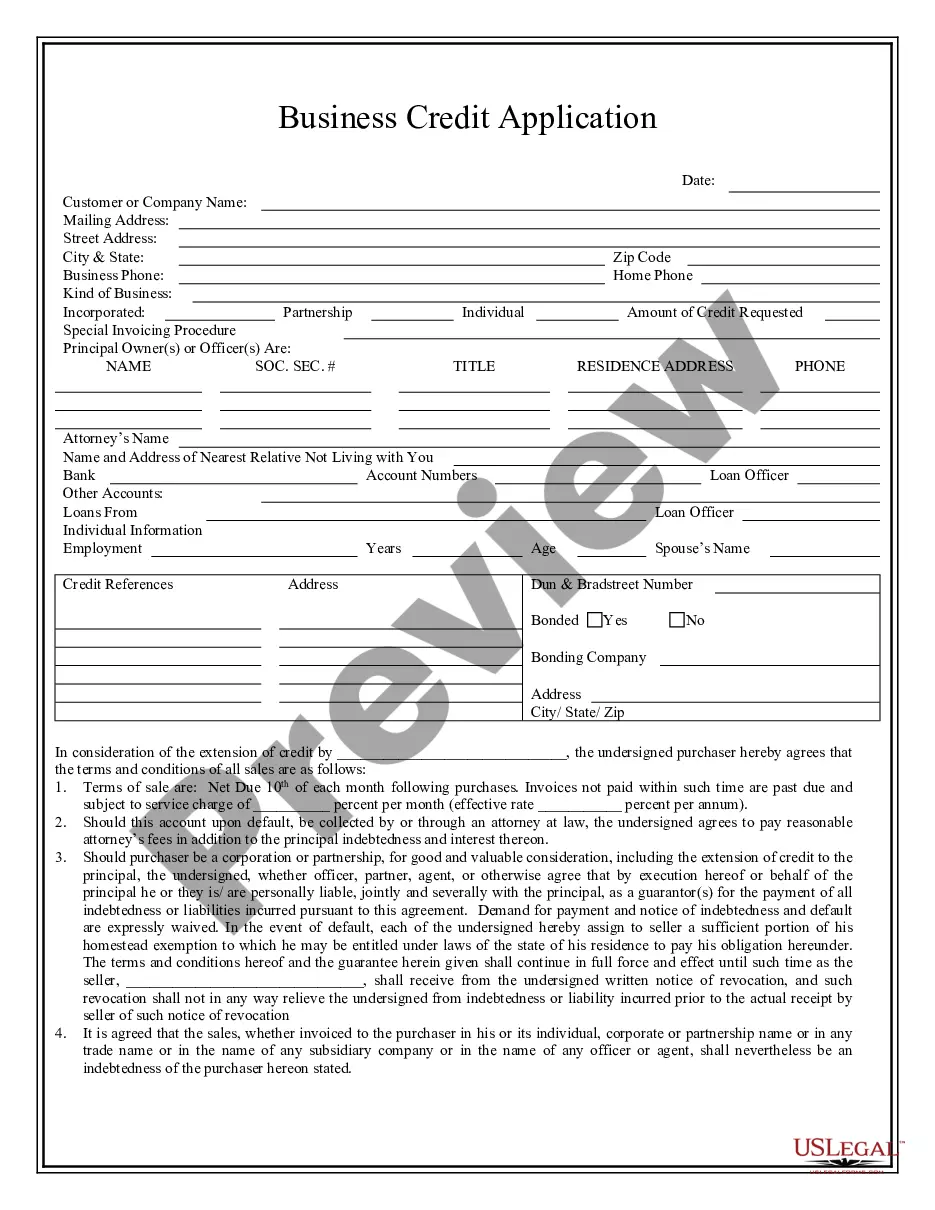

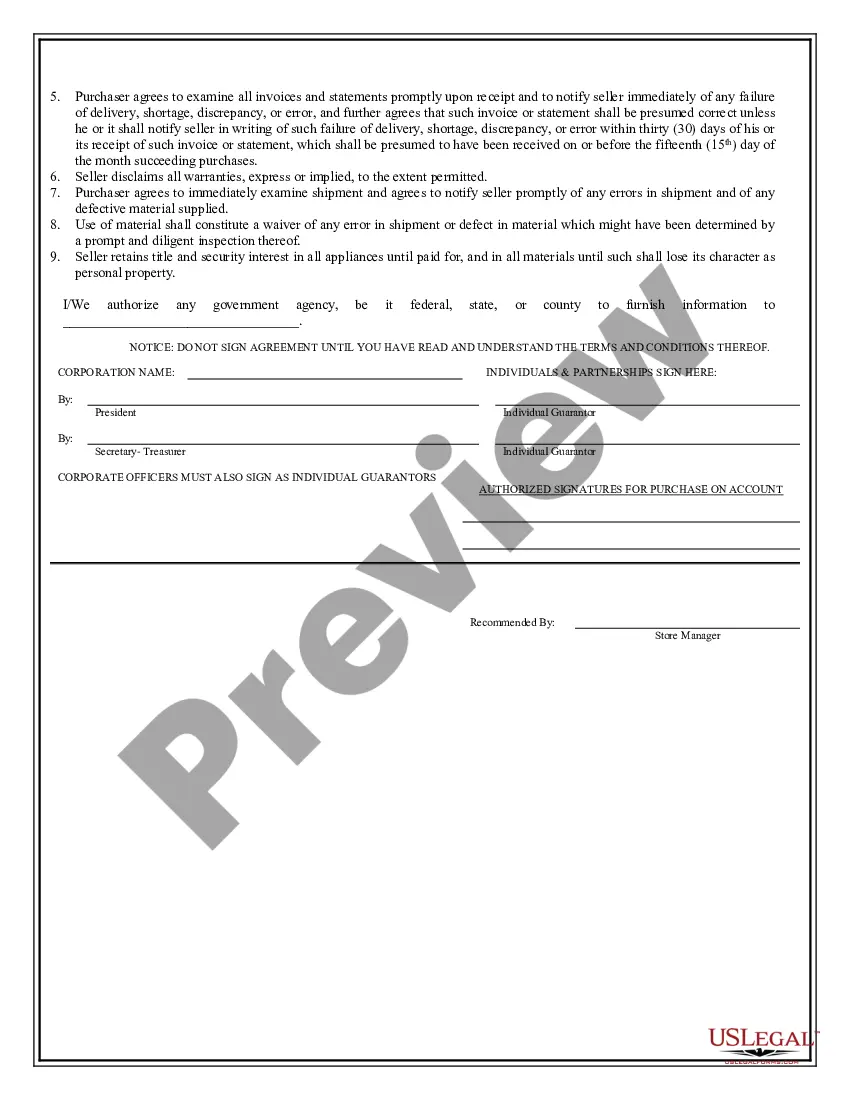

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

League City Texas Business Credit Application is a comprehensive application form that businesses in League City, Texas, used to apply for credit from financial institutions, lenders, or creditors. This application serves as a crucial tool for businesses seeking financial assistance and helps lenders evaluate the creditworthiness and reliability of the business applying for credit. The League City Texas Business Credit Application gathers necessary information about the business, its owners, and financial history to determine the applicant's ability to repay the credit. It typically includes: 1. Business Information: This section collects vital details about the business entity, such as its legal name, address, phone number, and email. It may also require the employer identification number (EIN) or social security number (SSN) if it is a sole proprietorship. 2. Ownership Details: In this part, the application gathers information about the business's ownership structure, including the names, addresses, and contact information of the owners, partners, or shareholders. 3. Financial Statements: Lenders often require businesses to provide financial statements, such as balance sheets, profit and loss statements, cash flow statements, and tax returns. These documents provide insights into the business's financial health, liquidity, and profitability. 4. Business History: The application may inquire about the history of the business, including the date of establishment, previous addresses, and any bankruptcy or legal issues. This helps the lender assess the business's stability and potential risk. 5. References: Applicants may be required to provide professional references, such as suppliers, vendors, or clients, along with their contact information. These references can vouch for the applicant's credibility and track record in fulfilling financial obligations. 6. Desired Credit Amount: Businesses must specify the amount of credit they are seeking, along with the purpose of this credit, whether it is for expansion, working capital, inventory, machinery, or other needs. Different types of League City Texas Business Credit Application may exist depending on the type of creditor or lender receiving the application. For example, there could be specific credit applications for traditional banks, credit unions, online lenders, or government-sponsored programs. Each application may have slight variations in terms of required documents or information fields. In conclusion, League City Texas Business Credit Application is a crucial document that businesses in League City use to apply for credit. By providing detailed and accurate information, businesses increase their chances of