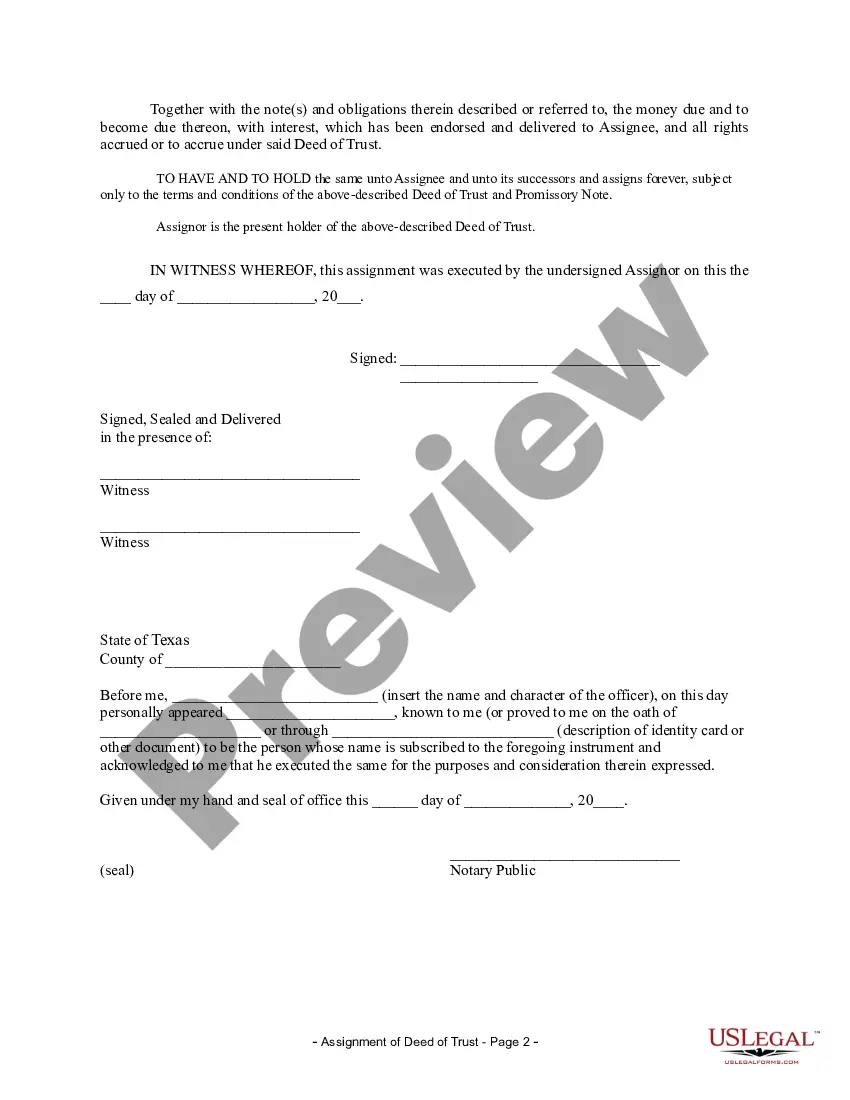

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder

Description

How to fill out Texas Assignment Of Deed Of Trust By Individual Mortgage Holder?

Irrespective of societal or occupational standing, filling out law-related paperwork is a regrettable requirement in the contemporary world.

Too frequently, it’s nearly impossible for an individual lacking legal education to create these types of documents from the ground up, primarily due to the intricate language and legal subtleties they entail.

This is where US Legal Forms steps in to assist.

Verify that the template you have selected is tailored to your area as regulations vary from one state or location to another.

Examine the form and read through a brief overview (if available) of situations for which the document can be utilized.

- Our platform features an extensive collection of over 85,000 ready-to-use state-specific forms that cater to nearly any legal situation.

- US Legal Forms is also a superb aid for associates or legal advisors aiming to enhance their efficiency by utilizing our DIY papers.

- Regardless of whether you require the Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder or any other form that will be applicable in your region, with US Legal Forms, everything is readily available.

- Here’s how to acquire the Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder in minutes using our reliable platform.

- If you are already a current client, you may proceed and Log In to your account to download the necessary document.

- Nevertheless, if you are new to our platform, make sure you complete the following steps before obtaining the Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder.

Form popularity

FAQ

To file a deed of trust in Texas, complete the deed with accurate property information and signatures. Next, you need to deliver the document to the county clerk’s office where the property is located for recording. After filing, retain a copy for your records. For guidance on navigating the process of the Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder, you can explore US Legal Forms for comprehensive resources.

To transfer your house to a trust in Texas, you must first create a trust and appoint a trustee. Next, you will need to execute a new deed that transfers ownership from you to the trust. This process involves preparing the deed, signing it before a notary, and filing it with the county clerk’s office. Using a reliable resource like US Legal Forms can help you navigate the Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder effectively.

To obtain the deed to your house in Dallas, Texas, you can visit the local county clerk's office. They maintain public records, including the Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder. Furthermore, you can search online databases offered by local authorities or legal platforms like USLegalForms. These resources provide easy access to your property records, ensuring you have the necessary documentation for your home.

The deed of trust is generally signed by the borrower and the lender involved in the transaction. In some cases, a trustee may also sign, signifying their role in the arrangement. Knowing who should sign in the Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder is crucial for ensuring the enforceability of the mortgage.

The Assignment of deed of trust is typically signed by the original lender or their legal representative. This signature validates the transfer of interest in the deed to another party. Understanding who signs this important document in the context of the Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder can simplify the transaction process and protect your rights.

In most cases, a trustee is the individual responsible for signing documents on behalf of a trust. The trustee must act in the best interest of the trust and its beneficiaries, ensuring that all actions comply with legal standards. When dealing with the Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder, having a trustworthy and knowledgeable trustee is vital for a successful process.

The assignment of a mortgage or deed of trust represents a legal process where the initial lender transfers their interest in the mortgage to another party. This assignment is crucial because it informs all relevant parties about who now holds the rights to the mortgage. With the Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder, understanding this process helps you protect your investment.

In Texas, a deed of trust can typically be prepared by a licensed attorney or a qualified individual familiar with real estate transactions. Homeowners often choose to use services like U.S. Legal Forms to find reliable templates and legal guidance for the Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder. This helps avoid errors and ensures compliance with local laws.

The assignment of a deed of trust refers to the transfer of the rights and benefits associated with the deed from one party to another. In the context of Dallas Texas Assignment of Deed of Trust by Individual Mortgage Holder, this transfer commonly occurs when a mortgage holder sells or transfers their interest in the property. Understanding this process can help you ensure a smooth transaction when managing your property.