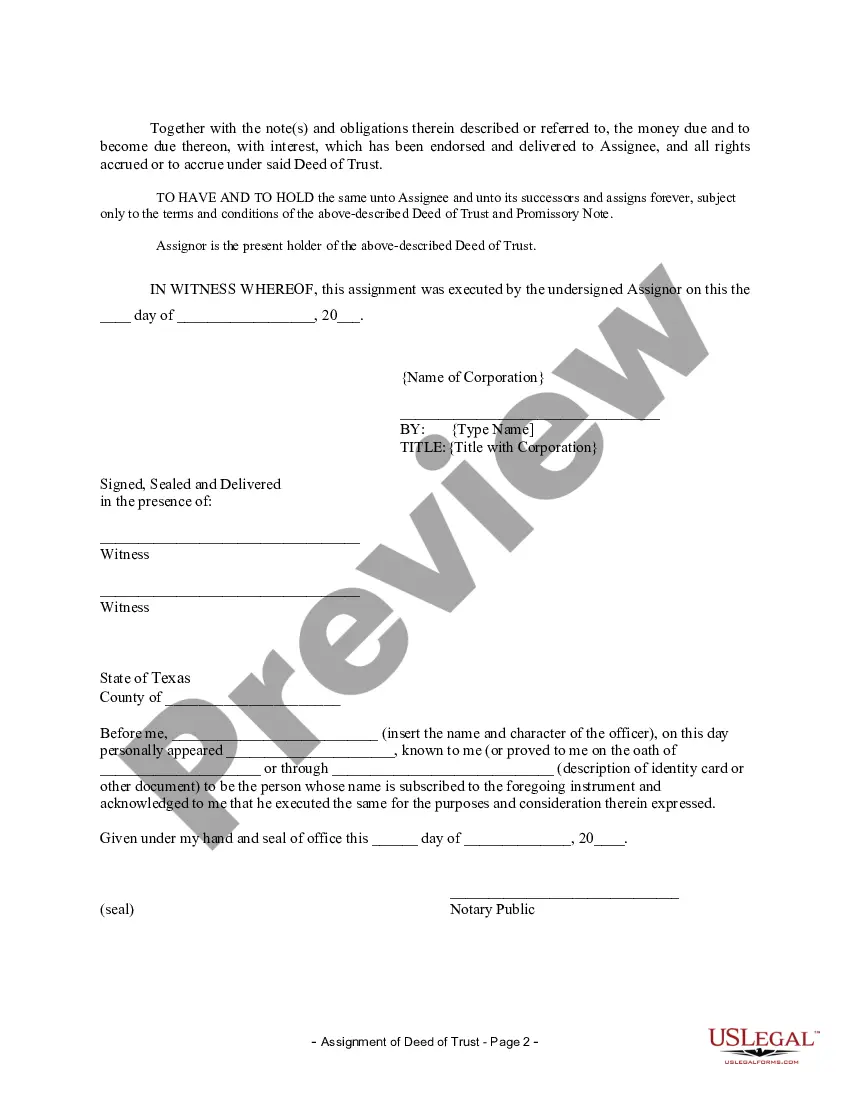

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Title: San Angelo Texas Assignment of Deed of Trust by Corporate Mortgage Holder: Explained Introduction: In San Angelo, Texas, an Assignment of Deed of Trust by Corporate Mortgage Holder refers to the transfer of a mortgage loan from a corporate mortgage holder to another entity or individual. This legal procedure allows for the conveyance of rights and obligations tied to the original Deed of Trust to a new party. The assignment process is essential when the corporate mortgage holder wishes to transfer the mortgage or modify the loan terms. Types of San Angelo Texas Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Standard Assignment: This type of assignment occurs when a corporate mortgage holder transfers the mortgage loan to another entity or individual, typically through a written agreement. The assignee takes over the rights and responsibilities, including the collection of payments, foreclosure proceedings, and modification of loan terms. 2. Partial Assignment: In this scenario, a corporate mortgage holder transfers only a portion of their interest in the Deed of Trust to another entity or individual. It could involve assigning a percentage of the debt, interest, or rights associated with the mortgage to the assignee. 3. Multiple Assignments: It is possible for a corporate mortgage holder to assign the Deed of Trust to multiple parties simultaneously. Such assignments can occur when the mortgage debt is syndicated or shared among different investors or lenders. 4. Collateral Assignment: Sometimes, a corporate mortgage holder assigns the Deed of Trust as collateral to secure another debt or obligation. This form of assignment grants a lien on the property to the assignee until the assigned debt is repaid or the obligation is fulfilled. 5. Assignments with Assumption: In certain cases, a corporate mortgage holder assigns the Deed of Trust while simultaneously allowing a new party to assume the mortgage. This arrangement transfers both the rights and obligations associated with the mortgage loan to the assignee, who becomes responsible for future payments and any foreclosure proceedings if necessary. Keywords: — San AngelTextxa— - Assignment of Deed of Trust — Corporate MortgagHoldde— - Mortgage Loan Transfer — Loan Modificatio— - Written Agreement - Rights and Responsibilities — Collection of Payment— - Foreclosure Proceedings — Partial Assignmen— - Multiple Assignments — Collateral Assignmen— - Syndicated Mortgage Debt — CollateralizeObligationio— - Assignments with Assumption Conclusion: Understanding the various types of San Angelo Texas Assignment of Deed of Trust by Corporate Mortgage Holder is crucial for both investors and borrowers. Whether it involves the complete transfer of the mortgage loan or partial assignments, these legal processes facilitate the smooth transition of rights and obligations associated with a corporate mortgage. As with any legal matter, seeking professional advice and guidance