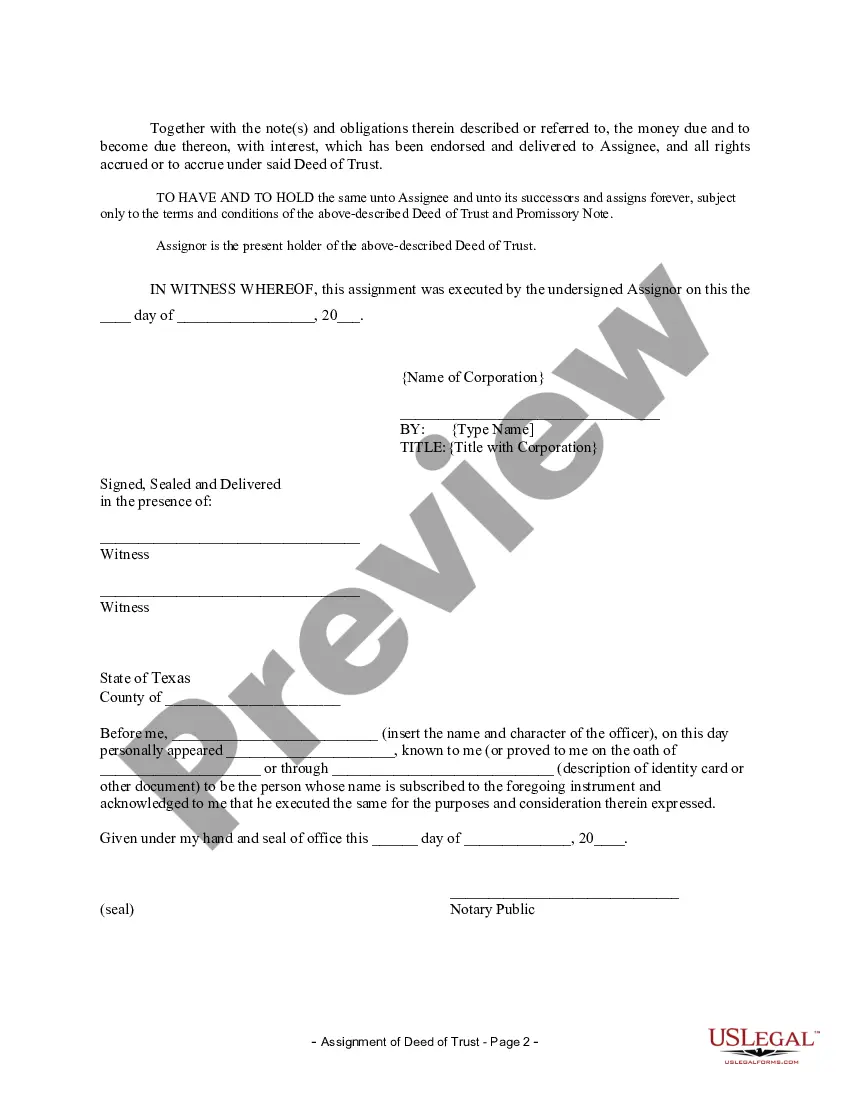

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Irving, Texas Assignment of Deed of Trust by Corporate Mortgage Holder — Comprehensive Guide Introduction: An Irving, Texas Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal process through which a corporate mortgage holder transfers its interests in a deed of trust to another party. This assignment allows the new party to assume the responsibilities and rights associated with the mortgage, including receiving payments, enforcing the terms of the loan, and, if necessary, initiating foreclosure proceedings. This document is vital in real estate transactions involving mortgages, ensuring proper transfer of obligations and securing the rights of all parties involved. Let's explore the details and types of Irving, Texas Assignment of Deed of Trust by Corporate Mortgage Holder. 1. Importance of the Irving, Texas Assignment of Deed of Trust: The Assignment of Deed of Trust is essential for maintaining transparency and clarity in real estate transactions. It outlines the transfer of rights and responsibilities, protecting both the mortgage holder and the borrower. Without this assignment, the new party may not have legal standing to enforce the terms of the loan, collect payments, or pursue foreclosure if necessary. 2. Key Elements of an Assignment of Deed of Trust: a. Parties Involved: A typical Irving, Texas Assignment of Deed of Trust involves three key parties: the original mortgage holder (assignor), the new party (assignee), and the borrower. Mentioning these parties is crucial to establish their roles and responsibilities throughout the assignment process. b. Property Information: The assignment document must specify the details of the property involved, including its legal description, address, and any relevant identification numbers. This ensures clarity and accuracy, reducing the risk of confusion or misinterpretation. c. Mortgage Details: The assignment should include critical mortgage information such as the original loan amount, interest rate, repayment terms, and any specific conditions or clauses. These details serve as a reference for the new mortgage holder to effectively administer and enforce the loan. d. Consideration: Consideration refers to any compensation, financial or otherwise, exchanged between the assignor and the assignee. Clearly stating the consideration, such as a purchase price or a value that represents the assignment's transactional nature, is vital for legal validity. e. Signatures and Notarization: All parties involved must sign the Irving, Texas Assignment of Deed of Trust to validate their agreement. Notarization ensures authenticity and helps prevent potential disputes in the future. 3. Types of Irving, Texas Assignment of Deed of Trust: a. Full Assignment: A full assignment involves the complete transfer of the mortgage holder's rights and interests to the assignee. This type of assignment allows the assignee to assume all responsibilities related to the original mortgage. b. Partial Assignment: A partial assignment occurs when the mortgage holder transfers only a portion of their interests to another party. This type of assignment can be useful when one party wishes to share the risk or benefits associated with the mortgage. c. Assignment with Assumption: An assignment with assumption takes place when the assignee not only assumes the rights and responsibilities of the original mortgage holder but also agrees to be personally liable for the mortgage. Conclusion: Understanding the intricacies of Irving, Texas Assignment of Deed of Trust by Corporate Mortgage Holder is crucial to ensure a smooth and legally binding transfer of mortgage rights. Whether it's a full, partial, or assignment with assumption, this process plays a vital role in real estate transactions, providing security for mortgage holders and borrowers alike. Seeking legal guidance during the assignment process is highly recommended ensuring