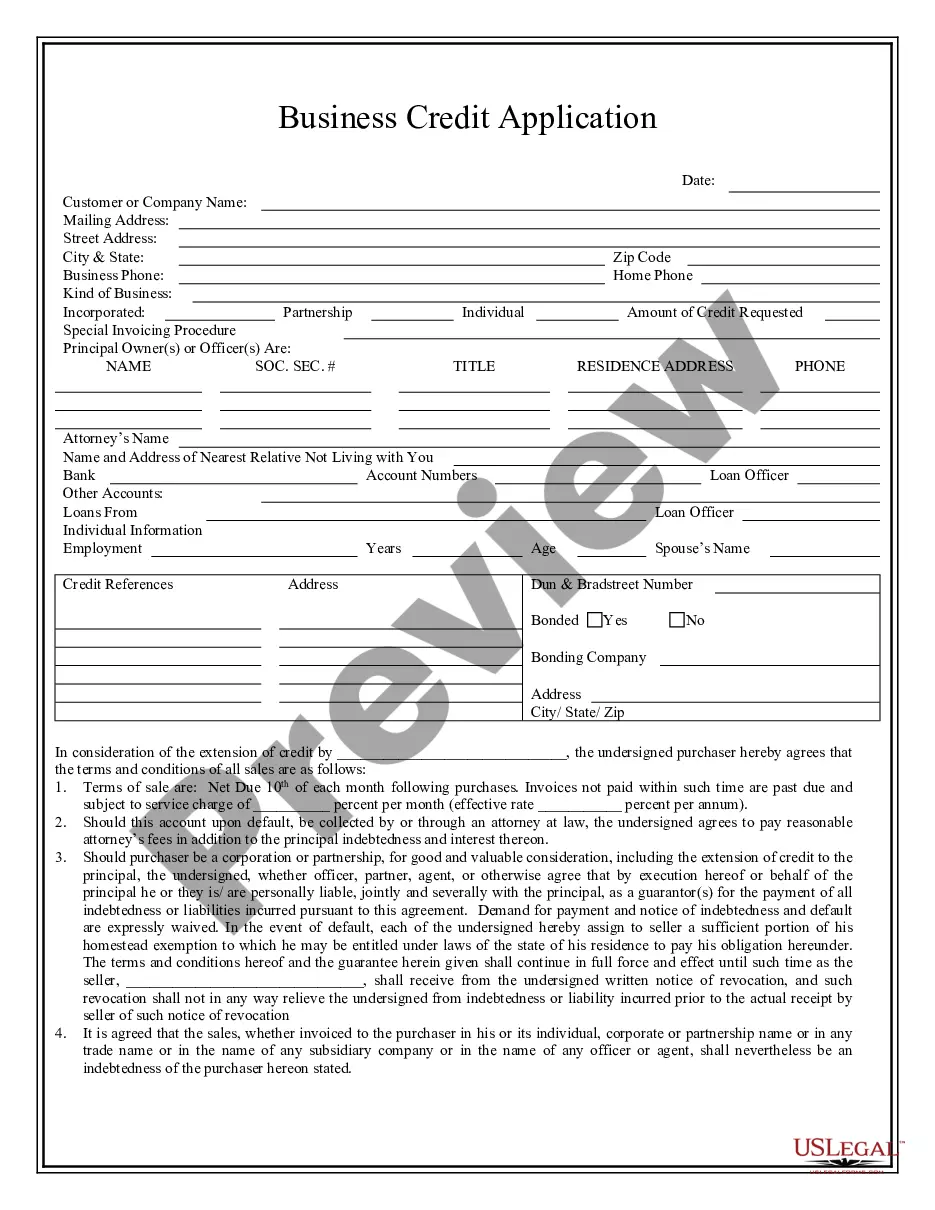

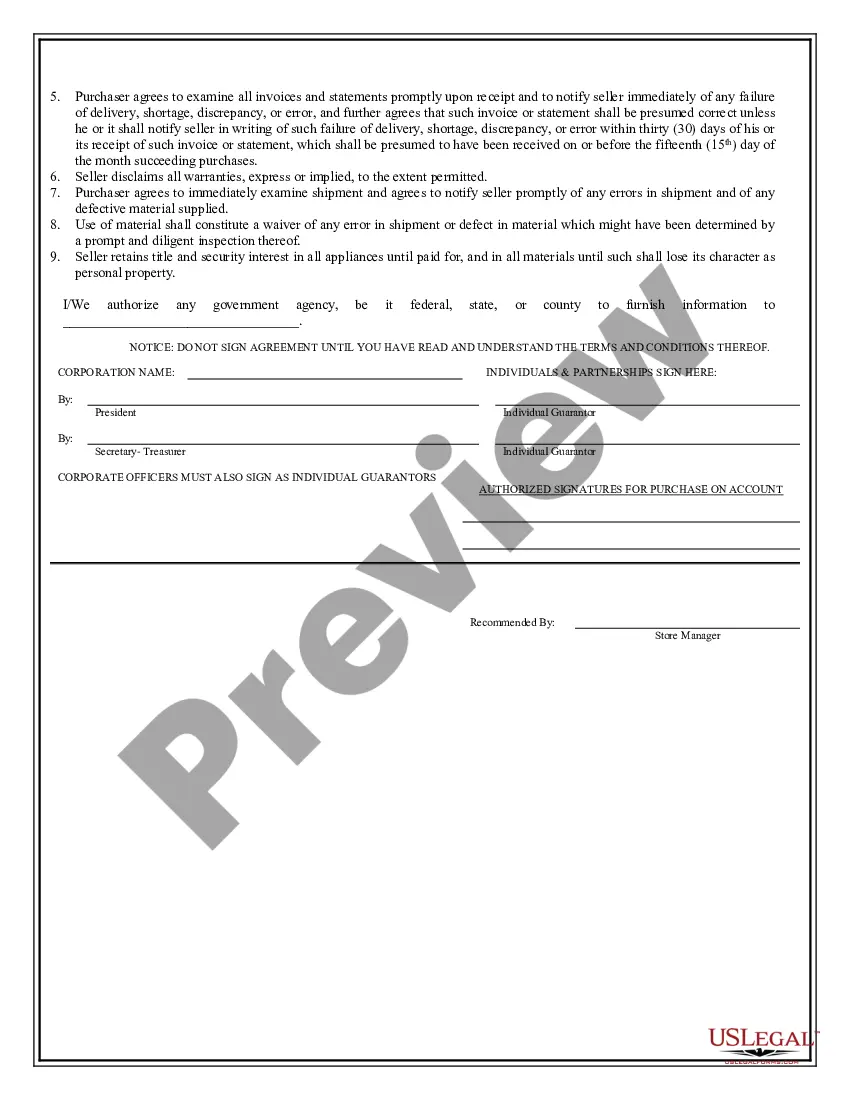

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Odessa Texas Business Credit Application is a crucial document required by businesses located in Odessa, Texas, in order to apply for credit from financial institutions or suppliers. It acts as a formal request for a line of credit or the extension of credit terms, allowing businesses to access funds or products without upfront payment. Key Features: 1. Comprehensive Information Gathering: The Odessa Texas Business Credit Application includes sections to gather detailed information about the applying business, such as legal entity name, business address, contact details, industry type, tax identification number, and years in operation. This ensures that the creditor has a clear understanding of the business's background before proceeding with the credit approval process. 2. Financial Information: The application typically requires businesses to provide their financial statements, including income statements, balance sheets, and cash flow statements. This helps the creditor assess the financial health and creditworthiness of the business. Supplementary documents such as tax returns, bank statements, and profit and loss statements may also be requested to provide a clearer picture of the business's financial position. 3. Trade References: Businesses may be required to furnish trade references, which are the names and contact details of other suppliers or creditors with whom they have established credit relationships. These references play a crucial role in determining the business's payment history and reliability as a borrower. 4. Legal Details: The application may ask for information about the business's legal structure, including the names and ownership percentages of its partners, shareholders, or LLC members. This helps establish the credibility and responsibility of the individuals behind the business. 5. Terms and Conditions: The Odessa Texas Business Credit Application outlines the terms and conditions of the credit agreement, specifying credit limits, interest rates, repayment terms, and penalties for late or missed payments. It is essential for businesses to review these terms thoroughly before signing, ensuring alignment with their financial capabilities and operational requirements. Different Types of Odessa Texas Business Credit Applications: 1. Small Business Credit Application: Designed for small businesses or startups, this application usually accommodates the limited financial history and resources of new ventures. 