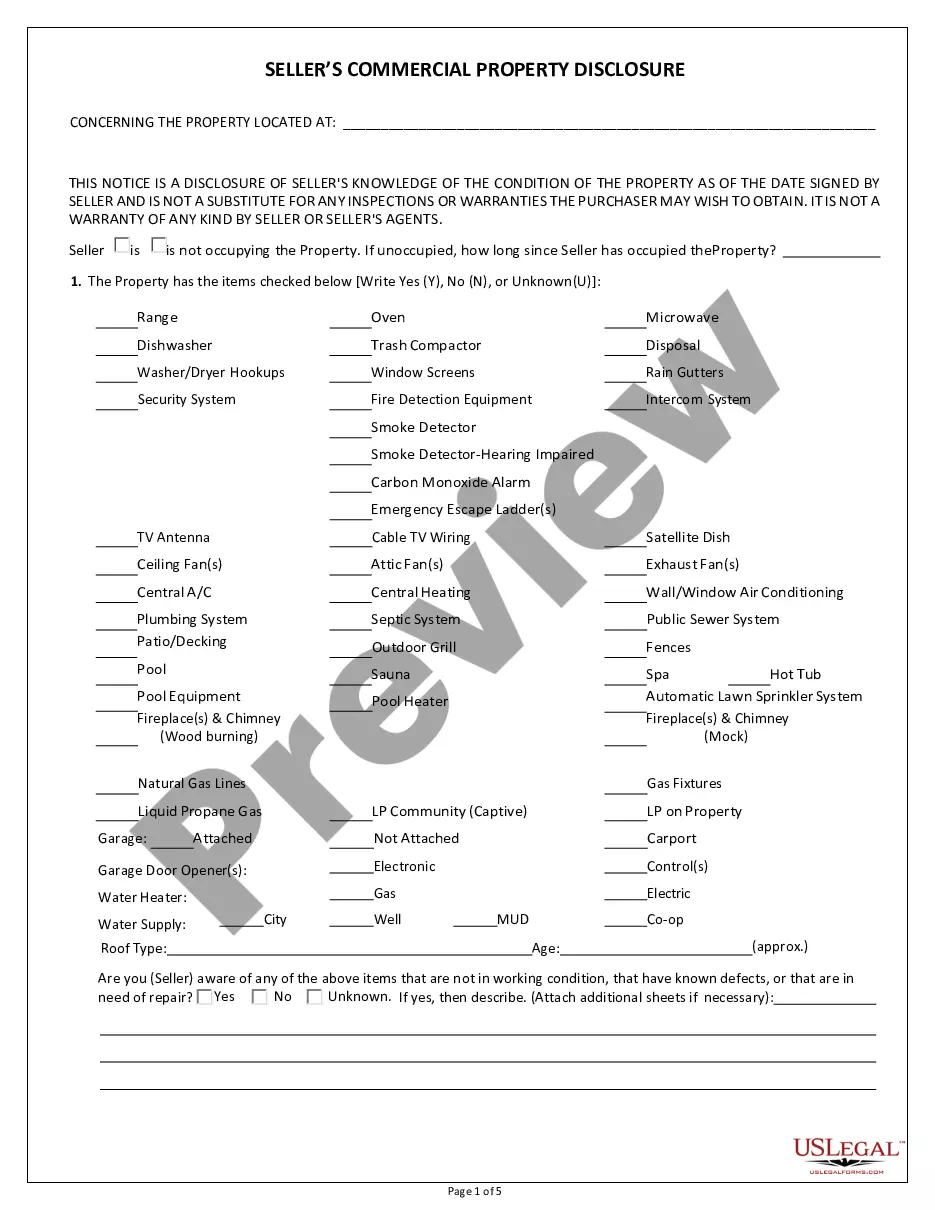

College Station Texas Seller's Commercial Property Disclosure Statement

Description

How to fill out Texas Seller's Commercial Property Disclosure Statement?

We consistently aim to reduce or evade legal complications when engaging with intricate legal or financial issues.

To achieve this, we enroll in legal services that are generally very costly.

However, not all legal situations are equally complicated. Many can be managed independently.

US Legal Forms is an online repository of current DIY legal forms covering a range of documents from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always retrieve it again from the My documents tab. The process is just as straightforward if you're unfamiliar with the website! You can set up your account within a few minutes. Ensure that the College Station Texas Seller's Commercial Property Disclosure Statement complies with the statutes and regulations of your state and region. Additionally, it’s crucial to review the form’s description (if available), and if you notice any inconsistencies with what you initially needed, look for a different form. Once you confirm that the College Station Texas Seller's Commercial Property Disclosure Statement is appropriate for your needs, you can select a subscription plan and complete a payment. You can then download the document in any preferred format. Over more than 24 years in the industry, we've assisted millions by providing customizable and up-to-date legal forms. Make the most of US Legal Forms now to conserve time and resources!

