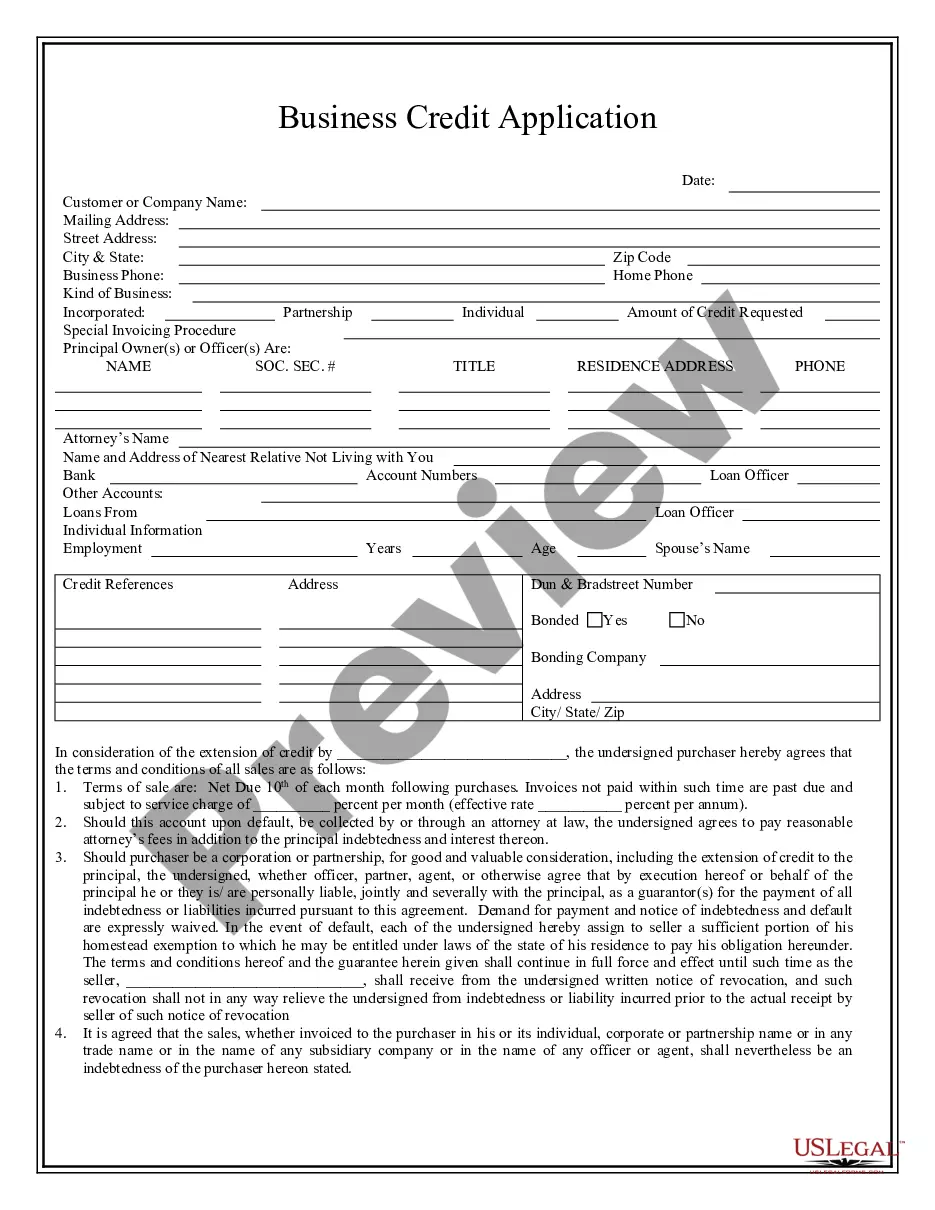

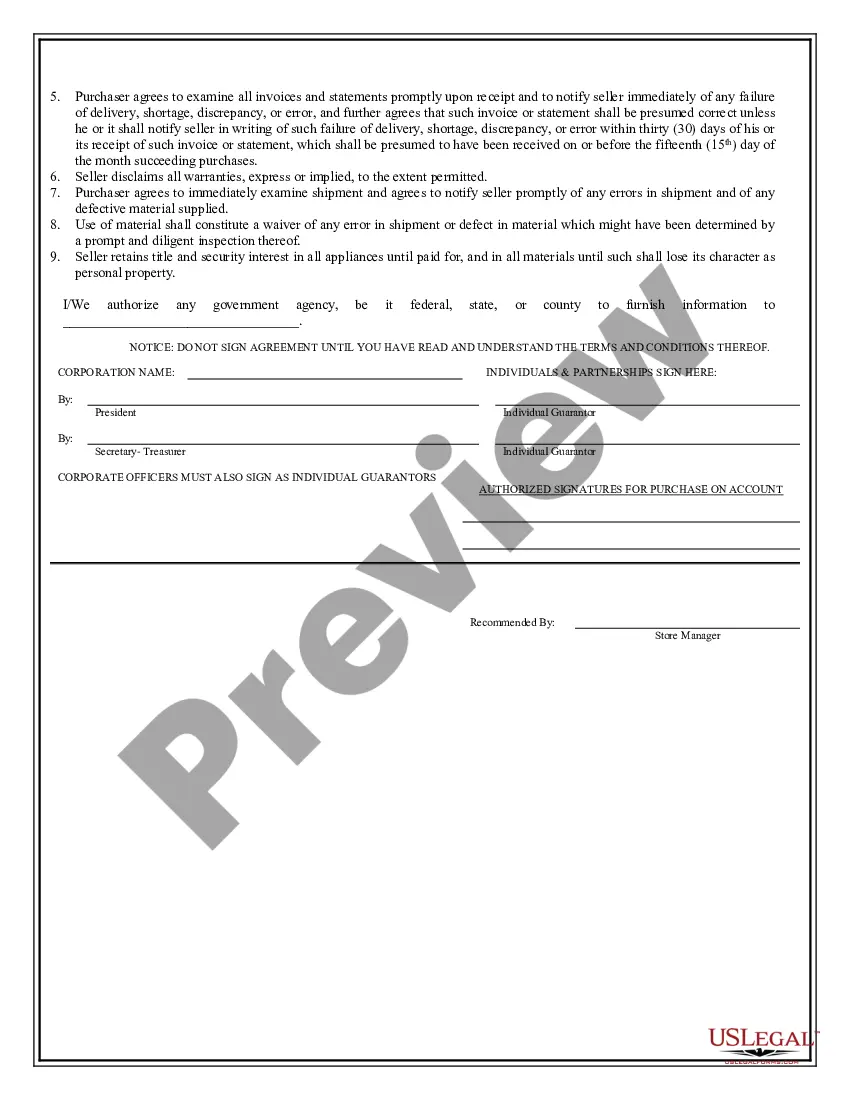

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

San Angelo Texas Business Credit Application is a comprehensive form that businesses in San Angelo, Texas can use to apply for credit from various financial institutions, lenders, or loan providers. This application is crucial for businesses seeking monetary assistance to support their operations, expansion plans, or to manage cash flow. The San Angelo Texas Business Credit Application typically requires businesses to provide specific details to begin the assessment process. Keywords relevant to this application include: 1. Business Information: The application would ask for general information about the business, such as the legal name, business type (sole proprietorship, partnership, corporation, etc.), years in operation, industry, mailing address, contact information, and legal registration details. 2. Financial Statements: These statements provide key financial data that lenders consider when evaluating creditworthiness. This may include balance sheets, income statements, cash flow statements, and tax returns for the business. These documents help lenders understand the financial health and stability of the business. 3. Owner/Principal Information: Lenders often require demographic and personal details of the business owner(s). Such information includes names, social security numbers, contact information, personal addresses, employment history, and any relevant financial obligations. 4. Purpose of Credit: Businesses need to specify the purpose for which they are seeking credit. This might include working capital, equipment purchase, real estate acquisition, inventory management, or debt consolidation. 5. Business Plan: In some cases, a detailed business plan highlighting strategies, goals, and revenue projections may be required. This plan demonstrates the potential for credit repayment and the overall viability of the business. Different types of San Angelo Texas Business Credit Applications may include: 1. Small Business Loan Application: This application is intended for small businesses looking for credit options to fund their day-to-day operations or specific projects. The loan amount and terms may vary depending on the lender and the specific needs of the business. 