2. Corporate Credit Application: Intended for larger corporations or established businesses, this application caters to the complex financial structures and higher credit requirements associated with these entities. 3. Vendor-Specific Credit Application: Some suppliers may have their own customized credit applications for businesses seeking credit specifically with them. These applications are tailored to the supplier's credit policies and requirements. 4. Industry-Specific Credit Application: Certain industries, such as construction or manufacturing, may have credit applications unique to their sector. These applications may include specific questions or documentation required for credit assessment in those industries. In summary, the Odessa Texas Business Credit Application is a vital tool for businesses in Odessa, Texas, seeking credit from financial institutions or suppliers. By providing detailed information on the business's financials, history, and legal structure, businesses can facilitate the credit approval process and secure the necessary funds or products to support and grow their operations.Odessa Texas Business Credit Application is a crucial document required by businesses located in Odessa, Texas, in order to apply for credit from financial institutions or suppliers. It acts as a formal request for a line of credit or the extension of credit terms, allowing businesses to access funds or products without upfront payment. Key Features: 1. Comprehensive Information Gathering: The Odessa Texas Business Credit Application includes sections to gather detailed information about the applying business, such as legal entity name, business address, contact details, industry type, tax identification number, and years in operation. This ensures that the creditor has a clear understanding of the business's background before proceeding with the credit approval process. 2. Financial Information: The application typically requires businesses to provide their financial statements, including income statements, balance sheets, and cash flow statements. This helps the creditor assess the financial health and creditworthiness of the business. Supplementary documents such as tax returns, bank statements, and profit and loss statements may also be requested to provide a clearer picture of the business's financial position. 