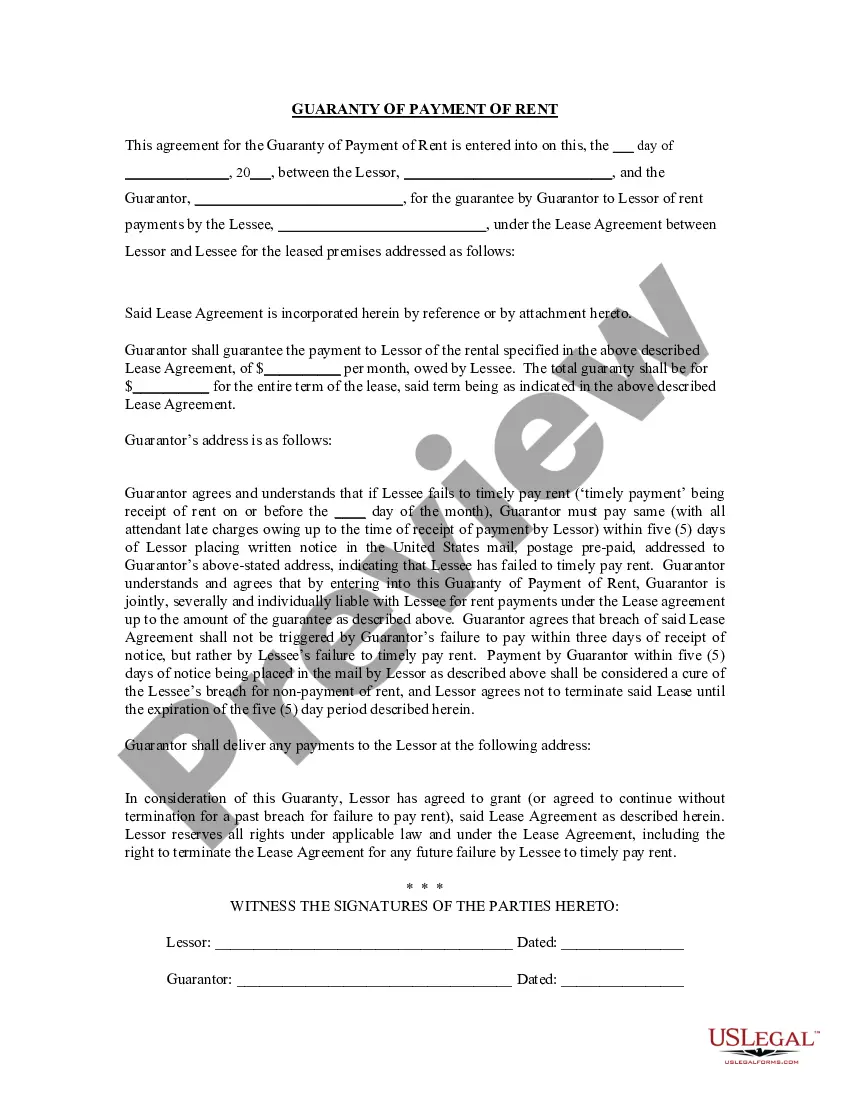

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Brownsville Texas Guaranty or Guarantee of Payment of Rent is a legal document that ensures the landlord's rent will be paid on time and in full. It is a written agreement between the landlord and a third-party guarantor, often required when the tenant's income or creditworthiness is questionable. The guarantor agrees to cover the tenant's rental obligations in case of default, ensuring the landlord's financial security. In Brownsville Texas, there are two types of Guaranty or Guarantee of Payment of Rent commonly used: 1. Individual Guarantor: This type of guaranty involves a specific person taking on the responsibility of the tenant's rent payment. Typically, a friend, family member, or business associate with a stable income and good credit history acts as the guarantor. The individual guarantor agrees to be personally liable for the rent payments if the tenant fails to meet their obligations. 2. Corporate Guarantor: In some cases, landlords may require a corporate guarantor, especially when dealing with commercial properties. A corporation, often with substantial assets and financial stability, guarantees the rental payments on behalf of the tenant. This type of guarantor ensures that rent will be paid even if the tenant's business struggles or faces financial difficulties. The Brownsville Texas Guaranty or Guarantee of Payment of Rent is an essential safeguard for landlords, protecting their financial interests and reducing the risk of rental income losses. The agreement outlines the responsibilities and liabilities of the guarantor, including when their obligation takes effect, the duration, and the maximum amount of rent to be covered. Landlords commonly insert relevant clauses such as automatic rent increases carrying over to the guarantor's responsibility, specified late fees, and penalties for non-payment. The Guaranty or Guarantee of Payment of Rent also establishes the process for invoking the guarantor’s obligation, such as providing proper notice and any required documentation. In Brownsville, Texas, these Guaranty or Guarantee of Payment of Rent documents are often prepared by legal professionals to ensure compliance with local laws and regulations. It's crucial for both landlords and guarantors to thoroughly review and understand the terms before signing, as it establishes a legally binding agreement. Keywords: Brownsville Texas, Guaranty, Guarantee of Payment, Rent, third-party guarantor, legal document, landlord, tenant, default, financial security, creditworthiness, income, individual guarantor, corporate guarantor, commercial properties, assets, financial stability, liability, safeguard, risk, rental income, agreement, responsibilities, liabilities, automatic rent increases, late fees, penalties, non-payment, notice, documentation, legal professionals, compliance, local