2. Line of Credit Application: A line of credit application allows businesses to access funds up to a certain limit, similar to a credit card. It provides flexibility for businesses to borrow and repay funds as needed, making it useful for managing short-term cash flow gaps. 3. Equipment Financing Application: Businesses that require funding for purchasing or leasing equipment can use this application. Lenders often offer equipment loans specifically designed to finance the purchase of machinery, vehicles, or other essential assets. 4. Commercial Real Estate Loan Application: Businesses seeking to purchase or renovate commercial property can use this application. It typically involves larger loan amounts due to the significant investments in real estate, and the lender may require additional property-related documentation. 5. Business Line of Credit Application: This application is similar to a traditional line of credit application but is specifically designed for businesses. It provides businesses with a pre-approved credit limit that they can draw on when necessary, helping them manage cash flow fluctuations effectively. San Angelo Texas Business Credit Applications vary depending on the type and size of the business as well as the lender's specific requirements. It's crucial for businesses to carefully complete these applications and provide accurate, up-to-date information to increase their chances of obtaining credit.San Angelo Texas Business Credit Application is a comprehensive form that businesses in San Angelo, Texas can use to apply for credit from various financial institutions, lenders, or loan providers. This application is crucial for businesses seeking monetary assistance to support their operations, expansion plans, or to manage cash flow. The San Angelo Texas Business Credit Application typically requires businesses to provide specific details to begin the assessment process. Keywords relevant to this application include: 1. Business Information: The application would ask for general information about the business, such as the legal name, business type (sole proprietorship, partnership, corporation, etc.), years in operation, industry, mailing address, contact information, and legal registration details. 2. Financial Statements: These statements provide key financial data that lenders consider when evaluating creditworthiness. This may include balance sheets, income statements, cash flow statements, and tax returns for the business. These documents help lenders understand the financial health and stability of the business. 