustable rates. Seller financing, on the other hand, offers negotiation flexibility, minimal bank approval hurdles, and accelerated closing processes. Understanding these financing options empowers buyers with the knowledge to select the one that best suits their needs and financial situation.Lewisville Texas Conventional or Seller Financing: A Comprehensive Overview In Lewisville, Texas, there are several financing options available for homebuyers, including conventional and seller financing. This detailed description will explore these financing methods, explaining their key characteristics and benefits. Conventional Financing: Conventional financing refers to a traditional mortgage loan that is obtained through a financial institution such as a bank, credit union, or mortgage broker. It is a popular choice among homebuyers and offers various advantages. 1. Fixed or Adjustable Rate: Conventional financing offers both fixed-rate and adjustable-rate mortgage (ARM) options. A fixed-rate mortgage locks in a specific interest rate for the entire loan term, providing stability and predictable monthly payments. In contrast, an ARM offers an initial fixed rate for a specified period, after which the interest rate adjusts periodically based on market conditions. 2. Down Payment: Conventional loans typically require a down payment ranging from 3% to 20% of the home's purchase price. A higher down payment often results in better interest rates and can help avoid costly private mortgage insurance (PMI) premiums for buyers with less than a 20% down payment. 3. Mortgage Insurance: If the down payment is less than 20%, private mortgage insurance (PMI) may be required. However, once the loan-to-value ratio reaches 80%, PMI can usually be canceled. 4. Credit Score: Conventional lenders typically require a minimum credit score of 620. A stronger credit score enhances the likelihood of loan approval and better interest rates. Seller Financing: Seller financing, also known as owner financing, is an alternative financing option wherein the seller acts as the lender and provides financing for the buyer. It offers unique advantages for both buyers and sellers. 1. Terms Negotiation: With seller financing, the terms of the loan are negotiated directly between the buyer and the seller, allowing for greater flexibility. This can include the interest rate, down payment, loan duration, and other terms, making it suitable for buyers who may not meet conventional lender requirements. 2. Minimal Bank Approval Hurdles: Since seller financing bypasses traditional lenders, buyers may face fewer loan approval hurdles. This can be beneficial for individuals with less-than-ideal credit scores, limited documentation, or non-traditional income sources. 3. Faster Process: Seller financing often results in a quicker closing process compared to traditional mortgages, as it eliminates the need for bank underwriting and related paperwork. Types of Seller Financing in Lewisville, Texas: 1. All-inclusive mortgage: This involves the buyer making a single monthly payment to the seller, who then allocates a portion to pay an underlying mortgage. 2. Contract for deed: The buyer pays the seller in installments under a contract, granting them equitable title. The buyer gains full ownership rights upon fulfilling the contract's obligations. 3. Lease option: The seller leases the property to the buyer with an option to purchase it within a specific timeframe. A portion of the monthly rent is often credited toward the purchase price. In conclusion, Lewisville, Texas offers homebuyers a range of financing options, including conventional and seller financing. Conventional financing provides stability, flexibility, and options for fixed or adjustable rates. Seller financing, on the other hand, offers negotiation flexibility, minimal bank approval hurdles, and accelerated closing processes. Understanding these financing options empowers buyers with the knowledge to select the one that best suits their needs and financial situation.