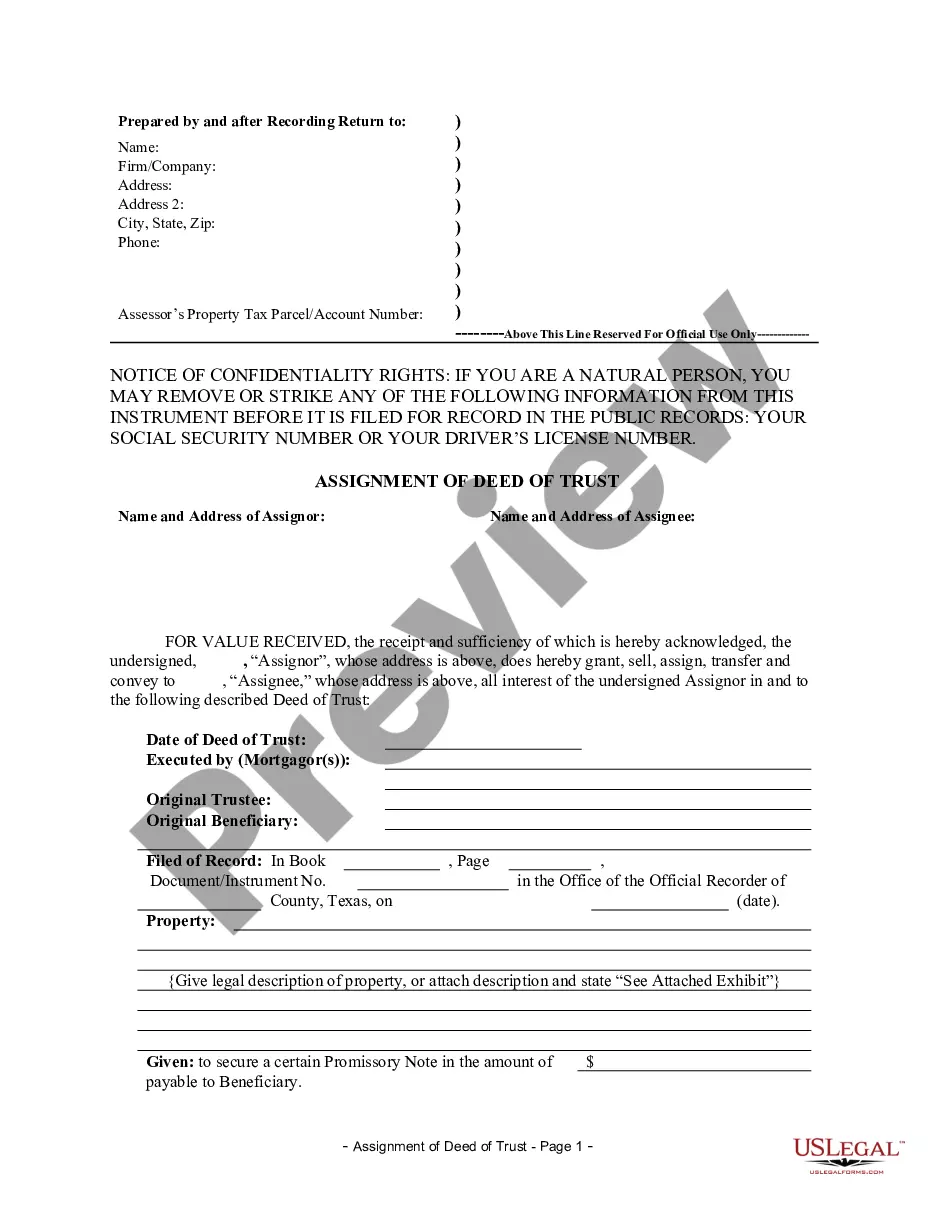

Assignment of Deed of Trust by Corporate Mortgage Holder

Assignments Generally:

Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rule

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Texas Law

Recording Satisfaction:

There are no provisions requiring a Texas creditor to release a fully paid debt, but if a creditor

fails to do so within 60 days of full payoff, a representative of a title

insurance company may record an affidavit which releases the lien described

in the affidavit.

