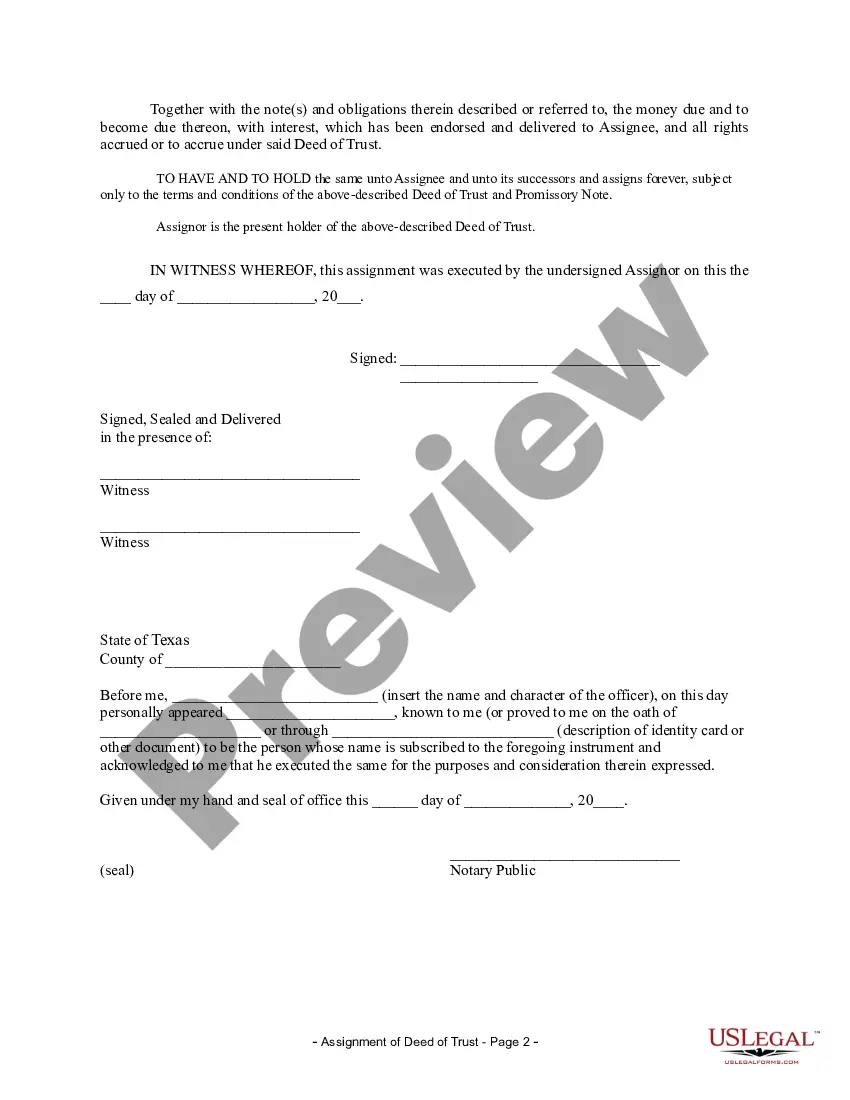

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Plano Texas Assignment of Deed of Trust by Individual Mortgage Holder is a legal document that facilitates the transfer of ownership of a mortgage from one individual to another. This assignment allows the new mortgage holder to assume the rights and responsibilities associated with the mortgage. The Plano Texas Assignment of Deed of Trust is crucial when a mortgage holder wishes to sell or transfer their mortgage to another individual. This process typically occurs when the mortgage holder wants to free up capital, invest elsewhere, or transfer the mortgage to a family member or trusted individual. By executing an Assignment of Deed of Trust, the current mortgage holder, known as the assignor, legally transfers the rights and obligations of the mortgage to the new mortgage holder, referred to as the assignee. This document must be notarized and recorded with the appropriate county office to ensure its validity and protect the rights of all parties involved. There are various types of Assignment of Deed of Trust by Individual Mortgage Holder in Plano, Texas. Some common types include: 1. Voluntary Assignment: This type of assignment occurs when the mortgage holder willingly transfers their mortgage to another party, often through a sale or as a gifting arrangement. The assignee assumes the rights, interests, and obligations associated with the mortgage. 2. Involuntary Assignment: In certain situations, a mortgage holder may be forced to assign their deed of trust. This can happen in cases of foreclosure, bankruptcy, or court-ordered transfers. The assignee becomes the new mortgage holder and continues with the existing terms and conditions of the mortgage. 3. Partial Assignment: This type of assignment involves the transfer of only a portion of the mortgage to a new holder. It may occur when the mortgage holder wants to sell a partial interest in the mortgage while still retaining a beneficial interest. Both assignor and assignee have specific rights and obligations outlined in the assignment document. 4. Full Assignment: In a full assignment, the mortgage holder transfers the entire mortgage to a new holder. The assignee becomes the primary mortgage holder and is responsible for managing the mortgage, including handling payments, enforcing the terms, and issuing necessary notices. It's important to consult with legal professionals or mortgage experts to ensure that the Plano Texas Assignment of Deed of Trust by Individual Mortgage Holder is prepared accurately, compliant with applicable laws, and protects the rights of all involved parties.Plano Texas Assignment of Deed of Trust by Individual Mortgage Holder is a legal document that facilitates the transfer of ownership of a mortgage from one individual to another. This assignment allows the new mortgage holder to assume the rights and responsibilities associated with the mortgage. The Plano Texas Assignment of Deed of Trust is crucial when a mortgage holder wishes to sell or transfer their mortgage to another individual. This process typically occurs when the mortgage holder wants to free up capital, invest elsewhere, or transfer the mortgage to a family member or trusted individual. By executing an Assignment of Deed of Trust, the current mortgage holder, known as the assignor, legally transfers the rights and obligations of the mortgage to the new mortgage holder, referred to as the assignee. This document must be notarized and recorded with the appropriate county office to ensure its validity and protect the rights of all parties involved. There are various types of Assignment of Deed of Trust by Individual Mortgage Holder in Plano, Texas. Some common types include: 1. Voluntary Assignment: This type of assignment occurs when the mortgage holder willingly transfers their mortgage to another party, often through a sale or as a gifting arrangement. The assignee assumes the rights, interests, and obligations associated with the mortgage. 2. Involuntary Assignment: In certain situations, a mortgage holder may be forced to assign their deed of trust. This can happen in cases of foreclosure, bankruptcy, or court-ordered transfers. The assignee becomes the new mortgage holder and continues with the existing terms and conditions of the mortgage. 3. Partial Assignment: This type of assignment involves the transfer of only a portion of the mortgage to a new holder. It may occur when the mortgage holder wants to sell a partial interest in the mortgage while still retaining a beneficial interest. Both assignor and assignee have specific rights and obligations outlined in the assignment document. 4. Full Assignment: In a full assignment, the mortgage holder transfers the entire mortgage to a new holder. The assignee becomes the primary mortgage holder and is responsible for managing the mortgage, including handling payments, enforcing the terms, and issuing necessary notices. It's important to consult with legal professionals or mortgage experts to ensure that the Plano Texas Assignment of Deed of Trust by Individual Mortgage Holder is prepared accurately, compliant with applicable laws, and protects the rights of all involved parties.