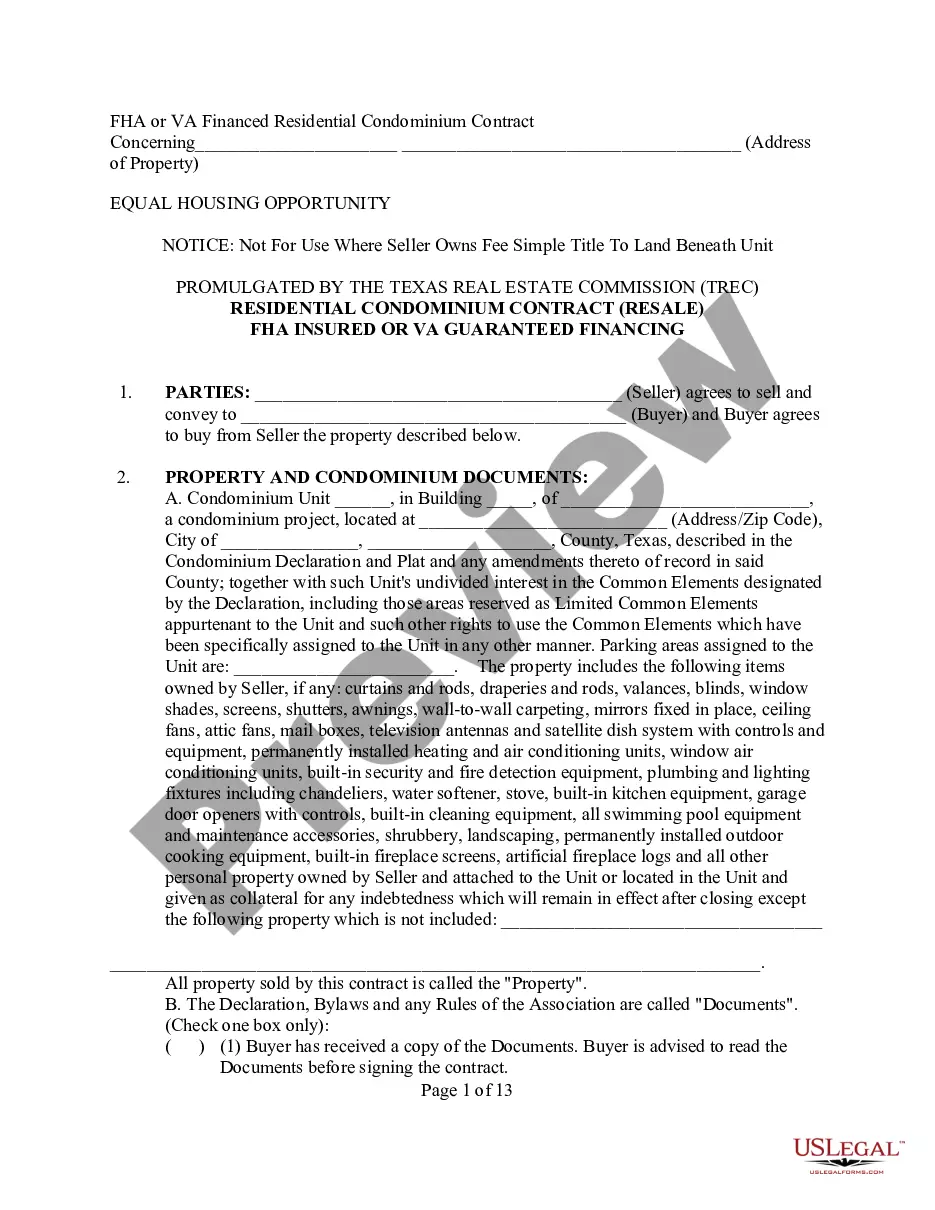

This detailed sample Financing Agreementcomplies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Fort Worth Texas Financing refers to the various means by which individuals, businesses, and organizations in Fort Worth, Texas, obtain funds to support their financial needs. These financing options can be availed from numerous entities such as banks, credit unions, private lenders, and government agencies. Fort Worth Texas Financing encompasses a wide range of financial products and services, each tailored to meet specific needs and objectives. One common type of Fort Worth Texas Financing is personal loans. Personal loans are unsecured borrowings that individuals can utilize for different purposes such as debt consolidation, medical expenses, educational costs, or home renovations. These loans typically have fixed interest rates and repayment terms based on the borrower's creditworthiness. For businesses in Fort Worth, Texas, commercial financing options are available. Commercial loans provide essential funds for starting or expanding businesses, purchasing equipment, inventory, or real estate, and covering operational expenses. Such loans may be secured by collateral, such as property or equipment, and are typically structured with terms specific to the needs of the business. In addition to personal and commercial loans, Fort Worth Texas Financing includes mortgage loans. Mortgage financing assists individuals in buying homes or properties in the Fort Worth area. Homebuyers can choose from various types of mortgages, including fixed-rate mortgages, adjustable-rate mortgages, and government-insured loans such as Federal Housing Administration (FHA) loans or Veterans Affairs (VA) loans. Another form of financing available in Fort Worth, Texas is auto loans. Auto financing allows individuals to purchase vehicles while spreading the cost over time. These loans can be obtained from banks, credit unions, or dealership financing departments, offering competitive interest rates and flexible repayment terms. Furthermore, Fort Worth Texas Financing involves the availability of business lines of credit. A business line of credit provides businesses with access to a predetermined amount of funds that can be used for working capital, emergency expenses, or other short-term financial needs. Unlike a loan, businesses only pay interest on the portion of the credit line that is utilized, making it a flexible and cost-effective option. Lastly, Fort Worth Texas Financing includes specialized financing options such as agricultural loans, healthcare financing, and equipment financing. Agricultural loans cater to the unique needs of farmers and ranchers, offering funds for purchasing land, equipment, or livestock. Healthcare financing assists medical professionals and organizations in obtaining funds for medical equipment, facility expansions, or practice acquisitions. Equipment financing helps businesses acquire necessary machinery, vehicles, or technology through lease or purchase agreements. Overall, Fort Worth Texas Financing encompasses a wide range of financial products tailored to the needs of individuals, businesses, and organizations in the Fort Worth area. Various types of financing options, including personal loans, commercial loans, mortgage loans, auto loans, lines of credit, and specialized financing, enable