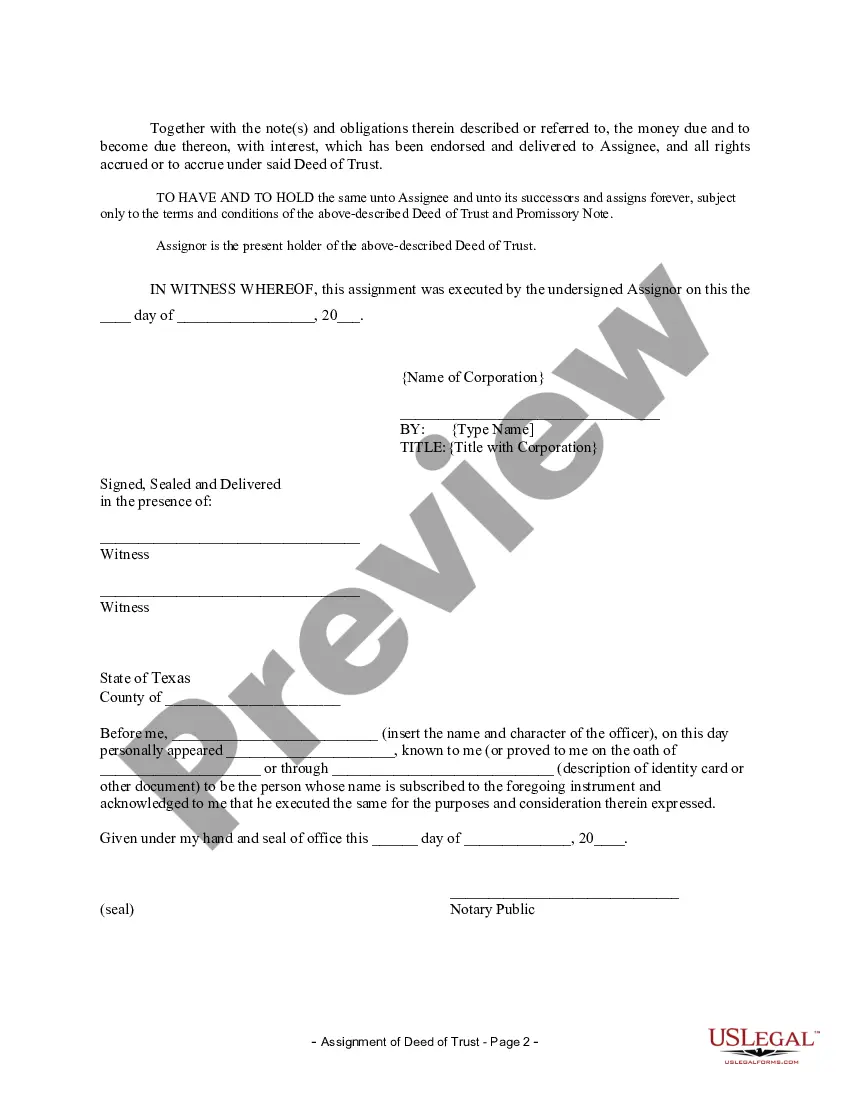

Acknowledgment:

An assignment or satisfaction must contain a proper Texas acknowledgment, or other acknowledgment approved

by Statute.

Texas Statutes

CHAPTER 12. RECORDING OF INSTRUMENTS

§ 12.001. Instruments Concerning Property

(a) An instrument concerning real or personal

property may be recorded if it has been acknowledged, sworn to with a proper

jurat, or proved according to law.

(b) An instrument conveying real property

may not be recorded unless it is signed and acknowledged or sworn to by

the grantor in the presence of two or more credible subscribing witnesses

or acknowledged or sworn to before and certified by an officer authorized

to take acknowledgements or oaths, as applicable.

(c) This section does not require the acknowledgement

or swearing or prohibit the recording of a financing statement, a security

agreement filed as a financing statement, or a continuation statement filed

for record under the Business & Commerce Code.

(d) The failure of a notary public to attach

an official seal to an acknowledgment, a jurat, or other proof taken outside

this state but inside the United States or its territories renders the

acknowledgment, jurat, or other proof invalid only if the jurisdiction

in which the acknowledgment, jurat, or other proof is taken requires the

notary public to attach the seal.

§ 12.009. Mortgage or Deed of Trust Master Form

(a) A master form of a mortgage or deed

of trust may be recorded in any county without acknowledgement or proof.

