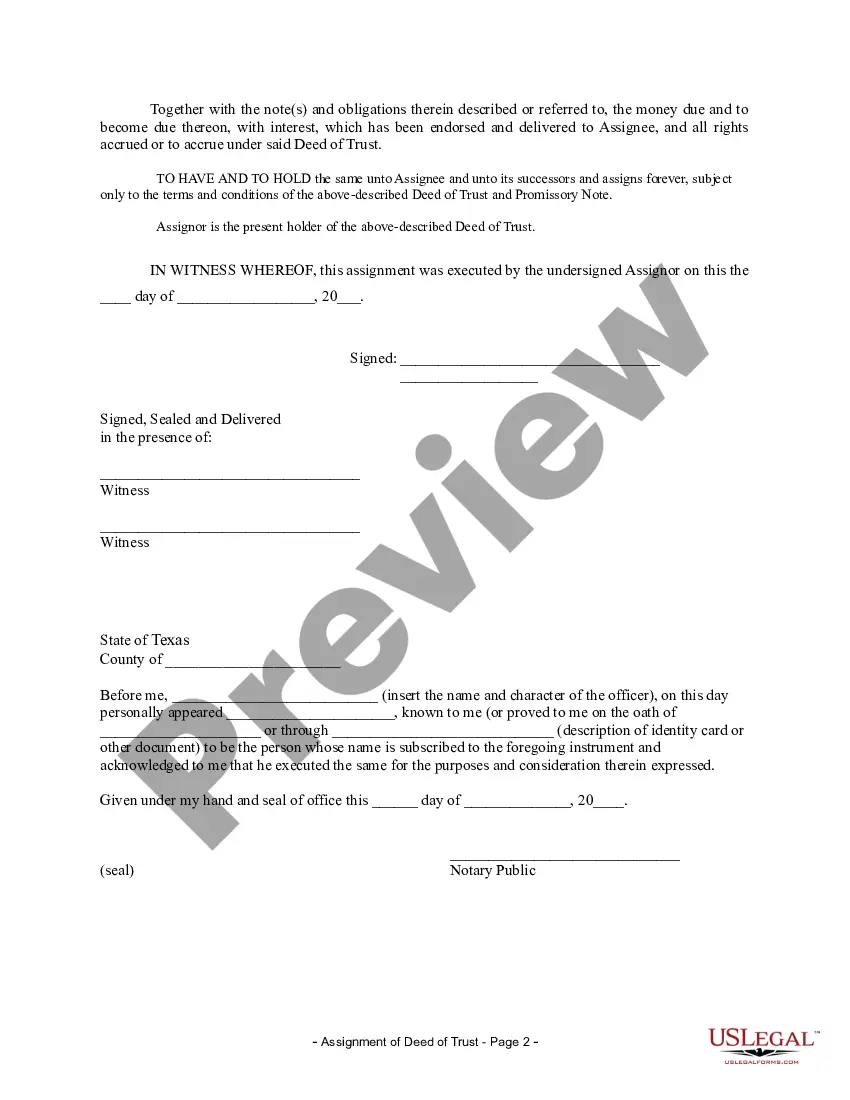

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Title: Round Rock Texas Assignment of Deed of Trust by Individual Mortgage Holder — A Comprehensive Guide Introduction: In Round Rock, Texas, property transactions can involve the assignment of a Deed of Trust by an individual mortgage holder. This legal process enables the transfer of a mortgage loan from the original lender to another party, known as the assignee. This article will delve into the intricacies of Round Rock Texas Assignment of Deed of Trust by Individual Mortgage Holder, highlighting its significance, process, and potential variations. Keywords: Round Rock Texas, Assignment of Deed of Trust, Individual Mortgage Holder, property transactions, mortgage loan, assignee. 1. Understanding Assignment of Deed of Trust: The Assignment of Deed of Trust is a common real estate practice in Round Rock, Texas, where an individual mortgage holder legally transfers their rights and interests in a mortgage loan to another party. This assignment does not alter the terms of the mortgage, such as the interest rate or repayment period. Keywords: real estate practice, mortgage loan, terms, interest rate, repayment period. 2. Importance of Assignment of Deed of Trust: The Assignment of Deed of Trust holds tremendous importance as it allows for the smooth transfer of mortgage loans. By enabling mortgage holders to assign their rights to other individuals or entities, it facilitates the free flow of property sales and investments in Round Rock, Texas. Keywords: transfer, mortgage loans, property sales, investments. 3. The Process of Assignment: a. Consent of Mortgage Holder: Before proceeding with the assignment, the individual mortgage holder must provide written consent and agreement to transfer their rights to a chosen assignee. Keywords: consent, transfer rights, chosen assignee. b. Preparation of Assignment Documents: The assignor (original mortgage holder) prepares an Assignment of Deed of Trust document, clearly stating the intent to transfer the mortgage rights to the assignee. This document should include the legal description of the property, names of involved parties, and details of the mortgage. Keywords: Assignment of Deed of Trust documents, legal description, involved parties, mortgage details. c. Decoration: The completed Assignment of Deed of Trust document must be recorded with the appropriate county office in Round Rock, Texas. This ensures public notice of the transfer and establishes the assignee's legal rights to enforce the mortgage. Keywords: decoration, county office, public notice, legal rights. 4. Variations of Round Rock Texas Assignment of Deed of Trust by Individual Mortgage Holder: While the general process remains consistent, there can be specific variations or additional types of Assignment of Deed of Trust in Round Rock, Texas. These may include: a. Partial Assignment: An individual mortgage holder may choose to transfer only a portion of their mortgage rights, allowing the assignee to share responsibility for collecting a portion of the mortgage payments. Keywords: partial assignment, share responsibility, mortgage payments. b. Assignment with Assumption: In some cases, an assignee may assume the mortgage loan, taking over the original mortgage holder's liability and becoming the new borrower. Keywords: assignment with assumption, new borrower, liability. c. Assignment by an Entity: While this content primarily focuses on individual mortgage holders, it's important to note that entities like trusts, corporations, or partnerships can also act as assignors or assignees in Round Rock, Texas. Keywords: assignment by an entity, trusts, corporations, partnerships. Conclusion: Assignment of Deed of Trust by an Individual Mortgage Holder in Round Rock, Texas plays a crucial role in facilitating property transactions and ensuring the smooth transfer of mortgage loans. By understanding the process, importance, and potential variations in this legal practice, individuals can navigate the realm of real estate investments and sales more efficiently. Keywords: property transactions, transfer of mortgage