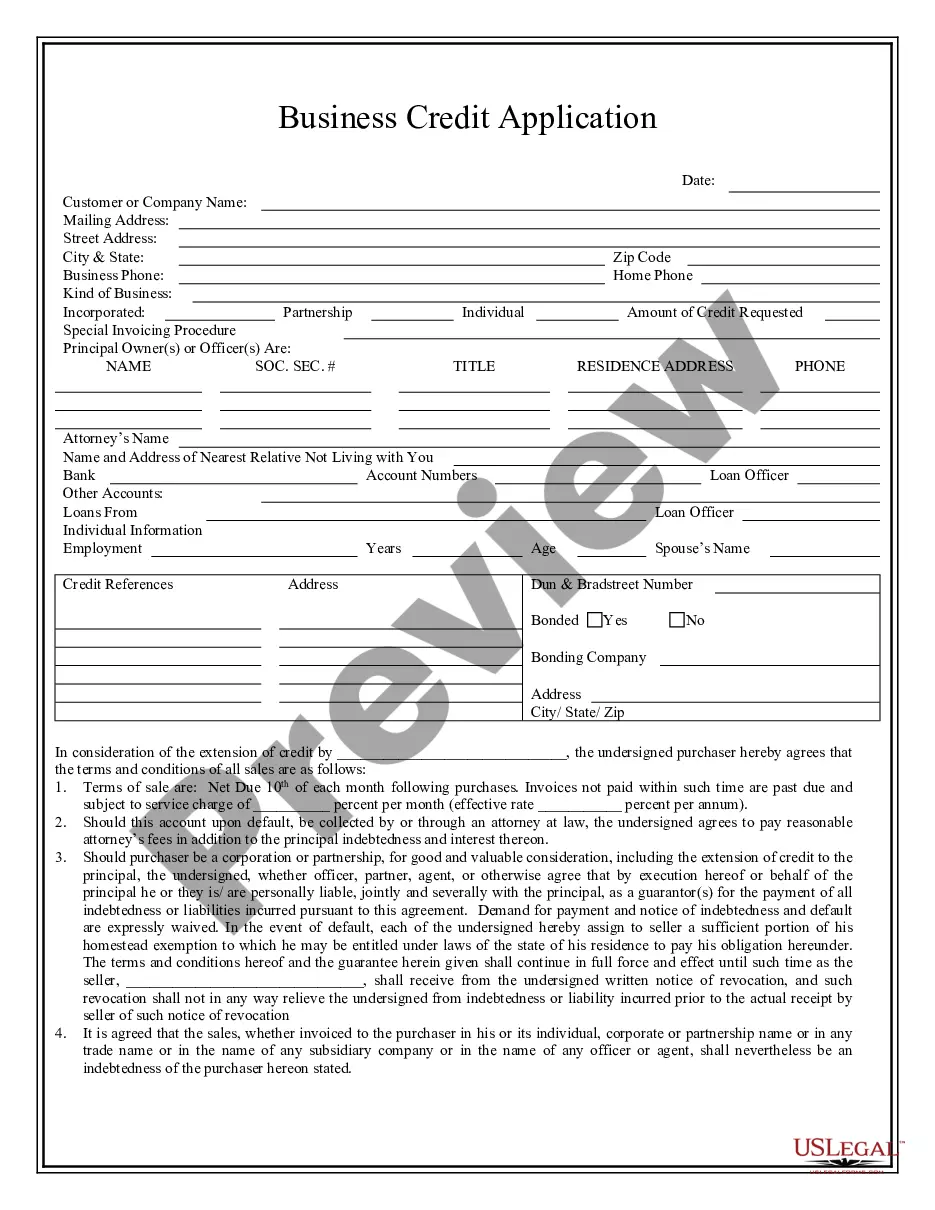

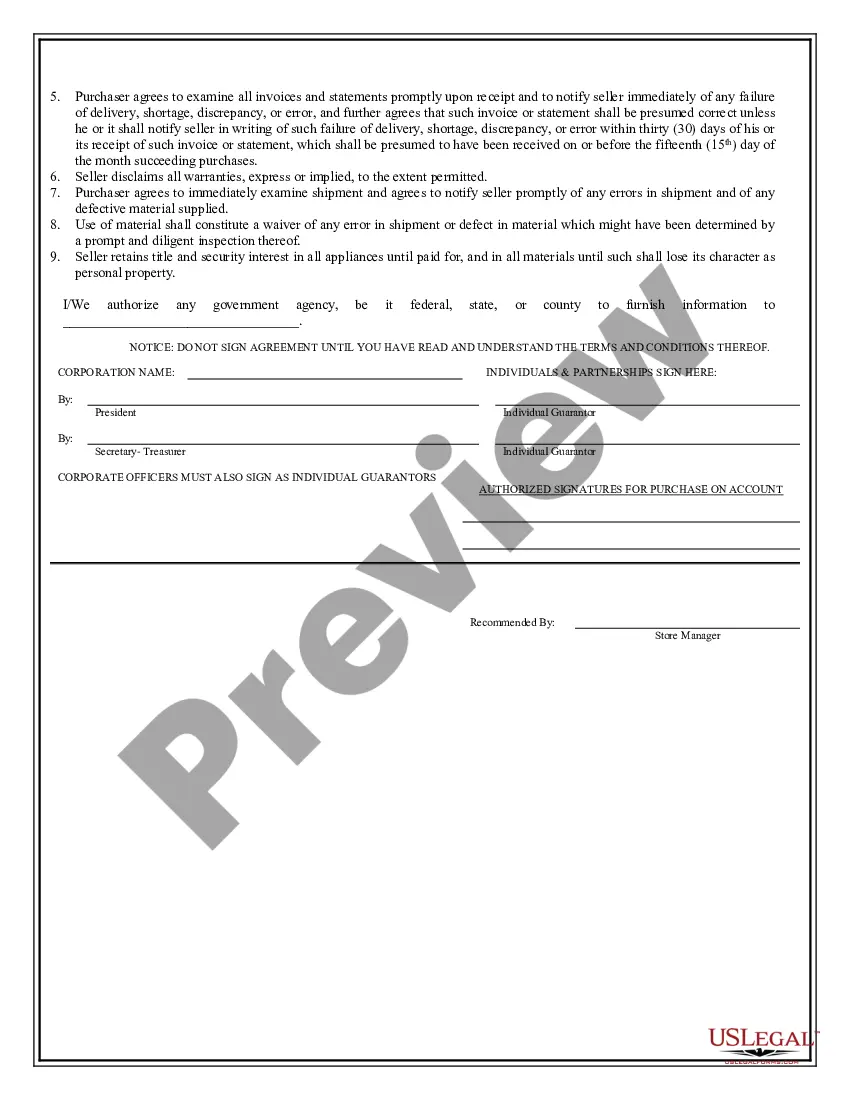

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Beaumont Texas Business Credit Application is a structured form used by businesses in Beaumont, Texas, to apply for credit or financing options with various financial institutions or lenders. This application is designed to gather essential information about the business, its financial stability, and creditworthiness to determine if it qualifies for a business loan or credit line. Keywords: Beaumont Texas, business, credit application, financing options, financial institutions, lenders, creditworthiness, business loan, credit line. Types of Beaumont Texas Business Credit Application: 1. Traditional Business Credit Application: This type of credit application includes essential details such as the business's name, address, contact information, legal structure, years in operation, and ownership information. Additionally, it requires financial statements, such as balance sheets, profit and loss statements, and cash flow statements. 2. Small Business Administration (SBA) Loan Application: Small businesses in Beaumont, Texas, may opt for an SBA loan to secure financing. The SBA loan application form is slightly different from a traditional credit application and requests specific information about the business, its ownership details, management background, collateral, and credit history. 3. Line of Credit Application: Some businesses in Beaumont, Texas, may require a revolving line of credit rather than a lump sum loan. These businesses can complete a line of credit application, which focuses on establishing credit limits, terms, and conditions for ongoing borrowing needs. This type of application may include details about the business's average monthly expenses, anticipated credit requirements, and a financial overview to assess the creditworthiness. 4. Vendor Credit Application: Businesses often require credit from their suppliers or vendors to maintain smooth operations. A vendor credit application includes information about the business, its tax identification number, banking information, trade references, and credit references. Vendors may use this application to assess the business's creditworthiness and set credit terms for future purchases. Overall, a Beaumont Texas Business Credit Application is crucial for businesses seeking credit options in Beaumont, Texas. It allows lenders and financial institutions to evaluate the business's financial health, credit history, and repayment capabilities before extending a loan or credit line. By providing accurate and comprehensive information on the application, businesses can increase their chances of securing the desired