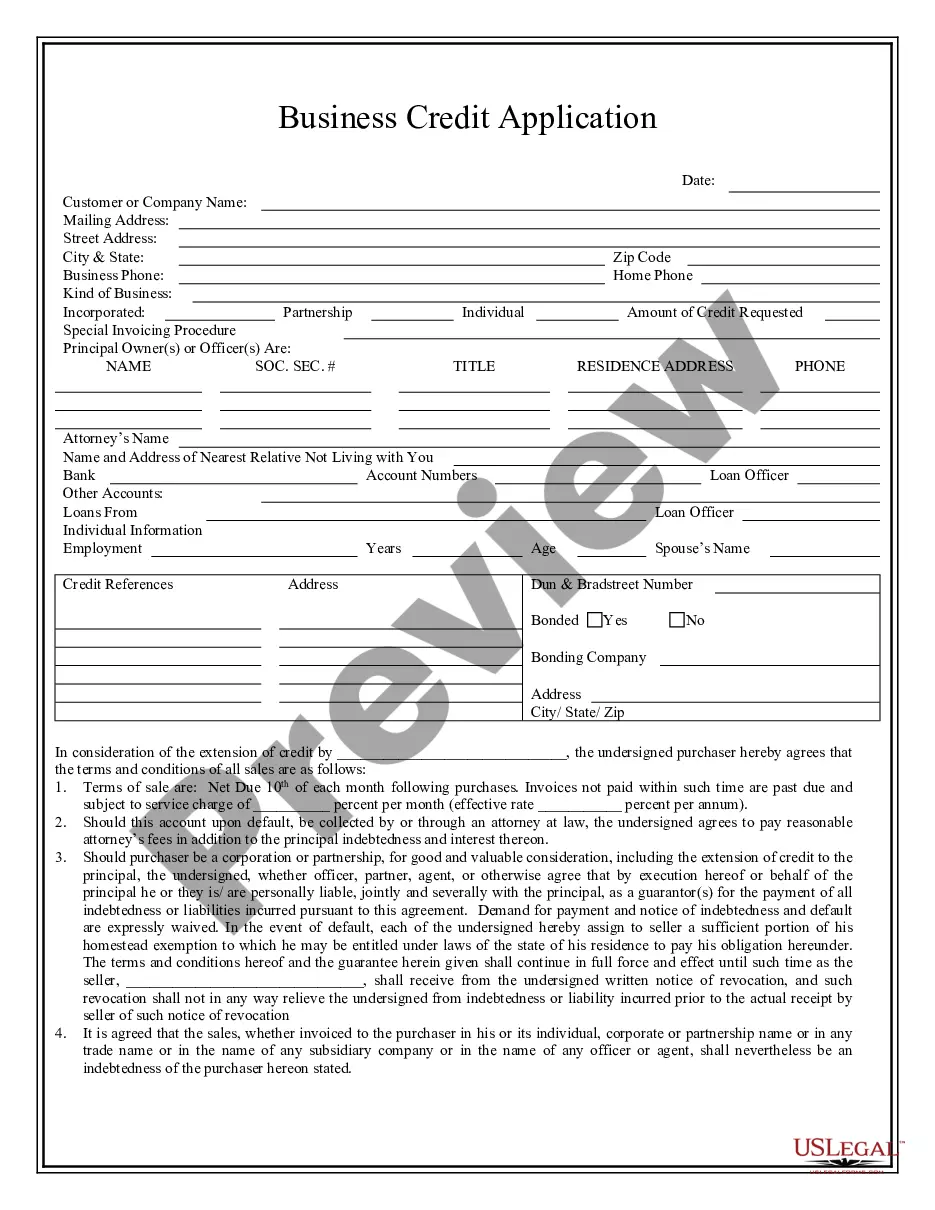

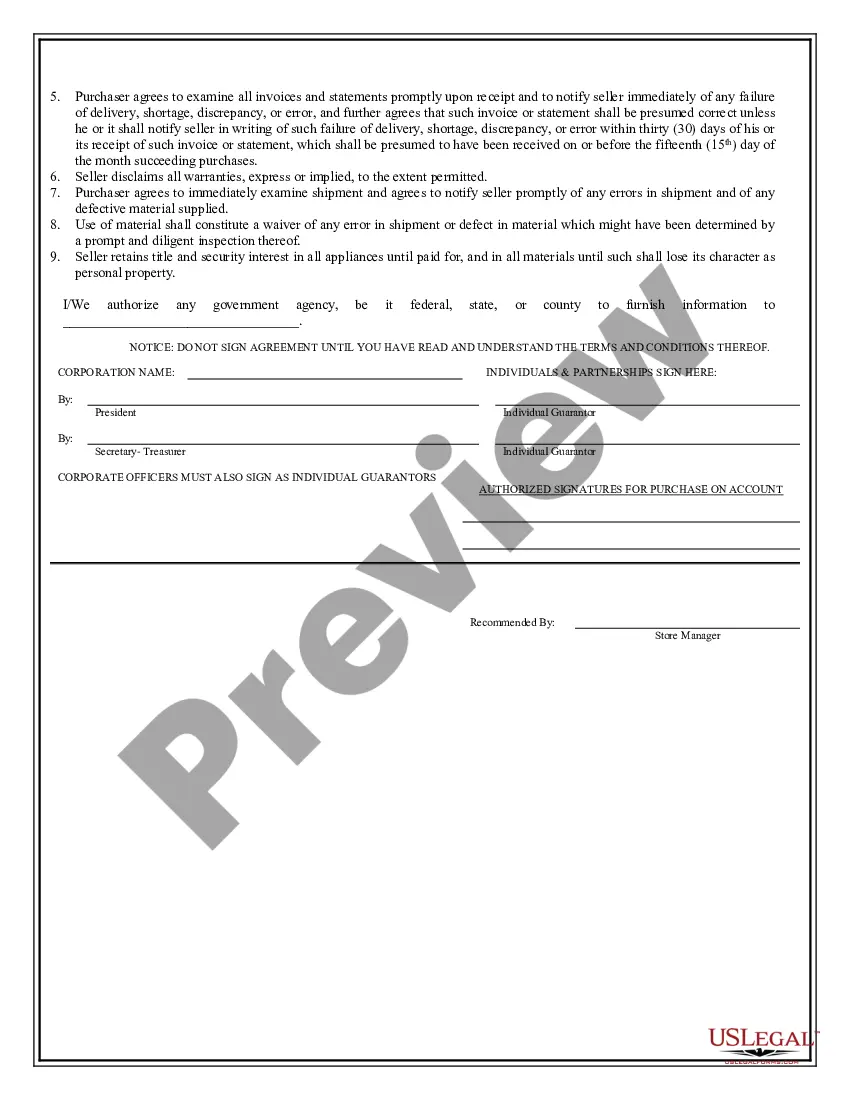

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Title: Brownsville Texas Business Credit Application: Simplify Your Financing Process! Introduction: In the bustling business hub of Brownsville, Texas, businesses understand the importance of secure and efficient financing solutions. To cater to the diverse needs of local enterprises, several types of Brownsville Texas Business Credit Applications are offered. In this article, we will delve into the details of these applications, providing a comprehensive understanding of their features and benefits. 1. Traditional Brownsville Texas Business Credit Application: The traditional business credit application caters to established enterprises seeking reliable funding options. This application serves as an essential tool for businesses to provide comprehensive information about their financial background, including financial statements, balance sheets, tax returns, and other relevant documents. This application type might require a personal guarantee or collateral submission, which ensures lenders' security. 2. Small Business Brownsville Texas Business Credit Application: Specifically designed for small businesses, this credit application seeks to streamline the financing process for local enterprises. Understanding the varying requirements and limited resources of small businesses, this application often demands less extensive documentation but emphasizes factors like monthly revenue, cash flow, and business credit score. It offers an opportunity for startups or newer businesses to access affordable credit options to foster growth and expansion. 3. Brownsville Texas Business Credit Application for Women and Minority-owned Businesses: Recognizing the significance of inclusion and diversity in the Brownsville business landscape, specialized credit applications are available for women and minority-owned businesses. These applications focus on promoting equal access to financing and aim to foster business growth among underrepresented communities. They may involve additional criteria, such as certification of minority or women-owned business status. 4. Brownsville Texas Business Credit Application for Commercial Real Estate: Tailored to businesses involved in the commercial real estate sector, this application assists in procuring financing for property acquisition, construction, or renovations. Lenders evaluating such applications often consider factors such as location, property value, potential rental income, and the borrower's real estate investment experience. 