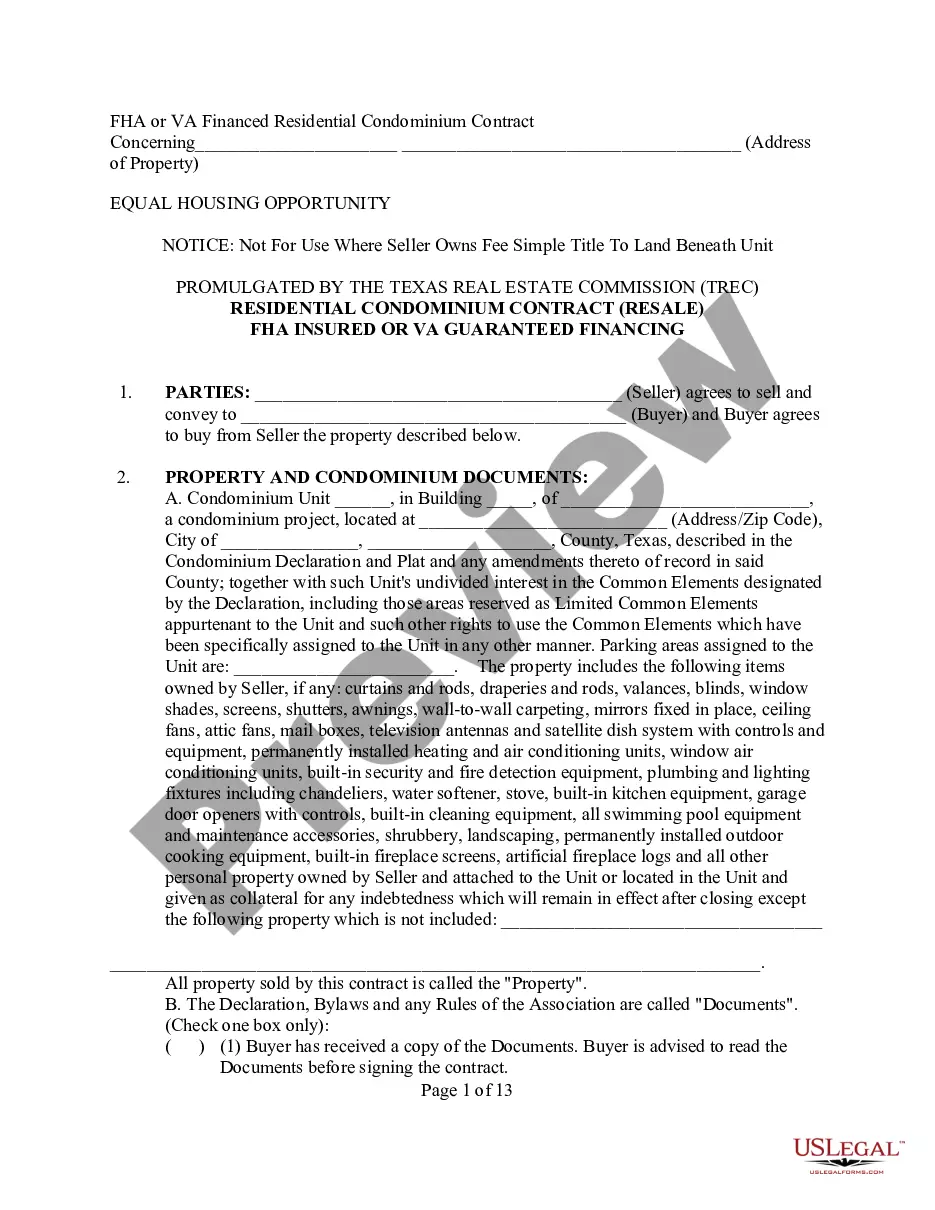

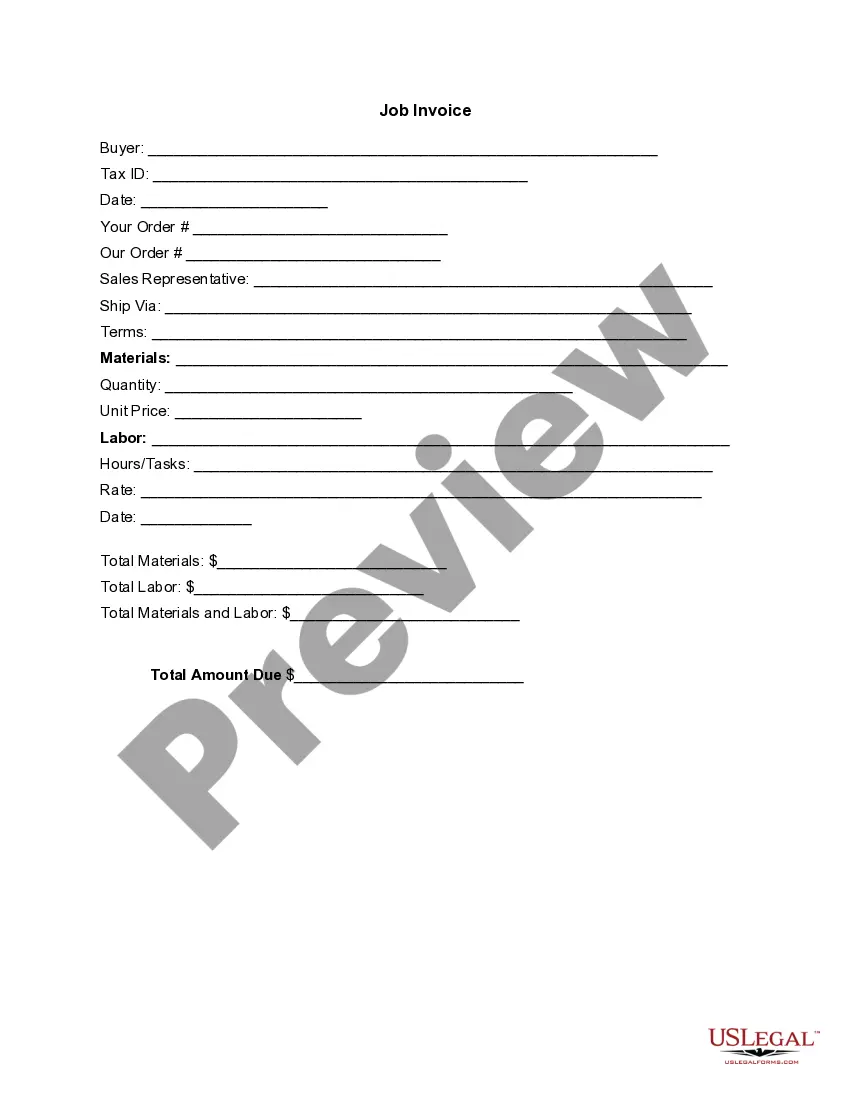

This detailed sample Financing Agreementcomplies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Beaumont Texas Financing refers to the various financial options and services available to individuals and businesses in the city of Beaumont, Texas, for their borrowing or investment needs. This financial support is crucial for personal expenses, business growth, home purchases, education, and much more. Beaumont Texas Financing encompasses a range of options, each tailored to meet specific financial requirements. Here, we will explore different types of financing available in Beaumont, Texas and describe their key features. 1. Personal loans in Beaumont Texas: Personal loans offer individuals the flexibility to meet their personal financial needs. Whether it's for debt consolidation, medical expenses, home repairs, or unexpected emergencies, personal loans provide borrowers with a lump sum amount at a fixed or variable interest rate. Beaumont Texas residents can avail personal loans from banks, credit unions, and online lenders. 2. Auto loans in Beaumont Texas: Auto financing enables individuals to purchase vehicles without having to pay the full amount upfront. Beaumont Texas residents can choose from various auto loan options, such as new car loans, used car loans, and refinancing. These loans usually have fixed interest rates and repayment terms that depend on the loan amount and the borrower's credit history. 3. Mortgage loans in Beaumont Texas: Mortgage financing helps individuals and families in Beaumont, Texas, purchase homes. Beaumont Texas residents can avail themselves of different mortgage loans, such as fixed-rate mortgages, adjustable-rate mortgages (ARM), FHA loans, VA loans, and USDA rural development loans. These loans offer different interest rates, down payment requirements, and repayment terms. 4. Business loans in Beaumont Texas: Business financing options in Beaumont, Texas support entrepreneurs and small businesses in starting, expanding, or managing their operations. Commercial banks, credit unions, and government-backed programs provide various business loan options such as term loans, lines of credit, SBA loans, equipment financing, and commercial real estate loans. Terms and eligibility criteria vary based on the specific loan type and the lender. 