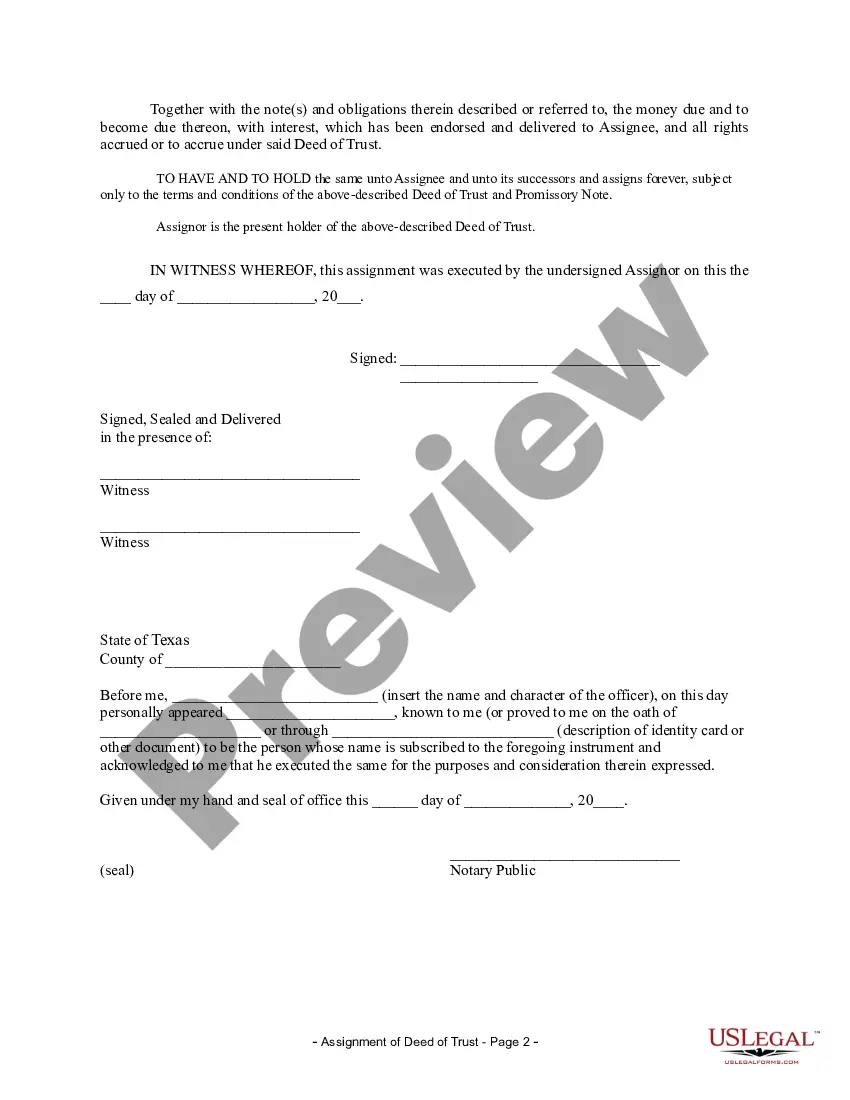

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Title: McAllen Texas Assignment of Deed of Trust by Individual Mortgage Holder — A Comprehensive Guide Introduction: In McAllen, Texas, the Assignment of Deed of Trust by Individual Mortgage Holder is a crucial legal instrument used in real estate transactions. This document transfers the rights and interest in a property's deed of trust from the original mortgage holder to another party. In this article, we will delve into the intricacies surrounding this assignment, its significance, and potential variations you may encounter. Key Concepts: 1. Deed of Trust: A legal document that serves as security for a loan by granting a trustee the authority to hold the property's title until the debt is fully repaid. 2. Assignment of Deed of Trust: The process of transferring the rights and obligations of a Deed of Trust from one mortgage holder to another individual or entity. 3. Individual Mortgage Holder: A person who holds a mortgage on a property instead of a financial institution. Important Points: 1. Parties Involved: The Assignment of Deed of Trust typically involves three key parties: the assignor (original mortgage holder), the assignee (new mortgage holder), and the trustee (responsible for holding the property title). 2. Role of Trustee: The trustee, typically a neutral third party, carries out the transfer of the Deed of Trust, ensuring all legal requirements are met. 3. Legal Requirements: The Assignment of Deed of Trust must comply with Texas laws and include essential details such as property description, loan details, the names of involved parties, and their signatures. 4. Note Endorsement: In some cases, the assignment requires an endorsement of the associated promissory note, indicating the transfer of both the Deed of Trust and the underlying debt. Types of McAllen Texas Assignment of Deed of Trust by Individual Mortgage Holder: 1. Full Assignment: A complete transfer of the entire Deed of Trust and associated rights to a new mortgage holder. 2. Partial Assignment: The assignment transfers only a portion of the mortgage holder's interest in the Deed of Trust, while the original holder retains some interest and obligations. 3. Assignment with Re conveyance: This type occurs when the original mortgage holder transfers the Deed of Trust to a new party with the expectation of receiving it back (reconveyance) once certain conditions, such as loan repayment, are met. Conclusion: The McAllen Texas Assignment of Deed of Trust by Individual Mortgage Holder is an essential legal document that facilitates property transfers and changes in the mortgagee's rights and obligations. Understanding the intricacies and potential variations of this assignment process is crucial for both mortgage holders and those involved in real estate transactions in McAllen, Texas. Ensure you consult with legal professionals experienced in real estate law to