- Our platform empowers you to handle your legal matters without needing to hire legal counsel.

- We provide access to legal document templates that may not always be available to the general public.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- You can download the College Station Texas Seller's Commercial Property Disclosure Statement or any other document with ease and security.

Form popularity

FAQ

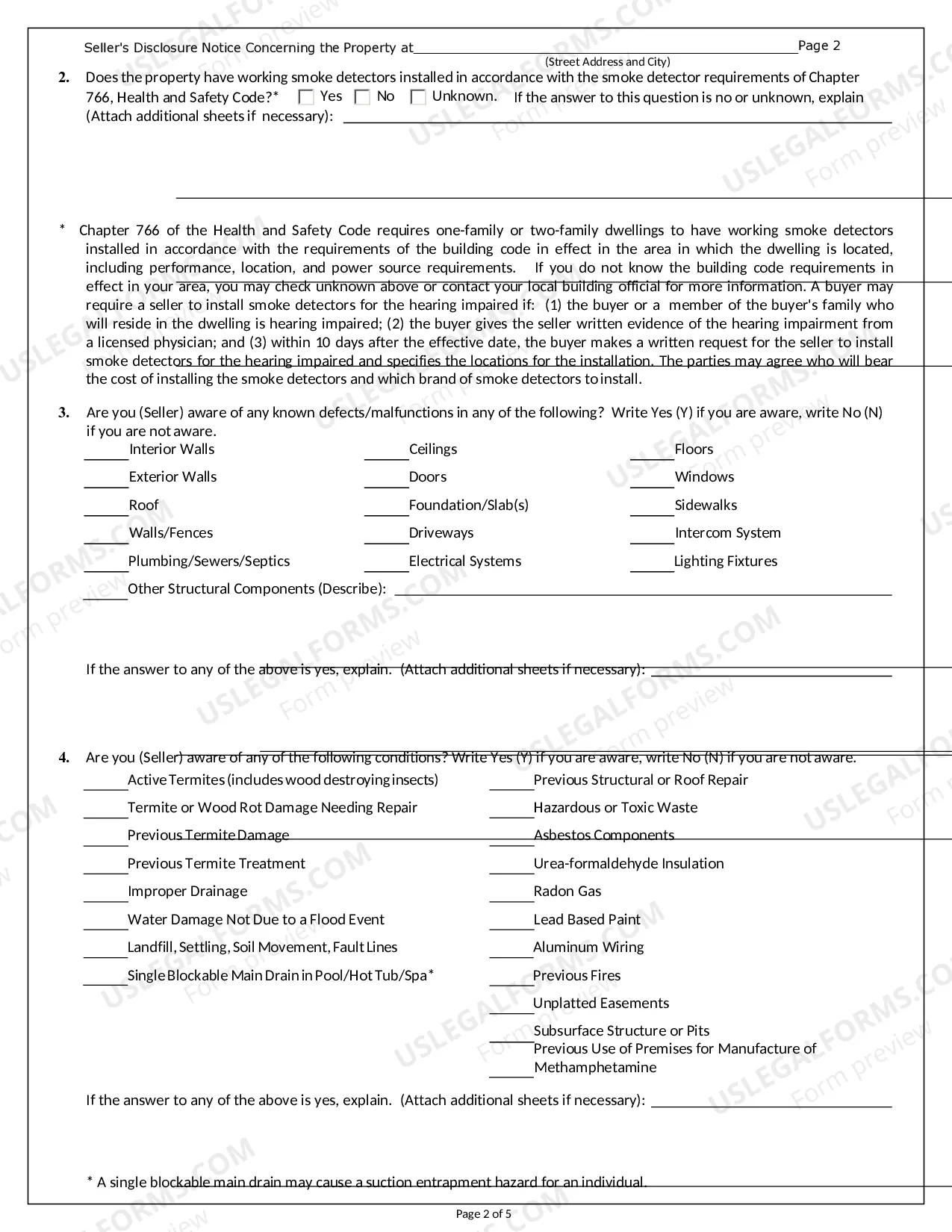

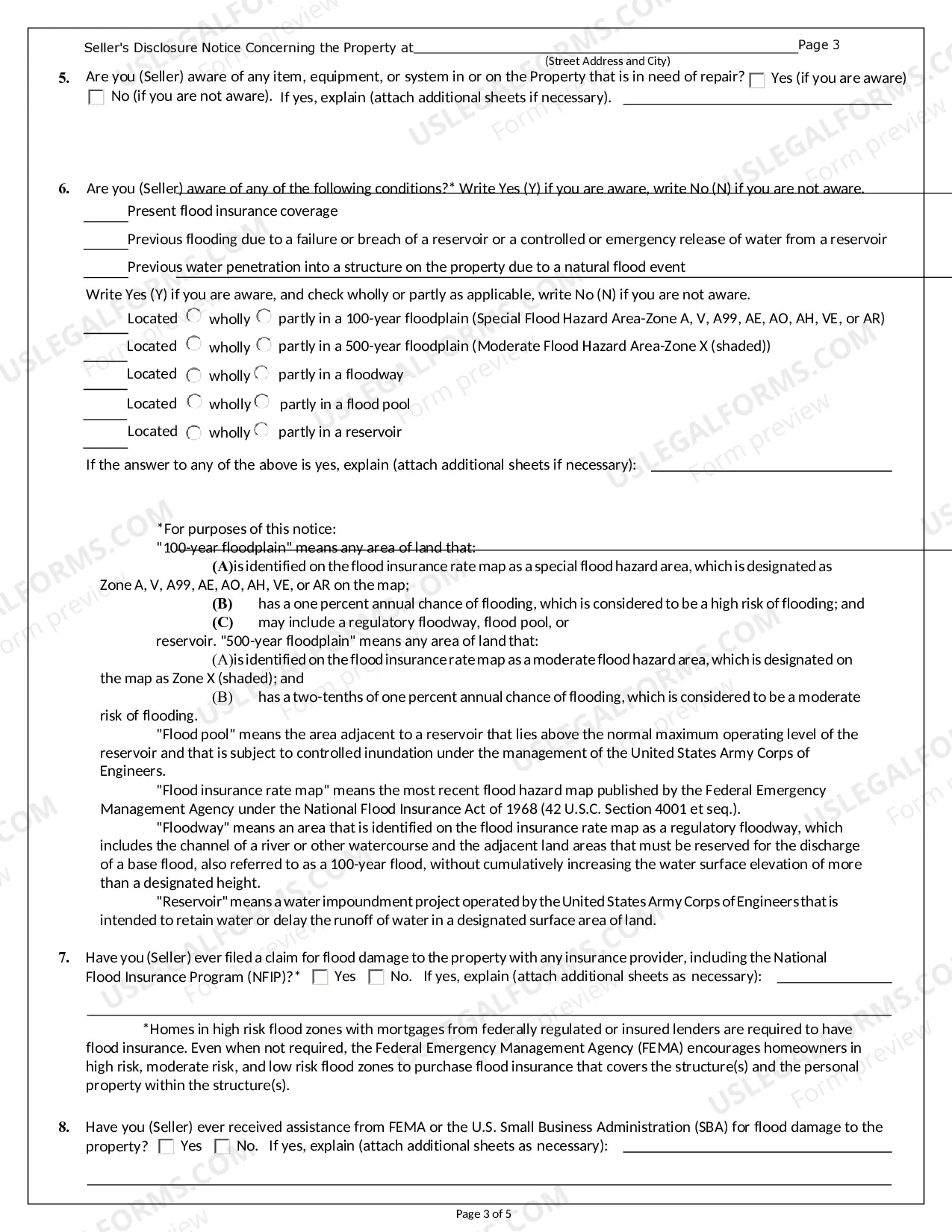

Seller's disclosure requirements do not apply to foreclosure sales, or to the subsequent sale by a foreclosing lender (Texas Property Code Section 5.008). Foreclosure sales are also exempt from the federal lead-based-paint disclosure requirements.