5. Student loans in Beaumont Texas: Student financing assists individuals in financing their education and covering expenses like tuition fees, books, and living costs. Students in Beaumont, Texas can explore federal student loans, private student loans, or state-specific educational loans. These loans come with different interest rates, repayment terms, and eligibility criteria. 6. Home equity loans in Beaumont Texas: Homeowners in Beaumont can utilize their property's equity to secure a home equity loan or line of credit (HELOT). These loans enable borrowers to borrow against the appraised value of their home, often at a lower interest rate compared to other options. Home equity loans can be used for various purposes, such as home renovations, debt consolidation, or funding major expenses. It's important to note that the availability and terms of financing options in Beaumont, Texas may vary from lender to lender. Therefore, it is advisable for individuals and businesses to thoroughly research different lenders, compare interest rates and fees, and evaluate their financial situation before selecting the most suitable financing option for their needs.Beaumont Texas Financing refers to the various financial options and services available to individuals and businesses in the city of Beaumont, Texas, for their borrowing or investment needs. This financial support is crucial for personal expenses, business growth, home purchases, education, and much more. Beaumont Texas Financing encompasses a range of options, each tailored to meet specific financial requirements. Here, we will explore different types of financing available in Beaumont, Texas and describe their key features. 1. Personal loans in Beaumont Texas: Personal loans offer individuals the flexibility to meet their personal financial needs. Whether it's for debt consolidation, medical expenses, home repairs, or unexpected emergencies, personal loans provide borrowers with a lump sum amount at a fixed or variable interest rate. Beaumont Texas residents can avail personal loans from banks, credit unions, and online lenders. 