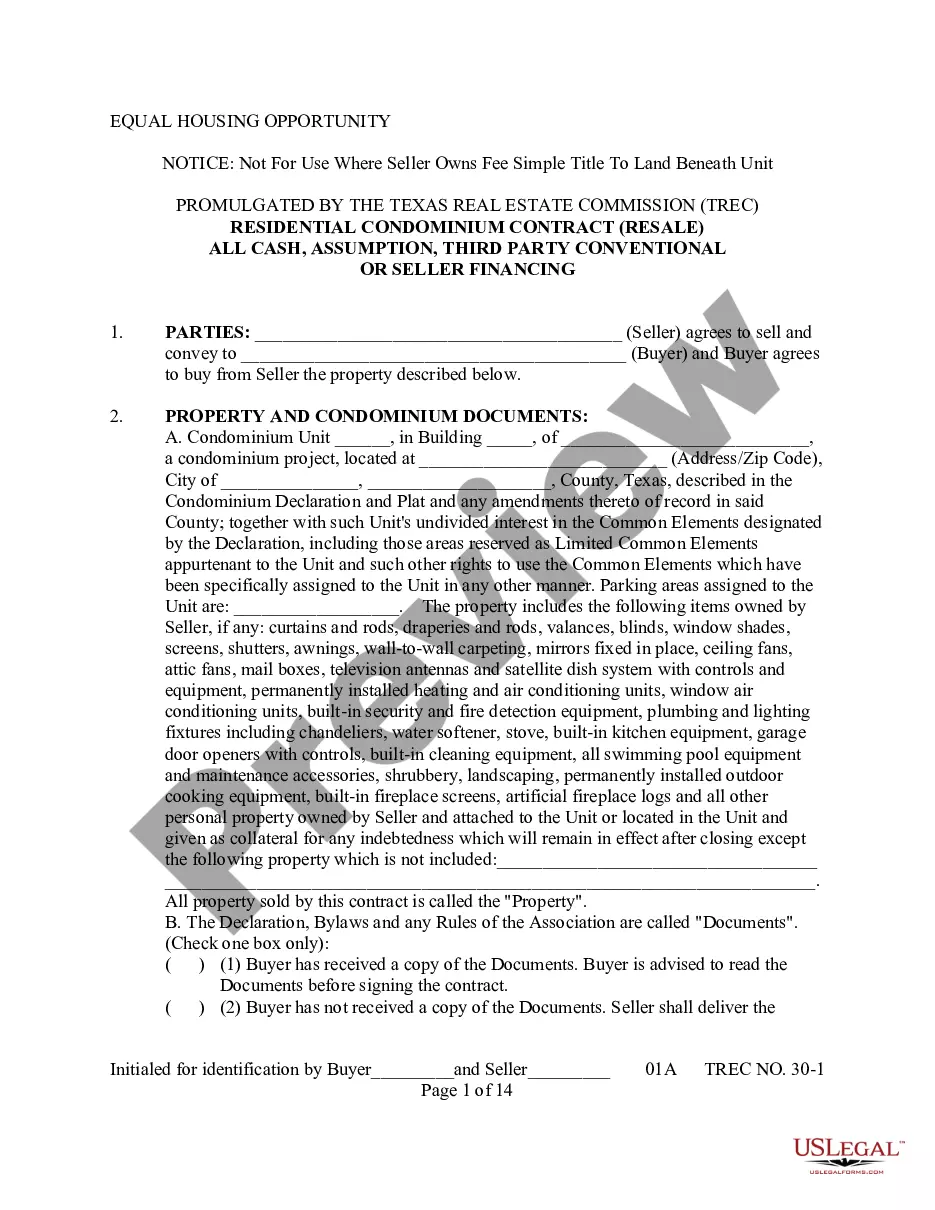

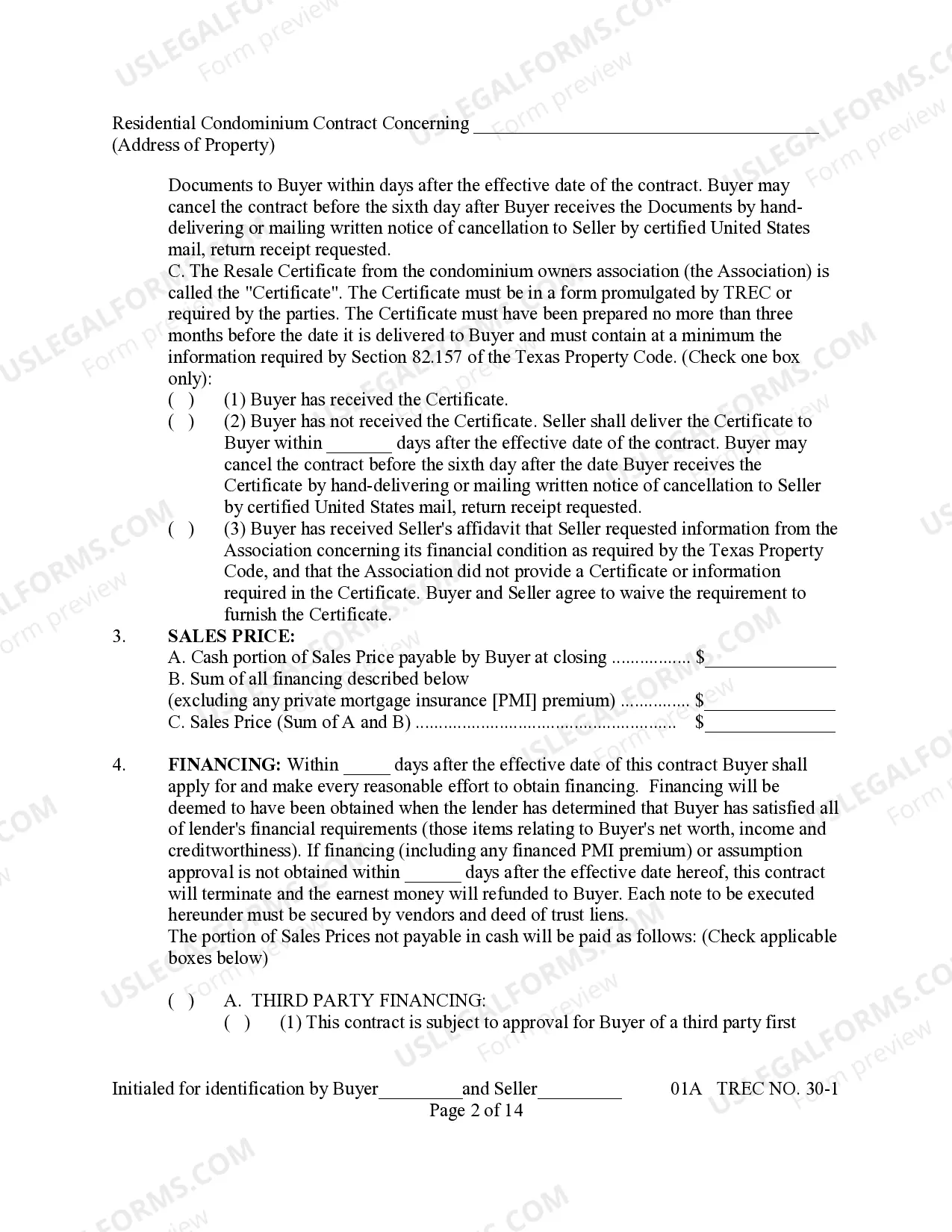

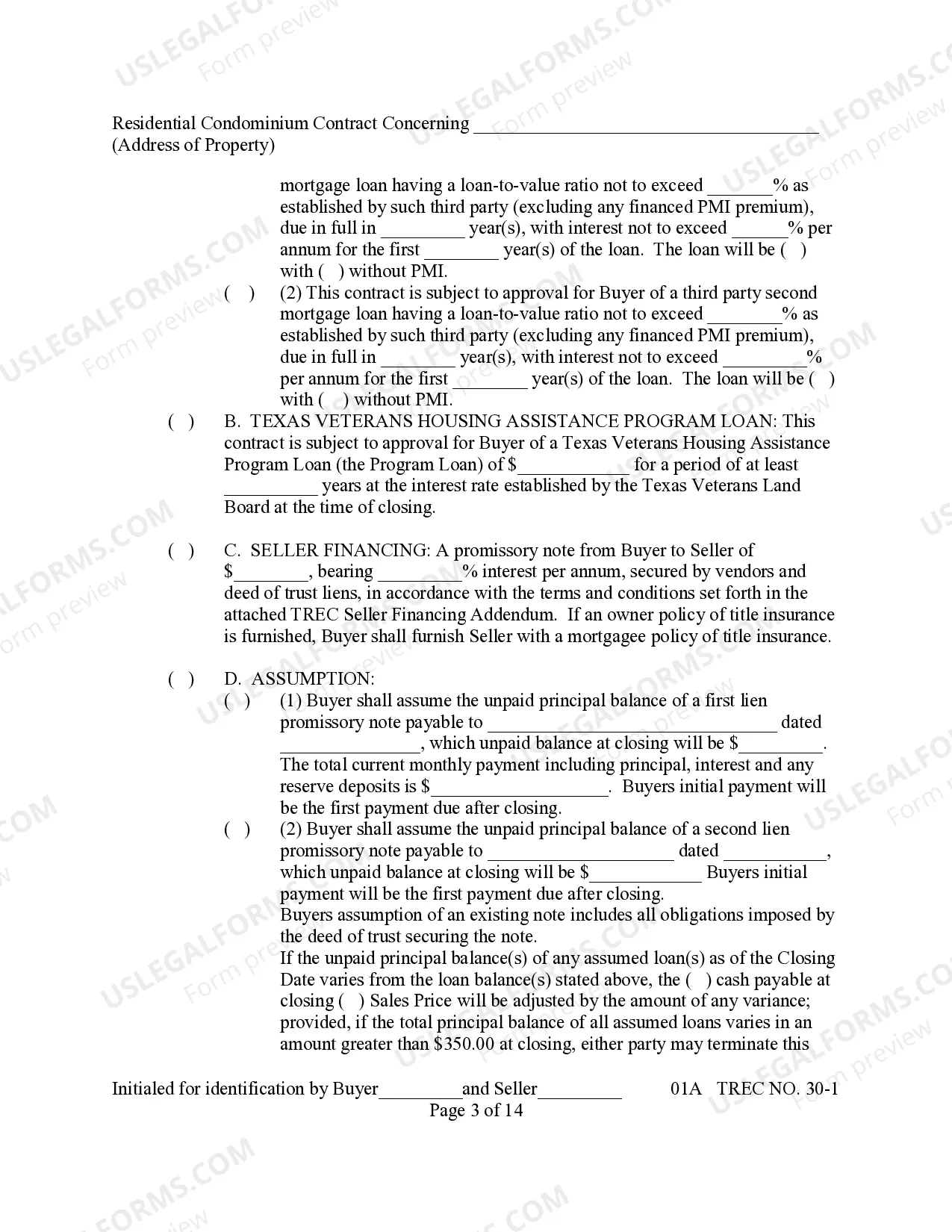

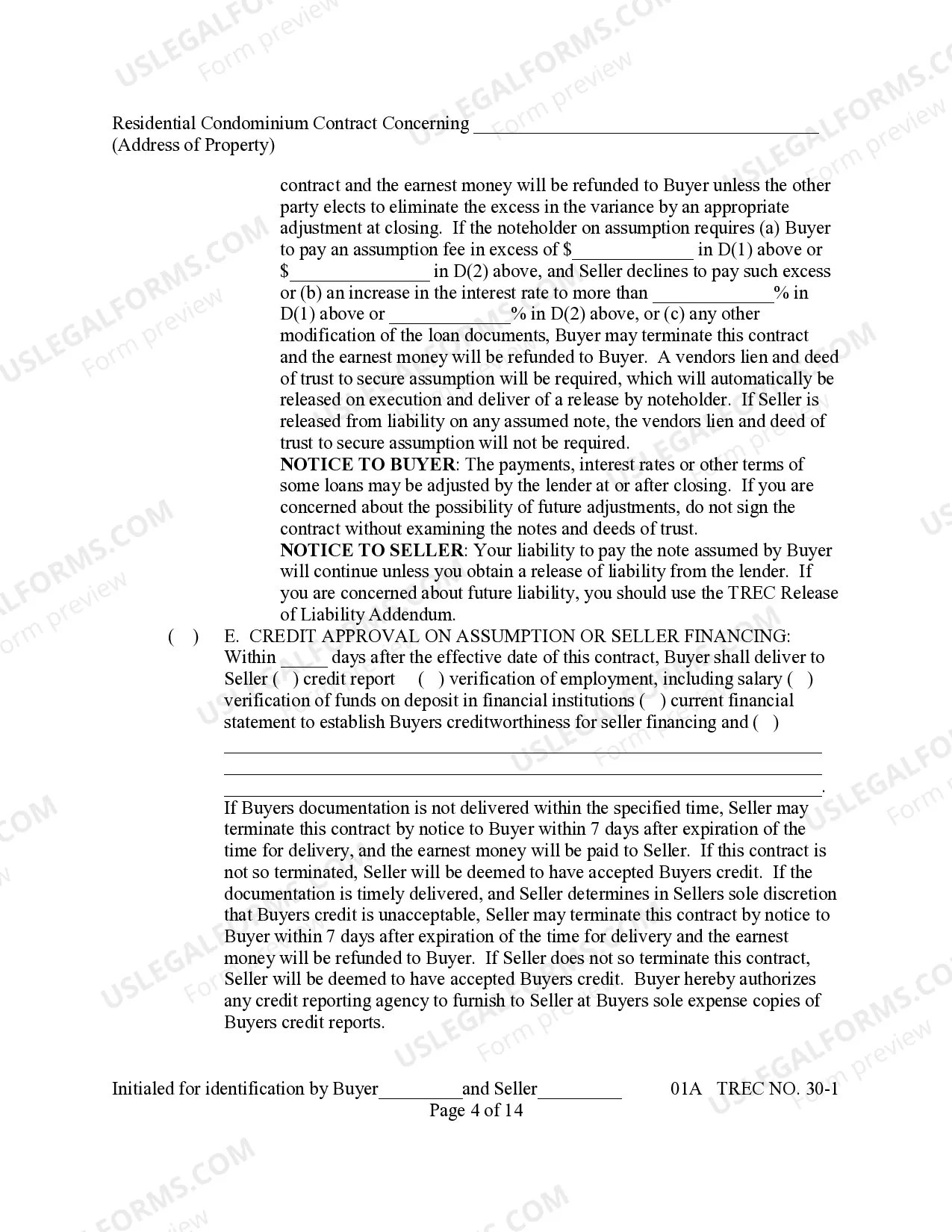

This detailed sample Conventional or Seller Financing Agreementcomplies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Tarrant Texas Conventional Financing is a popular option for homebuyers and refers to a traditional mortgage loan provided by a bank, credit union, or mortgage lender. This type of financing requires the borrower to meet specific credit requirements, income criteria, and a down payment, typically around 20% of the home's purchase price. Conventional financing offers competitive interest rates and terms, making it attractive to individuals with stable financial backgrounds. In contrast, Tarrant Texas Seller Financing, also known as owner financing or seller carry back, is an alternative method of purchasing a property where the seller acts as the lender. This arrangement allows the buyer to make monthly payments directly to the seller instead of going through a traditional lending institution. Seller financing can be beneficial for potential buyers who may not meet the stringent credit or income qualifications of conventional financing. It can also be an appealing option for sellers who want to attract a wider range of buyers or sell their property more quickly. There are different