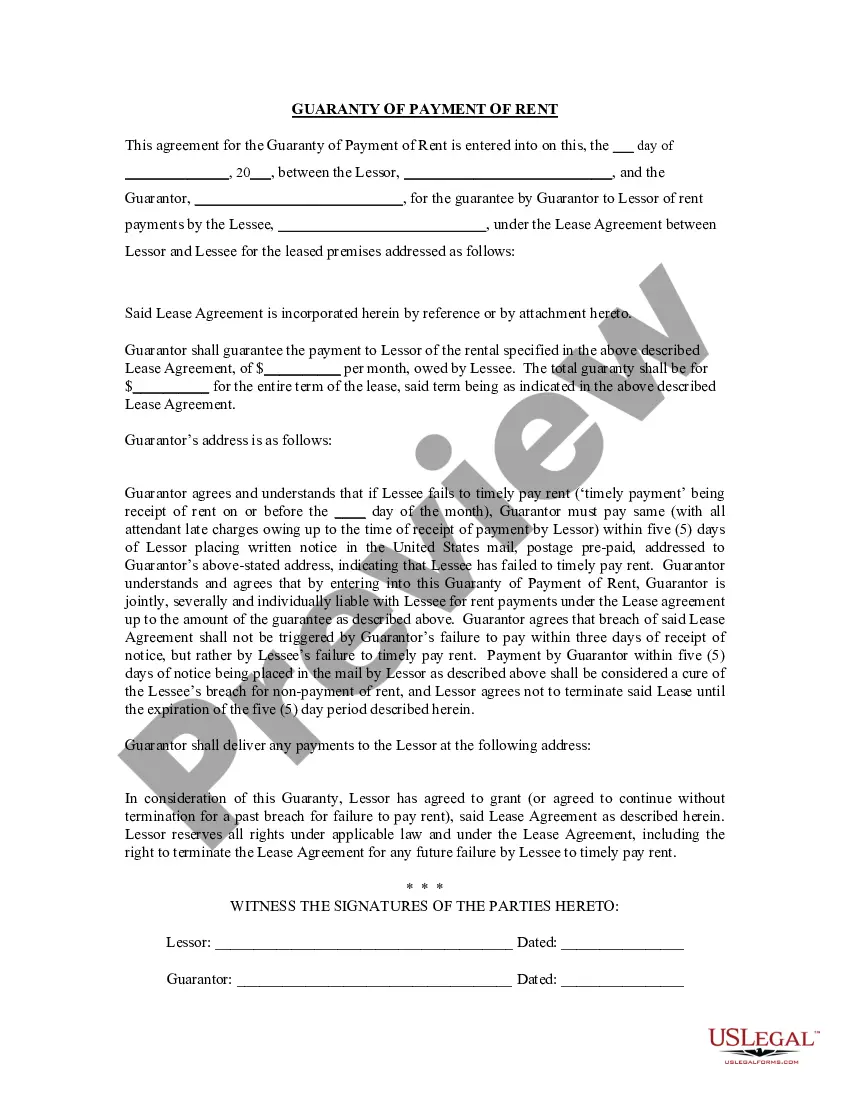

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Arlington Texas Guaranty or Guarantee of Payment of Rent refers to a legal agreement in which a third party assumes responsibility for fulfilling the rental payments if the tenant is unable to meet their financial obligations. This ensures that landlords receive the rent owed to them even if the tenant defaults on their payment. This type of agreement is typically used by landlords or property owners in Arlington, Texas, to protect themselves from potential financial loss caused by tenant default. By having a guarantor or a guaranty of payment of rent, property owners can have peace of mind knowing they have a backup plan in place to ensure uninterrupted rental income. There can be different types of Arlington Texas Guaranty or Guarantee of Payment of Rent: 1. Personal Guaranty: A personal guaranty is the most common type, where an individual (typically a friend or family member of the tenant) agrees to assume the responsibility of rental payments if the tenant fails to pay. 2. Corporate Guaranty: In some cases, a corporation or business entity may assume the role of the guarantor. This occurs when a business is leasing a property, and one of its directors or partners guarantees the rent payment on behalf of the company. 3. Institutional Guaranty: An institutional guaranty involves having a financial institution, such as a bank or an insurance company, guarantee the rent payment on behalf of the tenant. This type of guaranty is usually employed for high-value leases or commercial properties. 4. Lease Deposit: While not strictly a guaranty, landlords in Arlington, Texas, may require tenants to pay a significant lease deposit upfront. This deposit acts as insurance for the landlord, as they can use it to cover any unpaid rent or damages caused by the tenant. However, the deposit does not involve a third party assuming responsibility for rent payment like the other types of guaranties. In conclusion, an Arlington Texas Guaranty or Guarantee of Payment of Rent is an agreement that protects landlords from financial losses due to tenant default. Different types of guaranties can be used, including personal guaranties, corporate guaranties, institutional guaranties, and lease deposits. These ensure landlords in Arlington, Texas, receive their rental payments consistently and provide peace of mind in their leasing arrangements.Arlington Texas Guaranty or Guarantee of Payment of Rent refers to a legal agreement in which a third party assumes responsibility for fulfilling the rental payments if the tenant is unable to meet their financial obligations. This ensures that landlords receive the rent owed to them even if the tenant defaults on their payment. This type of agreement is typically used by landlords or property owners in Arlington, Texas, to protect themselves from potential financial loss caused by tenant default. By having a guarantor or a guaranty of payment of rent, property owners can have peace of mind knowing they have a backup plan in place to ensure uninterrupted rental income. There can be different types of Arlington Texas Guaranty or Guarantee of Payment of Rent: 1. Personal Guaranty: A personal guaranty is the most common type, where an individual (typically a friend or family member of the tenant) agrees to assume the responsibility of rental payments if the tenant fails to pay. 2. Corporate Guaranty: In some cases, a corporation or business entity may assume the role of the guarantor. This occurs when a business is leasing a property, and one of its directors or partners guarantees the rent payment on behalf of the company. 3. Institutional Guaranty: An institutional guaranty involves having a financial institution, such as a bank or an insurance company, guarantee the rent payment on behalf of the tenant. This type of guaranty is usually employed for high-value leases or commercial properties. 4. Lease Deposit: While not strictly a guaranty, landlords in Arlington, Texas, may require tenants to pay a significant lease deposit upfront. This deposit acts as insurance for the landlord, as they can use it to cover any unpaid rent or damages caused by the tenant. However, the deposit does not involve a third party assuming responsibility for rent payment like the other types of guaranties. In conclusion, an Arlington Texas Guaranty or Guarantee of Payment of Rent is an agreement that protects landlords from financial losses due to tenant default. Different types of guaranties can be used, including personal guaranties, corporate guaranties, institutional guaranties, and lease deposits. These ensure landlords in Arlington, Texas, receive their rental payments consistently and provide peace of mind in their leasing arrangements.