2. Auto loans in Beaumont Texas: Auto financing enables individuals to purchase vehicles without having to pay the full amount upfront. Beaumont Texas residents can choose from various auto loan options, such as new car loans, used car loans, and refinancing. These loans usually have fixed interest rates and repayment terms that depend on the loan amount and the borrower's credit history. 3. Mortgage loans in Beaumont Texas: Mortgage financing helps individuals and families in Beaumont, Texas, purchase homes. Beaumont Texas residents can avail themselves of different mortgage loans, such as fixed-rate mortgages, adjustable-rate mortgages (ARM), FHA loans, VA loans, and USDA rural development loans. These loans offer different interest rates, down payment requirements, and repayment terms. 4. Business loans in Beaumont Texas: Business financing options in Beaumont, Texas support entrepreneurs and small businesses in starting, expanding, or managing their operations. Commercial banks, credit unions, and government-backed programs provide various business loan options such as term loans, lines of credit, SBA loans, equipment financing, and commercial real estate loans. Terms and eligibility criteria vary based on the specific loan type and the lender. 5. Student loans in Beaumont Texas: Student financing assists individuals in financing their education and covering expenses like tuition fees, books, and living costs. Students in Beaumont, Texas can explore federal student loans, private student loans, or state-specific educational loans. These loans come with different interest rates, repayment terms, and eligibility criteria. 6. Home equity loans in Beaumont Texas: Homeowners in Beaumont can utilize their property's equity to secure a home equity loan or line of credit (HELOT). These loans enable borrowers to borrow against the appraised value of their home, often at a lower interest rate compared to other options. Home equity loans can be used for various purposes, such as home renovations, debt consolidation, or funding major expenses. It's important to note that the availability and terms of financing options in Beaumont, Texas may vary from lender to lender. Therefore, it is advisable for individuals and businesses to thoroughly research different lenders, compare interest rates and fees, and evaluate their financial situation before selecting the most suitable financing option for their needs.