5. Government-Supported Brownsville Texas Business Credit Application: In collaboration with local or state government agencies and organizations, certain credit applications offer government-backed support programs. These programs facilitate access to more affordable credit options, support business growth, enhance job creation, and foster economic development in Brownsville, Texas. Depending on the program, eligibility criteria and required documentation may vary. Conclusion: Brownsville, Texas businesses searching for convenient and flexible financing options can benefit greatly from exploring the diverse array of Brownsville Texas Business Credit Applications available. Whether it's a traditional application for established businesses, support for small or minority-owned enterprises, commercial real estate financing, or government-supported programs, each application type offers unique advantages to suit businesses' varying needs. By understanding these options and preparing the necessary documentation, local businesses can enhance their chances of securing the credit needed to fuel their growth and success.Title: Brownsville Texas Business Credit Application: Simplify Your Financing Process! Introduction: In the bustling business hub of Brownsville, Texas, businesses understand the importance of secure and efficient financing solutions. To cater to the diverse needs of local enterprises, several types of Brownsville Texas Business Credit Applications are offered. In this article, we will delve into the details of these applications, providing a comprehensive understanding of their features and benefits. 1. Traditional Brownsville Texas Business Credit Application: The traditional business credit application caters to established enterprises seeking reliable funding options. This application serves as an essential tool for businesses to provide comprehensive information about their financial background, including financial statements, balance sheets, tax returns, and other relevant documents. This application type might require a personal guarantee or collateral submission, which ensures lenders' security. 