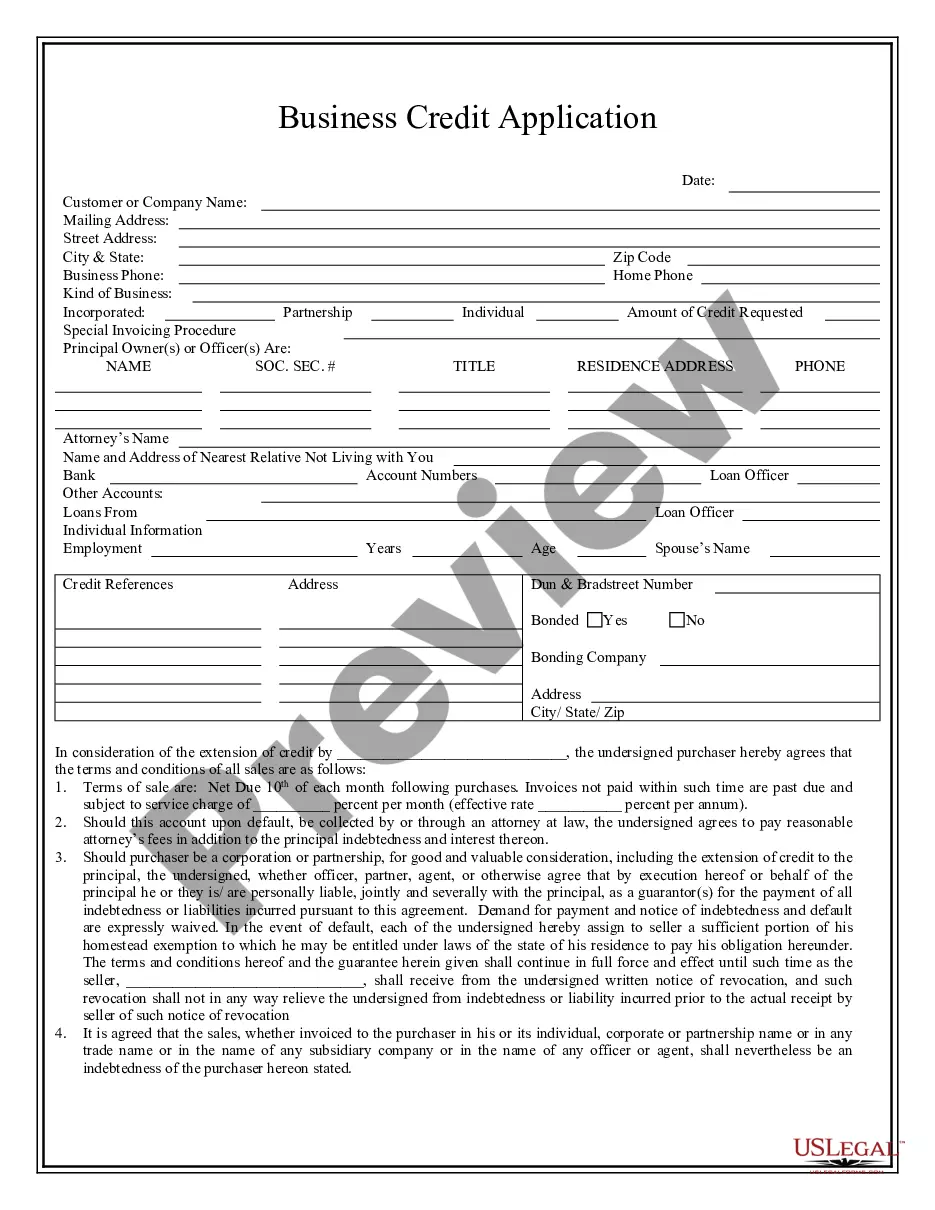

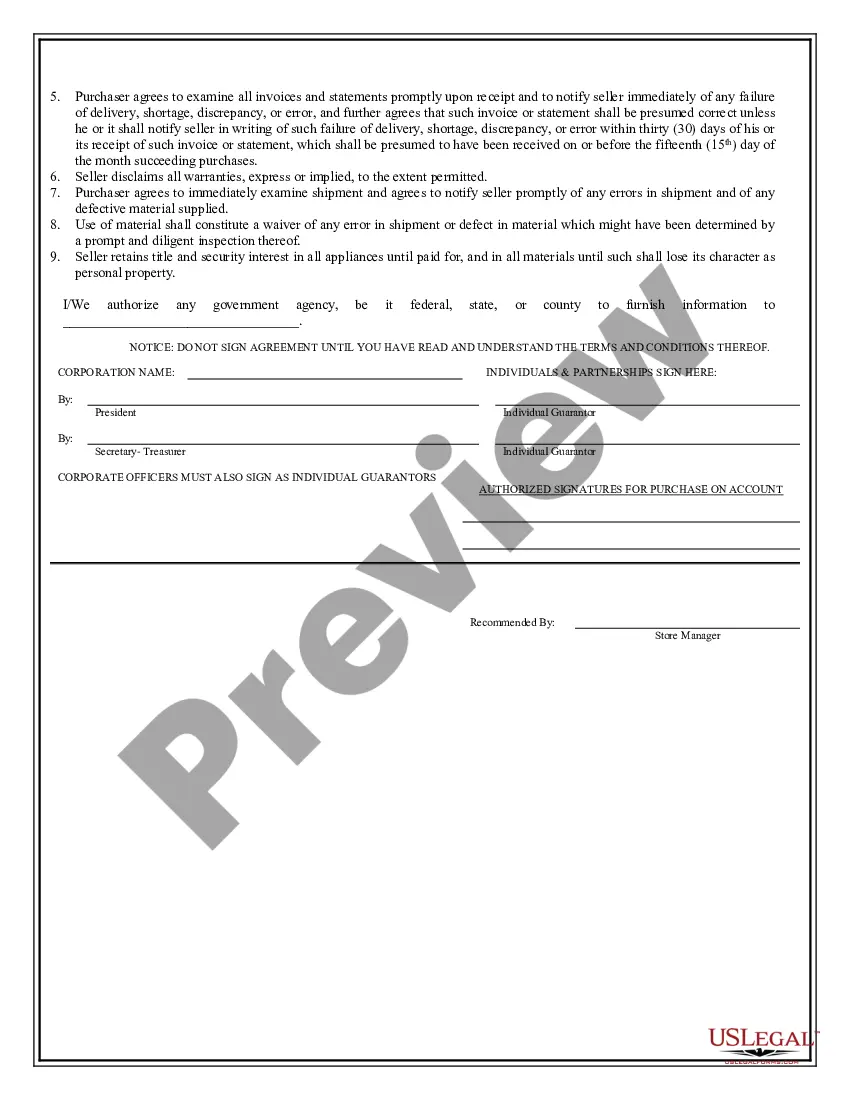

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Lewisville, Texas Business Credit Application: A Comprehensive Guide If you are a business owner in Lewisville, Texas, looking to establish or expand your business, then the Lewisville Texas Business Credit Application is an essential tool for you. This detailed application allows businesses to apply for credit and obtain financial support from various lending institutions, enabling them to reach their maximum potential. The Lewisville Texas Business Credit Application is a robust document that covers all aspects of a business's financial health and creditworthiness. It serves as a comprehensive tool to assess a business's ability to repay debts, manage finances, and fulfill its obligations. When filling out the Lewisville Texas Business Credit Application, it's crucial to pay attention to the following key areas: 1. Business Information: Provide accurate and up-to-date information about your business, including its legal name, address, tax identification number, and contact details. Be sure to outline the nature of your business and specify the industry it operates in. 2. Financial Statements: Prepare comprehensive financial statements, including balance sheets, profit and loss statements, and cash flow statements. These documents showcase your business's financial history and performance and help lenders assess their lending risk. 3. Bank References: Include references from your business's bank(s) to establish a positive banking relationship. This information helps lenders gauge your banking practices, account stability, and creditworthiness. 4. Trade References: Provide a list of suppliers, vendors, or other businesses you have worked with. These references offer insights into your payment history, your ability to meet financial obligations, and your credibility within the business community. 5. Personal Financial Statements: It is common for lenders to request personal financial statements from business owners as a measure of their ability to support the business financially. Therefore, include personal assets, liabilities, and income details, as well as any other relevant financial information. 