This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Collin Texas Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out Texas Assignment Of Deed Of Trust By Corporate Mortgage Holder?

Finding authentic templates that comply with your local regulations can be difficult unless you utilize the US Legal Forms database.

This is an online repository of over 85,000 legal documents tailored for personal and professional purposes as well as various real-world situations.

All materials are properly organized by type of use and jurisdiction, making it as simple and straightforward as pie to find the Collin Texas Assignment of Deed of Trust by Corporate Mortgage Holder.

Maintaining documents organized and in accordance with legal requirements is critically important. Take advantage of the US Legal Forms library to always have vital document templates readily available for any needs!

- Ensure to review the Preview mode and document description.

- Verify you have chosen the appropriate one that fulfills your needs and completely aligns with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you detect any discrepancies, use the Search tab above to locate the correct one. If it meets your criteria, proceed to the next stage.

- Select the document.

- Click on the Buy Now button and choose your desired subscription plan. You will need to create an account to gain access to the library’s offerings.

Form popularity

FAQ

In Texas, a deed of trust can be prepared by any qualified individual, including attorneys and legal professionals. However, those unfamiliar with Texas real estate law may benefit from consulting an expert. It is important to create these documents accurately to ensure they effectively secure the interests of the parties involved. If you’re looking for assistance, uslegalforms can provide the necessary templates and guidance for your Collin Texas Assignment of Deed of Trust by Corporate Mortgage Holder.

Yes, you can assign a mortgage to a trust, provided you follow the legal requirements set forth by Texas law. This process involves creating a formal assignment that reflects the transfer of ownership and responsibilities to the trust. Utilizing services like uslegalforms can streamline this process, especially when dealing with a Collin, Texas Assignment of Deed of Trust by Corporate Mortgage Holder, ensuring you remain compliant throughout.

To assign a mortgage to a trust, you need to draft an assignment document that outlines the transfer of mortgage rights to the trust. This document should be signed by the current mortgage holder and must comply with relevant Texas laws. For further assistance, uslegalforms provides resources to facilitate the Collin, Texas Assignment of Deed of Trust by Corporate Mortgage Holder, ensuring all legal requirements are met.

Yes, you can assume a mortgage in a trust, but certain conditions apply. The trust must meet the lender's requirements and regulations, which typically includes reviewing the trust documents and potential credit evaluations. Understanding the stipulations regarding Collin, Texas Assignment of Deed of Trust by Corporate Mortgage Holder will help ensure a smooth assumption process.

To file a deed of trust in Texas, you must prepare the document, ensuring it includes all necessary information. After that, you must sign it before a notary public and then file it with the county clerk's office where the property is located. For those navigating this process, using platforms like uslegalforms can provide the necessary templates and guidance to ensure compliance with local laws, including the nuances of Collin, Texas Assignment of Deed of Trust by Corporate Mortgage Holder.

People often place their mortgage in a trust for several reasons, including estate planning and asset protection. By doing so, they can manage their assets more effectively and avoid probate upon their death. In Collin, Texas, using a trust can also help ensure that the mortgage remains managed according to the creator's wishes, simplifying the process for heirs.

To find a deed of trust in Texas, start by accessing the county clerk's office where the property is located. Many counties offer online search tools, making it easier to locate documents by inputting essential details such as the property owner's name or the property address. In Collin, Texas, using a well-structured platform like US Legal can streamline your search, providing access to official documents that reflect the status of deeds of trust. Don't hesitate to use these tools for quick and reliable results.

The assignment of a deed of trust refers to the transfer of the beneficial interest from one party to another. This process is essential in the context of mortgages, as it can change the holder of the mortgage rights. When dealing with a Collin Texas Assignment of Deed of Trust by Corporate Mortgage Holder, understanding the implications of this transfer helps ensure that all parties are properly informed of their rights and obligations. US Legal provides valuable resources to facilitate clear and effective assignments.