loans, legal practice, real estate investments, sales.Title: Round Rock Texas Assignment of Deed of Trust by Individual Mortgage Holder — A Comprehensive Guide Introduction: In Round Rock, Texas, property transactions can involve the assignment of a Deed of Trust by an individual mortgage holder. This legal process enables the transfer of a mortgage loan from the original lender to another party, known as the assignee. This article will delve into the intricacies of Round Rock Texas Assignment of Deed of Trust by Individual Mortgage Holder, highlighting its significance, process, and potential variations. Keywords: Round Rock Texas, Assignment of Deed of Trust, Individual Mortgage Holder, property transactions, mortgage loan, assignee. 1. Understanding Assignment of Deed of Trust: The Assignment of Deed of Trust is a common real estate practice in Round Rock, Texas, where an individual mortgage holder legally transfers their rights and interests in a mortgage loan to another party. This assignment does not alter the terms of the mortgage, such as the interest rate or repayment period. Keywords: real estate practice, mortgage loan, terms, interest rate, repayment period. 2. Importance of Assignment of Deed of Trust: The Assignment of Deed of Trust holds tremendous importance as it allows for the smooth transfer of mortgage loans. By enabling mortgage holders to assign their rights to other individuals or entities, it facilitates the free flow of property sales and investments in Round Rock, Texas. Keywords: transfer, mortgage loans, property sales, investments. 3. The Process of Assignment: a. Consent of Mortgage Holder: Before proceeding with the assignment, the individual mortgage holder must provide written consent and agreement to transfer their rights to a chosen assignee. Keywords: consent, transfer rights, chosen assignee. b. Preparation of Assignment Documents: The assignor (original mortgage holder) prepares an Assignment of Deed of Trust document, clearly stating the intent to transfer the mortgage rights to the assignee. This document should include the legal description of the property, names of involved parties, and details of the mortgage. Keywords: Assignment of Deed of Trust documents, legal description, involved parties, mortgage details. c. Decoration: The completed Assignment of Deed of Trust document must be recorded with the appropriate county office in Round Rock, Texas. This ensures public notice of the transfer and establishes the assignee's legal rights to enforce the mortgage. Keywords: decoration, county office, public notice, legal rights. 4. Variations of Round Rock Texas Assignment of Deed of Trust by Individual Mortgage Holder: While the general process remains consistent, there can be specific variations or additional types of Assignment of Deed of Trust in Round Rock, Texas. These may include: a. Partial Assignment: An individual mortgage holder may choose to transfer only a portion of their mortgage rights, allowing the assignee to share responsibility for collecting a portion of the mortgage payments. Keywords: partial assignment, share responsibility, mortgage payments. b. Assignment with Assumption: In some cases, an assignee may assume the mortgage loan, taking over the original mortgage holder's liability and becoming the new borrower. Keywords: assignment with assumption, new borrower, liability. c. Assignment by an Entity: While this content primarily focuses on individual mortgage holders, it's important to note that entities like trusts, corporations, or partnerships can also act as assignors or assignees in Round Rock, Texas. Keywords: assignment by an entity, trusts, corporations, partnerships. Conclusion: Assignment of Deed of Trust by an Individual Mortgage Holder in Round Rock, Texas plays a crucial role in facilitating property transactions and ensuring the smooth transfer of mortgage loans. By understanding the process, importance, and potential variations in this legal practice, individuals can navigate the realm of real estate investments and sales more efficiently. Keywords: property transactions, transfer of mortgage loans, legal practice, real estate investments, sales.