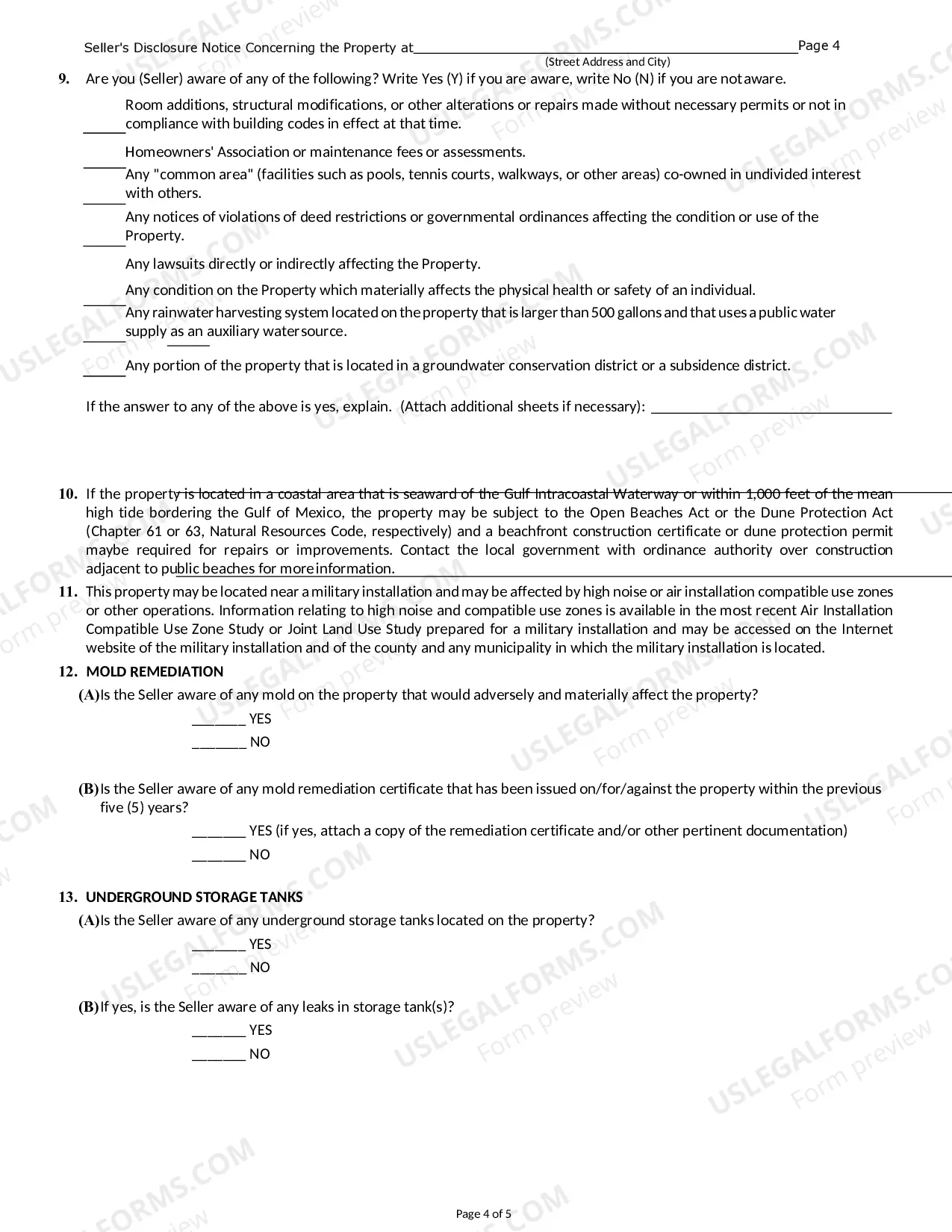

The Transfer Disclosure Statement (TDS) is required in the state of California unless the seller (or transferor) meets one of the following conditions: Court-ordered sales such as probate sales, foreclosure sales, sale by bankruptcy trustee, eminent domain.

The seller's failure to provide the required disclosures entitles you to make claims for monetary damages for undisclosed defects under either the Texas Deceptive Trade - Consumer Protection Act or the Statutory Fraud Act.

Seller's disclosure requirements do not apply to foreclosure sales, or to the subsequent sale by a foreclosing lender (Texas Property Code Section 5.008). Foreclosure sales are also exempt from the federal lead-based-paint disclosure requirements.

Is a Seller's Disclosure Required in Texas? Yes. Section 5.008 of the Texas Property Code requires anyone selling a single family home to fill out a seller's disclosure. It even has a script you can use to write your disclosure?so you know you've met all the requirements.

Which transfers of property are exempt from a disclosure report? The property consists of one to four dwelling units. The property is sold at public auction. The property is a sale, exchange, land sales contract, or lease with option to buy.

Is a Seller's Disclosure Required in Texas? Yes. Section 5.008 of the Texas Property Code requires anyone selling a single family home to fill out a seller's disclosure. It even has a script you can use to write your disclosure?so you know you've met all the requirements.

In order to prevail in court, the buyer must prove the party made a material statement that was false. In layman's terms, the buyers have to prove that they were lied to. The most frequent evidence on which buyers base their fraud claims are the Seller's Disclosure Notice, agent marketing materials, and MLS statements.