ensure a smooth and legally-compliant transfer.Title: McAllen Texas Assignment of Deed of Trust by Individual Mortgage Holder — A Comprehensive Guide Introduction: In McAllen, Texas, the Assignment of Deed of Trust by Individual Mortgage Holder is a crucial legal instrument used in real estate transactions. This document transfers the rights and interest in a property's deed of trust from the original mortgage holder to another party. In this article, we will delve into the intricacies surrounding this assignment, its significance, and potential variations you may encounter. Key Concepts: 1. Deed of Trust: A legal document that serves as security for a loan by granting a trustee the authority to hold the property's title until the debt is fully repaid. 2. Assignment of Deed of Trust: The process of transferring the rights and obligations of a Deed of Trust from one mortgage holder to another individual or entity. 3. Individual Mortgage Holder: A person who holds a mortgage on a property instead of a financial institution. Important Points: 1. Parties Involved: The Assignment of Deed of Trust typically involves three key parties: the assignor (original mortgage holder), the assignee (new mortgage holder), and the trustee (responsible for holding the property title). 2. Role of Trustee: The trustee, typically a neutral third party, carries out the transfer of the Deed of Trust, ensuring all legal requirements are met. 3. Legal Requirements: The Assignment of Deed of Trust must comply with Texas laws and include essential details such as property description, loan details, the names of involved parties, and their signatures. 4. Note Endorsement: In some cases, the assignment requires an endorsement of the associated promissory note, indicating the transfer of both the Deed of Trust and the underlying debt. Types of McAllen Texas Assignment of Deed of Trust by Individual Mortgage Holder: 1. Full Assignment: A complete transfer of the entire Deed of Trust and associated rights to a new mortgage holder. 2. Partial Assignment: The assignment transfers only a portion of the mortgage holder's interest in the Deed of Trust, while the original holder retains some interest and obligations. 3. Assignment with Re conveyance: This type occurs when the original mortgage holder transfers the Deed of Trust to a new party with the expectation of receiving it back (reconveyance) once certain conditions, such as loan repayment, are met. Conclusion: The McAllen Texas Assignment of Deed of Trust by Individual Mortgage Holder is an essential legal document that facilitates property transfers and changes in the mortgagee's rights and obligations. Understanding the intricacies and potential variations of this assignment process is crucial for both mortgage holders and those involved in real estate transactions in McAllen, Texas. Ensure you consult with legal professionals experienced in real estate law to ensure a smooth and legally-compliant transfer.