6. Purpose of Credit: Clearly define the purpose for which you are seeking credit. Whether it is for expansion, purchasing inventory, or financing new equipment, specifying how the credit will benefit your business demonstrates your intentions and how you plan to use the funds responsibly. Different types of Lewisville Texas Business Credit Applications may include: 1. Small Business Credit Application: Aimed at small businesses looking for financing options tailored to their unique needs and operations. 2. Startup Business Credit Application: Specifically designed for new business ventures or startups that require funding to get off the ground. 3. Equipment Financing Credit Application: Geared towards businesses seeking funding for purchasing or leasing equipment necessary for their operations. 4. Line of Credit Application: For businesses looking to establish a revolving credit line to access funds as needed to manage cash flow, meet short-term obligations, or take advantage of growth opportunities. 5. Commercial Real Estate Loan Application: Catering to businesses planning to purchase or refinance commercial property for their operations. In conclusion, the Lewisville Texas Business Credit Application is a vital tool for businesses seeking financial support in the thriving Lewisville, Texas business environment. By completing a comprehensive application that covers all pertinent financial information, businesses can demonstrate their creditworthiness and secure the funding needed for growth and success.Lewisville, Texas Business Credit Application: A Comprehensive Guide If you are a business owner in Lewisville, Texas, looking to establish or expand your business, then the Lewisville Texas Business Credit Application is an essential tool for you. This detailed application allows businesses to apply for credit and obtain financial support from various lending institutions, enabling them to reach their maximum potential. The Lewisville Texas Business Credit Application is a robust document that covers all aspects of a business's financial health and creditworthiness. It serves as a comprehensive tool to assess a business's ability to repay debts, manage finances, and fulfill its obligations. When filling out the Lewisville Texas Business Credit Application, it's crucial to pay attention to the following key areas: 1. Business Information: Provide accurate and up-to-date information about your business, including its legal name, address, tax identification number, and contact details. Be sure to outline the nature of your business and specify the industry it operates in. 2. Financial Statements: Prepare comprehensive financial statements, including balance