securing the desired credit and fueling their growth and development.League City Texas Business Credit Application is a comprehensive application form that businesses in League City, Texas, used to apply for credit from financial institutions, lenders, or creditors. This application serves as a crucial tool for businesses seeking financial assistance and helps lenders evaluate the creditworthiness and reliability of the business applying for credit. The League City Texas Business Credit Application gathers necessary information about the business, its owners, and financial history to determine the applicant's ability to repay the credit. It typically includes: 1. Business Information: This section collects vital details about the business entity, such as its legal name, address, phone number, and email. It may also require the employer identification number (EIN) or social security number (SSN) if it is a sole proprietorship. 2. Ownership Details: In this part, the application gathers information about the business's ownership structure, including the names, addresses, and contact information of the owners, partners, or shareholders. 3. Financial Statements: Lenders often require businesses to provide financial statements, such as balance sheets, profit and loss statements, cash flow statements, and tax returns. These documents provide insights into the business's financial health, liquidity, and profitability. 4. Business History: The application may inquire about the history of the business, including the date of establishment, previous addresses, and any bankruptcy or legal issues. This helps the lender assess the business's stability and potential risk. 5. References: Applicants may be required to provide professional references, such as suppliers, vendors, or clients, along with their contact information. These references can vouch for the applicant's credibility and track record in fulfilling financial obligations. 6. Desired Credit Amount: Businesses must specify the amount of credit they are seeking, along with the purpose of this credit, whether it is for expansion, working capital, inventory, machinery, or other needs. Different types of League City Texas Business Credit Application may exist depending on the type of creditor or lender receiving the application. For example, there could be specific credit applications for traditional banks, credit unions, online lenders, or government-sponsored programs. Each application may have slight variations in terms of required documents or information fields. In conclusion, League City Texas Business Credit Application is a crucial document that businesses in League City use to apply for credit. By providing detailed and accurate information, businesses increase their chances of securing the desired credit and fueling their growth and development.