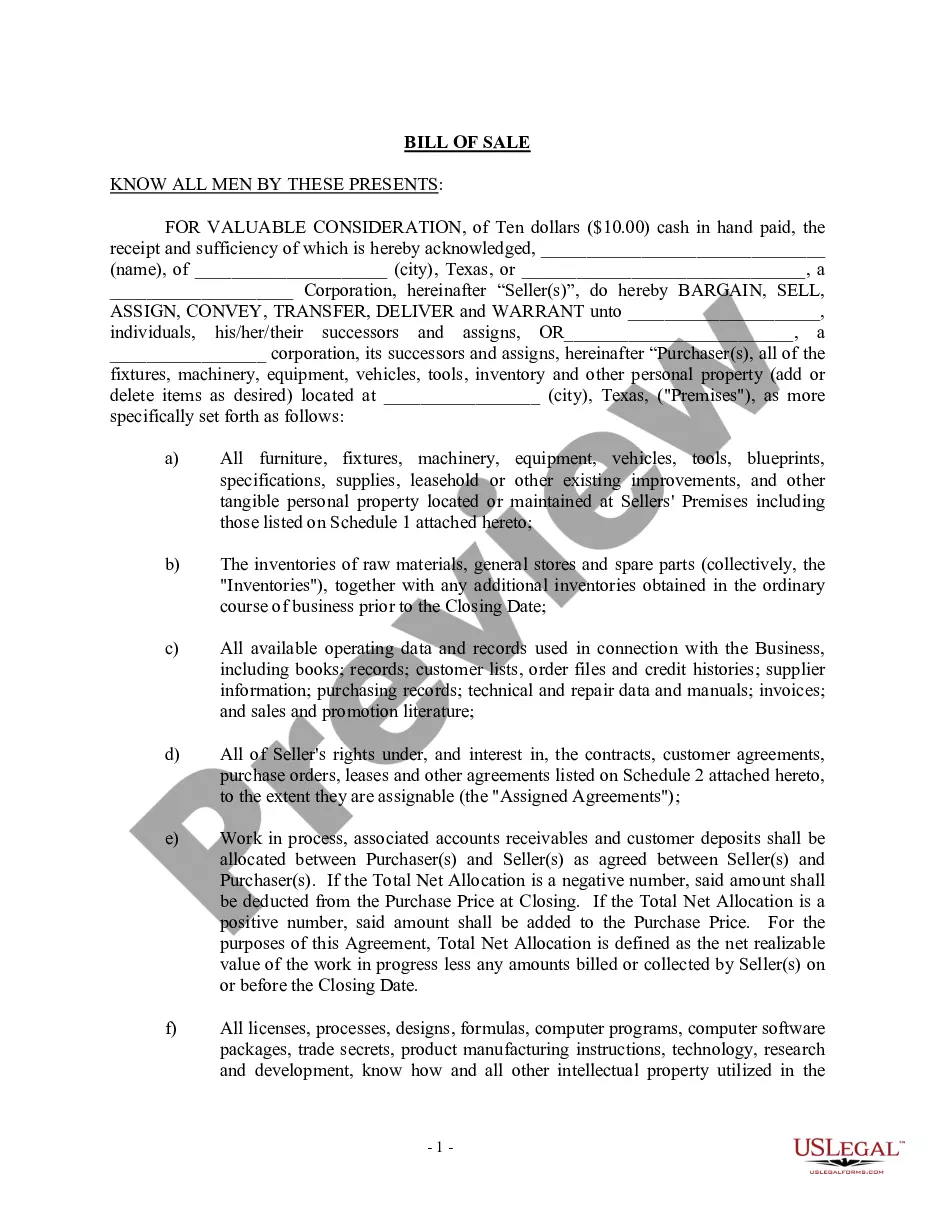

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

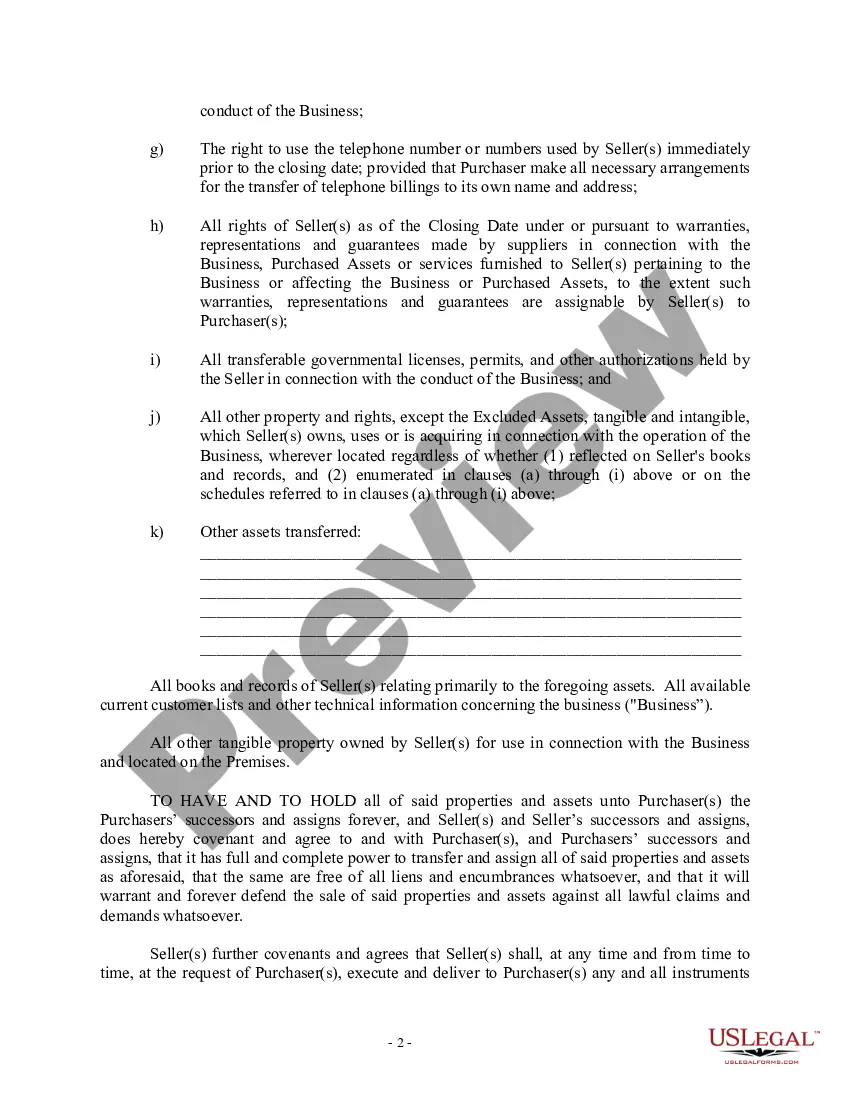

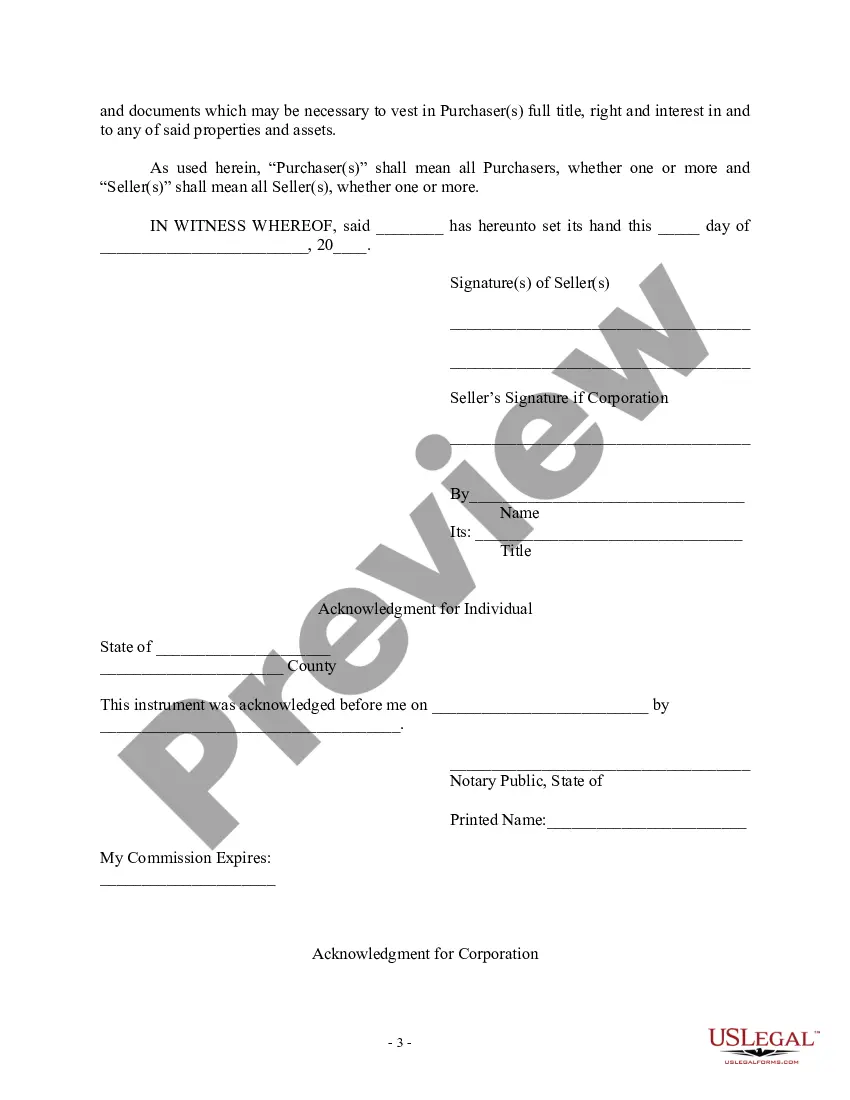

The Fort Worth Texas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is a legal document that serves as proof of transfer of ownership of a business from an individual or a corporate seller to a buyer. It is an essential document that outlines the terms and conditions of the sale, recording all pertinent details about the transaction. Keywords: Fort Worth Texas, bill of sale, sale of business, individual seller, corporate seller, transfer of ownership, legal document, terms and conditions, transaction. This bill of sale includes various sections that provide comprehensive information about the sale agreement. Some of these sections may include: 1. Parties Involved: The document identifies the parties involved in the transaction, including the individual or corporate seller(s) and the buyer. 2. Business Description: A detailed description of the business being sold is provided, including its name, address, type of business, assets, and any additional relevant information. 3. Purchase Price: The agreed-upon purchase price for the business is clearly stated in the document, which includes any deposits or down payments made by the buyer. 4. Payment Terms: The bill of sale outlines the payment terms, such as whether it will be a lump-sum payment or installments, and the payment due dates. 5. Assets and Liabilities: This section lists all the assets and liabilities associated with the business being sold. It may include equipment, real estate, inventory, intellectual property, pending contracts, outstanding debts, and any other obligations. 6. Representations and Warranties: The seller makes certain statements, representations, and warranties regarding the business being sold. This section ensures that the buyer receives accurate information and protects them from any undisclosed issues or liabilities. 