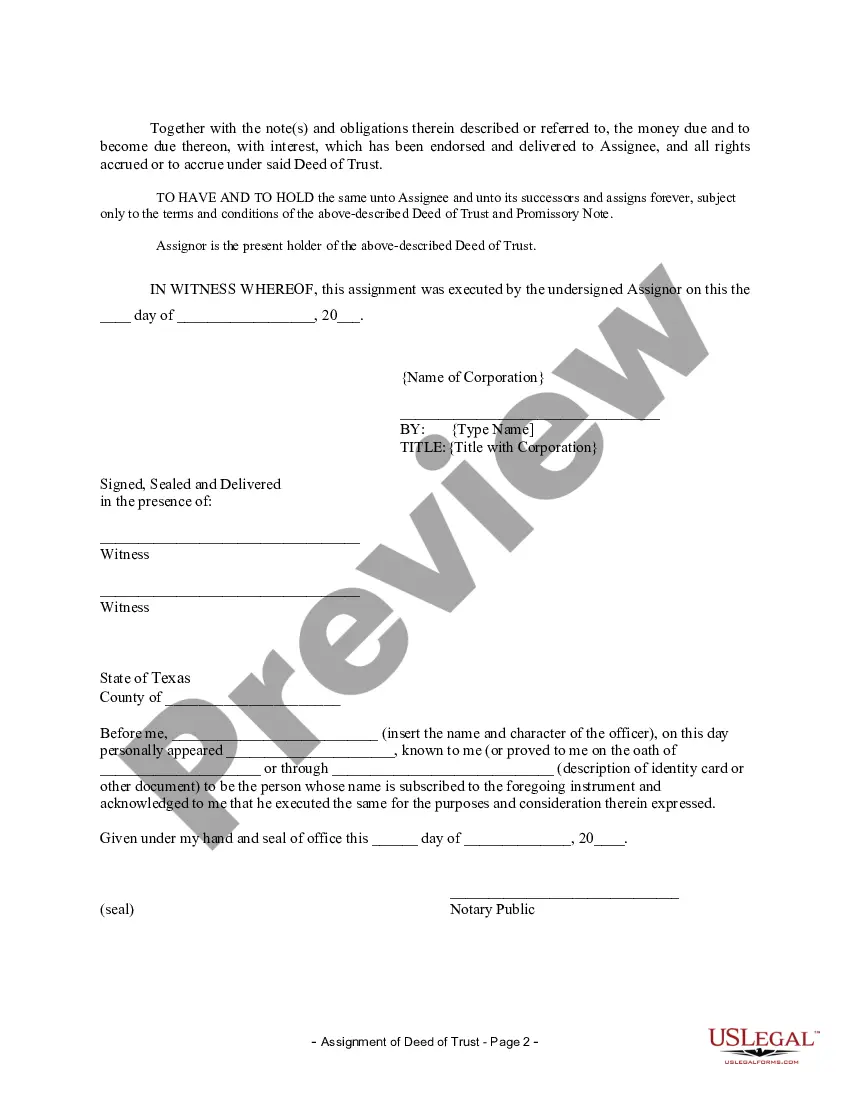

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Title: Understanding the Grand Prairie Texas Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: The Grand Prairie Texas Assignment of Deed of Trust by Corporate Mortgage Holder refers to a legal process involving the transfer of a mortgage from one corporate entity to another in the city of Grand Prairie, Texas. This article will delve into the intricacies of this assignment, highlighting its significance, benefits, and potential types that may exist. Keywords: Grand Prairie Texas, Assignment of Deed of Trust, Corporate Mortgage Holder, legal process, transfer, benefits I. Definition and Importance of Assignment of Deed of Trust: The Assignment of Deed of Trust is a critical step in the real estate process. This legal document allows a corporate mortgage holder to transfer the rights and responsibilities associated with a mortgage loan to another corporate entity. II. Significance of Grand Prairie Texas Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Seamless Mortgage Transfer: By opting for an assignment, the corporate mortgage holder can conveniently transfer the mortgage to another corporate entity, ensuring a smooth transition in the lending process. 2. Risk Mitigation: Assigning a deed of trust reduces the risks associated with a defaulting borrower. In the event of non-payment, the new corporate mortgage holder becomes responsible for the repayment, preventing the need for legal proceedings against the borrower. III. Types of Grand Prairie Texas Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Partial Assignment: In this type, a portion of the mortgage is transferred to another corporate entity, often as a strategic financial move. 2. Full Assignment: A full assignment involves the complete transfer of the mortgage loan from the original corporate mortgage holder to a new entity. This type is more common when the original mortgage lender wants to exit the loan agreement. 3. Collateral Assignment: In this scenario, the corporate mortgage holder assigns the security interest associated with the mortgage, providing collateral to secure another loan or debt. Conclusion: The Grand Prairie Texas Assignment of Deed of Trust by Corporate Mortgage Holder plays a vital role in facilitating the transfer of mortgage loans from one corporate entity to another. It offers several advantages, including risk mitigation and easier loan management. Different types, such as partial, full, and collateral assignments, cater to diverse financial scenarios and objectives. It is essential for both parties involved to have a clear understanding of the assignment process to ensure a smooth and legally compliant transition.Title: Understanding the Grand Prairie Texas Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: The Grand Prairie Texas Assignment of Deed of Trust by Corporate Mortgage Holder refers to a legal process involving the transfer of a mortgage from one corporate entity to another in the city of Grand Prairie, Texas. This article will delve into the intricacies of this assignment, highlighting its significance, benefits, and potential types that may exist. Keywords: Grand Prairie Texas, Assignment of Deed of Trust, Corporate Mortgage Holder, legal process, transfer, benefits I. Definition and Importance of Assignment of Deed of Trust: The Assignment of Deed of Trust is a critical step in the real estate process. This legal document allows a corporate mortgage holder to transfer the rights and responsibilities associated with a mortgage loan to another corporate entity. II. Significance of Grand Prairie Texas Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Seamless Mortgage Transfer: By opting for an assignment, the corporate mortgage holder can conveniently transfer the mortgage to another corporate entity, ensuring a smooth transition in the lending process. 2. Risk Mitigation: Assigning a deed of trust reduces the risks associated with a defaulting borrower. In the event of non-payment, the new corporate mortgage holder becomes responsible for the repayment, preventing the need for legal proceedings against the borrower. III. Types of Grand Prairie Texas Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Partial Assignment: In this type, a portion of the mortgage is transferred to another corporate entity, often as a strategic financial move. 2. Full Assignment: A full assignment involves the complete transfer of the mortgage loan from the original corporate mortgage holder to a new entity. This type is more common when the original mortgage lender wants to exit the loan agreement. 3. Collateral Assignment: In this scenario, the corporate mortgage holder assigns the security interest associated with the mortgage, providing collateral to secure another loan or debt. Conclusion: The Grand Prairie Texas Assignment of Deed of Trust by Corporate Mortgage Holder plays a vital role in facilitating the transfer of mortgage loans from one corporate entity to another. It offers several advantages, including risk mitigation and easier loan management. Different types, such as partial, full, and collateral assignments, cater to diverse financial scenarios and objectives. It is essential for both parties involved to have a clear understanding of the assignment process to ensure a smooth and legally compliant transition.