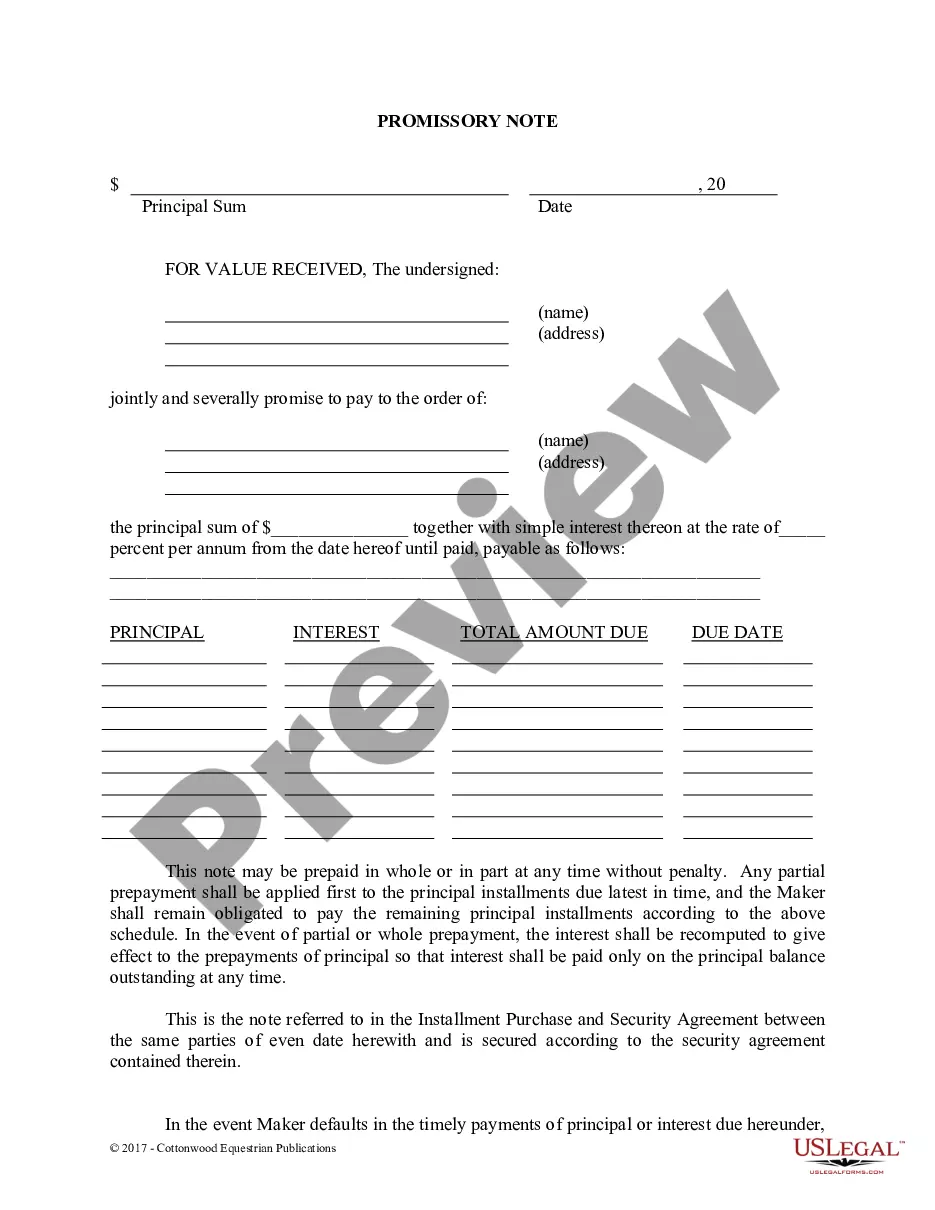

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

A McKinney Texas Promissory Note — Horse Equine Form is a legally binding document used in McKinney, Texas, to establish a written agreement between two parties involved in a horse transaction. This promissory note outlines the terms and conditions under which a borrower agrees to repay a loan taken for purchasing, leasing, or financing a horse. It serves as a secure and organized tool for documenting the financial agreement to avoid any future disputes or misunderstandings. The McKinney Texas Promissory Note — Horse Equine Form typically contains the following key elements: 1. Parties Involved: The promissory note identifies both the lender and the borrower, stating their full legal names, addresses, and contact information. It ensures clarity and ease of communication between the parties. 2. Loan Details: This section provides comprehensive information about the loan, including the principal amount borrowed, interest rate (if applicable), repayment schedule, and other relevant terms. It ensures that both parties are aware of the financial obligations. 3. Horse Description: The promissory note includes a detailed description of the horse being financed or leased. This includes the horse's name, age, breed, color, identification marks, registration details, and any significant medical history. Such information is crucial for the lender to understand the horse's value and ensures transparency regarding the transaction. 4. Security Agreement: In some cases, the promissory note may incorporate a security agreement. This means that the horse serves as collateral to secure the loan. The terms and conditions related to this agreement are included in this section, providing legal protection for the lender. Different types of McKinney Texas Promissory Note — Horse Equine Forms include: 1. Purchase Promissory Note: This type of promissory note is used when a borrower requires financing for purchasing a horse. It contains detailed information about the purchase price, down payment, interest rate, and repayment terms. 2. Lease Promissory Note: A lease promissory note is utilized when a borrower wishes to lease a horse and requires financial assistance. It specifies the lease amount, monthly payments, and lease duration. 3. Show or Competition Promissory Note: This specific form of promissory note is used for financing a horse's participation in shows, competitions, or events. It outlines the financial aspects, such as entry fees, training costs, and additional expenses incurred during the event. In summary, a McKinney Texas Promissory Note — Horse Equine Form is an essential document that safeguards the interests of both lenders and borrowers involved in horse-related transactions. By clearly outlining the loan details and horse information, it ensures a smooth and transparent agreement. Whether it is for purchasing, leasing, or financing show participation, using a proper promissory note guarantees legal