7. Non-Compete Agreement: In some cases, a non-compete agreement might be included. This prohibits the seller from engaging in a similar business within a defined time and geographic area. 8. Governing Law: The bill of sale states that it is governed by the laws of the state of Texas, specifically the city of Fort Worth. Different types or variations of the Fort Worth Texas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller may exist based on specific requirements or additional clauses that are applicable to the business being sold. For example: 1. Asset Purchase Agreement: In this type of bill of sale, only the assets of the business are transferred, excluding any liabilities or obligations. 2. Stock Purchase Agreement: This type of bill of sale is used when the buyer acquires the ownership interest or shares of a corporation. 3. Membership Interest Purchase Agreement: Instead of buying stocks, this type of bill of sale is used when the buyer acquires the membership interests or shares of a limited liability company (LLC). It is essential to consult an attorney or legal expert to ensure that the bill of sale accurately reflects the intentions of both parties and complies with all relevant laws and regulations in Fort Worth, Texas.The Fort Worth Texas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is a legal document that serves as proof of transfer of ownership of a business from an individual or a corporate seller to a buyer. It is an essential document that outlines the terms and conditions of the sale, recording all pertinent details about the transaction. Keywords: Fort Worth Texas, bill of sale, sale of business, individual seller, corporate seller, transfer of ownership, legal document, terms and conditions, transaction. This bill of sale includes various sections that provide comprehensive information about the sale agreement. Some of these sections may include: 1. Parties Involved: The document identifies the parties involved in the transaction, including the individual or corporate seller(s) and the buyer. 2. Business Description: A detailed description of the business being sold is provided, including its name, address, type of business, assets, and any additional relevant information. 