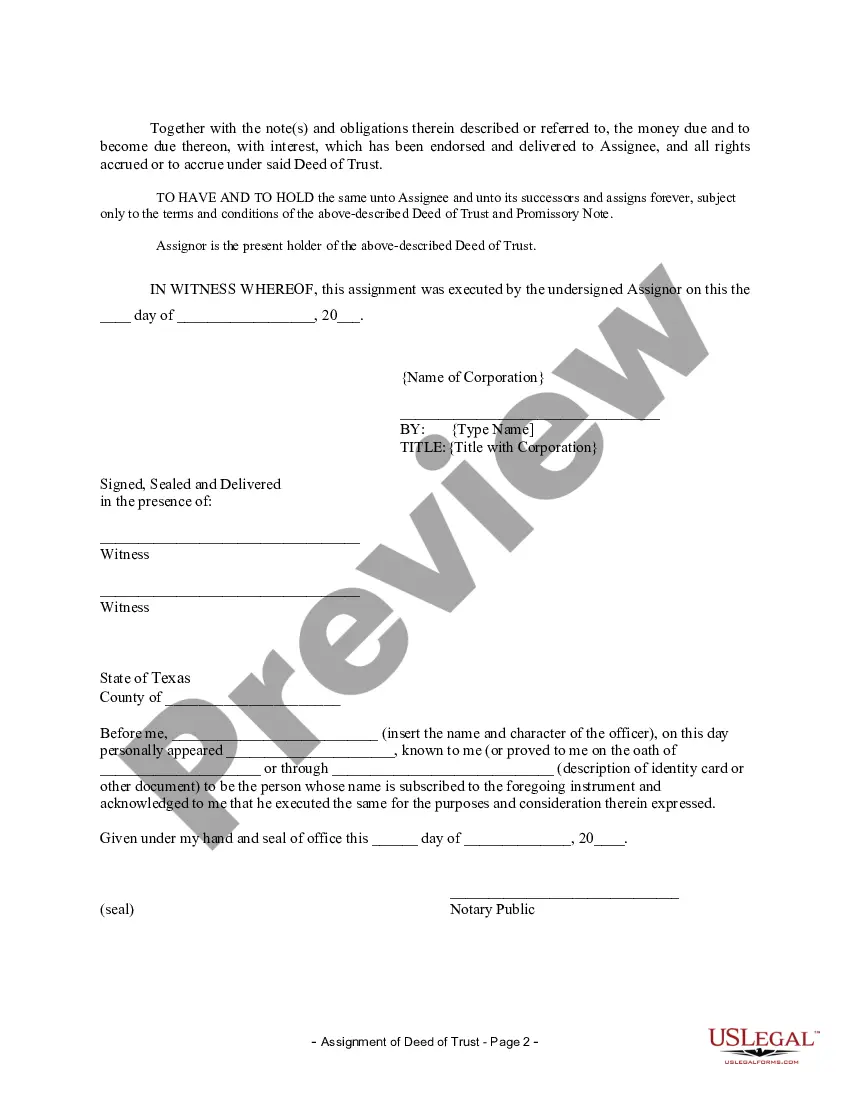

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

McAllen Texas Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out Texas Assignment Of Deed Of Trust By Corporate Mortgage Holder?

Utilize the US Legal Forms to gain instant access to any form example you need.

Our advantageous platform featuring a vast array of templates streamlines the process of locating and acquiring nearly any document example you seek.

You can save, complete, and validate the McAllen Texas Assignment of Deed of Trust by Corporate Mortgage Holder in mere minutes rather than spending hours online searching for a suitable template.

Using our collection is an excellent method to enhance the security of your document submissions.

If you do not have an account yet, follow the instructions provided below.

Access the page containing the template you need. Ensure it is the template you are searching for by reviewing its title and description, and utilize the Preview option if available. Otherwise, use the Search field to locate the correct one.

