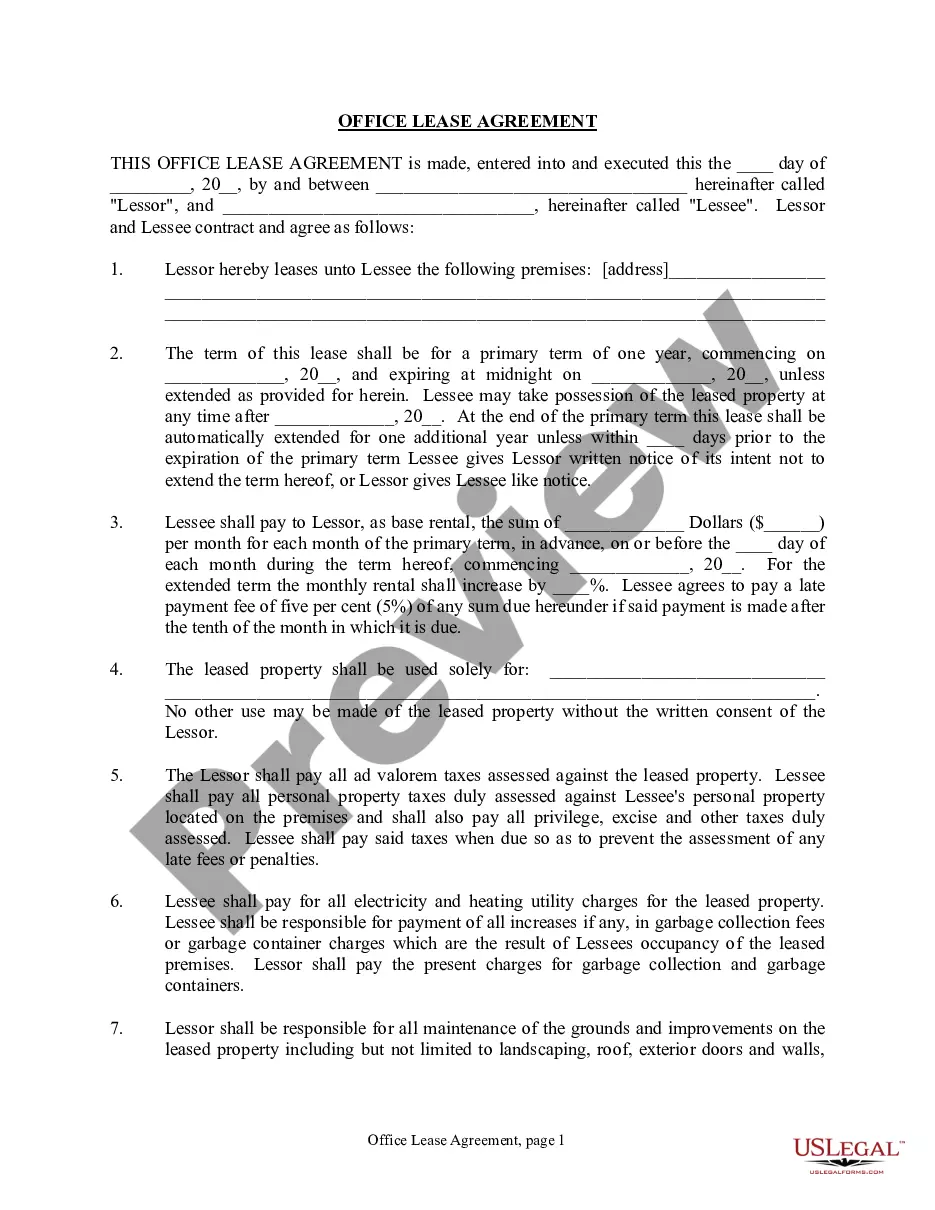

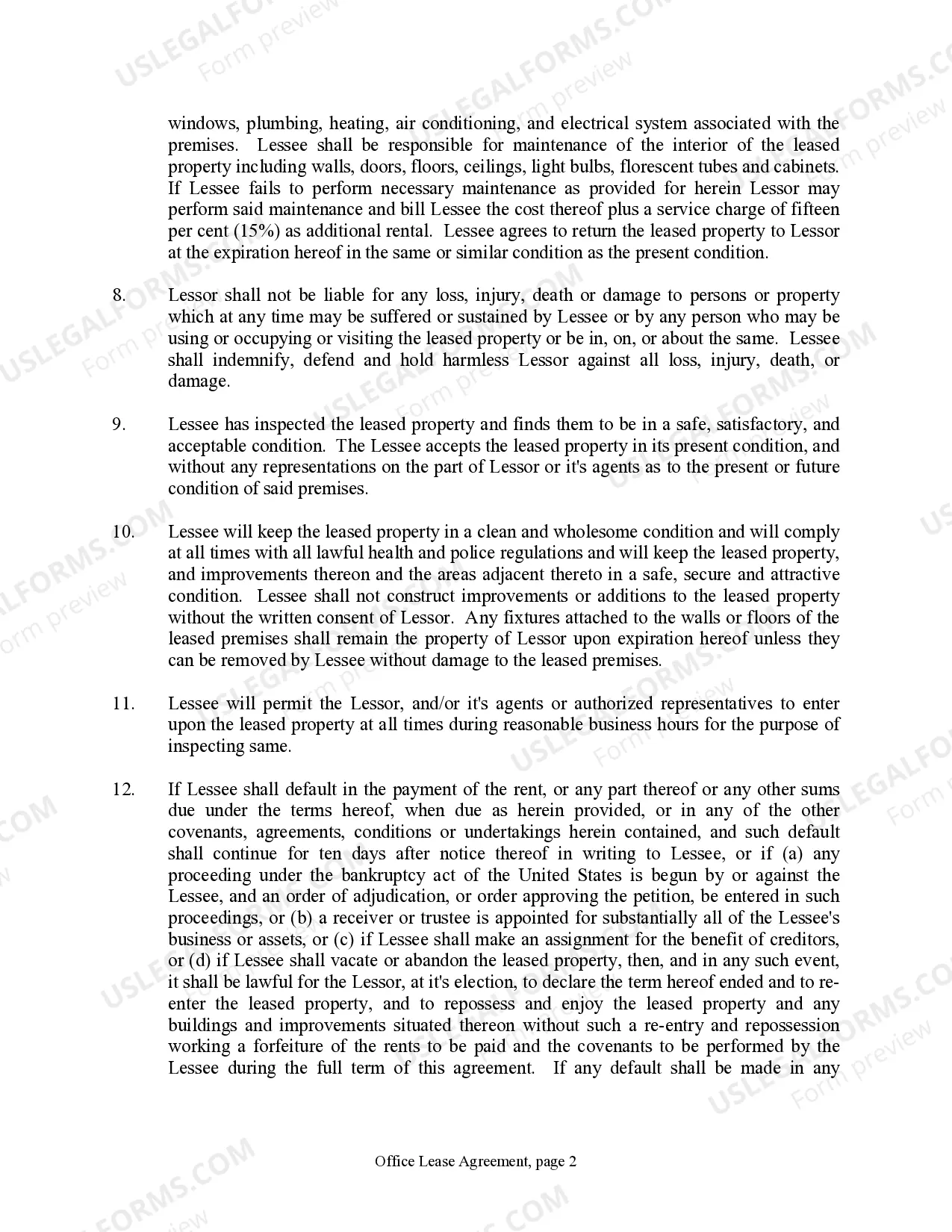

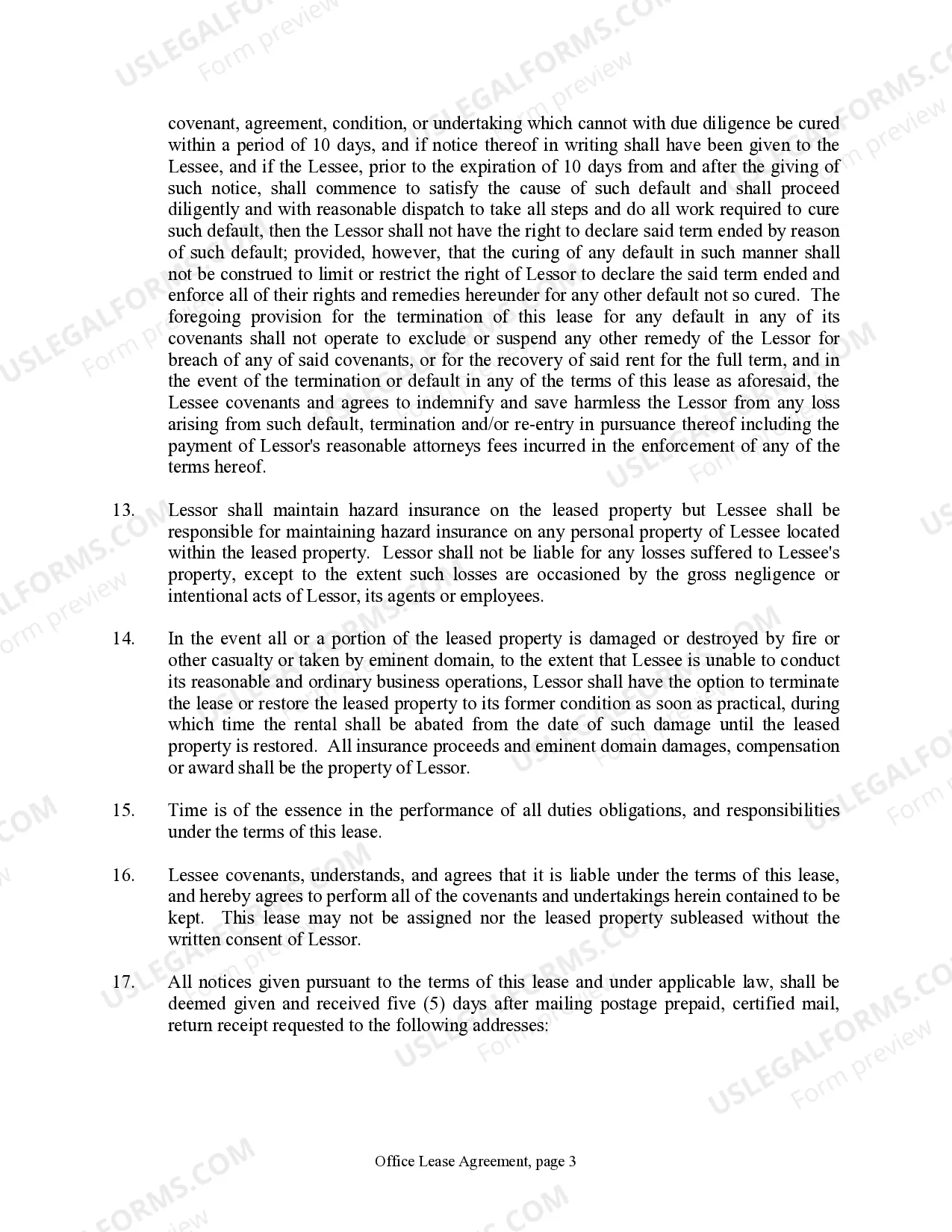

This form is a contract to Lease office space from property owner to tenant. This contract will include lease terms that are compliant with state statutory law. Tenant must abide by terms of the lease and its conditions as agreed.

