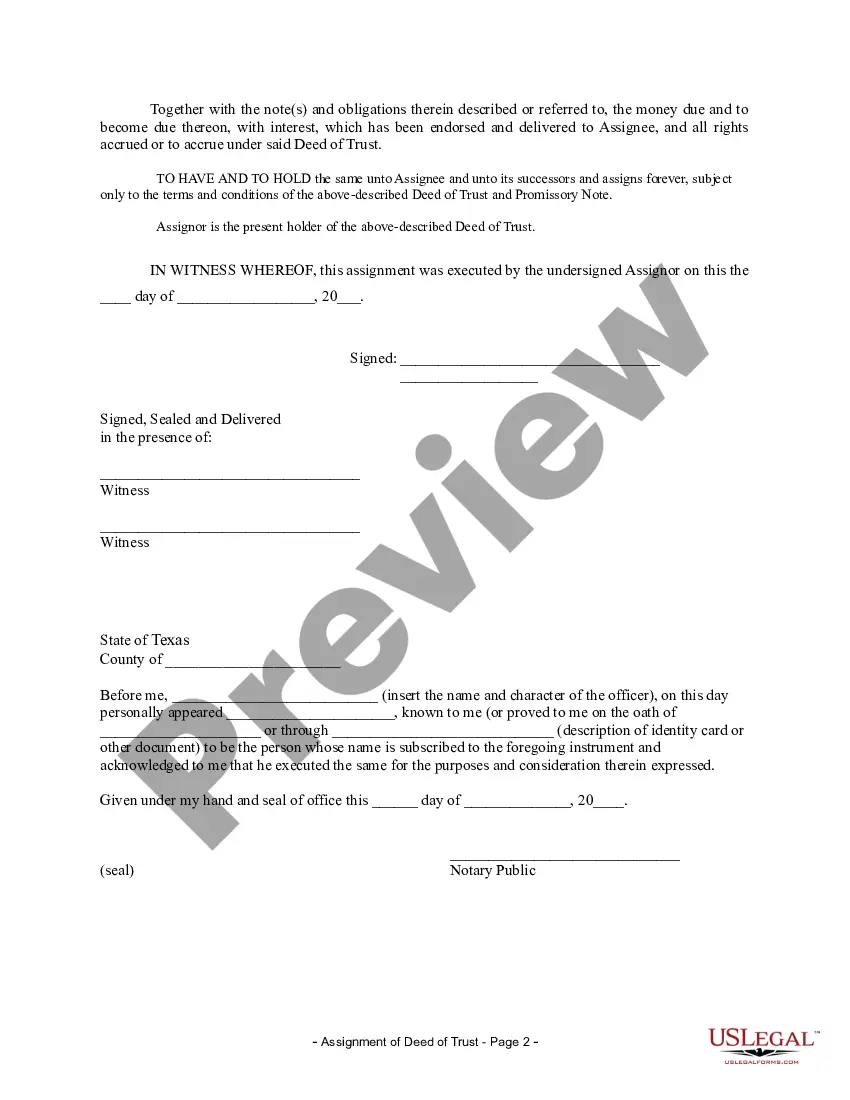

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Edinburg, Texas Assignment of Deed of Trust by Individual Mortgage Holder is a legal document that allows an individual mortgage holder to transfer their interest in a property to another party. This assignment acts as a means to ensure the transfer of rights and obligations associated with the mortgage loan. In Edinburg, Texas, there are several types of Assignment of Deed of Trust by Individual Mortgage Holder depending on the specific circumstances and needs of the parties involved. Some common types include: 1. Partial Assignment: This type of assignment occurs when a mortgage holder transfers only a part of their interest in the property to another party. It is often used when there are multiple mortgage holders or when the original mortgage holder wants to sell only a portion of the loan. 2. Full Assignment: A full assignment takes place when the entire mortgage holder's interest in the property is transferred to another individual or entity. This type of assignment is typically used when the mortgage holder wants to sell their entire loan or transfer ownership of the property to a new party. 3. Assignment for Collateral Purposes: In some cases, a mortgage holder might assign their deed of trust to another party for collateral purposes. This means that the assignee will hold the deed of trust as security for a loan or other financial obligation. 4. Assignment with Assumption: This type of assignment occurs when the mortgage holder transfers their interest in the property along with the assumption of the existing mortgage loan. It means that the new party takes responsibility for both the property and the outstanding loan. 5. Assignment due to Bankruptcy: In cases where the mortgage holder files for bankruptcy, they might be required to assign their deed of trust to a bankruptcy trustee or other parties involved in the bankruptcy proceedings. 6. Assignment to a Trust or Estate: Sometimes, an individual mortgage holder might transfer their interest in the property to a trust or estate for estate planning or asset protection purposes. This ensures that the property ownership is properly managed and distributed according to the wishes of the mortgage holder. It is important to note that the assignment of a deed of trust should be handled with care and executed following the legal requirements of Edinburg, Texas. It is advisable to consult with a qualified attorney or real estate professional to ensure that the assignment is properly drafted, recorded, and legally binding.Edinburg, Texas Assignment of Deed of Trust by Individual Mortgage Holder is a legal document that allows an individual mortgage holder to transfer their interest in a property to another party. This assignment acts as a means to ensure the transfer of rights and obligations associated with the mortgage loan. In Edinburg, Texas, there are several types of Assignment of Deed of Trust by Individual Mortgage Holder depending on the specific circumstances and needs of the parties involved. Some common types include: 1. Partial Assignment: This type of assignment occurs when a mortgage holder transfers only a part of their interest in the property to another party. It is often used when there are multiple mortgage holders or when the original mortgage holder wants to sell only a portion of the loan. 2. Full Assignment: A full assignment takes place when the entire mortgage holder's interest in the property is transferred to another individual or entity. This type of assignment is typically used when the mortgage holder wants to sell their entire loan or transfer ownership of the property to a new party. 3. Assignment for Collateral Purposes: In some cases, a mortgage holder might assign their deed of trust to another party for collateral purposes. This means that the assignee will hold the deed of trust as security for a loan or other financial obligation. 4. Assignment with Assumption: This type of assignment occurs when the mortgage holder transfers their interest in the property along with the assumption of the existing mortgage loan. It means that the new party takes responsibility for both the property and the outstanding loan. 5. Assignment due to Bankruptcy: In cases where the mortgage holder files for bankruptcy, they might be required to assign their deed of trust to a bankruptcy trustee or other parties involved in the bankruptcy proceedings. 6. Assignment to a Trust or Estate: Sometimes, an individual mortgage holder might transfer their interest in the property to a trust or estate for estate planning or asset protection purposes. This ensures that the property ownership is properly managed and distributed according to the wishes of the mortgage holder. It is important to note that the assignment of a deed of trust should be handled with care and executed following the legal requirements of Edinburg, Texas. It is advisable to consult with a qualified attorney or real estate professional to ensure that the assignment is properly drafted, recorded, and legally binding.