borrowers to meet their diverse financial goals and requirements.Fort Worth Texas Financing refers to the various means by which individuals, businesses, and organizations in Fort Worth, Texas, obtain funds to support their financial needs. These financing options can be availed from numerous entities such as banks, credit unions, private lenders, and government agencies. Fort Worth Texas Financing encompasses a wide range of financial products and services, each tailored to meet specific needs and objectives. One common type of Fort Worth Texas Financing is personal loans. Personal loans are unsecured borrowings that individuals can utilize for different purposes such as debt consolidation, medical expenses, educational costs, or home renovations. These loans typically have fixed interest rates and repayment terms based on the borrower's creditworthiness. For businesses in Fort Worth, Texas, commercial financing options are available. Commercial loans provide essential funds for starting or expanding businesses, purchasing equipment, inventory, or real estate, and covering operational expenses. Such loans may be secured by collateral, such as property or equipment, and are typically structured with terms specific to the needs of the business. In addition to personal and commercial loans, Fort Worth Texas Financing includes mortgage loans. Mortgage financing assists individuals in buying homes or properties in the Fort Worth area. Homebuyers can choose from various types of mortgages, including fixed-rate mortgages, adjustable-rate mortgages, and government-insured loans such as Federal Housing Administration (FHA) loans or Veterans Affairs (VA) loans. Another form of financing available in Fort Worth, Texas is auto loans. Auto financing allows individuals to purchase vehicles while spreading the cost over time. These loans can be obtained from banks, credit unions, or dealership financing departments, offering competitive interest rates and flexible repayment terms. Furthermore, Fort Worth Texas Financing involves the availability of business lines of credit. A business line of credit provides businesses with access to a predetermined amount of funds that can be used for working capital, emergency expenses, or other short-term financial needs. Unlike a loan, businesses only pay interest on the portion of the credit line that is utilized, making it a flexible and cost-effective option. Lastly, Fort Worth Texas Financing includes specialized financing options such as agricultural loans, healthcare financing, and equipment financing. Agricultural loans cater to the unique needs of farmers and ranchers, offering funds for purchasing land, equipment, or livestock. Healthcare financing assists medical professionals and organizations in obtaining funds for medical equipment, facility expansions, or practice acquisitions. Equipment financing helps businesses acquire necessary machinery, vehicles, or technology through lease or purchase agreements. Overall, Fort Worth Texas Financing encompasses a wide range of financial products tailored to the needs of individuals, businesses, and organizations in the Fort Worth area. Various types of financing options, including personal loans, commercial loans, mortgage loans, auto loans, lines of credit, and specialized financing, enable borrowers to meet their diverse financial goals and requirements.