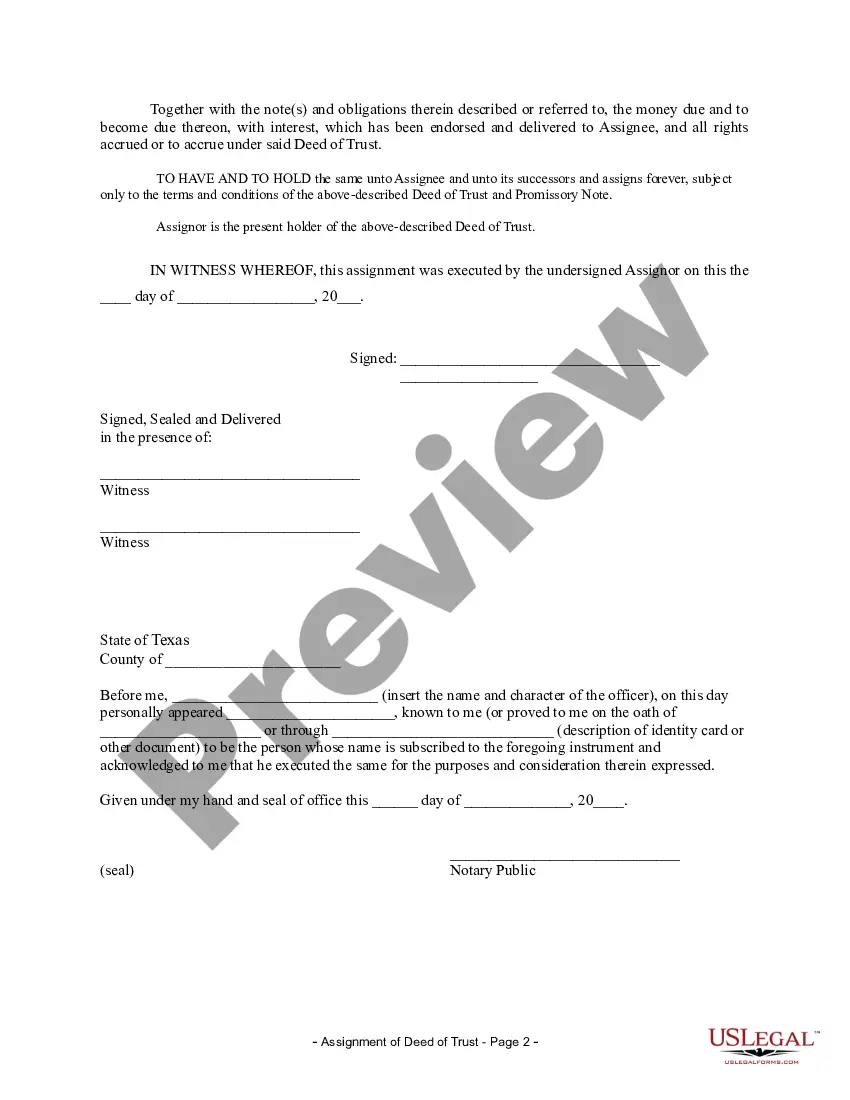

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Bexar Texas Assignment of Deed of Trust by Individual Mortgage Holder is a legal document that transfers the rights and interest of a mortgage holder to another individual or entity. This assignment can be made for various reasons, such as selling the mortgage, transferring ownership, or assigning the mortgage to a trust or investment company. When a mortgage holder decides to transfer their interest in a property, they can use the Bexar Texas Assignment of Deed of Trust by Individual Mortgage Holder. This document outlines the terms and conditions of the assignment, including the identification of the parties involved, the property details, and the legal description of the original deed of trust. It also includes information regarding the outstanding balance, interest rate, and repayment terms of the mortgage. Keywords: Bexar Texas, Assignment of Deed of Trust, Individual Mortgage Holder, transfer of rights, mortgage transfer, ownership transfer, legal document, property details, legal description, outstanding balance, interest rate, repayment terms. Types of Bexar Texas Assignment of Deed of Trust by Individual Mortgage Holder: 1. Sale Assignment: This type of assignment occurs when the mortgage holder decides to sell their mortgage to another individual or entity. The document specifies the terms of the sale, including the purchase price, transfer of rights, and any conditions or warranties. 2. Transfer of Ownership Assignment: In this type of assignment, the mortgage holder transfers their interest in the property and the associated mortgage to another party, such as a family member or business partner. The assignment document includes details of the transfer, legal descriptions, and any necessary consent or approvals. 3. Assignment to Trust or Investment Company: Sometimes, a mortgage holder may choose to assign their mortgage to a trust or investment company for various reasons, such as tax planning or estate management. This assignment outlines the transfer of the mortgage to the designated entity and includes specific instructions for handling repayments, interest rates, and any additional terms or conditions. 4. Assignment for Loan Modification: If the original mortgage holder agrees to modify the terms of the loan, they may assign the modified mortgage to another individual or entity. This type of assignment ensures that the new mortgage holder is responsible for the modified terms, such as the revised interest rate, repayment schedule, or loan amount. The Bexar Texas Assignment of Deed of Trust by Individual Mortgage Holder serves as a legal documentation tool to facilitate the transfer of rights, ownership, or responsibilities associated with a mortgage. It is essential to review and understand the terms of the assignment carefully to ensure compliance with applicable laws and regulations. Seeking legal advice or consulting with a qualified professional is advisable