3. Trade References: Businesses may be required to furnish trade references, which are the names and contact details of other suppliers or creditors with whom they have established credit relationships. These references play a crucial role in determining the business's payment history and reliability as a borrower. 4. Legal Details: The application may ask for information about the business's legal structure, including the names and ownership percentages of its partners, shareholders, or LLC members. This helps establish the credibility and responsibility of the individuals behind the business. 5. Terms and Conditions: The Odessa Texas Business Credit Application outlines the terms and conditions of the credit agreement, specifying credit limits, interest rates, repayment terms, and penalties for late or missed payments. It is essential for businesses to review these terms thoroughly before signing, ensuring alignment with their financial capabilities and operational requirements. Different Types of Odessa Texas Business Credit Applications: 1. Small Business Credit Application: Designed for small businesses or startups, this application usually accommodates the limited financial history and resources of new ventures. 2. Corporate Credit Application: Intended for larger corporations or established businesses, this application caters to the complex financial structures and higher credit requirements associated with these entities. 3. Vendor-Specific Credit Application: Some suppliers may have their own customized credit applications for businesses seeking credit specifically with them. These applications are tailored to the supplier's credit policies and requirements. 4. Industry-Specific Credit Application: Certain industries, such as construction or manufacturing, may have credit applications unique to their sector. These applications may include specific questions or documentation required for credit assessment in those industries. In summary, the Odessa Texas Business Credit Application is a vital tool for businesses in Odessa, Texas, seeking credit from financial institutions or suppliers. By providing detailed information on the business's financials, history, and legal structure, businesses can facilitate the credit approval process and secure the necessary funds or products to support and grow their operations.