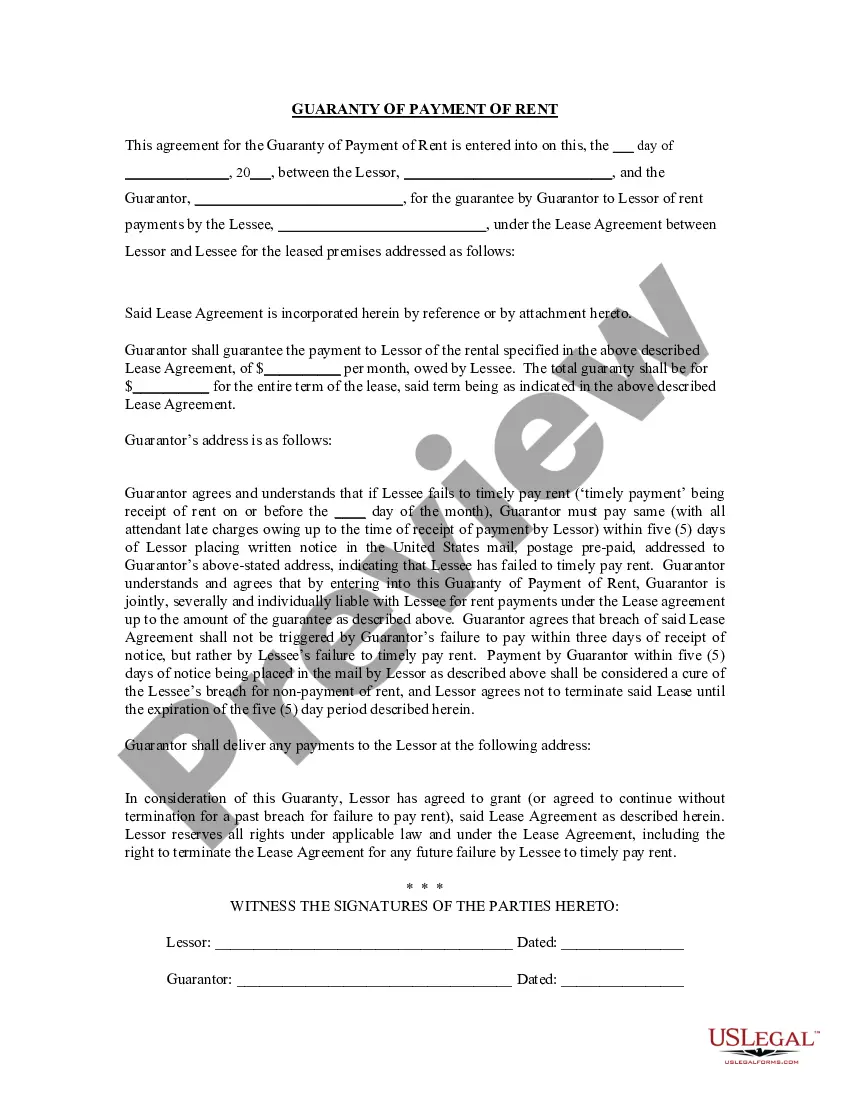

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Harris Texas Guaranty or Guarantee of Payment of Rent refers to a legal agreement commonly used in the state of Texas to secure the payment of rent from a tenant. This type of guarantee provides financial protection for landlords, ensuring that they receive rental payments consistently and timely. Landlords often require tenants to provide a guarantee of payment to minimize the risk of potential default on rent obligations. The Harris Texas Guaranty or Guarantee of Payment of Rent is a legally binding document that outlines the terms and conditions of the arrangement between the landlord and the guarantor. A guarantor, often a friend, family member, or a financial institution, agrees to be responsible for paying the rent in case the tenant fails to do so. This guarantee is aimed at enhancing the landlord's confidence in the tenant's financial capability and integrity. There are several types of Harris Texas Guaranty or Guarantee of Payment of Rent, each with its own conditions and considerations: 1. Individual Guarantor: This type of guarantee involves a specific individual, typically a friend or family member of the tenant, who assumes the responsibility of paying the rent if the tenant cannot fulfill their obligations. The individual guarantor is often required to undergo a credit check to gauge their financial stability. 2. Corporate Guarantor: In some cases, the tenant's employer or a corporation can act as a corporate guarantor. This arrangement is commonly seen when the tenant is a business or an organization. The corporate guarantor assumes the responsibility to pay the rent in case of tenant default. 3. Third-Party Guarantor: In situations where the tenant does not have an individual or corporate guarantor, a third-party guarantor may step in. Third-party guarantors can be financial institutions or companies that provide guarantee services for a fee. They act as a neutral party ensuring the landlord's rent payment in case of tenant default. 4. Limited Guaranty: A limited guaranty places certain restrictions or limits on the guarantor's liability. For instance, the guarantor may only be responsible for a portion of the rent or for a limited period of time, depending on the terms agreed upon in the guarantee agreement. Overall, the Harris Texas Guaranty or Guarantee of Payment of Rent provides a crucial layer of protection for landlords, ensuring that they receive rent payments even if the tenant fails to fulfill their obligations. The specific type of guarantee chosen depends on the unique circumstances of the tenancy and the preferences of the landlord.Harris Texas Guaranty or Guarantee of Payment of Rent refers to a legal agreement commonly used in the state of Texas to secure the payment of rent from a tenant. This type of guarantee provides financial protection for landlords, ensuring that they receive rental payments consistently and timely. Landlords often require tenants to provide a guarantee of payment to minimize the risk of potential default on rent obligations. The Harris Texas Guaranty or Guarantee of Payment of Rent is a legally binding document that outlines the terms and conditions of the arrangement between the landlord and the guarantor. A guarantor, often a friend, family member, or a financial institution, agrees to be responsible for paying the rent in case the tenant fails to do so. This guarantee is aimed at enhancing the landlord's confidence in the tenant's financial capability and integrity. There are several types of Harris Texas Guaranty or Guarantee of Payment of Rent, each with its own conditions and considerations: 1. Individual Guarantor: This type of guarantee involves a specific individual, typically a friend or family member of the tenant, who assumes the responsibility of paying the rent if the tenant cannot fulfill their obligations. The individual guarantor is often required to undergo a credit check to gauge their financial stability. 2. Corporate Guarantor: In some cases, the tenant's employer or a corporation can act as a corporate guarantor. This arrangement is commonly seen when the tenant is a business or an organization. The corporate guarantor assumes the responsibility to pay the rent in case of tenant default. 3. Third-Party Guarantor: In situations where the tenant does not have an individual or corporate guarantor, a third-party guarantor may step in. Third-party guarantors can be financial institutions or companies that provide guarantee services for a fee. They act as a neutral party ensuring the landlord's rent payment in case of tenant default. 4. Limited Guaranty: A limited guaranty places certain restrictions or limits on the guarantor's liability. For instance, the guarantor may only be responsible for a portion of the rent or for a limited period of time, depending on the terms agreed upon in the guarantee agreement. Overall, the Harris Texas Guaranty or Guarantee of Payment of Rent provides a crucial layer of protection for landlords, ensuring that they receive rent payments even if the tenant fails to fulfill their obligations. The specific type of guarantee chosen depends on the unique circumstances of the tenancy and the preferences of the landlord.