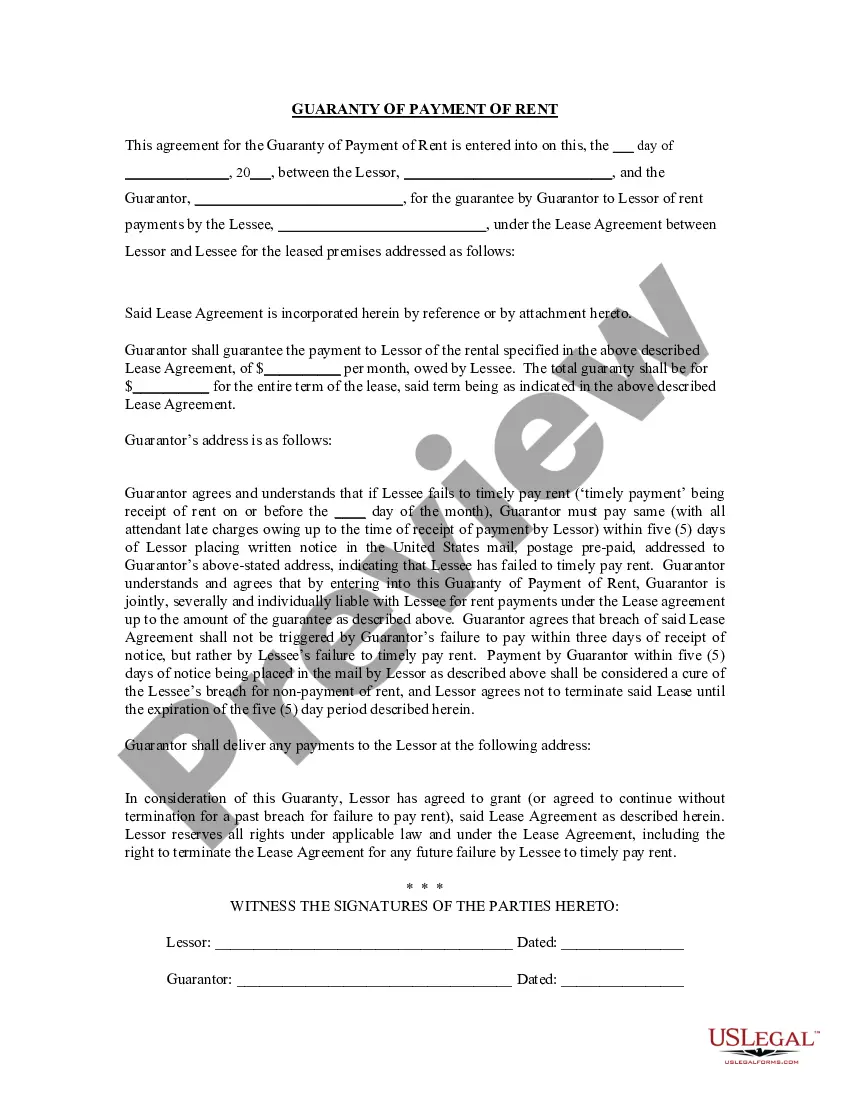

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Houston Texas Guaranty or Guarantee of Payment of Rent is a legal agreement that provides assurance to a landlord that rent will be paid on time and in full by a third party in the event that the tenant defaults on their rent payments. This guarantee serves as a form of financial security for the landlord. The Houston Texas Guaranty or Guarantee of Payment of Rent is typically used in commercial leasing agreements but may also be applicable in residential rental agreements. It is particularly important in situations where the tenant has no established credit history or has a poor credit rating. There are different types of Houston Texas Guaranty or Guarantee of Payment of Rent that may be utilized depending on the specific circumstances of the lease agreement. Some of these types include: 1. Individual Guaranty: This form of guarantee involves an individual, usually a family member or close friend of the tenant, agreeing to be responsible for the payment of rent if the tenant fails to do so. The individual guarantor's personal assets may be at risk in case of default. 2. Corporate Guaranty: In some cases, a business entity may act as the guarantor and assume the responsibility of rent payment on behalf of the tenant. This type of guarantee usually requires the corporation to have sufficient financial resources to cover the rent and potential damages. 3. Letter of Credit: A letter of credit is a financial document issued by a bank on behalf of the tenant, promising to pay the landlord up to a specified amount in case of default. The landlord can draw on the letter of credit if the tenant fails to make rent payments. Each type of guarantee has its own advantages and disadvantages. Landlords typically evaluate the creditworthiness and financial standing of potential guarantors before entering into a lease agreement. The Houston Texas Guaranty or Guarantee of Payment of Rent provides landlords with a layer of security and peace of mind, ensuring that their rental income will be protected even if the tenant fails to meet their obligations.Houston Texas Guaranty or Guarantee of Payment of Rent is a legal agreement that provides assurance to a landlord that rent will be paid on time and in full by a third party in the event that the tenant defaults on their rent payments. This guarantee serves as a form of financial security for the landlord. The Houston Texas Guaranty or Guarantee of Payment of Rent is typically used in commercial leasing agreements but may also be applicable in residential rental agreements. It is particularly important in situations where the tenant has no established credit history or has a poor credit rating. There are different types of Houston Texas Guaranty or Guarantee of Payment of Rent that may be utilized depending on the specific circumstances of the lease agreement. Some of these types include: 1. Individual Guaranty: This form of guarantee involves an individual, usually a family member or close friend of the tenant, agreeing to be responsible for the payment of rent if the tenant fails to do so. The individual guarantor's personal assets may be at risk in case of default. 2. Corporate Guaranty: In some cases, a business entity may act as the guarantor and assume the responsibility of rent payment on behalf of the tenant. This type of guarantee usually requires the corporation to have sufficient financial resources to cover the rent and potential damages. 3. Letter of Credit: A letter of credit is a financial document issued by a bank on behalf of the tenant, promising to pay the landlord up to a specified amount in case of default. The landlord can draw on the letter of credit if the tenant fails to make rent payments. Each type of guarantee has its own advantages and disadvantages. Landlords typically evaluate the creditworthiness and financial standing of potential guarantors before entering into a lease agreement. The Houston Texas Guaranty or Guarantee of Payment of Rent provides landlords with a layer of security and peace of mind, ensuring that their rental income will be protected even if the tenant fails to meet their obligations.