financing they need to grow and thrive in the Beaumont, Texas area.Beaumont Texas Business Credit Application is a structured form used by businesses in Beaumont, Texas, to apply for credit or financing options with various financial institutions or lenders. This application is designed to gather essential information about the business, its financial stability, and creditworthiness to determine if it qualifies for a business loan or credit line. Keywords: Beaumont Texas, business, credit application, financing options, financial institutions, lenders, creditworthiness, business loan, credit line. Types of Beaumont Texas Business Credit Application: 1. Traditional Business Credit Application: This type of credit application includes essential details such as the business's name, address, contact information, legal structure, years in operation, and ownership information. Additionally, it requires financial statements, such as balance sheets, profit and loss statements, and cash flow statements. 2. Small Business Administration (SBA) Loan Application: Small businesses in Beaumont, Texas, may opt for an SBA loan to secure financing. The SBA loan application form is slightly different from a traditional credit application and requests specific information about the business, its ownership details, management background, collateral, and credit history. 3. Line of Credit Application: Some businesses in Beaumont, Texas, may require a revolving line of credit rather than a lump sum loan. These businesses can complete a line of credit application, which focuses on establishing credit limits, terms, and conditions for ongoing borrowing needs. This type of application may include details about the business's average monthly expenses, anticipated credit requirements, and a financial overview to assess the creditworthiness. 4. Vendor Credit Application: Businesses often require credit from their suppliers or vendors to maintain smooth operations. A vendor credit application includes information about the business, its tax identification number, banking information, trade references, and credit references. Vendors may use this application to assess the business's creditworthiness and set credit terms for future purchases. Overall, a Beaumont Texas Business Credit Application is crucial for businesses seeking credit options in Beaumont, Texas. It allows lenders and financial institutions to evaluate the business's financial health, credit history, and repayment capabilities before extending a loan or credit line. By providing accurate and comprehensive information on the application, businesses can increase their chances of securing the desired financing they need to grow and thrive in the Beaumont, Texas area.