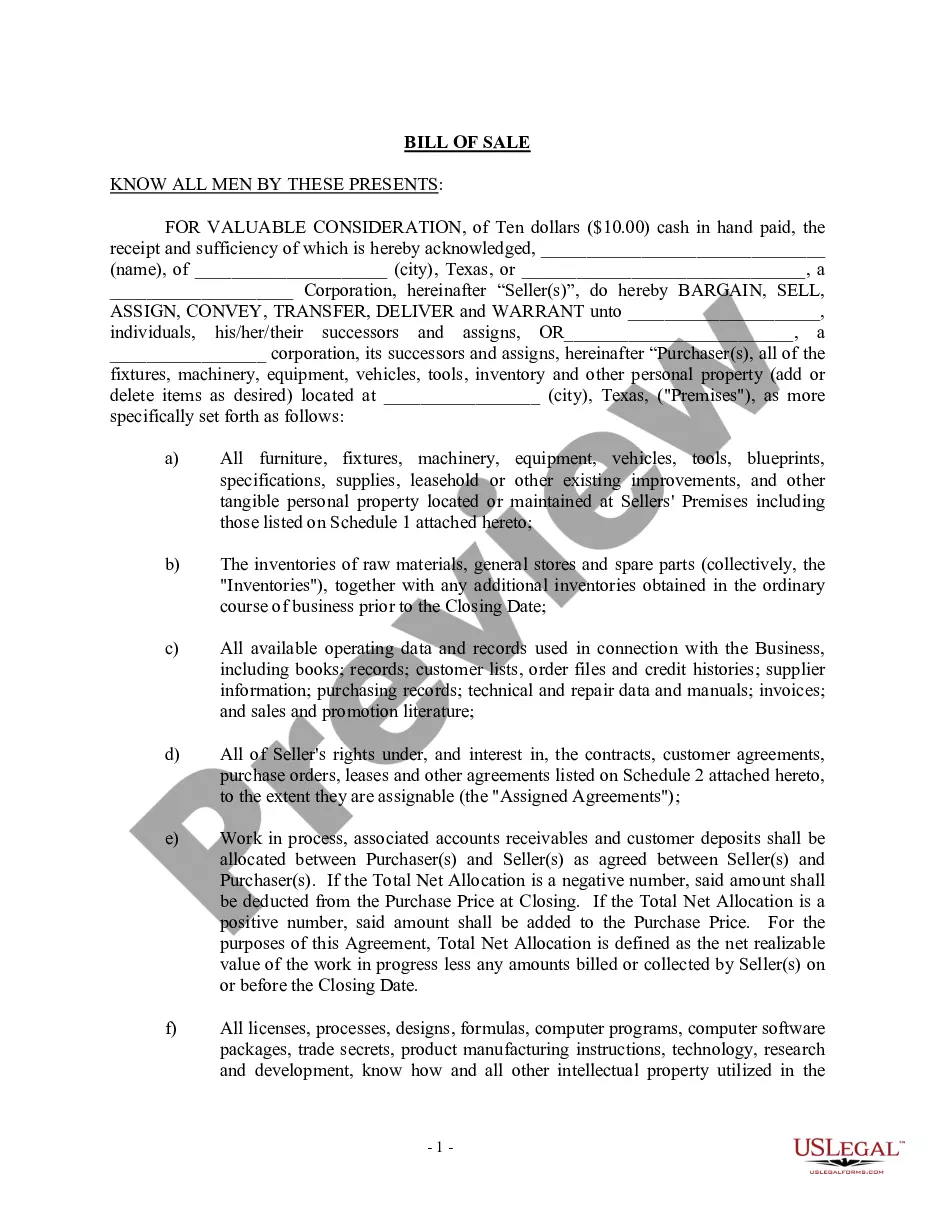

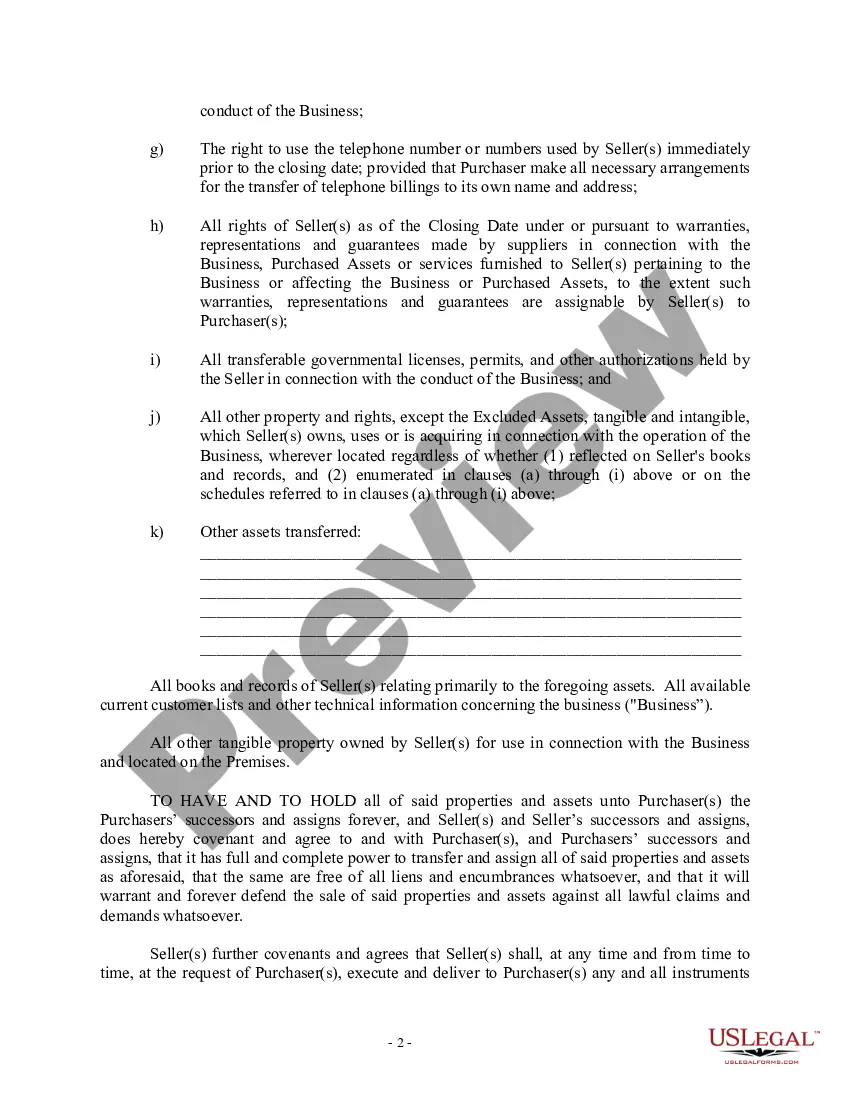

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

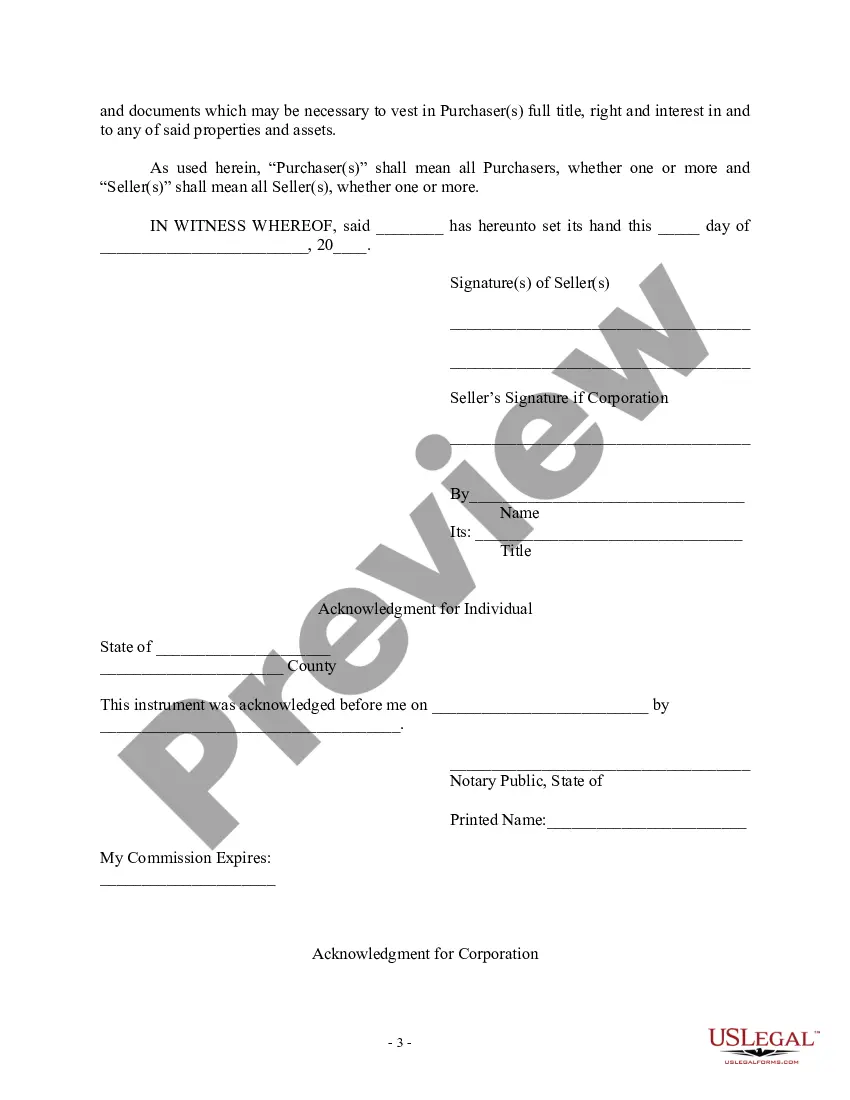

The Houston Texas Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legal document that outlines the terms and conditions of a business sale transaction. This document is crucial for both the buyer and the seller as it serves as proof of the transfer of ownership and helps protect the interests of both parties. The Bill of Sale typically includes relevant details such as the names and contact information of both the buyer and the seller, the business entity being sold, the purchase price, and the terms of payment. It also contains a detailed description of the assets and liabilities included in the sale, which may consist of physical assets like equipment, inventory, and real estate, as well as intangible assets like contracts, goodwill, and intellectual property. In addition to these general aspects, there may be different types of Houston Texas Bill of Sale in connection with the sale of a business by an individual or corporate seller, depending on the specific circumstances of the transaction. Some of these variations include: 1. Asset Purchase Agreement: This type of Bill of Sale is used when the buyer only wants to purchase specific assets of the business rather than acquiring the entire entity. It includes a comprehensive list of the assets being transferred, along with any associated liabilities. 2. Stock Purchase Agreement: When the buyer wants to acquire the entire business entity, including ownership of stocks or shares, a Stock Purchase Agreement is used. This agreement outlines the terms and conditions regarding the transfer of ownership and may include provisions for shareholder rights, voting rights, and warranties. 