protection and clarity in the transaction process.A McKinney Texas Promissory Note — Horse Equine Form is a legally binding document used in McKinney, Texas, to establish a written agreement between two parties involved in a horse transaction. This promissory note outlines the terms and conditions under which a borrower agrees to repay a loan taken for purchasing, leasing, or financing a horse. It serves as a secure and organized tool for documenting the financial agreement to avoid any future disputes or misunderstandings. The McKinney Texas Promissory Note — Horse Equine Form typically contains the following key elements: 1. Parties Involved: The promissory note identifies both the lender and the borrower, stating their full legal names, addresses, and contact information. It ensures clarity and ease of communication between the parties. 2. Loan Details: This section provides comprehensive information about the loan, including the principal amount borrowed, interest rate (if applicable), repayment schedule, and other relevant terms. It ensures that both parties are aware of the financial obligations. 3. Horse Description: The promissory note includes a detailed description of the horse being financed or leased. This includes the horse's name, age, breed, color, identification marks, registration details, and any significant medical history. Such information is crucial for the lender to understand the horse's value and ensures transparency regarding the transaction. 4. Security Agreement: In some cases, the promissory note may incorporate a security agreement. This means that the horse serves as collateral to secure the loan. The terms and conditions related to this agreement are included in this section, providing legal protection for the lender. Different types of McKinney Texas Promissory Note — Horse Equine Forms include: 1. Purchase Promissory Note: This type of promissory note is used when a borrower requires financing for purchasing a horse. It contains detailed information about the purchase price, down payment, interest rate, and repayment terms. 2. Lease Promissory Note: A lease promissory note is utilized when a borrower wishes to lease a horse and requires financial assistance. It specifies the lease amount, monthly payments, and lease duration. 3. Show or Competition Promissory Note: This specific form of promissory note is used for financing a horse's participation in shows, competitions, or events. It outlines the financial aspects, such as entry fees, training costs, and additional expenses incurred during the event. In summary, a McKinney Texas Promissory Note — Horse Equine Form is an essential document that safeguards the interests of both lenders and borrowers involved in horse-related transactions. By clearly outlining the loan details and horse information, it ensures a smooth and transparent agreement. Whether it is for purchasing, leasing, or financing show participation, using a proper promissory note guarantees legal protection and clarity in the transaction process.