when dealing with such assignment transactions.Bexar Texas Assignment of Deed of Trust by Individual Mortgage Holder is a legal document that transfers the rights and interest of a mortgage holder to another individual or entity. This assignment can be made for various reasons, such as selling the mortgage, transferring ownership, or assigning the mortgage to a trust or investment company. When a mortgage holder decides to transfer their interest in a property, they can use the Bexar Texas Assignment of Deed of Trust by Individual Mortgage Holder. This document outlines the terms and conditions of the assignment, including the identification of the parties involved, the property details, and the legal description of the original deed of trust. It also includes information regarding the outstanding balance, interest rate, and repayment terms of the mortgage. Keywords: Bexar Texas, Assignment of Deed of Trust, Individual Mortgage Holder, transfer of rights, mortgage transfer, ownership transfer, legal document, property details, legal description, outstanding balance, interest rate, repayment terms. Types of Bexar Texas Assignment of Deed of Trust by Individual Mortgage Holder: 1. Sale Assignment: This type of assignment occurs when the mortgage holder decides to sell their mortgage to another individual or entity. The document specifies the terms of the sale, including the purchase price, transfer of rights, and any conditions or warranties. 2. Transfer of Ownership Assignment: In this type of assignment, the mortgage holder transfers their interest in the property and the associated mortgage to another party, such as a family member or business partner. The assignment document includes details of the transfer, legal descriptions, and any necessary consent or approvals. 3. Assignment to Trust or Investment Company: Sometimes, a mortgage holder may choose to assign their mortgage to a trust or investment company for various reasons, such as tax planning or estate management. This assignment outlines the transfer of the mortgage to the designated entity and includes specific instructions for handling repayments, interest rates, and any additional terms or conditions. 4. Assignment for Loan Modification: If the original mortgage holder agrees to modify the terms of the loan, they may assign the modified mortgage to another individual or entity. This type of assignment ensures that the new mortgage holder is responsible for the modified terms, such as the revised interest rate, repayment schedule, or loan amount. The Bexar Texas Assignment of Deed of Trust by Individual Mortgage Holder serves as a legal documentation tool to facilitate the transfer of rights, ownership, or responsibilities associated with a mortgage. It is essential to review and understand the terms of the assignment carefully to ensure compliance with applicable laws and regulations. Seeking legal advice or consulting with a qualified professional is advisable when dealing with such assignment transactions.