types of Seller Financing in Tarrant Texas, including: 1. Installment Sale: This type of seller financing involves the seller and buyer entering into an agreement where the buyer makes regular installment payments, including principal and interest, to the seller over an agreed-upon period. 2. Lease Option: In a lease option arrangement, the seller leases the property to the buyer with an option to purchase it at a later date. A portion of the monthly lease payments may go towards the eventual down payment or purchase price. 3. Subject-To: Subject-To financing occurs when the buyer takes over the existing mortgage payments of the seller without formally assuming the loan. The buyer agrees to make payments on the existing mortgage while the title remains in the seller's name until the loan is paid off. 4. Wraparound Mortgage: Also known as an all-inclusive trust deed (AID), a wraparound mortgage combines the current mortgage balance with the additional financing provided by the seller. The buyer makes a single payment to the seller, who then distributes the necessary funds to pay off the existing mortgage and keeps the remaining amount as their profit. In conclusion, Tarrant Texas offers both Conventional Financing, which follows the traditional lending process, and Seller Financing options that leverage agreements between the buyer and seller, allowing for more flexibility in terms and conditions. These options accommodate a wider range of buyers, making homeownership more accessible in the Tarrant Texas area.Tarrant Texas Conventional Financing is a popular option for homebuyers and refers to a traditional mortgage loan provided by a bank, credit union, or mortgage lender. This type of financing requires the borrower to meet specific credit requirements, income criteria, and a down payment, typically around 20% of the home's purchase price. Conventional financing offers competitive interest rates and terms, making it attractive to individuals with stable financial backgrounds. In contrast, Tarrant Texas Seller Financing, also known as owner financing or seller carry back, is an alternative method of purchasing a property where the seller acts as the lender. This arrangement allows the buyer to make monthly payments directly to the seller instead of going through a traditional lending institution. Seller financing can be beneficial for potential buyers who may not meet the stringent credit or income qualifications of conventional financing. It can also be an appealing option for sellers who want to attract a wider range of buyers or sell their property more quickly. There are different types of Seller Financing in Tarrant Texas, including: 1. Installment Sale: This type of seller financing involves the seller and buyer entering into an agreement where the buyer makes regular installment payments, including principal and interest, to the seller over an agreed-upon period. 2. Lease Option: In a lease option arrangement, the seller leases the property to the buyer with an option to purchase it at a later date. A portion of the monthly lease payments may go towards the eventual down payment or purchase price. 3. Subject-To: Subject-To financing occurs when the buyer takes over the existing mortgage payments of the seller without formally assuming the loan. The buyer agrees to make payments on the existing mortgage while the title remains in the seller's name until the loan is paid off. 4. Wraparound Mortgage: Also known as an all-inclusive trust deed (AID), a wraparound mortgage combines the current mortgage balance with the additional financing provided by the seller. The buyer makes a single payment to the seller, who then distributes the necessary funds to pay off the existing mortgage and keeps the remaining amount as their profit. In conclusion, Tarrant Texas offers both Conventional Financing, which follows the traditional lending process, and Seller Financing options that leverage agreements between the buyer and seller, allowing for more flexibility in terms and conditions. These options accommodate a wider range of buyers, making homeownership more accessible in the Tarrant Texas area.