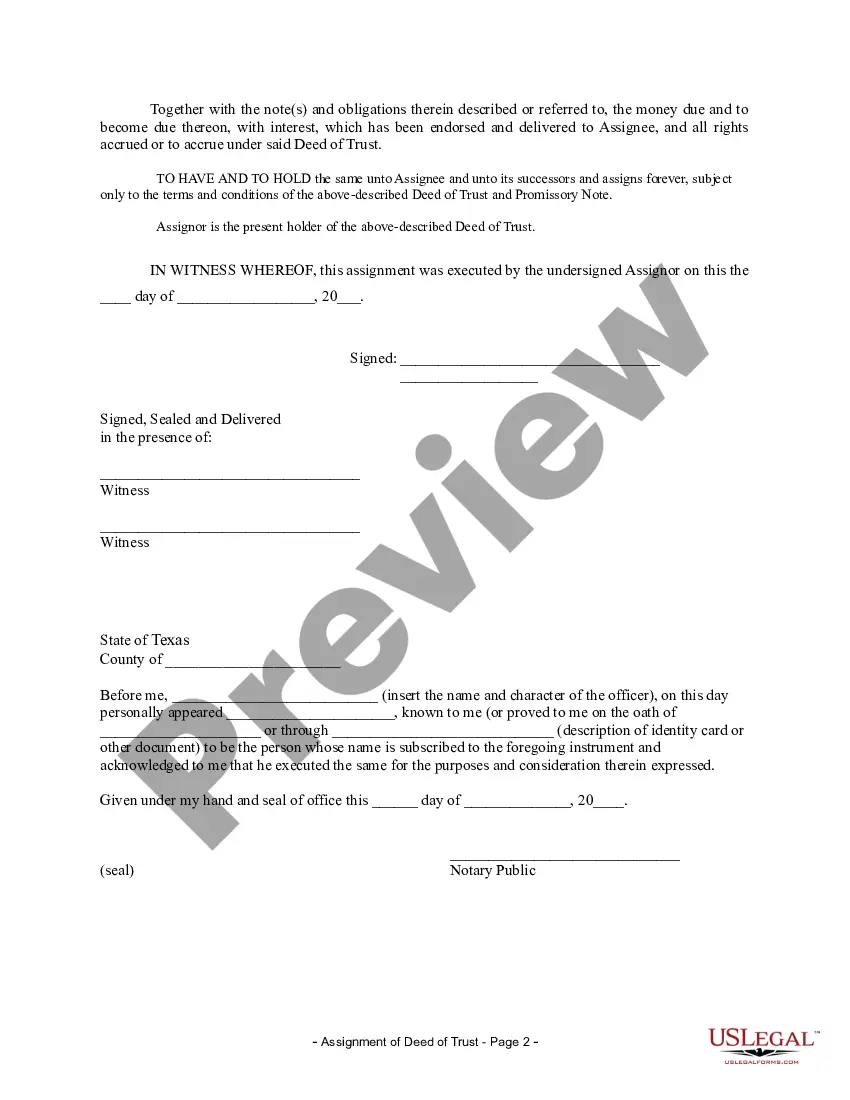

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Austin Texas Assignment of Deed of Trust by Individual Mortgage Holder

Description

How to fill out Texas Assignment Of Deed Of Trust By Individual Mortgage Holder?

Irrespective of social or professional standing, filling out law-related documents is an unfortunate requirement in today’s professional landscape.

Often, it’s nearly impossible for someone lacking any legal knowledge to produce this type of documentation from scratch, primarily due to the complex terminology and legal nuances they contain.

This is where US Legal Forms proves to be useful.

Ensure the template you’ve located is tailored to your area as the laws of one state or county do not apply to another state or county.

Examine the form and take a look at a brief overview (if available) of situations where the document can be utilized.

- Our service provides a vast assortment with over 85,000 state-specific documents that are applicable for nearly any legal situation.

- US Legal Forms also serves as an excellent tool for associates or legal advisors who wish to optimize their time by using our DIY forms.

- Whether you need the Austin Texas Assignment of Deed of Trust by Individual Mortgage Holder or any other paperwork that will be acceptable in your state or county, with US Legal Forms, all you need is at your fingertips.

- Here’s how to obtain the Austin Texas Assignment of Deed of Trust by Individual Mortgage Holder in just a few minutes using our dependable service.

- If you are currently a subscriber, you can proceed to Log In to your account to access the required form.

- However, if you are new to our platform, be sure to follow these steps before obtaining the Austin Texas Assignment of Deed of Trust by Individual Mortgage Holder.

Form popularity

FAQ

Assignment of Deed of Trust. (Commercial) (Texas) This form is an assignment of deed of trust that may be used to assign and transfer an existing deed of trust from an existing lender to a lender in Texas.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

Definition. An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

Texas is one of the few states that is a ?deed of trust? state. While many people take out a mortgage to purchase real estate, which is a loan borrowed from a bank to finance the purchase of a home, in most states, there are only two parties named on this legal document ? the lender (bank) and the borrower (homeowner).

A Deed of Assignment is used when the owner wants to transfer to another person the ownership (and the rights and obligations) of the property. The deed is normally executed in the course (or as part of the terms) of another contract.

The deed of assignment is an essential land document required to bind legality of transaction between two parties. Extensively, it transfers the ownership of land or property from a seller (an assignor) to a new buyer (the Assignee). A Deed of Assignment can only be prepared by a lawyer in Nigeria.

Valid Evidence of Transfer: A deed of assignment is very beneficial since it serves as a valid root of title to the land. It serves as valid evidence of transfer, particularly when the legitimacy of the land is disputed or a third party attempts to claim ownership of the same land.

Deeds of trusts are frequently used in Texas in real estate transactions to create an agreement such as a mortgage.

To assign the note and mortgage is to transfer ownership of the note and mortgage. Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note.