3. Purchase Price: The agreed-upon purchase price for the business is clearly stated in the document, which includes any deposits or down payments made by the buyer. 4. Payment Terms: The bill of sale outlines the payment terms, such as whether it will be a lump-sum payment or installments, and the payment due dates. 5. Assets and Liabilities: This section lists all the assets and liabilities associated with the business being sold. It may include equipment, real estate, inventory, intellectual property, pending contracts, outstanding debts, and any other obligations. 6. Representations and Warranties: The seller makes certain statements, representations, and warranties regarding the business being sold. This section ensures that the buyer receives accurate information and protects them from any undisclosed issues or liabilities. 7. Non-Compete Agreement: In some cases, a non-compete agreement might be included. This prohibits the seller from engaging in a similar business within a defined time and geographic area. 8. Governing Law: The bill of sale states that it is governed by the laws of the state of Texas, specifically the city of Fort Worth. Different types or variations of the Fort Worth Texas Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller may exist based on specific requirements or additional clauses that are applicable to the business being sold. For example: 1. Asset Purchase Agreement: In this type of bill of sale, only the assets of the business are transferred, excluding any liabilities or obligations. 2. Stock Purchase Agreement: This type of bill of sale is used when the buyer acquires the ownership interest or shares of a corporation. 3. Membership Interest Purchase Agreement: Instead of buying stocks, this type of bill of sale is used when the buyer acquires the membership interests or shares of a limited liability company (LLC). It is essential to consult an attorney or legal expert to ensure that the bill of sale accurately reflects the intentions of both parties and complies with all relevant laws and regulations in Fort Worth, Texas.