Documents on behalf of a trust are generally signed by the trustee. The trustee has the legal authority to manage trust assets and make decisions as outlined in the trust agreement. In the context of a Collin Texas Assignment of Deed of Trust by Corporate Mortgage Holder, it is crucial for the trustee to execute the documents faithfully to uphold their fiduciary responsibilities. Ensure you have proper documentation by utilizing resources from US Legal.

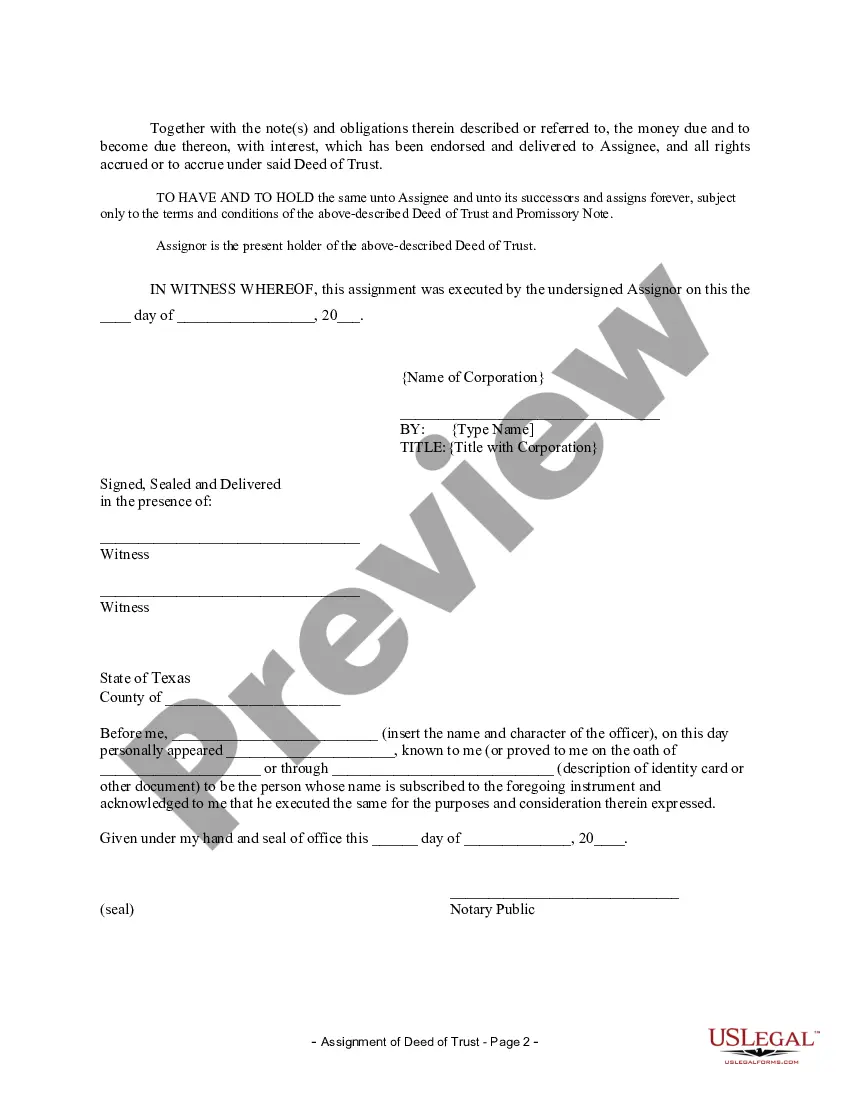

The Assignment of Deed of Trust is typically signed by the mortgage holder or their authorized representative. In the case of a Corporate Mortgage Holder, a designated officer or agent would execute this document on behalf of the entity. This process ensures that the assignment is legally binding and reflects the necessary authority granted under the corporate structure. For accurate handling, consider using the US Legal platform for templates and guidance.