2. Small Business Brownsville Texas Business Credit Application: Specifically designed for small businesses, this credit application seeks to streamline the financing process for local enterprises. Understanding the varying requirements and limited resources of small businesses, this application often demands less extensive documentation but emphasizes factors like monthly revenue, cash flow, and business credit score. It offers an opportunity for startups or newer businesses to access affordable credit options to foster growth and expansion. 3. Brownsville Texas Business Credit Application for Women and Minority-owned Businesses: Recognizing the significance of inclusion and diversity in the Brownsville business landscape, specialized credit applications are available for women and minority-owned businesses. These applications focus on promoting equal access to financing and aim to foster business growth among underrepresented communities. They may involve additional criteria, such as certification of minority or women-owned business status. 4. Brownsville Texas Business Credit Application for Commercial Real Estate: Tailored to businesses involved in the commercial real estate sector, this application assists in procuring financing for property acquisition, construction, or renovations. Lenders evaluating such applications often consider factors such as location, property value, potential rental income, and the borrower's real estate investment experience. 5. Government-Supported Brownsville Texas Business Credit Application: In collaboration with local or state government agencies and organizations, certain credit applications offer government-backed support programs. These programs facilitate access to more affordable credit options, support business growth, enhance job creation, and foster economic development in Brownsville, Texas. Depending on the program, eligibility criteria and required documentation may vary. Conclusion: Brownsville, Texas businesses searching for convenient and flexible financing options can benefit greatly from exploring the diverse array of Brownsville Texas Business Credit Applications available. Whether it's a traditional application for established businesses, support for small or minority-owned enterprises, commercial real estate financing, or government-supported programs, each application type offers unique advantages to suit businesses' varying needs. By understanding these options and preparing the necessary documentation, local businesses can enhance their chances of securing the credit needed to fuel their growth and success.