The master form must contain on its face the designation: "Master form

recorded by (name of person causing the recording)."

(b) The county clerk shall index a master

form under the name of the person causing the recording and indicate in

the index and records that the document is a master mortgage.

(c) The parties to an instrument may incorporate

by reference a provision of a recorded master form with the same effect

as if the provision were set out in full in the instrument. The reference

must state:

(2) the numbers of the book or volume and

first page of the records in which the master form is recorded; and

(d) If a mortgage or deed of trust incorporates

by reference a provision of a master form, the mortgagee shall give the

mortgagor a copy of the master form at the time the instrument is executed.

A statement in the mortgage or deed of trust or in a separate instrument

signed by the mortgagor that the mortgagor received a copy of the master

form is conclusive evidence of its receipt. On written request the mortgagee

shall give a copy of the master form without charge to the mortgagor, the

mortgagor's successors in interest, or the mortgagor's or a successor's

agent.

(e) The provisions of the Uniform Commercial

Code prevail over this section.

§ 12.017 PROP. Title Insurance Company Affidavit as Release

of Lien; Civil Penalty

(a) In this section:

(3) "Mortgage servicer" means the last person

to whom a mortgagor has been instructed by a mortgagee to send payments

for the loan secured by a mortgage. A person transmitting a payoff statement

is considered the mortgage servicer for the mortgage described in the payoff

statement.

(A) the unpaid balance of a loan

secured by a mortgage, including principal, interest, and other charges

properly assessed under the loan documentation of the mortgage; and

(6) "Title insurance company" means a corporation

or other business entity authorized and licensed to transact the business

of insuring titles to interests in real property in this state.

(b) This section applies only to a mortgage on property consisting

exclusively of a one-to-four-family residence, including a residential

unit in a condominium regime.

(c) If a mortgagee fails to execute and deliver a release

of mortgage to the mortgagor or the mortgagor's designated agent within

60 days after the date of receipt of payment of the mortgage by the mortgagee

in accordance with a payoff statement furnished by the mortgagee or its

mortgage servicer, an authorized officer of a title insurance company may,

on behalf of the mortgagor or a transferee of the mortgagor who acquired

title to the property described in the mortgage, execute an affidavit that

complies with the requirements of this section and record the affidavit

in the real property records of each county in which the mortgage was recorded.

(d) An affidavit executed under this section must state that:

(2) the affidavit is made on behalf of the mortgagor

or a transferee of the mortgagor who acquired title to the property described

in the mortgage;

(4) the affiant has ascertained that the mortgagee

has received payment of the loan secured by the mortgage in accordance

with the payoff statement, as evidenced by:

(A) a bank check, certified check,

escrow account check from the title company or title insurance agent, or

attorney trust account check that has been negotiated by the mortgagee;

or

(6) the title insurance company or its agent

has given the mortgagee at least 15 days' notice in writing of its intention

to execute and record an affidavit in accordance with this section, with

a copy of the proposed affidavit attached to the written notice; and

(7) the mortgagee has not responded in writing

to the notification, or a request for additional payment made by the mortgagee

has been complied with at least 15 days before the date of the affidavit.

(e) The affidavit must include the names of the mortgagor

and the mortgagee, the date of the mortgage, and the volume and page or

clerk's file number of the real property records where the mortgage is

recorded, together with similar information for a recorded assignment of

the mortgage.

(f) The affiant must attach to the affidavit a photostatic

copy, certified as a true copy of the original document, of:

(1) the documentary evidence that payment has

been received by the mortgagee, including the mortgagee's endorsement of

a negotiated check if paid by check; and

(g) An affidavit that is executed and recorded as provided

by this section operates as a release of the mortgage described in the

affidavit.

(h) The county clerk shall index the affidavit in the names

of the original mortgagee and the last assignee of the mortgage appearing

of record as the grantors and in the name of the mortgagor as grantee.

(i) A person who knowingly causes an affidavit with false

information to be executed and recorded under this section is liable for

the penalties for filing a false affidavit, including the penalties for

commission of offenses under Section 37.02 PROP. of the Penal Code, and

to a party injured by the affidavit for actual damages or $5,000, whichever

is greater. The attorney general may sue to collect the penalty. If the

attorney general or an injured party bringing suit substantially prevails

in an action under this subsection, the court may award reasonable attorney's

fees and court costs to the prevailing party.