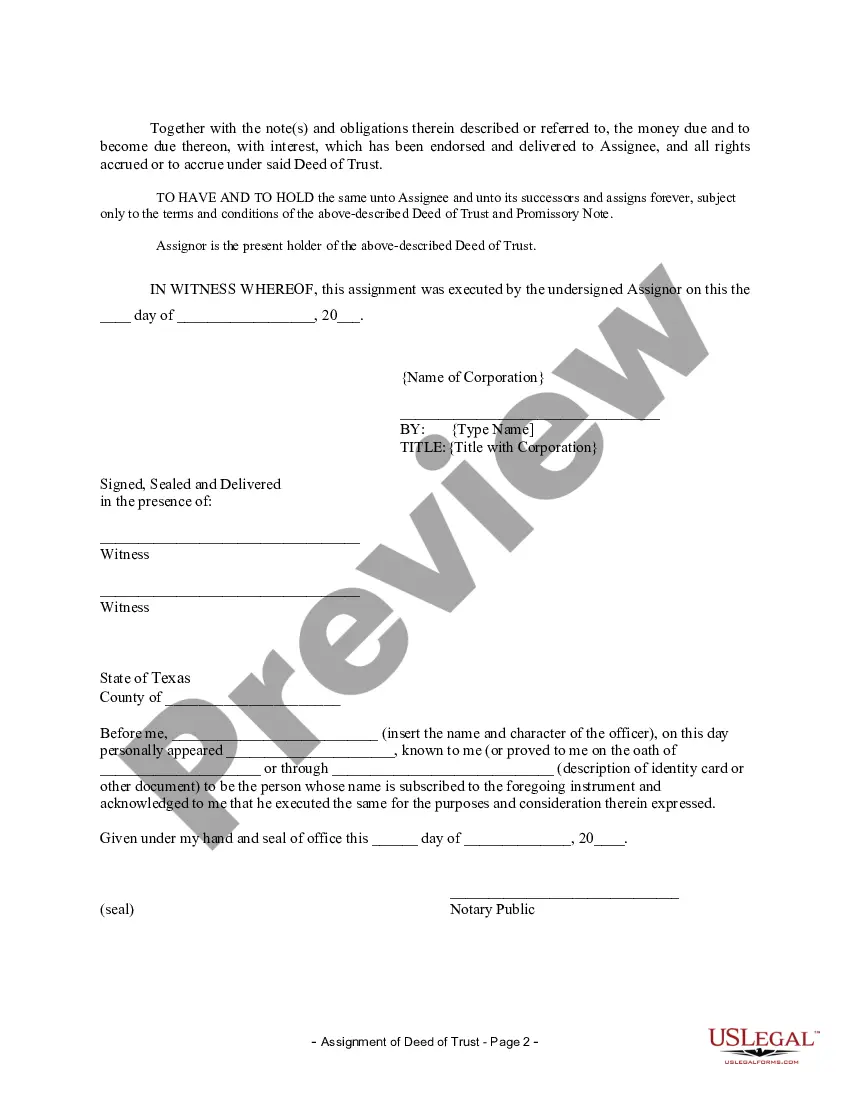

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Title: Understanding the Sugar Land Texas Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: The Sugar Land Texas Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process that involves the transfer of a mortgage from one entity to another within the city of Sugar Land, Texas. This article aims to provide a comprehensive overview of this assignment, its purpose, and the potential types involved. 1. Definition and Purpose of Deed of Trust: A Deed of Trust is a document that serves as security for a loan, ensuring that the lender has the right to foreclose and recover their investment should the borrower default. It involves three parties: the borrower (trust or), the lender (beneficiary), and the Trustee who holds the property title until the loan is paid off. 2. Understanding the Assignment of Deed of Trust: Assignment of Deed of Trust refers to the process by which the lender transfers or assigns their rights and interests in the mortgage to another party. This can occur when the lender wishes to sell the loan or when the mortgage is transferred to a different financial institution. 3. Types of Sugar Land Texas Assignment of Deed of Trust by Corporate Mortgage Holder: a. Assignment to Another Lender: When a corporate mortgage holder decides to transfer the ownership of a mortgage loan to another financial institution, they execute an Assignment of Deed of Trust. This enables the new lender to assume the rights and obligations associated with the original loan. b. Assignment to a Special Purpose Vehicle (SPV): In certain cases, corporate mortgage holders may assign the loan to a Special Purpose Vehicle (SPV). An SPV is an entity created solely for a specific purpose, often to hold multiple mortgages and manage the underlying assets on behalf of investors. 4. Key Steps Involved in the Assignment Process: a. Preparation of Assignment Document: The corporate mortgage holder or their legal representative prepares the Assignment of Deed of Trust document. It outlines the details of the transfer, including the names of the involved parties, property information, loan details, and any conditions or stipulations. b. Notarization and Recording: The document is then notarized to verify its authenticity and signed by all necessary parties. It must then be recorded in the county where the property is located to provide public notice of the assignment. c. Notification to Borrower: Once the assignment is recorded, the borrower is notified of the transfer. This ensures they are aware of the change in ownership of the loan and any adjustments to payment instructions or mortgage payment collection. Conclusion: The Sugar Land Texas Assignment of Deed of Trust by Corporate Mortgage Holder is a crucial mechanism for transferring mortgage loans between corporate entities or lenders. Whether it involves the sale of a loan to a new lender or the transfer to a Special Purpose Vehicle, this assignment process helps ensure the continuity of loan servicing and mortgage security.Title: Understanding the Sugar Land Texas Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: The Sugar Land Texas Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process that involves the transfer of a mortgage from one entity to another within the city of Sugar Land, Texas. This article aims to provide a comprehensive overview of this assignment, its purpose, and the potential types involved. 