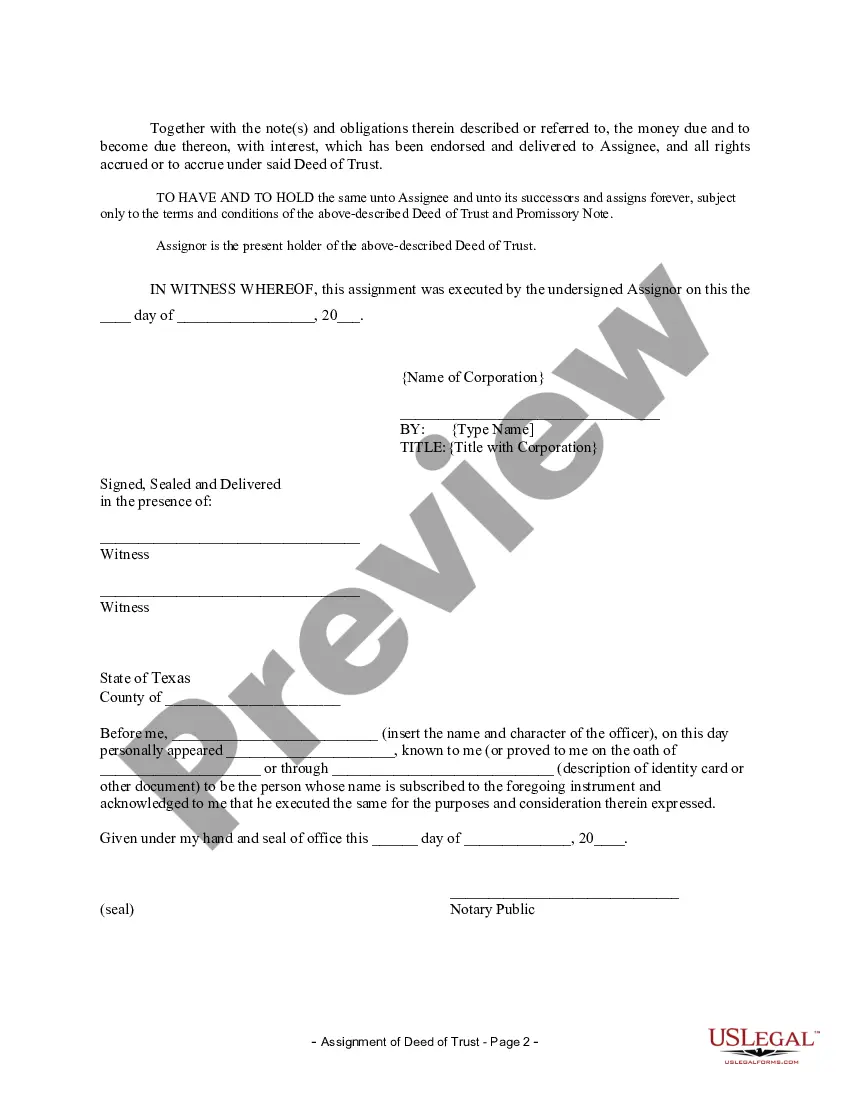

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

A Round Rock Texas Assignment of Deed of Trust by Corporate Mortgage Holder refers to the transfer of a property's mortgage from one corporate mortgage holder to another. This legal document allows the assignor (current mortgage holder) to transfer all rights, interests, and responsibilities associated with the original mortgage to the assignee (new corporate mortgage holder). In Round Rock, Texas, there are various types of Assignment of Deed of Trust by Corporate Mortgage Holder, including: 1. Standard Assignment of Deed of Trust: This type of assignment occurs when the mortgage holder decides to sell or transfer the mortgage to another corporate entity. It involves the complete transfer of all rights and obligations outlined in the original deed of trust. 2. Substitution of Trustee: This specific type of assignment involves replacing the trustee named in the original deed of trust. The assignor appoints a new corporate mortgage holder to act as the trustee, thereby transferring the responsibilities associated with managing the trust. 3. Partial Assignment of Deed of Trust: Sometimes, a corporate mortgage holder may choose to transfer only a portion of their interest in the mortgage to another entity. This partial assignment allows the assignee to assume a share of the rights and obligations associated with the original deed. 4. Assignment of Deed of Trust in Default: In cases where the mortgage has been defaulted upon, the corporate mortgage holder may assign the deed of trust to a different entity. This assignment is often a step taken to facilitate the foreclosure process. Round Rock, Texas Assignment of Deed of Trust by Corporate Mortgage Holder is a crucial legal procedure ensuring transparency and clarity in the transfer of mortgage rights. It safeguards the rights of both assignor and assignee and ensures that the mortgage is handled compliantly and within the legal framework. Prior to any assignment, it is imperative to seek legal guidance to ensure the validity and legality of the process.A Round Rock Texas Assignment of Deed of Trust by Corporate Mortgage Holder refers to the transfer of a property's mortgage from one corporate mortgage holder to another. This legal document allows the assignor (current mortgage holder) to transfer all rights, interests, and responsibilities associated with the original mortgage to the assignee (new corporate mortgage holder). In Round Rock, Texas, there are various types of Assignment of Deed of Trust by Corporate Mortgage Holder, including: 1. Standard Assignment of Deed of Trust: This type of assignment occurs when the mortgage holder decides to sell or transfer the mortgage to another corporate entity. It involves the complete transfer of all rights and obligations outlined in the original deed of trust. 2. Substitution of Trustee: This specific type of assignment involves replacing the trustee named in the original deed of trust. The assignor appoints a new corporate mortgage holder to act as the trustee, thereby transferring the responsibilities associated with managing the trust. 3. Partial Assignment of Deed of Trust: Sometimes, a corporate mortgage holder may choose to transfer only a portion of their interest in the mortgage to another entity. This partial assignment allows the assignee to assume a share of the rights and obligations associated with the original deed. 4. Assignment of Deed of Trust in Default: In cases where the mortgage has been defaulted upon, the corporate mortgage holder may assign the deed of trust to a different entity. This assignment is often a step taken to facilitate the foreclosure process. Round Rock, Texas Assignment of Deed of Trust by Corporate Mortgage Holder is a crucial legal procedure ensuring transparency and clarity in the transfer of mortgage rights. It safeguards the rights of both assignor and assignee and ensures that the mortgage is handled compliantly and within the legal framework. Prior to any assignment, it is imperative to seek legal guidance to ensure the validity and legality of the process.