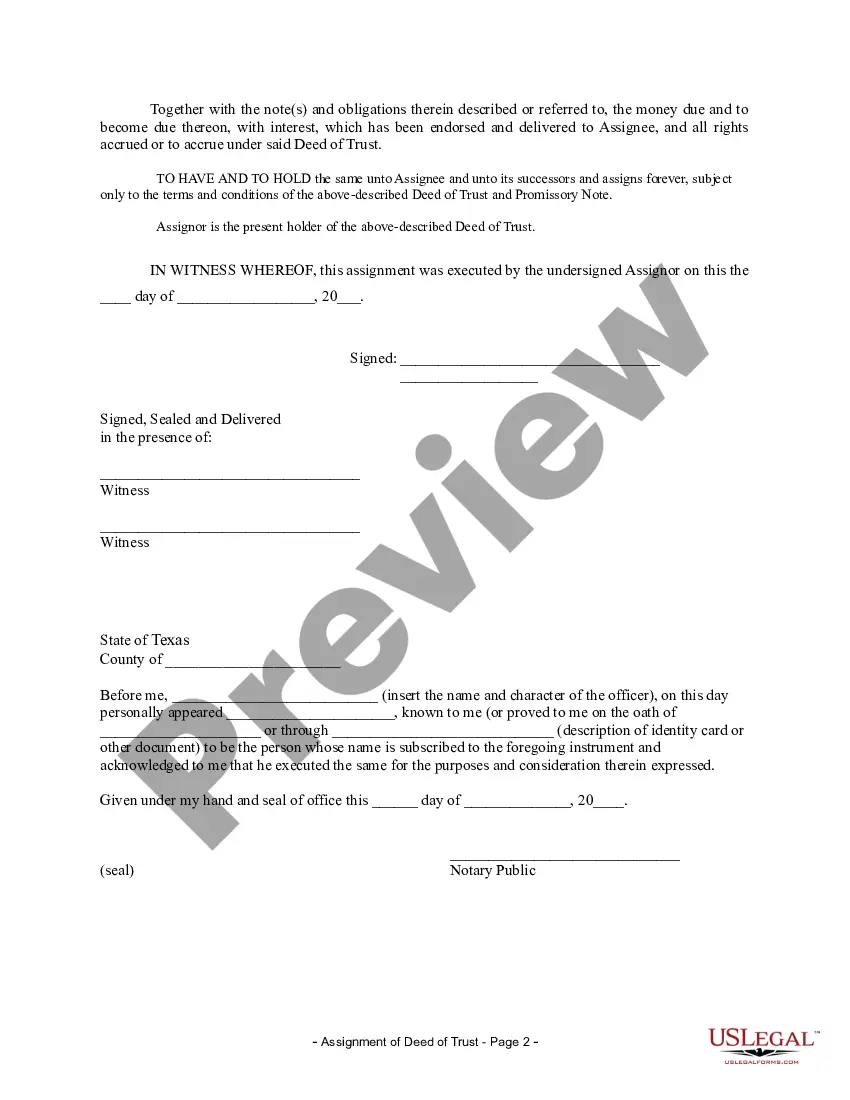

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder

Description

How to fill out Texas Assignment Of Deed Of Trust By Individual Mortgage Holder?

If you have previously used our service, Log In to your account and download the Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder to your device by clicking the Download button. Ensure that your subscription remains active. If it has expired, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have continuous access to all the documents you have purchased: you can find them in your profile under the My documents section whenever you need to use them again. Utilize the US Legal Forms service to quickly find and download any template for your personal or business requirements!

- Confirm that you’ve found the right document. Review the description and use the Preview feature, if available, to determine if it satisfies your requirements. If it’s not suitable, use the Search tab above to find the correct one.

- Procure the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Create an account and complete the payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder. Choose the file format for your document and store it on your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A deed of assignment specifically pertains to the transfer of rights or interests in a deed of trust or mortgage, while a deed of transfer may involve a more general transfer of property ownership. Understanding this distinction is vital, especially in the context of the Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder. By recognizing the nuances between these documents, you can navigate real estate transactions more effectively.

The deed of assignment serves as a formal document indicating the transfer of the mortgage interest from the original lender to the new assignee. This legal instrument protects the interests of both parties by providing a clear record of the assignment. With the Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder, having a proper deed of assignment is essential for ensuring a smooth transition in mortgage responsibilities.

The assignment of a deed of trust is the legal process where the original lender assigns their rights to collect mortgage payments to another entity. This process allows for the transfer of responsibilities while maintaining the original mortgage agreement's terms. When considering the Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder, it is crucial to recognize how this mechanism promotes financial flexibility.

In Texas, a deed of trust can be prepared by an attorney, a title company, or any qualified individual familiar with real estate documents. It is essential to ensure that the person preparing the deed understands the legal requirements associated with the Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder. Doing so helps you avoid potential problems in the future.

An assignment of deed of trust in Texas occurs when the original lender transfers their interest in the deed of trust to another party. This transfer does not change the terms of the mortgage or the obligation of the borrower. By understanding the Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder, you can recognize how these assignments affect both parties involved.

An assignment to a trust involves transferring property rights into a trust, which then manages those assets for designated beneficiaries. This process can provide benefits such as asset protection and tax advantages. In the context of the Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder, understanding how assignments to trusts work is essential for effective estate planning.

Transferring a house deed to a family member in Texas can be straightforward. You typically need to execute a new deed, which details the transfer and is then filed with the local county clerk. Utilizing resources like USLegalForms can streamline this process, ensuring your Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder is executed correctly.

Texas primarily uses a deed of trust instead of a traditional mortgage. This legal document allows for a more streamlined foreclosure process if the borrower defaults. When engaging in a Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder, understanding the distinction between these two can help clarify the rights and obligations you may assume.

A deed of assignment allows an individual to transfer their rights and responsibilities in a mortgage agreement to another party. This document is crucial for maintaining the integrity and legality of financial transactions. In the context of Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder, it provides clarity on ownership and obligations associated with a property.

Filing a deed of trust in Texas requires completing the appropriate forms and submitting them to the local county clerk's office. While this process can be straightforward, understanding the specific requirements can be challenging. Utilizing tools from platforms like US Legal Forms can aid in correctly preparing your Laredo Texas Assignment of Deed of Trust by Individual Mortgage Holder, ensuring compliance with local laws.