sheets, profit and loss statements, and cash flow statements. These documents showcase your business's financial history and performance and help lenders assess their lending risk. 3. Bank References: Include references from your business's bank(s) to establish a positive banking relationship. This information helps lenders gauge your banking practices, account stability, and creditworthiness. 4. Trade References: Provide a list of suppliers, vendors, or other businesses you have worked with. These references offer insights into your payment history, your ability to meet financial obligations, and your credibility within the business community. 5. Personal Financial Statements: It is common for lenders to request personal financial statements from business owners as a measure of their ability to support the business financially. Therefore, include personal assets, liabilities, and income details, as well as any other relevant financial information. 6. Purpose of Credit: Clearly define the purpose for which you are seeking credit. Whether it is for expansion, purchasing inventory, or financing new equipment, specifying how the credit will benefit your business demonstrates your intentions and how you plan to use the funds responsibly. Different types of Lewisville Texas Business Credit Applications may include: 1. Small Business Credit Application: Aimed at small businesses looking for financing options tailored to their unique needs and operations. 2. Startup Business Credit Application: Specifically designed for new business ventures or startups that require funding to get off the ground. 3. Equipment Financing Credit Application: Geared towards businesses seeking funding for purchasing or leasing equipment necessary for their operations. 4. Line of Credit Application: For businesses looking to establish a revolving credit line to access funds as needed to manage cash flow, meet short-term obligations, or take advantage of growth opportunities. 5. Commercial Real Estate Loan Application: Catering to businesses planning to purchase or refinance commercial property for their operations. In conclusion, the Lewisville Texas Business Credit Application is a vital tool for businesses seeking financial support in the thriving Lewisville, Texas business environment. By completing a comprehensive application that covers all pertinent financial information, businesses can demonstrate their creditworthiness and secure the funding needed for growth and success.