laws, regulations, legally binding agreement.Brownsville Texas Guaranty or Guarantee of Payment of Rent is a legal document that ensures the landlord's rent will be paid on time and in full. It is a written agreement between the landlord and a third-party guarantor, often required when the tenant's income or creditworthiness is questionable. The guarantor agrees to cover the tenant's rental obligations in case of default, ensuring the landlord's financial security. In Brownsville Texas, there are two types of Guaranty or Guarantee of Payment of Rent commonly used: 1. Individual Guarantor: This type of guaranty involves a specific person taking on the responsibility of the tenant's rent payment. Typically, a friend, family member, or business associate with a stable income and good credit history acts as the guarantor. The individual guarantor agrees to be personally liable for the rent payments if the tenant fails to meet their obligations. 2. Corporate Guarantor: In some cases, landlords may require a corporate guarantor, especially when dealing with commercial properties. A corporation, often with substantial assets and financial stability, guarantees the rental payments on behalf of the tenant. This type of guarantor ensures that rent will be paid even if the tenant's business struggles or faces financial difficulties. The Brownsville Texas Guaranty or Guarantee of Payment of Rent is an essential safeguard for landlords, protecting their financial interests and reducing the risk of rental income losses. The agreement outlines the responsibilities and liabilities of the guarantor, including when their obligation takes effect, the duration, and the maximum amount of rent to be covered. Landlords commonly insert relevant clauses such as automatic rent increases carrying over to the guarantor's responsibility, specified late fees, and penalties for non-payment. The Guaranty or Guarantee of Payment of Rent also establishes the process for invoking the guarantor’s obligation, such as providing proper notice and any required documentation. In Brownsville, Texas, these Guaranty or Guarantee of Payment of Rent documents are often prepared by legal professionals to ensure compliance with local laws and regulations. It's crucial for both landlords and guarantors to thoroughly review and understand the terms before signing, as it establishes a legally binding agreement. Keywords: Brownsville Texas, Guaranty, Guarantee of Payment, Rent, third-party guarantor, legal document, landlord, tenant, default, financial security, creditworthiness, income, individual guarantor, corporate guarantor, commercial properties, assets, financial stability, liability, safeguard, risk, rental income, agreement, responsibilities, liabilities, automatic rent increases, late fees, penalties, non-payment, notice, documentation, legal professionals, compliance, local laws, regulations, legally binding agreement.