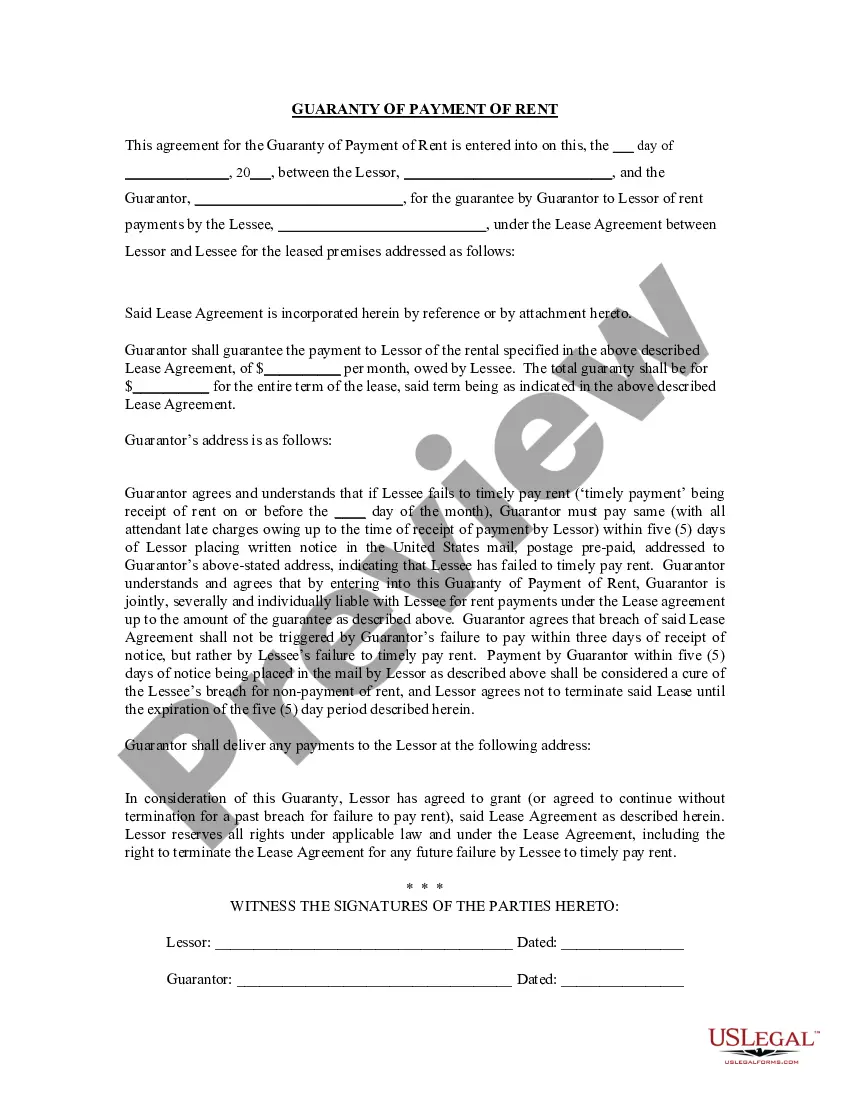

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Dallas Texas Guaranty or Guarantee of Payment of Rent is a legal agreement that gives landlords an added layer of financial protection in case a tenant fails to pay rent on time or breaches the terms of the lease agreement. This guarantee is typically provided by a third party, who agrees to take on the responsibility of paying the rent if the tenant defaults. In Dallas, Texas, Guaranty or Guarantee of Payment of Rent is commonly used in various lease agreements, especially in commercial real estate settings. Landlords often require this guarantee to ensure steady and reliable rental income, particularly when renting out high-value properties or dealing with tenants who may have limited credit history. There are different types of Guaranty or Guarantee of Payment of Rent options available in Dallas, Texas: 1. Individual Guaranty: This type of guarantee involves an individual, often a close relative or friend of the tenant, who agrees to shoulder the responsibility of rent payment if the tenant is unable to do so. Landlords may request financial information and credit history of the individual guarantor to ensure their ability to meet rental obligations. 2. Corporate Guaranty: In some cases, landlords require a corporate guarantor to guarantee the payment of rent. This involves a company or corporation assuming the responsibility for rent payments on behalf of the tenant. Generally, the corporation must have sufficient financial strength and creditworthiness to be eligible for such a guarantee. 3. Limited Guaranty: A limited guaranty puts certain conditions or limits on the guarantor's responsibility for rent payment. For instance, the guarantor may guarantee only a portion of the rent or limit the duration of the guarantee to a specific period. This provides landlords with flexibility and minimizes the extent of financial risk. 4. Unconditional Guaranty: An unconditional guaranty holds the guarantor fully responsible for any missed or default rent payments by the tenant. This type of guarantee provides the highest level of assurance to the landlord, as any non-payment would trigger immediate action from the guarantor. Dallas Texas Guaranty or Guarantee of Payment of Rent is an essential tool for landlords to mitigate the financial risks associated with rental properties. It provides additional security, ensuring a consistent stream of rental income for property owners.Dallas Texas Guaranty or Guarantee of Payment of Rent is a legal agreement that gives landlords an added layer of financial protection in case a tenant fails to pay rent on time or breaches the terms of the lease agreement. This guarantee is typically provided by a third party, who agrees to take on the responsibility of paying the rent if the tenant defaults. In Dallas, Texas, Guaranty or Guarantee of Payment of Rent is commonly used in various lease agreements, especially in commercial real estate settings. Landlords often require this guarantee to ensure steady and reliable rental income, particularly when renting out high-value properties or dealing with tenants who may have limited credit history. There are different types of Guaranty or Guarantee of Payment of Rent options available in Dallas, Texas: 1. Individual Guaranty: This type of guarantee involves an individual, often a close relative or friend of the tenant, who agrees to shoulder the responsibility of rent payment if the tenant is unable to do so. Landlords may request financial information and credit history of the individual guarantor to ensure their ability to meet rental obligations. 2. Corporate Guaranty: In some cases, landlords require a corporate guarantor to guarantee the payment of rent. This involves a company or corporation assuming the responsibility for rent payments on behalf of the tenant. Generally, the corporation must have sufficient financial strength and creditworthiness to be eligible for such a guarantee. 3. Limited Guaranty: A limited guaranty puts certain conditions or limits on the guarantor's responsibility for rent payment. For instance, the guarantor may guarantee only a portion of the rent or limit the duration of the guarantee to a specific period. This provides landlords with flexibility and minimizes the extent of financial risk. 4. Unconditional Guaranty: An unconditional guaranty holds the guarantor fully responsible for any missed or default rent payments by the tenant. This type of guarantee provides the highest level of assurance to the landlord, as any non-payment would trigger immediate action from the guarantor. Dallas Texas Guaranty or Guarantee of Payment of Rent is an essential tool for landlords to mitigate the financial risks associated with rental properties. It provides additional security, ensuring a consistent stream of rental income for property owners.