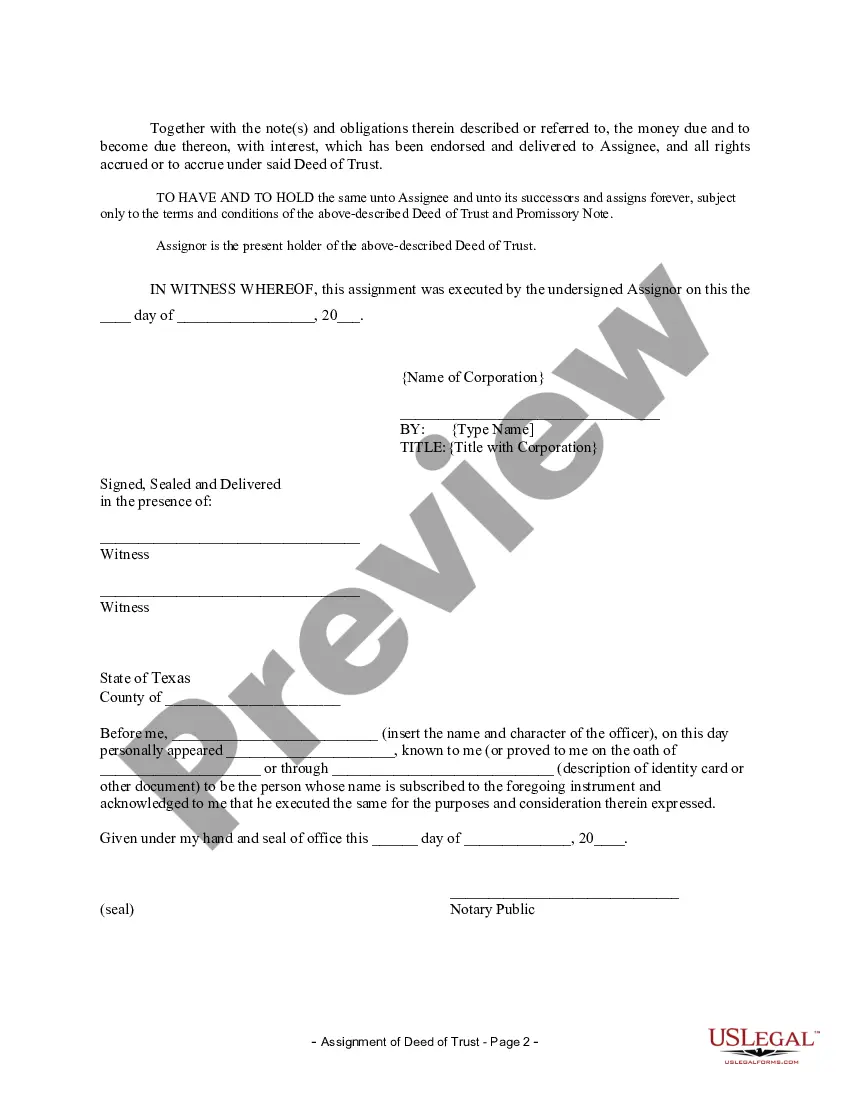

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Description: In Dallas, Texas, the Assignment of Deed of Trust by Corporate Mortgage Holder is an important legal process that involves transferring the rights and interests of a mortgage holder to another corporate entity. This assignment allows the transferee to assume all the rights, benefits, and obligations associated with the original mortgage. The primary purpose of the Dallas Texas Assignment of Deed of Trust by Corporate Mortgage Holder is to facilitate the smooth transfer of ownership and ensure that all parties involved comply with the legal requirements. This assignment typically occurs when the mortgage holder wants to transfer or sell their mortgage to another corporate entity. There are different types of Dallas Texas Assignment of Deed of Trust by Corporate Mortgage Holder, including: 1. Assignment with Full Recourse: This type of assignment involves the transfer of mortgage rights along with full legal responsibility for any default or breach of terms by the new corporate mortgage holder. The original mortgage holder can seek recourse from the new holder in case of any issues. 2. Assignment without Recourse: In this type of assignment, the new corporate mortgage holder assumes ownership of the mortgage without any legal obligation or responsibility for defaults or breaches that occurred before the assignment. The original mortgage holder relinquishes any claims or recourse against the new holder. 3. Partial Assignment: A partial assignment occurs when only a portion of the mortgage is transferred to another corporate mortgage holder. This type of assignment is often used when there is a need for shared ownership or to divide the debt between multiple entities. 4. Assignment of Interest: This type of assignment involves the transfer of the mortgage holder's interest, which may include financial benefits and rights associated with the mortgage, without necessarily transferring the full ownership or responsibilities of the mortgage. It is crucial to follow the specific legal requirements and procedures outlined by the state of Texas and any relevant federal laws when executing a Dallas Texas Assignment of Deed of Trust by Corporate Mortgage Holder. Consulting a qualified attorney or legal professional is highly recommended ensuring compliance and protect the rights and interests of all parties involved. Keywords: Dallas, Texas, Assignment of Deed of Trust, Corporate Mortgage Holder, transfer, ownership, legal process, rights, interests, obligations, transfer of ownership, sell, mortgage, Full Recourse, Without Recourse, Partial Assignment, Assignment of Interest, legal requirements, procedures, compliance, attorney, rights and interests.Description: In Dallas, Texas, the Assignment of Deed of Trust by Corporate Mortgage Holder is an important legal process that involves transferring the rights and interests of a mortgage holder to another corporate entity. This assignment allows the transferee to assume all the rights, benefits, and obligations associated with the original mortgage. The primary purpose of the Dallas Texas Assignment of Deed of Trust by Corporate Mortgage Holder is to facilitate the smooth transfer of ownership and ensure that all parties involved comply with the legal requirements. This assignment typically occurs when the mortgage holder wants to transfer or sell their mortgage to another corporate entity. There are different types of Dallas Texas Assignment of Deed of Trust by Corporate Mortgage Holder, including: 1. Assignment with Full Recourse: This type of assignment involves the transfer of mortgage rights along with full legal responsibility for any default or breach of terms by the new corporate mortgage holder. The original mortgage holder can seek recourse from the new holder in case of any issues. 2. Assignment without Recourse: In this type of assignment, the new corporate mortgage holder assumes ownership of the mortgage without any legal obligation or responsibility for defaults or breaches that occurred before the assignment. The original mortgage holder relinquishes any claims or recourse against the new holder. 3. Partial Assignment: A partial assignment occurs when only a portion of the mortgage is transferred to another corporate mortgage holder. This type of assignment is often used when there is a need for shared ownership or to divide the debt between multiple entities. 4. Assignment of Interest: This type of assignment involves the transfer of the mortgage holder's interest, which may include financial benefits and rights associated with the mortgage, without necessarily transferring the full ownership or responsibilities of the mortgage. It is crucial to follow the specific legal requirements and procedures outlined by the state of Texas and any relevant federal laws when executing a Dallas Texas Assignment of Deed of Trust by Corporate Mortgage Holder. Consulting a qualified attorney or legal professional is highly recommended ensuring compliance and protect the rights and interests of all parties involved. Keywords: Dallas, Texas, Assignment of Deed of Trust, Corporate Mortgage Holder, transfer, ownership, legal process, rights, interests, obligations, transfer of ownership, sell, mortgage, Full Recourse, Without Recourse, Partial Assignment, Assignment of Interest, legal requirements, procedures, compliance, attorney, rights and interests.