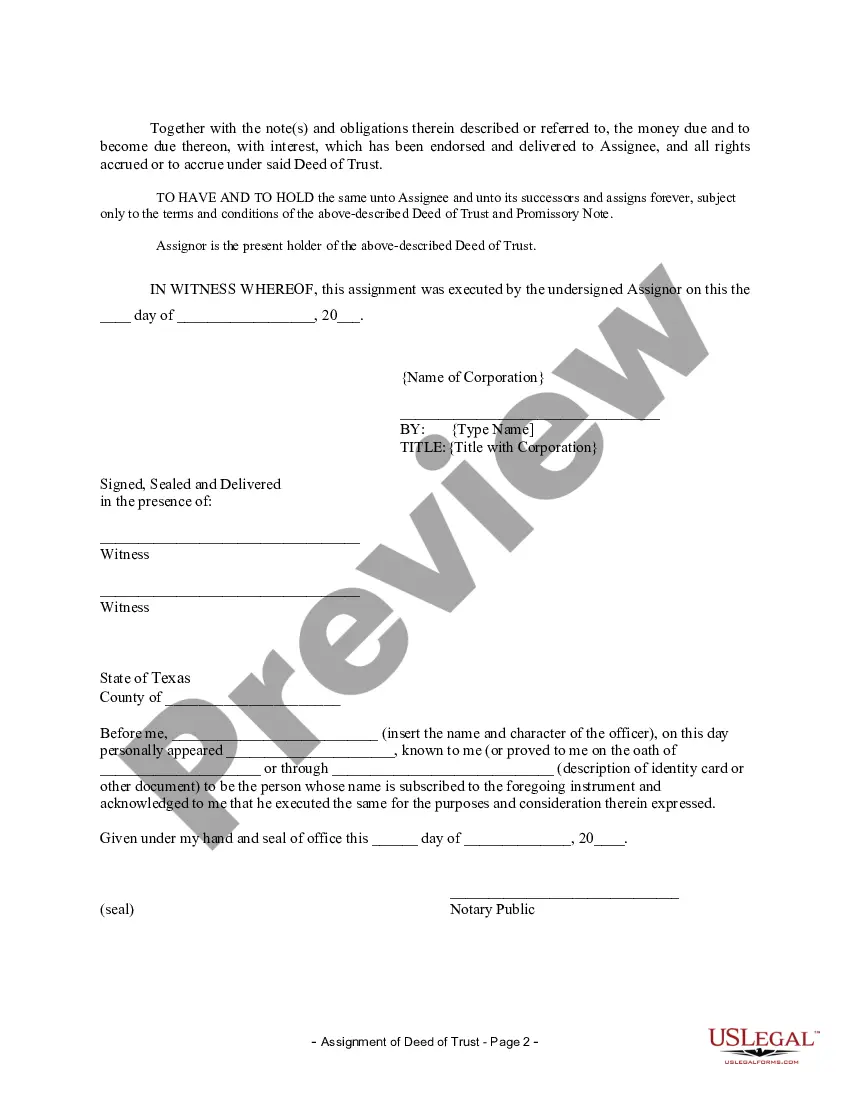

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

The Bexar Texas Assignment of Deed of Trust by Corporate Mortgage Holder is a legal document that enables a corporate mortgage holder to transfer their interest in a property to another party. This assignment is commonly used when the corporate mortgage holder wishes to sell or transfer their rights and responsibilities associated with a particular deed of trust. The purpose of the Bexar Texas Assignment of Deed of Trust by Corporate Mortgage Holder is to legally document the transfer of the mortgage holder's interest in the property to the assignee. This assignment typically includes relevant details about the property, such as its address and legal description, as well as information about the original deed of trust, the corporate mortgage holder, and the assignee. There can be various types of Bexar Texas Assignment of Deed of Trust by Corporate Mortgage Holder, each serving different purposes. Some examples include: 1. Partial Assignment: This type of assignment involves transferring only a portion of the corporate mortgage holder's interest in the property. For instance, if the mortgage holder owns 50% of the property, they may assign 25% of their interest to another party, while retaining the remaining 25%. 2. Full Assignment: In this type of assignment, the corporate mortgage holder transfers their entire interest in the property to the assignee. This is usually done when the mortgage holder wishes to completely release their rights and obligations related to the deed of trust. 3. Assignment with Warranty: This type of assignment includes a warranty clause, which guarantees that the corporate mortgage holder has the legal authority to transfer their interest in the property. It provides additional protection to the assignee against any potential claims or disputes regarding the assignment. 4. Assignment for Value: In certain cases, the assignment of deed of trust may involve a financial transaction between the corporate mortgage holder and the assignee. This type of assignment indicates that the transfer of interest is based on a specific monetary value. When preparing a Bexar Texas Assignment of Deed of Trust by Corporate Mortgage Holder, it is crucial to accurately include all the necessary information and adhere to the legal requirements outlined in the state laws. Professional legal advice should be sought to ensure compliance with the applicable regulations and to safeguard the rights and interests of all parties involved.The Bexar Texas Assignment of Deed of Trust by Corporate Mortgage Holder is a legal document that enables a corporate mortgage holder to transfer their interest in a property to another party. This assignment is commonly used when the corporate mortgage holder wishes to sell or transfer their rights and responsibilities associated with a particular deed of trust. The purpose of the Bexar Texas Assignment of Deed of Trust by Corporate Mortgage Holder is to legally document the transfer of the mortgage holder's interest in the property to the assignee. This assignment typically includes relevant details about the property, such as its address and legal description, as well as information about the original deed of trust, the corporate mortgage holder, and the assignee. There can be various types of Bexar Texas Assignment of Deed of Trust by Corporate Mortgage Holder, each serving different purposes. Some examples include: 1. Partial Assignment: This type of assignment involves transferring only a portion of the corporate mortgage holder's interest in the property. For instance, if the mortgage holder owns 50% of the property, they may assign 25% of their interest to another party, while retaining the remaining 25%. 2. Full Assignment: In this type of assignment, the corporate mortgage holder transfers their entire interest in the property to the assignee. This is usually done when the mortgage holder wishes to completely release their rights and obligations related to the deed of trust. 3. Assignment with Warranty: This type of assignment includes a warranty clause, which guarantees that the corporate mortgage holder has the legal authority to transfer their interest in the property. It provides additional protection to the assignee against any potential claims or disputes regarding the assignment. 4. Assignment for Value: In certain cases, the assignment of deed of trust may involve a financial transaction between the corporate mortgage holder and the assignee. This type of assignment indicates that the transfer of interest is based on a specific monetary value. When preparing a Bexar Texas Assignment of Deed of Trust by Corporate Mortgage Holder, it is crucial to accurately include all the necessary information and adhere to the legal requirements outlined in the state laws. Professional legal advice should be sought to ensure compliance with the applicable regulations and to safeguard the rights and interests of all parties involved.