This will package contains two wills for a man and woman living together with no children. It is designed for persons that, although not married, desire to execute mutual wills leaving some of their property to the other. State specific instructions are also included.

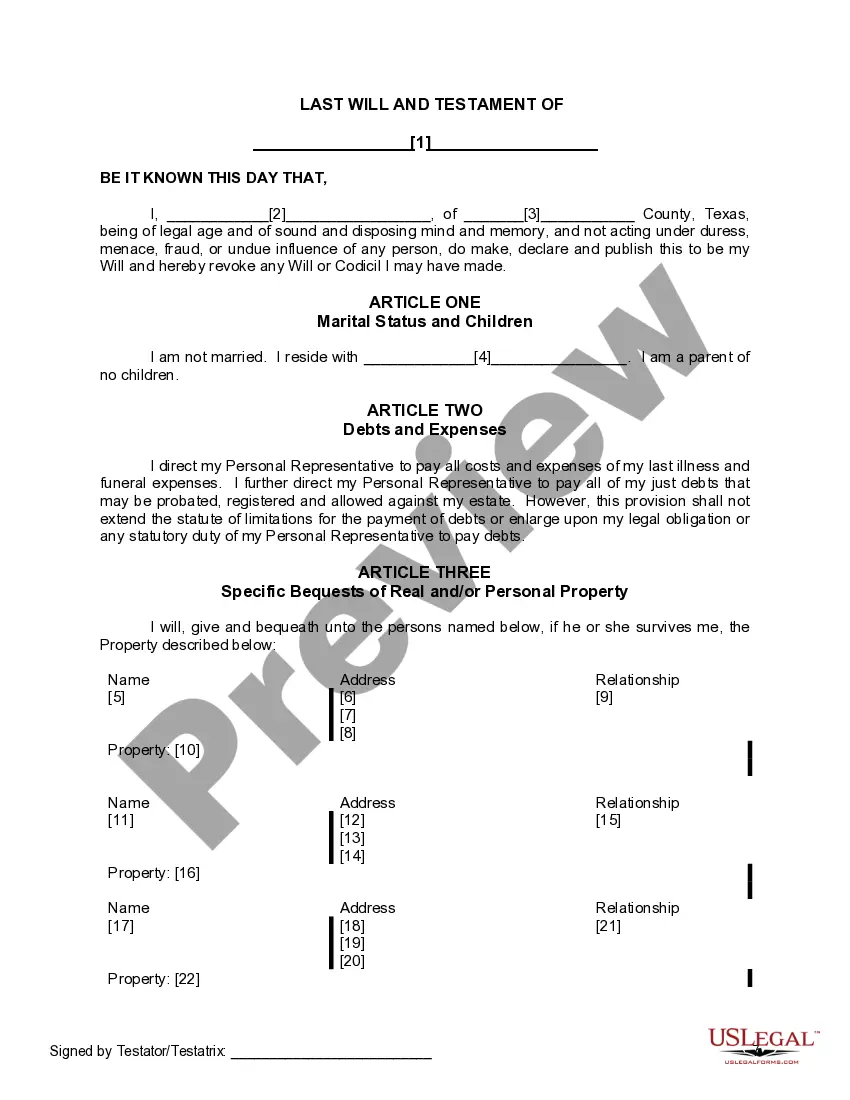

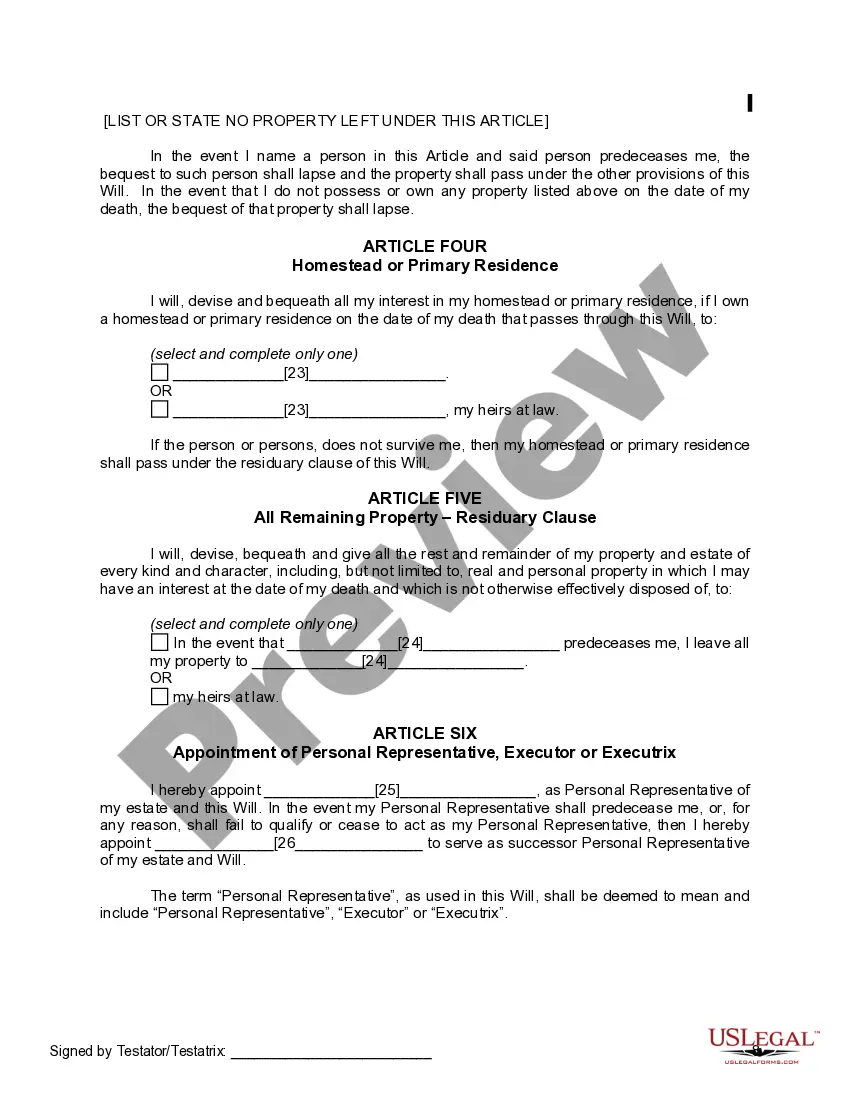

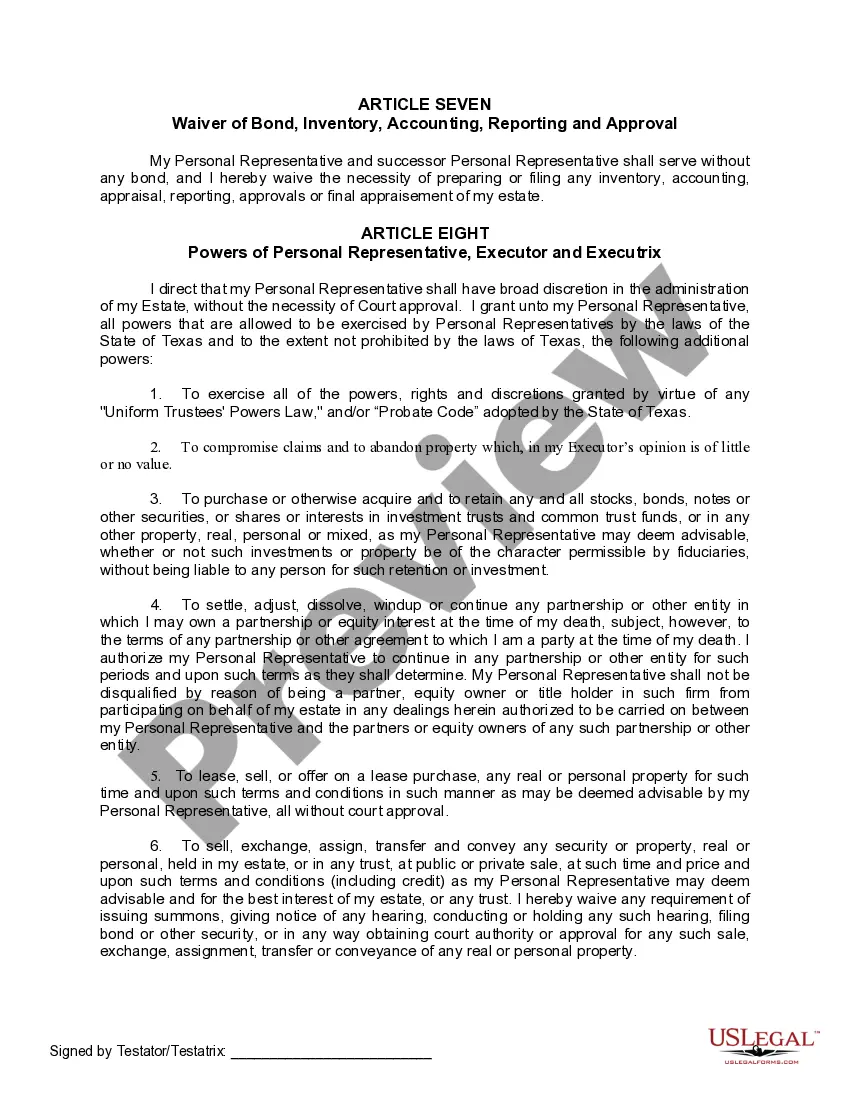

The wills must be signed in the presence of two witnesses, not related to you or named in the wills. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the wills. Wichita Falls, Texas Mutual Wills Containing Last Will and Testaments for Unmarried Persons Living Together With No Children are legal documents that allow unmarried couples to plan their estates and ensure their wishes are carried out after their passing. By creating these wills, couples can protect their assets, designate beneficiaries, and ensure the financial security of their partner. In Wichita Falls, Texas, couples who are not legally married but live together can use these mutual wills to establish clear guidelines for the distribution of their property, assets, and investments. It is important to note that mutual wills are only valid when both partners agree to the terms and conditions set forth in the document. Within Wichita Falls, there are several types of mutual wills containing last will and testaments for unmarried persons living together with no children: 1. Simple Mutual Will: A simple mutual will is a straightforward document that outlines the basic provisions for the distribution of assets and determines who will inherit specific possessions or properties. This type of mutual will, can be ideal for couples with uncomplicated financial situations. 2. Comprehensive Mutual Will: A comprehensive mutual will is more detailed and covers a wide range of matters such as real estate, investments, bank accounts, retirement funds, vehicles, and personal possessions. It allows couples to specify their wishes for each asset individually, ensuring that their intended beneficiaries receive their desired portions. 