compliance with all applicable laws and regulations.Irving, Texas Assignment of Deed of Trust by Corporate Mortgage Holder — Comprehensive Guide Introduction: An Irving, Texas Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal process through which a corporate mortgage holder transfers its interests in a deed of trust to another party. This assignment allows the new party to assume the responsibilities and rights associated with the mortgage, including receiving payments, enforcing the terms of the loan, and, if necessary, initiating foreclosure proceedings. This document is vital in real estate transactions involving mortgages, ensuring proper transfer of obligations and securing the rights of all parties involved. Let's explore the details and types of Irving, Texas Assignment of Deed of Trust by Corporate Mortgage Holder. 1. Importance of the Irving, Texas Assignment of Deed of Trust: The Assignment of Deed of Trust is essential for maintaining transparency and clarity in real estate transactions. It outlines the transfer of rights and responsibilities, protecting both the mortgage holder and the borrower. Without this assignment, the new party may not have legal standing to enforce the terms of the loan, collect payments, or pursue foreclosure if necessary. 2. Key Elements of an Assignment of Deed of Trust: a. Parties Involved: A typical Irving, Texas Assignment of Deed of Trust involves three key parties: the original mortgage holder (assignor), the new party (assignee), and the borrower. Mentioning these parties is crucial to establish their roles and responsibilities throughout the assignment process. b. Property Information: The assignment document must specify the details of the property involved, including its legal description, address, and any relevant identification numbers. This ensures clarity and accuracy, reducing the risk of confusion or misinterpretation. c. Mortgage Details: The assignment should include critical mortgage information such as the original loan amount, interest rate, repayment terms, and any specific conditions or clauses. These details serve as a reference for the new mortgage holder to effectively administer and enforce the loan. d. Consideration: Consideration refers to any compensation, financial or otherwise, exchanged between the assignor and the assignee. Clearly stating the consideration, such as a purchase price or a value that represents the assignment's transactional nature, is vital for legal validity. e. Signatures and Notarization: All parties involved must sign the Irving, Texas Assignment of Deed of Trust to validate their agreement. Notarization ensures authenticity and helps prevent potential disputes in the future. 3. Types of Irving, Texas Assignment of Deed of Trust: a. Full Assignment: A full assignment involves the complete transfer of the mortgage holder's rights and interests to the assignee. This type of assignment allows the assignee to assume all responsibilities related to the original mortgage. b. Partial Assignment: A partial assignment occurs when the mortgage holder transfers only a portion of their interests to another party. This type of assignment can be useful when one party wishes to share the risk or benefits associated with the mortgage. c. Assignment with Assumption: An assignment with assumption takes place when the assignee not only assumes the rights and responsibilities of the original mortgage holder but also agrees to be personally liable for the mortgage. Conclusion: Understanding the intricacies of Irving, Texas Assignment of Deed of Trust by Corporate Mortgage Holder is crucial to ensure a smooth and legally binding transfer of mortgage rights. Whether it's a full, partial, or assignment with assumption, this process plays a vital role in real estate transactions, providing security for mortgage holders and borrowers alike. Seeking legal guidance during the assignment process is highly recommended ensuring compliance with all applicable laws and regulations.