3. Merger or Acquisition Agreement: In cases where one company is acquiring another, a merger or acquisition agreement is used instead of a traditional Bill of Sale. This agreement outlines the terms of the merger or acquisition, including the exchange of shares, assets, and liabilities, as well as any regulatory or legal requirements that need to be met. It is essential for both the buyer and the seller to carefully review and understand the contents of the Houston Texas Bill of Sale before signing it. Seeking legal advice from an attorney specializing in business transactions can help ensure that all the necessary information is included and that the agreement accurately reflects the intentions of both parties. Additionally, the Bill of Sale should adhere to all relevant state laws and regulations to ensure its validity and enforceability.The Houston Texas Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legal document that outlines the terms and conditions of a business sale transaction. This document is crucial for both the buyer and the seller as it serves as proof of the transfer of ownership and helps protect the interests of both parties. The Bill of Sale typically includes relevant details such as the names and contact information of both the buyer and the seller, the business entity being sold, the purchase price, and the terms of payment. It also contains a detailed description of the assets and liabilities included in the sale, which may consist of physical assets like equipment, inventory, and real estate, as well as intangible assets like contracts, goodwill, and intellectual property. In addition to these general aspects, there may be different types of Houston Texas Bill of Sale in connection with the sale of a business by an individual or corporate seller, depending on the specific circumstances of the transaction. Some of these variations include: 1. Asset Purchase Agreement: This type of Bill of Sale is used when the buyer only wants to purchase specific assets of the business rather than acquiring the entire entity. It includes a comprehensive list of the assets being transferred, along with any associated liabilities. 2. Stock Purchase Agreement: When the buyer wants to acquire the entire business entity, including ownership of stocks or shares, a Stock Purchase Agreement is used. This agreement outlines the terms and conditions regarding the transfer of ownership and may include provisions for shareholder rights, voting rights, and warranties. 3. Merger or Acquisition Agreement: In cases where one company is acquiring another, a merger or acquisition agreement is used instead of a traditional Bill of Sale. This agreement outlines the terms of the merger or acquisition, including the exchange of shares, assets, and liabilities, as well as any regulatory or legal requirements that need to be met. It is essential for both the buyer and the seller to carefully review and understand the contents of the Houston Texas Bill of Sale before signing it. Seeking legal advice from an attorney specializing in business transactions can help ensure that all the necessary information is included and that the agreement accurately reflects the intentions of both parties. Additionally, the Bill of Sale should adhere to all relevant state laws and regulations to ensure its validity and enforceability.