3. Conditional Mutual Will: A conditional mutual will includes specific conditions or contingencies that must be met for certain assets to be distributed as per the deceased partner's wishes. For instance, a condition may state that a property can only be inherited if the surviving partner continues to reside in it or takes care of a particular family member. 4. Joint Mutual Will: In a joint mutual will, both partners agree to make a single will together. This type of will is binding on both parties and cannot be changed or revoked by the surviving partner alone after one party's death. Joint mutual wills are typically used when couples wish to leave their assets to the same beneficiaries. Creating Wichita Falls, Texas Mutual Wills Containing Last Will and Testaments for Unmarried Persons Living Together With No Children ensures that the intentions of unmarried couples are legally recognized and respected. Seeking professional legal assistance from an estate planning attorney is recommended to ensure these mutual wills are properly prepared, witnessed, and executed in accordance with Texas state laws.

Wichita Falls, Texas Mutual Wills Containing Last Will and Testaments for Unmarried Persons Living Together With No Children are legal documents that allow unmarried couples to plan their estates and ensure their wishes are carried out after their passing. By creating these wills, couples can protect their assets, designate beneficiaries, and ensure the financial security of their partner. In Wichita Falls, Texas, couples who are not legally married but live together can use these mutual wills to establish clear guidelines for the distribution of their property, assets, and investments. It is important to note that mutual wills are only valid when both partners agree to the terms and conditions