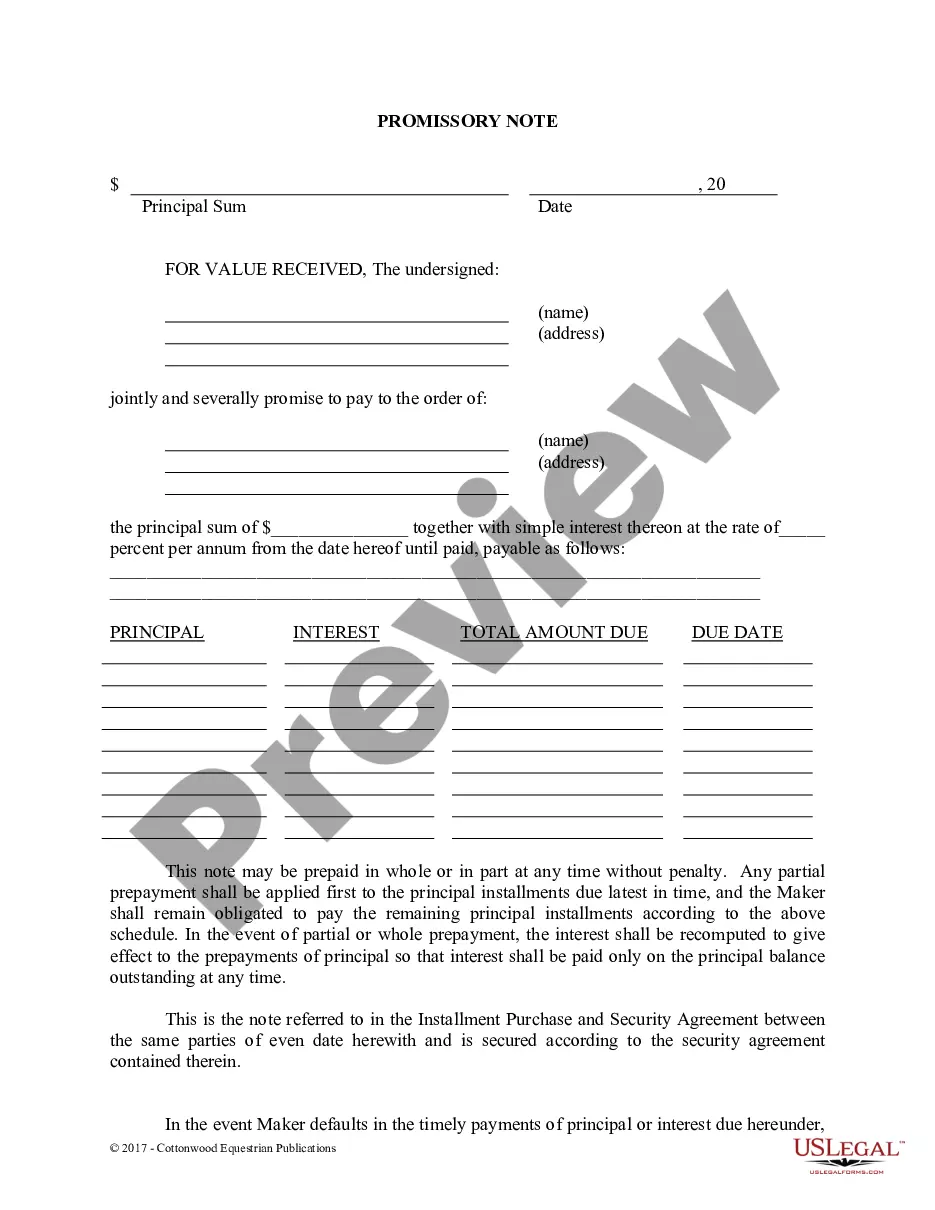

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

A Fort Worth Texas Promissory Note — Horse Equine Form is a legal document that represents a promise to repay a debt related to horse and equine-related transactions within the Fort Worth, Texas area. This note serves as a written agreement between two parties, the borrower and the lender, outlining the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any other applicable terms and conditions. Fort Worth Texas Promissory Note — Horse Equine Forms are designed to specifically cater to the unique requirements and intricacies involved in horse and equine transactions within the region. These forms take into account local laws and regulations, ensuring both parties involved are protected throughout the process. There might be different types of Fort Worth Texas Promissory Note — Horse Equine Forms, tailored to specific situations or preferences. Some common variations may include: 1. Simple Promissory Note: This type of promissory note is straightforward and covers the essential terms of the loan, such as the principal amount, interest rate, and repayment schedule. 2. Secured Promissory Note: This form includes additional provisions that grant the lender a security interest in a specific horse or equine-related asset. This allows the lender to possess and sell the specified asset to recover the outstanding debt in the event of non-payment. 3. Installment Promissory Note: This note structures the repayment of the loan in regular installments over a predetermined period. Each installment consists of both principal and interest portions. 4. Balloon Promissory Note: With this type of note, the borrower makes small periodic payments over the loan term, but a large final payment (the "balloon payment") is due at the end. This allows for lower regular payments while ensuring the full repayment of the loan by the maturity date. 5. Demand Promissory Note: This type of note provides the lender with the flexibility to demand full repayment of the loan at any time, without specifying a specific maturity date. This is commonly used for short-term or variable loans. By utilizing a Fort Worth Texas Promissory Note — Horse Equine Form, both borrowers and lenders can establish clear expectations and protect their interests when engaging in horse and equine-related financial transactions within the Fort Worth, Texas area. It is crucial to consult with legal professionals to ensure the accurate completion of the form and compliance with local laws and regulations.A Fort Worth Texas Promissory Note — Horse Equine Form is a legal document that represents a promise to repay a debt related to horse and equine-related transactions within the Fort Worth, Texas area. This note serves as a written agreement between two parties, the borrower and the lender, outlining the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any other applicable terms and conditions. Fort Worth Texas Promissory Note — Horse Equine Forms are designed to specifically cater to the unique requirements and intricacies involved in horse and equine transactions within the region. These forms take into account local laws and regulations, ensuring both parties involved are protected throughout the process. There might be different types of Fort Worth Texas Promissory Note — Horse Equine Forms, tailored to specific situations or preferences. Some common variations may include: 1. Simple Promissory Note: This type of promissory note is straightforward and covers the essential terms of the loan, such as the principal amount, interest rate, and repayment schedule. 2. Secured Promissory Note: This form includes additional provisions that grant the lender a security interest in a specific horse or equine-related asset. This allows the lender to possess and sell the specified asset to recover the outstanding debt in the event of non-payment. 3. Installment Promissory Note: This note structures the repayment of the loan in regular installments over a predetermined period. Each installment consists of both principal and interest portions. 4. Balloon Promissory Note: With this type of note, the borrower makes small periodic payments over the loan term, but a large final payment (the "balloon payment") is due at the end. This allows for lower regular payments while ensuring the full repayment of the loan by the maturity date. 5. Demand Promissory Note: This type of note provides the lender with the flexibility to demand full repayment of the loan at any time, without specifying a specific maturity date. This is commonly used for short-term or variable loans. By utilizing a Fort Worth Texas Promissory Note — Horse Equine Form, both borrowers and lenders can establish clear expectations and protect their interests when engaging in horse and equine-related financial transactions within the Fort Worth, Texas area. It is crucial to consult with legal professionals to ensure the accurate completion of the form and compliance with local laws and regulations.