- Our knowledgeable attorneys frequently examine all documents to ensure that the forms are applicable to a specific area and adhere to current laws and regulations.

- How can you obtain the McAllen Texas Assignment of Deed of Trust by Corporate Mortgage Holder.

- If you already possess an account, simply Log In to your profile.

- The Download button will become available on all the documents you review.

- Additionally, you can access all your previously saved documents through the My documents section.

Form popularity

FAQ

A corporation Assignment of deed of trust mortgage occurs when a corporate entity holds the mortgage and subsequently assigns it to another party. This process can involve complex considerations, especially concerning corporate governance and authority. Understanding these dynamics is crucial for both borrowers and lenders. In McAllen Texas, the Assignment of Deed of Trust by Corporate Mortgage Holder offers clarity and efficiency in navigating these assignments.

The assignment of a mortgage deed of trust involves transferring the rights and obligations from the original lender to a new lender or party. This transfer allows the new entity to manage the mortgage and collect payments. It is an essential component of real estate finance, ensuring continuity in lending practices. In McAllen Texas, the process of Assignment of Deed of Trust by Corporate Mortgage Holder plays a key role in these transactions.

An assignment of a mortgage means that the original lender transfers their rights and obligations under the mortgage to another lender. This process allows the new lender to collect payments and enforce terms of the mortgage. It's a common practice in real estate transactions. In McAllen Texas, the Assignment of Deed of Trust by Corporate Mortgage Holder streamlines this transition for borrowers and lenders alike.

Lenders often prefer a deed of trust because it provides a quicker way to foreclose on a property if the borrower defaults. The process is generally streamlined, which reduces the time and costs associated with foreclosure. This efficiency can lead to less risk for the lender. In McAllen Texas, understanding the Assignment of Deed of Trust by Corporate Mortgage Holder helps clarify these benefits.

Typically, the lender or mortgage holder files the deed of trust, as they hold a financial interest in the property. In some cases, borrowers may also initiate the filing process to ensure their rights are protected. Understanding who files can clarify responsibilities within the McAllen Texas Assignment of Deed of Trust by Corporate Mortgage Holder.

Corporate Assignment of deed of trust refers to the transfer of a deed of trust from one corporate entity to another. This process allows a corporate mortgage holder to assign its beneficial interest in the property, which is essential in financing agreements. Understanding this concept is crucial for anyone navigating the McAllen Texas Assignment of Deed of Trust by Corporate Mortgage Holder.

The corporate Assignment of Deed of Trust refers to a legal process where a corporation transfers its rights and interests in a deed of trust to another party. This process is common in McAllen, Texas, especially among corporate mortgage holders who wish to assign their rights for financial management or restructuring purposes. Understanding this process helps you navigate real estate transactions with confidence. For precise assistance, consider using US Legal Forms, which offers tailored solutions for handling an Assignment of Deed of Trust by Corporate Mortgage Holder.

Yes, you can transfer a deed without an attorney, but it's essential to understand the legal requirements to avoid errors. Utilizing a dependable service like US Legal Forms can help you create the necessary documents correctly and efficiently. This is particularly important for your McAllen Texas Assignment of Deed of Trust by Corporate Mortgage Holder, as proper legal documentation protects your interests.

In Texas, a deed of trust can be prepared by an attorney, a title company, or by the parties involved if they are familiar with the necessary legal requirements. However, to ensure proper adherence to all state laws and avoid mistakes, consider using a resource like US Legal Forms. This can provide you with guidance for your McAllen Texas Assignment of Deed of Trust by Corporate Mortgage Holder.

A deed of assignment typically refers to the transfer of rights under a contract, while a deed of transfer involves the actual transfer of property ownership. Each document serves its purpose in real estate transactions, including a McAllen Texas Assignment of Deed of Trust by Corporate Mortgage Holder. Understanding these differences helps ensure that you are using the correct document to meet your real estate needs.