The Houston Texas Office Lease Agreement is a legally binding contract that outlines the terms and conditions for leasing office space in Houston, Texas. This agreement is typically entered into between the landlord, who owns the office space, and the tenant, who wishes to lease the space for their business. The Houston Texas Office Lease Agreement covers various aspects of the lease, such as the duration of the lease, rental payment details, security deposit requirements, and the rights and responsibilities of both the landlord and the tenant. It ensures that both parties understand their obligations and helps prevent potential disputes or misunderstandings during the course of the lease. Within the Houston Texas Office Lease Agreement, there can be variations and different types depending on the specific needs and circumstances of the landlord and tenant. While there are no standardized names for the different types, they can be classified based on key factors such as lease duration, payment terms, and specific clauses included. Some potential variations could include: 1. Short-Term Lease Agreement: This type of agreement typically covers a shorter duration, such as less than one year, which is suitable for businesses requiring temporary office space or anticipating changes in their office needs. 2. Long-Term Lease Agreement: This agreement is designed for a more extended period, generally ranging from one to several years. It provides stability for businesses that require a long-term commitment to their office space. 3. Gross Lease Agreement: Under this type of agreement, the tenant pays a fixed amount of rent that includes all costs, such as utilities, maintenance, and property taxes. The landlord is responsible for managing these expenses. 4. Net Lease Agreement: In a net lease, the tenant pays a lower base rent, but also covers additional expenses such as property taxes, insurance, and maintenance costs. There are various types of net leases, such as single net, double net, and triple net leases, where the tenant's responsibilities for expenses may vary. 5. Modified Gross Lease Agreement: This type of lease combines elements of both gross and net leases. The base rent includes some, but not all, additional costs, which are itemized separately and shared between the landlord and the tenant. These are just a few examples, and the exact terms and conditions can vary depending on the negotiations between the landlord and the tenant. It is crucial for both parties to carefully review and understand the Houston Texas Office Lease Agreement before signing, seeking legal advice if necessary, to ensure that all relevant aspects are covered and adequately protect their interests.The Houston Texas Office Lease Agreement is a legally binding contract that outlines the terms and conditions for leasing office space in Houston, Texas. This agreement is typically entered into between the landlord, who owns the office space, and the tenant, who wishes to lease the space for their business. The Houston Texas Office Lease Agreement covers various aspects of the lease, such as the duration of the lease, rental payment details, security deposit requirements, and the rights and responsibilities of both the landlord and the tenant. It ensures that both parties understand their obligations and helps prevent potential disputes or misunderstandings during the course of the lease. Within the Houston Texas Office Lease Agreement, there can be variations and different types depending on the specific needs and circumstances of the landlord and tenant. While there are no standardized names for the different types, they can be classified based on key factors such as lease duration, payment terms, and specific clauses included. Some potential variations could include: 1. Short-Term Lease Agreement: This type of agreement typically covers a shorter duration, such as less than one year, which is suitable for businesses requiring temporary office space or anticipating changes in their office needs. 2. Long-Term Lease Agreement: This agreement is designed for a more extended period, generally ranging from one to several years. It provides stability for businesses that require a long-term commitment to their office space. 3. Gross Lease Agreement: Under this type of agreement, the tenant pays a fixed amount of rent that includes all costs, such as utilities, maintenance, and property taxes. The landlord is responsible for managing these expenses. 4. Net Lease Agreement: In a net lease, the tenant pays a lower base rent, but also covers additional expenses such as property taxes, insurance, and maintenance costs. There are various types of net leases, such as single net, double net, and triple net leases, where the tenant's responsibilities for expenses may vary. 5. Modified Gross Lease Agreement: This type of lease combines elements of both gross and net leases. The base rent includes some, but not all, additional costs, which are itemized separately and shared between the landlord and the tenant. These are just a few examples, and the exact terms and conditions can vary depending on the negotiations between the landlord and the tenant. It is crucial for both parties to carefully review and understand the Houston Texas Office Lease Agreement before signing, seeking legal advice if necessary, to ensure that all relevant aspects are covered and adequately protect their interests.