is recommended for a seamless assignment process.Title: San Angelo Texas Assignment of Deed of Trust by Corporate Mortgage Holder: Explained Introduction: In San Angelo, Texas, an Assignment of Deed of Trust by Corporate Mortgage Holder refers to the transfer of a mortgage loan from a corporate mortgage holder to another entity or individual. This legal procedure allows for the conveyance of rights and obligations tied to the original Deed of Trust to a new party. The assignment process is essential when the corporate mortgage holder wishes to transfer the mortgage or modify the loan terms. Types of San Angelo Texas Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Standard Assignment: This type of assignment occurs when a corporate mortgage holder transfers the mortgage loan to another entity or individual, typically through a written agreement. The assignee takes over the rights and responsibilities, including the collection of payments, foreclosure proceedings, and modification of loan terms. 2. Partial Assignment: In this scenario, a corporate mortgage holder transfers only a portion of their interest in the Deed of Trust to another entity or individual. It could involve assigning a percentage of the debt, interest, or rights associated with the mortgage to the assignee. 3. Multiple Assignments: It is possible for a corporate mortgage holder to assign the Deed of Trust to multiple parties simultaneously. Such assignments can occur when the mortgage debt is syndicated or shared among different investors or lenders. 4. Collateral Assignment: Sometimes, a corporate mortgage holder assigns the Deed of Trust as collateral to secure another debt or obligation. This form of assignment grants a lien on the property to the assignee until the assigned debt is repaid or the obligation is fulfilled. 5. Assignments with Assumption: In certain cases, a corporate mortgage holder assigns the Deed of Trust while simultaneously allowing a new party to assume the mortgage. This arrangement transfers both the rights and obligations associated with the mortgage loan to the assignee, who becomes responsible for future payments and any foreclosure proceedings if necessary. Keywords: — San AngelTextxa— - Assignment of Deed of Trust — Corporate MortgagHoldde— - Mortgage Loan Transfer — Loan Modificatio— - Written Agreement - Rights and Responsibilities — Collection of Payment— - Foreclosure Proceedings — Partial Assignmen— - Multiple Assignments — Collateral Assignmen— - Syndicated Mortgage Debt — CollateralizeObligationio— - Assignments with Assumption Conclusion: Understanding the various types of San Angelo Texas Assignment of Deed of Trust by Corporate Mortgage Holder is crucial for both investors and borrowers. Whether it involves the complete transfer of the mortgage loan or partial assignments, these legal processes facilitate the smooth transition of rights and obligations associated with a corporate mortgage. As with any legal matter, seeking professional advice and guidance is recommended for a seamless assignment process.