3. Owner/Principal Information: Lenders often require demographic and personal details of the business owner(s). Such information includes names, social security numbers, contact information, personal addresses, employment history, and any relevant financial obligations. 4. Purpose of Credit: Businesses need to specify the purpose for which they are seeking credit. This might include working capital, equipment purchase, real estate acquisition, inventory management, or debt consolidation. 5. Business Plan: In some cases, a detailed business plan highlighting strategies, goals, and revenue projections may be required. This plan demonstrates the potential for credit repayment and the overall viability of the business. Different types of San Angelo Texas Business Credit Applications may include: 1. Small Business Loan Application: This application is intended for small businesses looking for credit options to fund their day-to-day operations or specific projects. The loan amount and terms may vary depending on the lender and the specific needs of the business. 2. Line of Credit Application: A line of credit application allows businesses to access funds up to a certain limit, similar to a credit card. It provides flexibility for businesses to borrow and repay funds as needed, making it useful for managing short-term cash flow gaps. 3. Equipment Financing Application: Businesses that require funding for purchasing or leasing equipment can use this application. Lenders often offer equipment loans specifically designed to finance the purchase of machinery, vehicles, or other essential assets. 4. Commercial Real Estate Loan Application: Businesses seeking to purchase or renovate commercial property can use this application. It typically involves larger loan amounts due to the significant investments in real estate, and the lender may require additional property-related documentation. 5. Business Line of Credit Application: This application is similar to a traditional line of credit application but is specifically designed for businesses. It provides businesses with a pre-approved credit limit that they can draw on when necessary, helping them manage cash flow fluctuations effectively. San Angelo Texas Business Credit Applications vary depending on the type and size of the business as well as the lender's specific requirements. It's crucial for businesses to carefully complete these applications and provide accurate, up-to-date information to increase their chances of obtaining credit.