1. Definition and Purpose of Deed of Trust: A Deed of Trust is a document that serves as security for a loan, ensuring that the lender has the right to foreclose and recover their investment should the borrower default. It involves three parties: the borrower (trust or), the lender (beneficiary), and the Trustee who holds the property title until the loan is paid off. 2. Understanding the Assignment of Deed of Trust: Assignment of Deed of Trust refers to the process by which the lender transfers or assigns their rights and interests in the mortgage to another party. This can occur when the lender wishes to sell the loan or when the mortgage is transferred to a different financial institution. 3. Types of Sugar Land Texas Assignment of Deed of Trust by Corporate Mortgage Holder: a. Assignment to Another Lender: When a corporate mortgage holder decides to transfer the ownership of a mortgage loan to another financial institution, they execute an Assignment of Deed of Trust. This enables the new lender to assume the rights and obligations associated with the original loan. b. Assignment to a Special Purpose Vehicle (SPV): In certain cases, corporate mortgage holders may assign the loan to a Special Purpose Vehicle (SPV). An SPV is an entity created solely for a specific purpose, often to hold multiple mortgages and manage the underlying assets on behalf of investors. 4. Key Steps Involved in the Assignment Process: a. Preparation of Assignment Document: The corporate mortgage holder or their legal representative prepares the Assignment of Deed of Trust document. It outlines the details of the transfer, including the names of the involved parties, property information, loan details, and any conditions or stipulations. b. Notarization and Recording: The document is then notarized to verify its authenticity and signed by all necessary parties. It must then be recorded in the county where the property is located to provide public notice of the assignment. c. Notification to Borrower: Once the assignment is recorded, the borrower is notified of the transfer. This ensures they are aware of the change in ownership of the loan and any adjustments to payment instructions or mortgage payment collection. Conclusion: The Sugar Land Texas Assignment of Deed of Trust by Corporate Mortgage Holder is a crucial mechanism for transferring mortgage loans between corporate entities or lenders. Whether it involves the sale of a loan to a new lender or the transfer to a Special Purpose Vehicle, this assignment process helps ensure the continuity of loan servicing and mortgage security.