set forth in the document. Within Wichita Falls, there are several types of mutual wills containing last will and testaments for unmarried persons living together with no children: 1. Simple Mutual Will: A simple mutual will is a straightforward document that outlines the basic provisions for the distribution of assets and determines who will inherit specific possessions or properties. This type of mutual will, can be ideal for couples with uncomplicated financial situations. 2. Comprehensive Mutual Will: A comprehensive mutual will is more detailed and covers a wide range of matters such as real estate, investments, bank accounts, retirement funds, vehicles, and personal possessions. It allows couples to specify their wishes for each asset individually, ensuring that their intended beneficiaries receive their desired portions. 3. Conditional Mutual Will: A conditional mutual will includes specific conditions or contingencies that must be met for certain assets to be distributed as per the deceased partner's wishes. For instance, a condition may state that a property can only be inherited if the surviving partner continues to reside in it or takes care of a particular family member. 4. Joint Mutual Will: In a joint mutual will, both partners agree to make a single will together. This type of will is binding on both parties and cannot be changed or revoked by the surviving partner alone after one party's death. Joint mutual wills are typically used when couples wish to leave their assets to the same beneficiaries. Creating Wichita Falls, Texas Mutual Wills Containing Last Will and Testaments for Unmarried Persons Living Together With No Children ensures that the intentions of unmarried couples are legally recognized and respected. Seeking professional legal assistance from an estate planning attorney is recommended to ensure these mutual wills are properly prepared, witnessed, and executed in accordance with Texas state laws.